Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.35 EUR

760.60 M EUR

114.23 M EUR

1.36 B

About POWER ASSETS HOLDINGS LTD.

Sector

Industry

CEO

Chao Chung Tsai

Website

Headquarters

Hong Kong

Founded

1976

ISIN

HK0006000050

FIGI

BBG000BNT9C2

Power Assets Holdings Ltd. engages in energy and utility-related businesses, which focuses on the distribution of electricity, gas, and oil It operates through the following segments: Investments in Hong Kong Electric Investments, United Kingdom, Australia, Others, and All Other Activities. The company was founded on April 9, 1976 and is headquartered in Hong Kong.

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

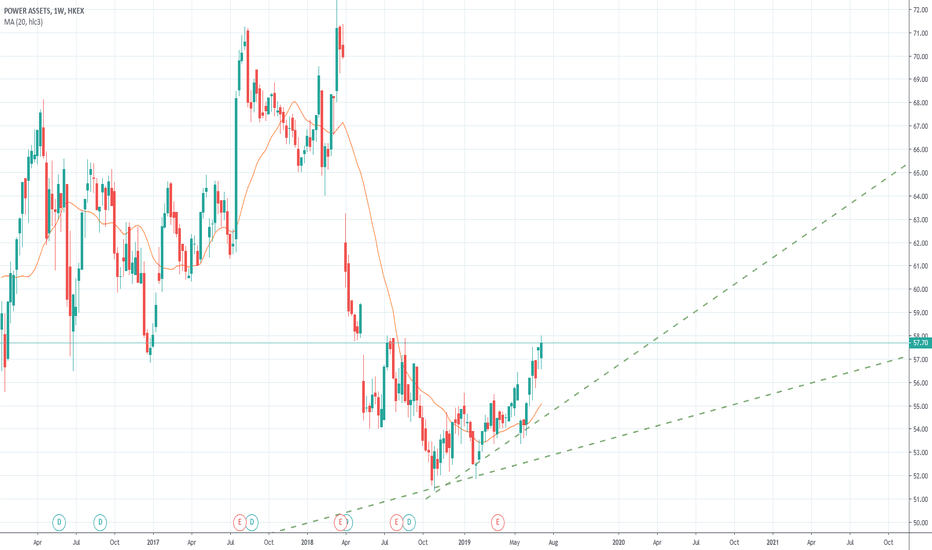

Displays a symbol's price movements over previous years to identify recurring trends.

Related stocks

Frequently Asked Questions

The current price of HEH is 5.90 EUR — it has decreased by −0.84% in the past 24 hours. Watch POWER ASSETS HLDG.LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange POWER ASSETS HLDG.LTD. stocks are traded under the ticker HEH.

HEH stock has risen by 2.61% compared to the previous week, the month change is a 11.32% rise, over the last year POWER ASSETS HLDG.LTD. has showed a 11.32% increase.

We've gathered analysts' opinions on POWER ASSETS HLDG.LTD. future price: according to them, HEH price has a max estimate of 7.30 EUR and a min estimate of 5.48 EUR. Watch HEH chart and read a more detailed POWER ASSETS HLDG.LTD. stock forecast: see what analysts think of POWER ASSETS HLDG.LTD. and suggest that you do with its stocks.

HEH stock is 0.85% volatile and has beta coefficient of −0.02. Track POWER ASSETS HLDG.LTD. stock price on the chart and check out the list of the most volatile stocks — is POWER ASSETS HLDG.LTD. there?

Today POWER ASSETS HLDG.LTD. has the market capitalization of 12.76 B, it has increased by 1.13% over the last week.

Yes, you can track POWER ASSETS HLDG.LTD. financials in yearly and quarterly reports right on TradingView.

POWER ASSETS HLDG.LTD. is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

HEH net income for the last half-year is 386.95 M EUR, while the previous report showed 359.30 M EUR of net income which accounts for 7.69% change. Track more POWER ASSETS HLDG.LTD. financial stats to get the full picture.

POWER ASSETS HLDG.LTD. dividend yield was 5.20% in 2024, and payout ratio reached 98.21%. The year before the numbers were 6.23% and 100.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 11, 2025, the company has 14 employees. See our rating of the largest employees — is POWER ASSETS HLDG.LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. POWER ASSETS HLDG.LTD. EBITDA is 57.43 M EUR, and current EBITDA margin is 50.27%. See more stats in POWER ASSETS HLDG.LTD. financial statements.

Like other stocks, HEH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade POWER ASSETS HLDG.LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So POWER ASSETS HLDG.LTD. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating POWER ASSETS HLDG.LTD. stock shows the buy signal. See more of POWER ASSETS HLDG.LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.