1CLD trade ideas

$CRC Potential Breakout Setup I like these clean supply line pivots. $CRC if u r still looking for an oil name.

ya ya many broke out already but they are not pulling away and choppy with hardly any progress. So a name that is setting up nicely that is in the base is still just as good. RS 97, so not a turtle

Top Shareholders leaving CRCTop shareholders of CRC have recently reduced there holdings.

1. GoldenTree Asset Management who owns 15,579,032 shares levelled holdings by a large 20.415% decrease

2. Ares Management who holds 14,788,286 shares have recently reduce there holdings by 14.64%

What could this mean?

--> Well to put it simply it may just be profit taking as Ares bought more shares around $30

--> Minimising positions. It is well known California is turning to green energy and the government is showing for support.

--> Stigma has also increased for oil due to media portrayal however the world is not ready to depart from oil so really it could be typically play of talking the talk and not walking the walk.

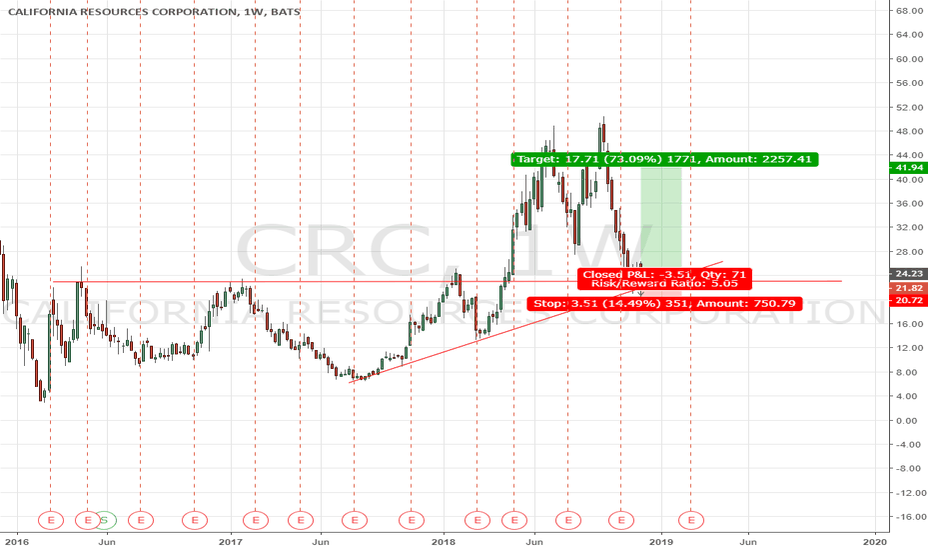

CALIFORNIA RESOURCES Good shortNYSE:CRC

Well, guys, even though Buffett thinks it's immoral to short, there's a good shorts on CRC.

There's likely to be a gap down at the opening.

However, if there is a point of entry, you can have time to take part in the funeral of this once large company.

Take care!

CRC oversoldThis large-cap stock has been trending sideways for a while now and is showing some bullish coiling. It will be oversold when it arrives at the buy zone, with both stochastics below 30%. Big picture opportunity is to BUY (passive), but a potential short-sell trade

(actively managed) can be made on its way down to the buy zone.

Best.

CRC OutlookFailed and a rejection of the weekly supply zone are setting up for the fourth leg of a cypher pattern the "C" position. The "C" area looks to set us up for a nice buy in 2 potential zones a. A strong daily swing point the turn into a nice demand zone from A-B around the 16.51-17.42 area. Or b. a full retracement to A between 13.54-14.86 area. May see some short-term buying setups over the next few days and weeks because of this recent swing point between 18.56-19.85 area. Sitting on my hands and waiting for a or b setups to present themselves. The first target will be the weekly supply zone between 28.71-30.31, we'll see how it plays out!

Daily:

Weekly:

$CRC CALIFORNIA RESOURCES CORP LACKS ENERGY. California resources are a oil and gas exploration company which reports earnings on the 2nd may. Expectation are are very low as can be seen from the recent price action.With the sudden drop in oil last week the price fell out from a ascending channel which is a significant sell signal. Options traders on the other hand seem more optimistic with a trading range from $24 to $35 with quite high volume. Seems to risky to enter any long position under current conditions and chart indicators.

CRC outlookDefinitely reacts to the news, good or bad but, definitely reactive! So we have 2 harmonic set ups, a bat and a butterfly both bullish. The move off of the first set up, the bat, was 562 points into the butterfly. The butterfly looks as if we'll move into a nice bullish channel into and the price levels to look out for 20.04 as a level to consider as support entry and rejection up until 26.79 at a newly formed resistance level. If the momentum continues I'm looking for a but from support to 30.17. The weekly tells the better story!

Daily markup:

Weekly markup:

CRC bustedWrite sometning about your psyhology thinking before trade? i am ok

Describe the trade. What you see? price will go up after the supstantinal drop

What have I done well for this trade? you recognize the support line perfectly and enter point was according to support resistance theory

What can I take away to help with later trades? that the stop loss was probaly too tight

CRC short term bearish on the retracement, long term bullish. CRC reversal confirmed on august 24, 2018. Continuation of primary long trend. Optimal entry point would of been around 32.50. Currently over extended expecting a 1/3-2/3 retracement. Based on previous trends I expect this to retrace to 50% around 36.00. At which point long term primary trend will continue with an average target of 45.00 which is approximately 25% roi -1.17% . The main idea right now is to see how over extended the current rally is and a retracement is imminent. We can also see volume divergence with the current rally which is considered bearish . Depending if volume contracts or expands on the retracement we could easily bounce at 1/3 = 38.00$, or 2/3 = 34.00. Short term bearish , long term bullish on CRC 3.03% . the blue channel is where i expect the retracement to occure where the yellow trendlines represent the 1/3, 1/2, 2/3 possible retracement areas.