GBPJPY.100.CSM trade ideas

Mister Y - GJ - Tuesday - 18/03/25 Top down analysisAnalysis done directly on the chart.

If you have missed this move and you are now FOMOing.

Don't worry, markets always present new opportunities,

new setups. Learning when not to trade will surely save

from bad trades as well.

Not financial advice, DYOR.

Mister Y

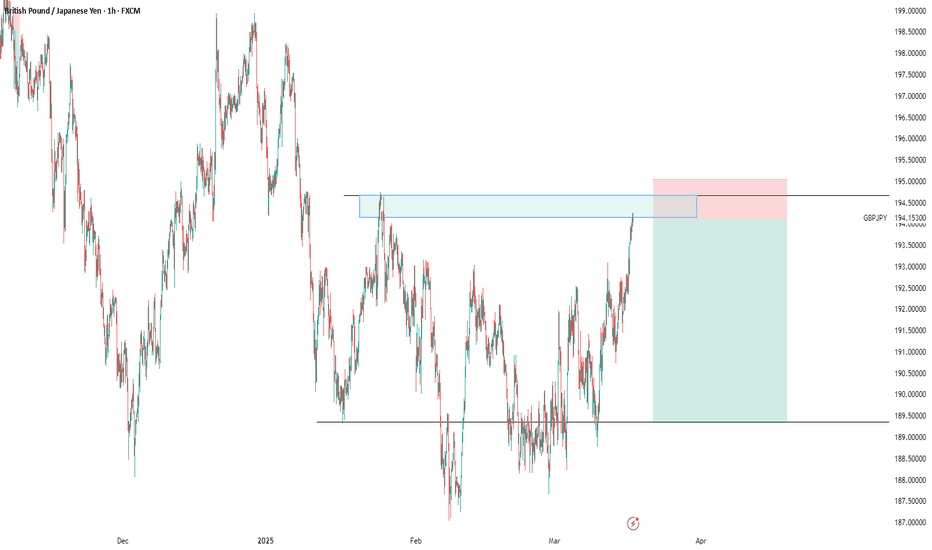

GBPJPY still bullish for expect

GBPJPY price is bounce 3 times on trend line, we are have and strong, long zone, which is be and breaked, we are not see some to long bullish push, price is revers what is done, currently from here expecting to see new bullish trend.

SUP zone: 190.150

RES zone: 194.250, 195.400

Look out for reversal on GBPJPY !I have been running on buys for gbpjpy and currently running at 750 pips.

My view for this pair remains bullish BUT i will be watching these zones and reversal prices for any shift of momentum in order for me to ride any bearish opportunity.

Will still hold my buys, but will be actively looking for opportunity to sell as well.

CHECK GBPJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(GPBJPY) trading signals technical analysis satup👇🏼

I think now (GBPJPY) ready for( BUY )trade ( GBPJPY ) BUY zone

( TRADE SATUP) 👇🏼

ENTRY POINT (192.600) to (192.500) 📊

FIRST TP (192.800)📊

2ND TARGET (193.100) 📊

LAST TARGET (193.400) 📊

STOP LOOS (192.00)❌

Tachincal analysis satup

Fallow risk management

GBPJPY: Both Moves Are Possible But It Has Higher Odds To RiseGBPJPY: Both Moves Are Possible But It Has Higher Odds To Rise

19 March - Bank of Japan (BOJ) Rate Decision The BOJ is expected to maintain its interest rate at 0.5%, with no hike anticipated. While the rate decision itself seems predictable, the real market mover will likely be the press conference. If the BOJ avoids providing clear guidance on its monetary policy and leaves room for interpretation, the Japanese yen (JPY) may weaken further.

20 March - Bank of England (BOE) Rate Decision The BOE is also expected to hold its interest rate steady at 4.5%, with no cuts or hikes on the horizon. This aligns with market expectations.

You may watch the analysis for further details!

Thank you:)

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/JPY Breakout Sell Trade Analysis🕵️♂️ Market Structure Analysis

The price was in a strong uptrend, forming higher highs and higher lows.

A key resistance zone was identified around 194.65 - 194.78, where price previously reacted.

The price tested this resistance multiple times but failed to break above it, showing exhaustion.

📌 Trade Entry Confirmation

✅ Resistance Rejection – Price reached the 194.65 - 194.78 resistance zone and struggled to break above it.

✅ Breakout Confirmation – The price started forming lower highs and showed bearish rejection wicks.

✅ Liquidity Grab – A small fakeout above resistance before reversing, trapping buyers.

✅ Bearish Candlestick Formation – Price formed a strong bearish candle rejection, confirming a possible reversal.

📉 Trade Execution

🔹 Sell Entry: After price rejected the resistance zone and showed bearish momentum.

🔹 Stop-Loss (SL): Above 194.78 (previous high & resistance zone).

🔹 Take-Profit (TP): 192.18 (previous support & liquidity area).

🔹 Risk-to-Reward (RR): 1:3 or better, maintaining proper trade management.

📊 Risk Management & Trade Plan

Partial Take-Profit at 1:5 RR, letting the rest run to full TP.

Trailing Stop to secure profits if price moves in favor.

Exit strategy if price shows bullish reversal signs before TP

GBP/JPY TODAY EXPECTED MOVERight now, we are analyzing the GBPJPY 1-hour time frame chart. My bias for today is towards the sell side, and I will be looking to sell the market today. As you can see on the chart, these are our key levels. Once the market price reaches our key levels and POI, we will wait for confirmation whether the price shows a bearish confirmation or forms a reversal candlestick pattern, so we can find the ideal entry point for our trade and execute it with precision. The most important thing to remember is to always wait for confirmation.

Make sure to always use a stop loss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis. Let's see what happens.

#GBPJPY 1H Technical Analysis Expected Move.

GBPJPY ANALYSIS FOR SELL*GBP/JPY Sell Opportunity Alert!*

We've identified a high-probability selling opportunity in the GBP/JPY pair, with a sell entry at 192.300. This level represents a strong resistance level, where sellers are likely to enter the market and push prices lower.

*Key Influencers:*

- Currencies: USD, EUR, and JPY

- Commodities: Oil

- Bonds: Gilt, GJGB10, and T-Note

- Indices: FTSE 100, Nikkei 225, and Dow Jones

- Organizations: Bank of England, Bank of Japan, and respective governments

*Trade Details:*

- Sell Entry: 192.300

- Target Levels: 191.440, 190.508, and 188.607

- Stop-Loss: 193.810

*Reasons to Sell:*

1. *Technical Resistance:* Strong resistance level at 192.300.

2. *Bearish Momentum:* Bearish signals from momentum indicators.

3. *Fundamental Analysis:* Negative UK economic data and strong JPY.

4. *Overbought Conditions:* Overbought conditions on RSI indicator.

*Trading Strategy:*

Sellers may enter at 192.300, with a stop-loss at 193.810. TP levels can be used to take profits or adjust the stop-loss.

*Share with Your Friends!*

Don't miss out on this potential trading opportunity! Share this alert with your friends and fellow traders, and let's make some profitable trades together!

*Remember:* Always use proper risk management and trading strategies to minimize losses and maximize gains. Happy tradings

Keep your best wishes to Travis 💯

GBPJPY The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the GBPJPY next move:

The instrument tests an important psychological level 193.00

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 191.639

My Stop Loss - 193.69

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

GBPJPY is in the Down TrendHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts