ONENTRY

ONENTRY

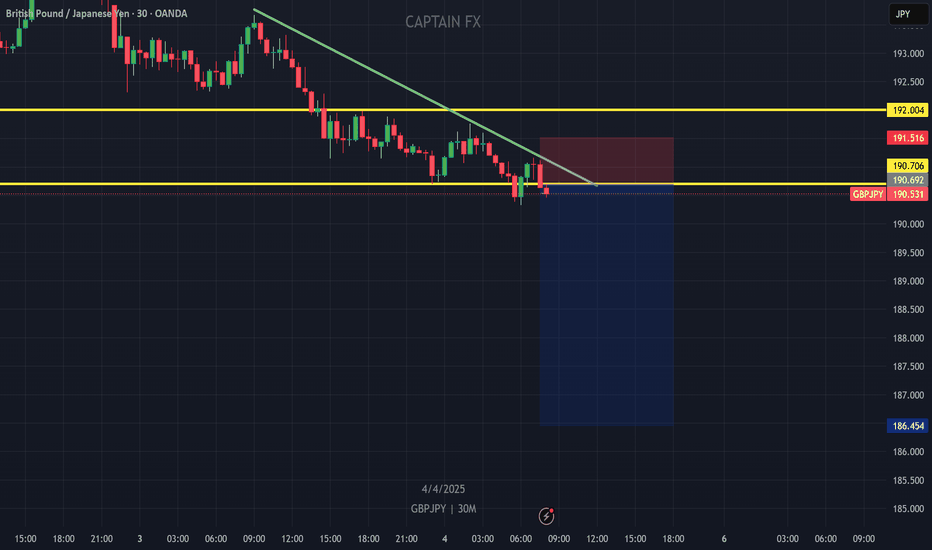

GBP/JPY - ONENTRY ' 2Fib Strategy '

Timeframe: 30 Minutes

Session: London Pre-Market (00:00 - 06:30 +2GMT)

Step 1: Identify the Overnight Range

Mark the high and low of the price range between 00:00 - 06:30 (+2GMT).

Wait for a clear breakout with a candle closing above (for longs) or below (for shorts) this range.

Step 2: Apply Fibonacci Levels

After the breakout, use the Fibonacci retracement tool:

Anchor Point 1: Start at the close of the breakout candle.

Anchor Point 2: Drag to the start of the impulse move (first candle of the range).

Key level for entry: 0.5 and 0.35 retracement.

Step 3: Trade Execution

Entry: Enter on a pullback to 0.5 and 0.35 Fib level after the breakout.

Stop Loss :

Long trades: Below the low of the breakout candle’s body.

Short trades: Above the high of the breakout candle’s body.

Take Profit Targets:

TP1: 1.0 Fib (1:1 risk-reward).

TP2: 1.25 Fib extension.

TP3: 1.6 FIB extension

TP4: 2.3 Fib extension (runner position).

Step 4: Trade Management

Move SL to breakeven when price hits TP1.

GBPJPY.100.CSM trade ideas

GBPJPY BUYAfter todays (3rd April) Tariff decisions from Mr.T the world has gone into a melt down and clearly the whole world has taken a hit.

GBPJPY from a MACD and RSI perspective show signs of exhaustion to the downside with the only catalyst is for bear targeting the previous lows or the continued news scaremongering sellers. With is sitting just near the 0.68 fib and the other MACD and RSI, I can see a long swing target on this that will rally behind 200.

Time will tell on this but I will at least hold position to the 197 and look at locking down profits. Swap rates will help reduce risk off and keeping the SL out the way of turning point and allowing the trade to breath.

GBP/JPY Technical Analysis – April 4, 2025GBP/JPY Technical Analysis – April 4, 2025 📉

🔹 Current Price: 190.706

🔹 Timeframe: 15M

📌 Key Supply Zone (Resistance Level):

🔴 191.628 – 191.757 – Potential reversal zone

📌 Key Demand Zone (Support Level):

⚫ 189.115 – Target support zone

📉 Bearish Scenario:

A rejection from the 191.628 – 191.757 supply zone could push the price lower towards 189.115, aligning with the bearish outlook.

📈 Bullish Scenario:

If the price breaks above 191.757, we might see further upside momentum.

⚡ Trading Tip:

✅ Look for bearish confirmation around 191.628 – 191.757 before entering short positions.

✅ 189.115 is a key level to watch for potential take-profit or reversal opportunities.

✅ Always use risk management strategies to secure profits.

#FXFOREVER #GBPJPY #ForexTrading #SmartMoney #PriceAction #TechnicalAnalysis #Trading

Short Term Counter Trend: GBP/JPYThe market needs to pull back to Fibonacci zones. Look at the charts for details and let me know what you think.

Counter Trend Setup:

1. Identify Liquidity, 200 EMA, and Market Hours

2. Mitigate Order Block

3. Strong Break of the Trendline

4. Retest Break at new Order Block 5/15 min

5. Rejection/Reversal at Break Retest on 5/15 min timeframe.

6. Enter

'Safe Haven' Strength going to continue? YES - SELL GBPJPYAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

GBPJPYHello Traders! 👋

What are your thoughts on GBPJPY?

On the daily chart of GBPJPY, a Rising Wedge pattern has formed. After a bullish move, the price has entered a resistance zone.

If the wedge breaks down and price confirms below the 192.000 level, a short position could offer a favorable risk-to-reward setup.

Don’t forget to like and share your thoughts in the comments! ❤️

GBP/JPY "The Dragon" Forex Bank Bullish Heist Plan(Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red MA Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing low or high level Using the 4H timeframe (192.000) Day/scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 198.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend target...

Before start the heist plan read it...go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

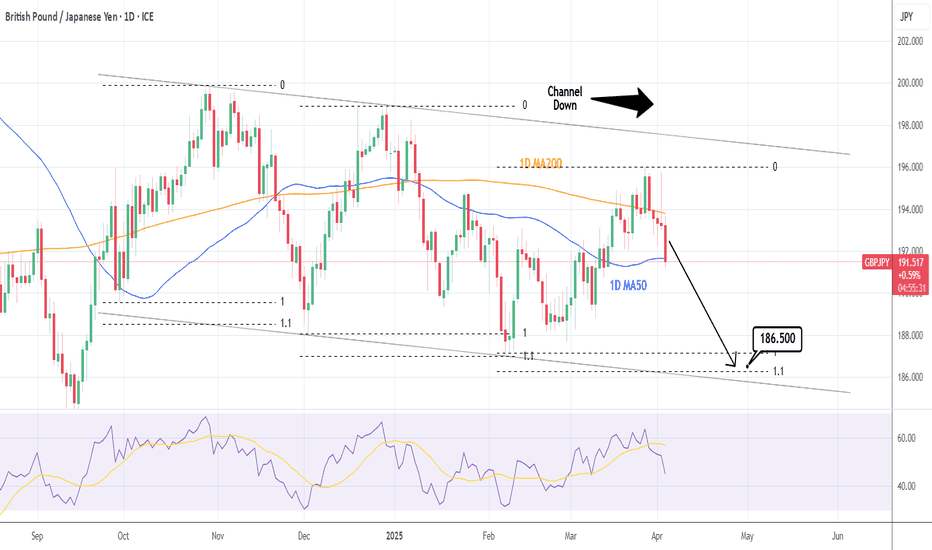

GBPJPY: Channel Down started its new bearish wave.GBJPY is neutral on its 1D technical outlook (RSI = 45.648, MACD = 0.440, ADX = 26.099) as the price is testing the 1D MA50 again, being already on a 4 red day streak. The recent March 28th high almost touched the top of the 6 month Channel Down, so it can be technically considered a LH. Since the 1D RSI already crossed under its MA, we have a validated sell signal. Both prior bearish waves reached the 1.1 Fibonacci extension. Aim just over it (TP = 186.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

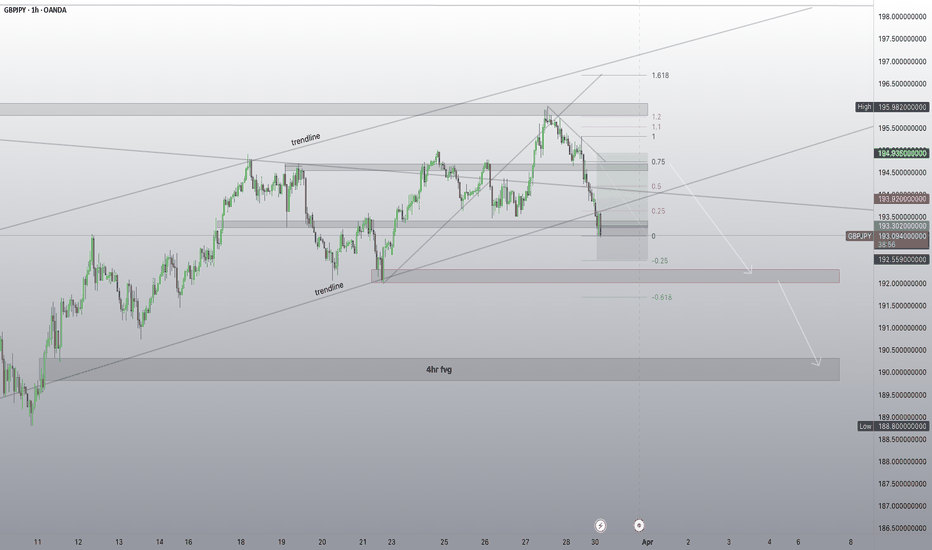

Going long now until we hit around the 75% fib zoneGoing long before a potential big sale off to close the 4HR FVG. We have broken the support trend line so we will probably see a retracement before continuing downward.

If we keep going down we will drop to the next zone before we retrace. I will be entering more buys if so.

*I also notice that we are very low compared to previous years so there could be a huge bull coming through. just something to keep in mind!*

📈📉📈

GBPJPY: Bullish Continuation is Highly Probable! Here is Why:

The analysis of the GBPJPY chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️Please, support our work with like & comment!❤️

GBPJPY INTRADAY support retest at 191.70The GBP/JPY pair is in an overall uptrend, though currently experiencing a short-term pullback.

• Key Support: 191.70 – A bounce from this level could push prices higher.

• Upside Targets: 194.00, 195.50, and 195.70 if the bullish trend continues.

• Bearish Scenario: A break below 191.70 could lead to further declines toward 190.90, 190.00, and 189.00.

Conclusion: The trend remains bullish unless GBP/JPY drops below 191.70, which would signal further downside risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ONENTRY### **GBP/JPY Overnight Range Breakout Strategy**

**Timeframe:** 30 Minutes

**Session:** London Pre-Market (00:00 - 06:30 +2GMT)

### **Step 1: Identify the Overnight Range**

- Mark the **high** and **low** of the price range between **00:00 - 06:30 (+2GMT)**.

- Wait for a **clear breakout** with a candle *closing* above (for longs) or below (for shorts) this range.

### **Step 2: Apply Fibonacci Levels**

- After the breakout, use the **Fibonacci retracement tool**:

- **Anchor Point 1:** Start at the *close* of the breakout candle.

- **Anchor Point 2:** Drag to the *start* of the impulse move (first candle of the range).

- Key level for entry: **0.5 and** **0.35 retracement**.

### **Step 3: Trade Execution**

- **Entry:** Enter on a pullback to **0.5** and **0.35 Fib level** after the breakout.

- **Stop Loss :**

- *Long trades:* Below the **low of the breakout candle’s body**.

- *Short trades:* Above the **high of the breakout candle’s body**.

- **Take Profit Targets:**

- **TP1:** 1.0 Fib (1:1 risk-reward).

- **TP2:** 1.25 Fib extension.

- TP3: 1.6 FIB extension

- **TP4:** 2.3 Fib extension (runner position).

### **Step 4: Trade Management**

- Move SL to breakeven when price hits **TP1**.