GBPJPY.100.CSM trade ideas

GBP/JPY BUY SETUP 1h chart analysisGBP/JPY

Entry Point:

Current price is around 189.436

Looks like your entry is at the breakout above the recent consolidation/structure (possibly just above 189.100)

Stop Loss (SL):

SL seems to be set just below the demand zone at around 188.000

Take Profit 1 (TP1):

Clearly labeled on the chart as TARGET 1

Positioned near 190.900

Final Target (TP2):

Labeled as TARGET 2

Positioned near 193.000

---

Summary:

Entry: ~189.100 (Breakout confirmation)

SL: ~188.000

TP1: ~190.900

TP2 (Final Target): ~193.000

Please hit the like button and

Leave a comment to support for My Post!

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, JAMES_GOLD_MASTER_MQL5

Thank you.

GBP/JPY) Bearish analysis Read The ChaptianSMC Trading point update

GBP/JPY 2-hour chart outlines a clear bearish setup within a well-defined downtrend. Here's a breakdown of the trading idea:

---

Technical Overview:

Downtrend Channel:

The pair is respecting a downward-sloping channel, with repeated rejections at the upper boundary, confirming bearish control.

Resistance Zone (~187.8 - 188.5):

Price has reached a highlighted resistance area that aligns with previous swing highs and trendline resistance — marked with red arrows for prior rejections.

Bearish Projection:

The analysis anticipates a rejection from this resistance zone followed by a downward impulse move. A pullback is expected, but continuation toward the target support zone around 179.150 is likely.

Target Zone (~179.150):

This level lines up with previous price action and matches the measured move (blue vertical box), adding confluence.

EMA 200 (around 190.36):

Price is well below the 200 EMA, reinforcing the bearish structure and trend bias.

RSI Indicator (~52):

RSI is slightly above 50 but not bullish — this neutral reading suggests the pair has room to drop if resistance holds.

Mr SMC Trading point

---

Trading Idea Summary:

Bias: Bearish

Entry Zone: 187.8 – 188.5 (resistance)

Confirmation: Bearish candlestick pattern or rejection signal

Target: 179.150

Invalidation: Break and close above 190.365 (above EMA 200 and prior highs)

---

plase support boost 🚀 analysis follow)

Is GBPJPY Set to Rise?GBPJPY has been catching attention this week—and for good reason. With price action pushing toward significant psychological zones, traders are asking: is the Dragon set to breathe fire once again?

Here’s the setup I’m watching closely:

Entry: 188.813

Stop Loss: 186.814

Target: 195.170

This trade idea is built on strong bullish structure and confluence across the higher timeframes. Price has respected key support zones and appears to be forming a base for a potential breakout. If momentum holds, we could see GBPJPY retest and possibly surpass recent highs.

What makes this setup compelling isn’t just the technicals—it’s also the fundamentals. With the Bank of Japan sticking to ultra-dovish policy and the UK showing relative economic resilience, the interest rate differential continues to favor GBP strength.

What do you see on your chart? Would you take this trade—or sit on the sidelines? Drop your bias in the comments.

GBP/JPY - Long Term SellHere in this chart starting in the higher TF we can notice lots of selling pressure. Every time price hit this key level we can notice a significant sell off.

From previous new in the past few weeks we can notice a strong Supply zone to look to sell from. This supply zone has a clean Mitigation Block within it.

If we sell this Supply zone it will be a strong possibility that we break out of this parallel channel giving us a break out.

Dropping down into the 6H we can notice a first target being the sell side liquidity. Im targeting here as the demand zone has been invalidated from this previous price movement giving me good conditions to sell into

Please do feel free to follow me or dm me about this read

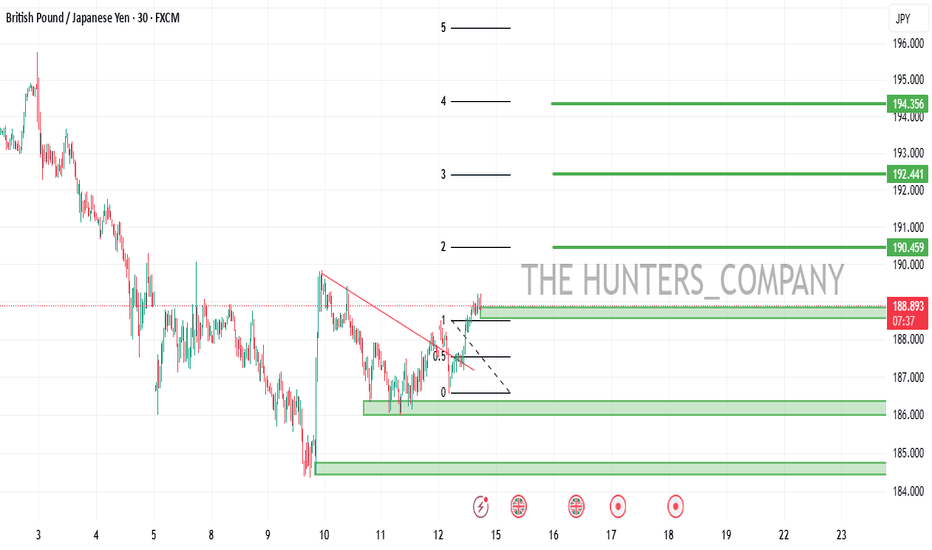

GBPJPY:SIGNALHello dears

Considering the heavy decline we had, you can see that buyers entered with a strong bullish spike, which is a good sign...

Now we can buy in steps on the price pullback and move with it to the specified targets, of course with capital and risk management.

*Trade safely with us*

GBPJPY Is Going Down! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 45m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 188.674.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 187.917 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP JPY SHORTWAITING FOR A BOS CONFIRMATION ON LOWER TIME FRAME

📉 GBP/JPY SHORT SETUP 🔥

Smart Money Confluences Lined Up

🔍 Key Confluences:

✅ Premium Supply Zone

Price is reacting to a 2H Order Block + 1H Fair Value Gap — a stacked area of supply where institutions typically sell from.

✅ Liquidity Sweep Confirmed

Price swept above recent highs before entering the OB. Classic stop hunt / inducement move before a potential reversal.

✅ Bearish Rejection Forming

Price is stalling in the OB. Watching for a bearish engulfing or break of structure on 15M/1H for entry confirmation.

🎯 Target Zones:

🟦 TP1: 4H Fair Value Gap — ideal for partials

📉 TP2: Structure support zone

🟩 TP3: Equal lows/liquidity pool — full target

📊 Bias: Bearish

⏱ Timeframes: 1H / 2H / 4H

🔐 Risk: Above OB EQ (0.5)

GBPJPY Sell Trade Analysis & Position SizingGBPJPY Sell Trade Analysis & Position Sizing*

*1. Trade Overview:*

- *Entry:* 191.050

- *Stop Loss (SL):* 191.800 (55 pips above entry)

- *Take Profit Targets:*

- *TP1:* 188.850 (180 pips)

- *TP2:* 187.250 (340 pips)

*2. Risk-Reward Ratios:*

- *TP1:* 180 pips / 55 pips = *3.27:1* (strong).

- *TP2:* 340 pips / 55 pips = *6.18:1* (very aggressive).

*3. Key Levels & Context:*

- *SL Placement:* Above the recent high (191.20), invalidating the bearish setup if breached.

- *TP Logic:* TP1 and TP2 likely align with historical support levels or Fibonacci retracement zones.

*4. Position Sizing Example:*

Assume you risk *1% of a $10,000 account* ($100):

- *Pip Value (approx):* $6.56 per standard lot (GBPJPY at 190.65, GBPUSD at 1.25).

- *Risk per Trade:* $100 = (55 pips × $6.56 × Lots).

- *Lots Size:* $100 / (55 × $6.56) ≈ *0.28 lots* (28,000 units).

*5. Execution Tips:*

- *Partial Profit-Taking:* Close 50-70% at TP1, trail SL to breakeven.

- *Fundamental Watch:* Monitor BoJ interventions, UK data, or risk sentiment shifts (JPY is a safe haven).

*6. Visual Guide:*

- Price rejected at 191.20 resistance.

- Entry at 190.650, SL above the high.

- TP1 near a swing low (188.85), TP2 at a stronger support (187.25).

*Need a position size calculator or further chart details? Let me know!* 📉💡

GBP/JPY "The Beast" Forex Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Beast" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (189.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (186.500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 191.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/JPY "The Beast" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GJ-Mon-14/04/25 TDA-GJ wide consolidation now!Analysis done directly on the chart

The market is testing your patience today,

don't let it fool you. With this price action

and market positioning and structure it's not

very good to scalp either!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y