gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY.100.CSM trade ideas

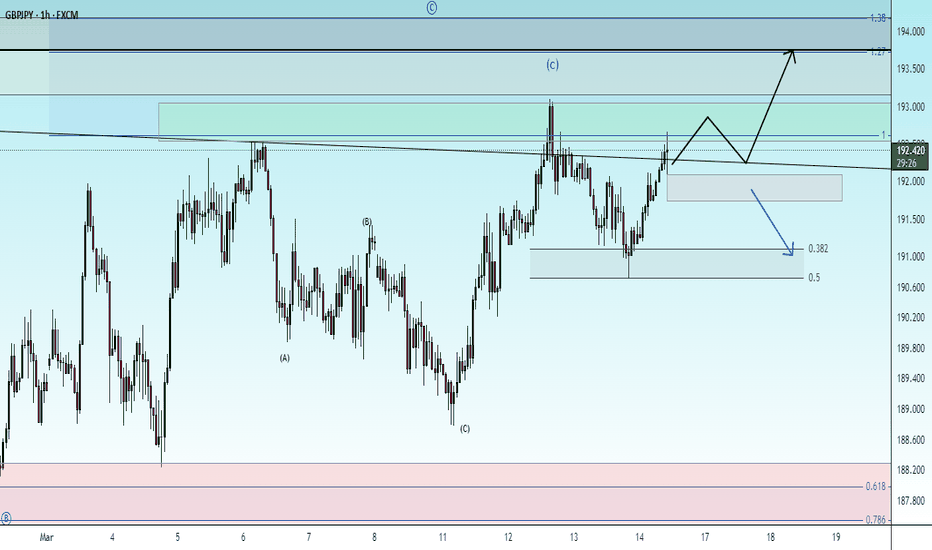

GBJPY Uptrend ContinuationAt 4H & 1H price more bullish leaving demand zone with huge imbalance.

I will waiting or buy limit at 1HR zone and targeted previous high for TP.

Above demand zone, we can see there are significant support formed.

Price probably breaks those sig support and test the demand zone before continue uptrend.

GBPJPY Trade Analysis**GBP/JPY 15-minute chart**

**Trade Analysis & Idea:**

📉 **Previous Downtrend**: The pair experienced a strong drop before finding support around **191.400**.

📈 **Current Recovery**: Price is now rebounding and trading above short-term moving averages (blue & red EMA).

🔄 **Resistance Zone**: The **192.000 - 192.200** area may act as resistance for further upside.

### **Potential Trade Setups:**

1️⃣ **Bullish Continuation**:

- If price **breaks & closes above 192.000**, we could see further upside towards **192.400 - 192.600**.

- A strong candle close above resistance would confirm bullish momentum.

2️⃣ **Rejection & Pullback**:

- If price struggles to hold above 192.000, a pullback toward **191.700 - 191.500** is possible.

- Look for **bearish candlestick patterns** (e.g., rejection wicks, engulfing candles) to confirm a short opportunity.

### **Risk Management:**

✅ Secure partial profits at key levels.

✅ Use **tight stop-loss** below **191.700** for longs or above **192.200** for shorts.

GBP/JPY - Prediction UpdateCurrently Our analysis has been correct showing Bullish movements towards Resistance Zone.

We now have had multiple movements into this zone which tells me im expecting for price to break this ranging market out of this resistance layer towards the new Targets.

This is a long Term movement and I will be holding long Term here until we reach this level

Previous movement has show a large Bullish movement leaving a Small FVG to use as a run away break. Measuring this with the FIB level shows that it is a confirmed OTE Tap giving me more confluence for a solid Bullish movement.

After the OTE tap we have left Behind a Demand zone.

Im already in this trade along with my other traders following me in my private chat

DM for any questions about this

Cheers and Good luck to everyone who will be following

Potential GBPJPY weekly long move / Bull RunOn the 3H time frame I noticed a bullish reversal candlestick and pattern which retested an area of demand which is marked in blue, the bullish reversal candlestick also retested an IMB (Imbalance)

Following the bullish reversal candlestick, price made a bullish reversal candlestick and pattern which looks like it will close bullish when the charts open up again

forecasting this trade with a R&R of 1/3 having my SL at 191.464 and my TP at 194.727

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY is in the Down TrendHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY Will Fall! Short!

Take a look at our analysis for GBPJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 192.236.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 190.200 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CHECK GBPJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(GPBJPY) trading signals technical analysis satup👇🏼

I think now (GBPJPY) ready for( SEEL )trade ( GBPJPY ) SEEL zone

( TRADE SATUP) 👇🏼

ENTRY POINT (192.800) to (192.300) 📊

FIRST TP (192.700)📊

2ND TARGET (191.000) 📊

LAST TARGET (190.200) 📊

STOP LOOS (193.300)❌

Tachincal analysis satup

Fallow risk management

GBPJPY: Bearish Continuation & Short Signal

GBPJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short GBPJPY

Entry - 192.49

Sl - 193.31

Tp - 191.06

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

DeGRAM | GBPJPY held the trend lineGBPJPY is in a descending channel between the trend lines.

The price is moving from the lower boundary of the channel, support level and lower trend line.

We expect the chart to rise after consolidating above the resistance level, which coincides with the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY analysisAfter two days of bullish candles, GBPJPY is still within the ranges of 189 to 193. However, it could present some good intraday trading opportunities during the London and NY session today. As I write this, the price has already broken below the 192 level and is hanging around the 191.2 level. If we see then level break, then we could see it make its way towards 190.2. If it finds suport at this level and goes up to the 192 level again, then it coulf present with a nice shorting opportunity to test the 191.2 levels again. The momentum seems to be towards the downside today and I would not buy this market unless I see some really healthy bullish candles towards the upside. At the moment, it is about waiting for the retracement to sell again.

There is big data release during the NY session today, so the overall direction could be dictated by what the data is like at that time.

CHECK GBPJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(GPBJPY) trading signals technical analysis satup👇🏼

I think now (GBPJPY) ready for( SEEL )trade ( GBPJPY ) SEEL zone

( TRADE SATUP) 👇🏼

ENTRY POINT (192.500) to (192.400) 📊

FIRST TP (191.900)📊

2ND TARGET (191.400) 📊

LAST TARGET (190.800) 📊

STOP LOOS (193.100)❌

Tachincal analysis satup

Fallow risk management