GBPUSD analysis as of 4/10 3:19pm Mind you, i still have a bullish trade going from my previous long trade.. I removed my take profit yesterday and im continuing to monitor the market. but as for now these are the numbers we are looking at.

The market has really overextended itself—prices are at levels that feel too high compared to the earlier consolidation. On the 1‑hour, 4‑hour, and daily charts, I’m spotting clear bearish signals (like the bearish bet-hold patterns, closing marubozu, bearish engulfing, and even hikkake formations) that suggest sellers might soon step in. Even though the higher timeframes still hold an overall bullish bias, these short-term resistance patterns are warning me that the rally may be topping out.

Given this, my plan is to close out my bullish trade as soon as I get confirmation of a reversal. I’m watching for a clear candlestick signal—a bearish engulfing pattern, a pin bar, or any strong rejection on the lower timeframe (say the 15‑minute or even a confirming close on the 1‑hour) around the 1.293–1.290 area. Once I see that confirmation, I’ll lock in my profits from the bullish trade and then pivot to a sell. I’d target my short entry near that level, with a stop-loss just above recent highs (around 1.296–1.297), aiming for a retracement toward the previous support zone (around 1.278–1.281).

In short: I’ll close my bullish position when the price clearly shows it’s reversing from these overextended, overbought highs, and then I’ll open a sell trade to take advantage of the expected short-term pullback. This approach lets me protect my gains and capitalize on the bearish signals emerging from the chart.

GBPUSD.1.MINI trade ideas

GBPUSD Watch – Bearish Momentum Building Below Supply ZoneGBPUSD pair has broken sharply below the long-standing accumulation range between 1.2857 – 1.3012, signaling a shift in market sentiment. The recent bearish engulfing structure has pushed price into a corrective pullback phase, with sellers likely to re-enter on rallies.

Key Technical Levels:

Current Price: 1.2795

Resistance (Supply Zone): 1.2857 – 1.2863

First Support Target: 1.2688 – 1.2690

Mid-Level Target: 1.2568 – 1.2570

Final Bearish Target: 1.2383 – 1.2390 (demand zone & key support)

Trade Scenario:

📉 Bearish Bias:

Price is expected to retrace into the supply zone (1.2857–1.2863) and then reject.

If resistance holds and structure remains intact, expect continuation toward:

TP1: 1.2689

TP2: 1.2568

TP3: 1.2385

🔁 Invalidation Zone:

A sustained break and close above 1.2863 would invalidate the bearish setup and could trigger a move toward 1.3012.

Technical Confluence:

✅ Previous consolidation turned into a strong resistance zone

✅ Bearish breakout from range

✅ Clean lower highs and lower lows structure

✅ Volume drop on the pullback (likely a corrective move)

GBPUSD Elliott Wave AnalysisHello friends

In the currency pair GBPUSD we are witnessing the completion of a 3-wave pattern.

These 3 waves can be a zigzag or 3 of 5.

But in both cases, a correction should take place.

So we expect a small increase and then a price correction.

This correction can continue to the level of 1.2800 and in the second stage to 1.2500.

Good luck and be profitable.

GBP/USD – 15M Short Setup (NY Session)Took a short position after a clear rejection from a key supply zone right at the New York Open, following a strong bullish push during London.

🧠 Trade Idea & Confluences:

• Supply Zone: Price tapped into a 15M supply area, showing multiple rejections with wicks and bearish momentum.

• Structure Shift: Break of minor bullish structure – signaling a possible reversal.

• NY Open Volatility: Leveraging high volume for a strong move away from supply.

• EMA Confluence: Price losing the 20 EMA, now acting as dynamic resistance.

• Risk-to-Reward: Solid R:R (~3R), targeting an untapped demand zone and imbalance fill below.

🎯 Trade Setup:

• Entry: After bearish engulfing on rejection from supply

• Stop Loss: Above the recent high

• Take Profit: Into 15M demand zone, near previous Asian session highs

⸻

If you want, I can also add a few hashtags for better visibility:

#GBPUSD #SmartMoney #SupplyDemand #DayTrading #ForexStrategy #NYSession #PriceAction #15MChart #TradeSetup

GBPUSD UPDATES FOR SHORTERM TRADEHello folks, refined the previous idea on GBPUSD,

this is my probability target 1.29500 zone, before it will go lower.

I closed the previous idea, but already win 100pips.

This is not a financial advice,

Follow for more.

Pewpewww. New chart once we reached that level again, aim for 250pips since posted the idea on 1.27 entry zone

GBPUSD Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for GBPUSD below:

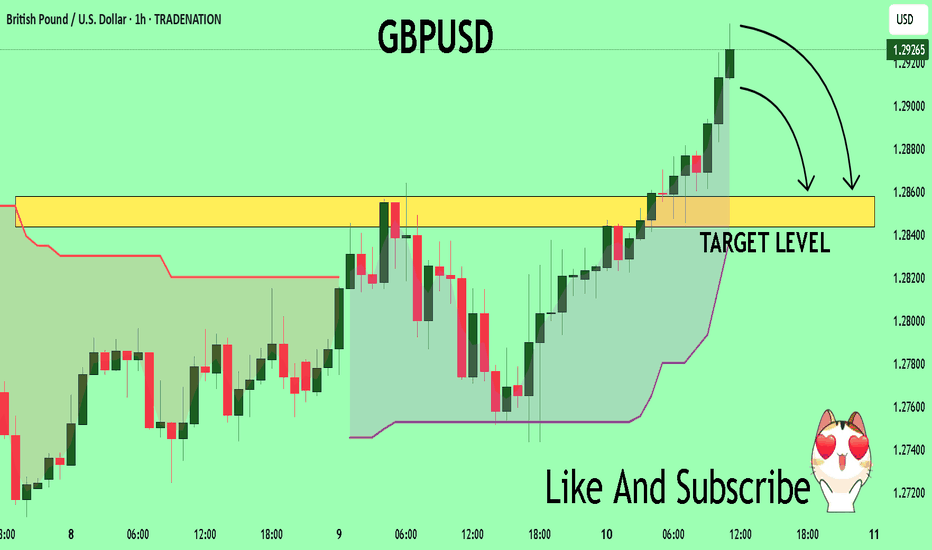

The instrument tests an important psychological level 1.2924

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.2858

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPUSD 15MBreak and Retest Strategy for GBPUAD Buy Position on 15m Chart

*Identifying the Break*

The GBPUSD pair has broken above the

1.27068 resistance level on the 15-minute chart. This level was previously tested multiple times, and the recent break suggests a potential shift in market sentiment.

*Waiting for the Retest*

After the break, the price has pulled back to retest the 1.27068 level. This retest is a crucial step in confirming the break and increasing the likelihood of a successful trade.

*Trade Idea*

*Buy* GBPUAD at 1.27520 (current price) with a *Stop Loss* at 1.27068 and a *Take Profit* at 1.3000.

*Rationale*

1. *Break and Retest:* The break above 1.27068 and subsequent retest increases the confidence in the trade.

2. *Support Turned Resistance:* The 1.27068 level, previously resistance, is now acting as support, indicating a potential shift in market sentiment.

3. *Momentum:* The break and retest have created a sense of momentum, which could propel the price higher.

*Risk Management*

- Set a stop loss at 1.27068 to limit potential losses.

- Use a risk-reward ratio of 1:3 or higher.

- Monitor the trade closely and adjust the stop loss and take profit levels as needed.

GBPUSD INTRADAY bullish continuation above 1.2765 support GBP/USD maintains a bullish bias, with the broader trend and structure supporting upside continuation. The recent intraday move appears to be a corrective pullback toward a key prior consolidation area.

Key Support: 1.2765 – aligns with the previous consolidation zone and potential bullish inflection point.

Upside Targets:

1.2935 – initial resistance level

1.2985 and 1.3026 – medium to long-term bullish targets

If price finds support at 1.2765 and forms a bullish reversal, it would confirm the continuation of the uptrend toward the mentioned resistance levels.

However, a break and daily close below 1.2765 would invalidate the bullish scenario, suggesting deeper retracement toward 1.2688, with further support at 1.2632 and 1.2600.

Conclusion

GBP/USD remains bullish above 1.2765. Look for a bounce from this level to confirm upside continuation. A daily close below 1.2765 would turn the outlook bearish, exposing lower support levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

REVERSAL ENTRY MODEL TARGETING SSLGBP/USD – 30M

Reversal Entry Model

During the London session, price swept the Asian highs, triggering buy-side liquidity. A clear change of character to the downside followed, signaling a potential reversal.

Now I'm in a sell position after price tapped into my Supply Zone and showed a clean rejection.

I’m expecting price to continue lower and sweep the sell side liquidity resting below!

GBPUSD InsightHello to all our subscribers!

Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- U.S. President Trump announced that he would suspend reciprocal tariffs for 90 days for the 70+ countries involved in negotiations, imposing only a 10% reciprocal tariff. He also stated that tariffs on China, which announced retaliatory tariffs, would be raised to 125%.

- There is speculation that foreign investors have recently been selling U.S. bonds. Considering that the U.S. 30-year bond yield has risen by around 50 basis points over the past three days, it is expected that Trump may have changed his stance.

- The market views these tariff measures as ultimately targeting China, while most other countries are expected to resolve the matter smoothly through negotiations.

Key Economic Events This Week

+ April 10: U.S. March Consumer Price Index (CPI)

+ April 11: U.K. February GDP, Germany March Consumer Price Index (CPI), U.S. March Producer Price Index (PPI)

GBPUSD Chart Analysis

Despite a recent sharp decline, the pair appears to be finding support around the 1.27000 level and is showing signs of recovering previous losses. In the short term, it is expected to continue its upward momentum toward the 1.31000 level.

However, given ongoing uncertainties, it’s important to monitor whether the pair can break through the 1.31000 resistance level. In addition, attention should continue to be paid to any changes in Trump’s policy stance.

GBP/USD Maintains a Consistent Upward ChannelThe bearish bias seen in previous sessions appears to have paused temporarily, giving way to a notable bullish momentum, which has driven gains of over 1% in the short term in favor of the British pound. Today’s White House announcement to temporarily pause tariffs on several previously threatened countries—excluding China, which could face tariffs of up to 125%—has weakened the U.S. dollar in the short term. This shift has allowed the British pound to regain ground, supporting a steady bullish bias in the GBP/USD pair.

Upward Channel

Since January 14 of this year, bullish strength has been dominant, forming a clear ascending channel that has repeatedly pushed the price above the 200-period moving average. Recent bearish swings have failed to break through the ascending trendline, which remains intact, making this bullish channel the most important formation to monitor for now.

TRIX

Despite recent declines in the TRIX line, the indicator continues to oscillate above the zero level. This suggests that buying momentum remains intact when averaging recent moving periods. As long as the TRIX line continues to hold above the neutral level, bullish strength may become increasingly consistent in the short term.

RSI

The RSI line is approaching the 50 level, which marks the neutral zone on the indicator. However, if a significant breakout above this level occurs, bullish impulses could become dominant in the market—potentially strengthening upward pressure on GBP/USD.

Key Levels:

1.29275 – Near Resistance: This level represents the recent weekly high. Bullish moves above this level could reinforce the short-term buying bias and lead to more sustained upward momentum.

1.27772 – Near Barrier: This level aligns with the 200-period moving average. Continued price action around this zone may lead to neutral consolidation and the formation of a short-term sideways range.

1.26183 – Final Support: This level corresponds to late February lows. A confirmed break below this support could signal the end of the current bullish channel.

By Julian Pineda, CFA – Market Analyst

GBPUSDOn the daily TF we had a nice rejection from the weekly resistance zone and support was also broken. H4 has been retesting the daily support that was broken while giving some bearish pressure. Next weekly support zone is 1.22000. Go short only if you get your bearish confirmations. Watch out for CPI and PPI.

GU-Tue-8/04/25 Top down analysis-Will GU consolidate ahead FOMC?Analysis done directly on the chart

Attract people with the value you provide.

The best way to create values is working on

yourself. It's difficult but what is something

that is not challenging? Without challenging

yourself, you'll always end up in the same spot

again and again. Have patience and give yourself

time.

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPUSD: Pullback From Support 🇬🇧🇺🇸

GBPUSD is likely to pull back from a key daily support.

I see a strong bullish pattern on an hourly time frame -

a double bottom formation.

Goal - 1.2825

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

My take on GBPUSD as of 11:23am 4/9/2025Market Insights from Indicators

Trend and Movement

Directional Indicators:

PLUS_DI (25.39) significantly outweighs MINUS_DI (5.54), indicating strong bullish momentum.

Directional Movement Index (DX: 64.15) confirms significant trend strength.

Aroon Oscillator (71.43) shows a healthy trend with potential upward movement.

Moving Averages:

EMA (1.3126), KAMA (1.31498), and TEMA (1.31703) remain above the current price, reinforcing a longer-term bearish bias.

However, shorter-term indicators like PLUS_DI and ROC suggest consolidation or temporary bullish moves.

Momentum and Oscillators:

RSI (68.12) reflects a mildly overbought condition, signaling possible resistance to bullish moves.

MACD (0.0052) and CMO (36.24) support short-term bullish momentum.

Williams %R (-29.19) and CCI (87.28) indicate price nearing resistance levels.

Volatility and Price Action

ATR (0.00356) suggests low volatility, allowing tighter stop-loss and target levels.

Price action is currently testing the support zone at 1.2780–1.2790 and resistance near 1.2830–1.2850.

Trend Analysis

Short-term momentum shows rising highs and closes, with support from bullish indicators like DX (~64).

Long-term bearish bias persists due to EMA, DEMA, and TEMA above the current price.

Key Levels:

Support: 1.2780–1.2790 (previous hourly lows).

Resistance: 1.2830–1.2850 (aligned with recent highs and trend indicators).

Directional Indicators and Oscillators:

Bullish dominance with PLUS_DI (29.18) outweighing MINUS_DI (12.42).

Momentum (MOM ~0.00877) supports short-term bullish opportunities.

Stochastic (45.48) and Stochastic RSI (26.07) indicate moderate upward momentum, but not extreme levels yet.

Volatility and Risk Indicators

True Range (TRANGE ~0.00354) indicates limited hourly price variability.

Moving averages like TEMA (1.31703), T3 (1.31303), and WMA (1.31403) reinforce long-term bearish resistance above 1.3140.

TSF (1.31757) points to strong resistance near 1.3170.

Key Events to Watch

April 9, 2025 (Today):

USD FOMC Minutes (High Impact): A hawkish tone could strengthen the USD, pushing GBP/USD lower, while a dovish approach may support GBP/USD gains.

April 10, 2025 (Tomorrow):

USD Inflation Data: Lower CPI or core inflation figures may weaken the USD and favor GBP/USD bullish moves.

Jobless Claims: Rising claims could signal labor market weakness, further pressuring the USD.

April 11, 2025 (Friday):

GBP GDP & Trade Balance: Positive data could strengthen the GBP, aligning with bullish chart patterns.

USD PPI & Consumer Sentiment: Higher producer prices or sentiment could support USD recovery.

Trading Considerations

FOMC Impact: Hawkish minutes may trigger bearish GBP/USD moves, while a dovish tone supports a bullish outlook.

Key Levels: Watch 1.2780–1.2790 (support) and 1.2830–1.2850 (resistance) for trading decisions.

Volatility Management: ATR (~0.00356) suggests tight stop-losses during high-impact news.

My Take

Given the bullish technical setup but acknowledging the risk from upcoming high-impact news, I lean toward caution. At this point of my trading career i'm not comfortable with aggressive trading. A well-defined long trade near 1.279–1.280 could be rewarding—but i'm prepared for rapid moves on news releases.

Aggressive Option: Enter long around support now with tight stops and target 1.283–1.285, but be very nimble in managing your position amid the news.

Conservative Option: Wait for the market to digest the FOMC minutes and inflation data, then look for a confirmed breakout or reversal that aligns with the bullish technical signals.

I think ill wait for the news... it's in about 2 hours. see ya then!

GBP/USD Is About to Explode – Here’s Why This Level Matters🚨 GBP/USD at a Critical Zone – Breakout or Reversal?

Let’s break down the price action from a technical perspective 👇

📊 Daily Technical Analysis – GBP/USD (April 2025)

The GBP/USD pair is trading near a key inflection point, with price action hinting at a potential breakout — or a deeper correction.

📈 Trend Overview:

The broader trend remains bullish, following a steady rally from the 1.2300 area back in February. The pair has been forming higher highs and higher lows, indicating strong underlying demand.

However, we’re now seeing signs of bullish exhaustion as the price struggles near the 1.2850 – 1.2900 resistance zone — an area that previously acted as a strong supply level.

🧱 Key Resistance Levels:

1.2850 – 1.2900: Major resistance zone; a daily close above this level would likely accelerate bullish momentum.

1.3000: Psychological round number and the next natural target.

1.3140: Historical swing high from mid-2023, could serve as the next upside objective.

🛡️ Key Support Levels:

1.2680: Previous higher low and potential first line of defense.

1.2520: Strong structural support — a break below this zone may shift the medium-term outlook to neutral or even bearish.

1.2300: February’s key low and the base of the current trend.

📐 Technical Structures:

Price appears to be forming an ascending triangle — a classic bullish continuation pattern — with flat resistance at 1.2850 and rising higher lows from below. This supports the idea of an impending breakout if bulls regain control.

Additionally, the pair is moving within a rising price channel, offering clean structure for both trend-following and breakout traders.

🧭 Potential Scenarios:

✅ Bullish Breakout:

A confirmed close above 1.2900 would likely open the door toward 1.3000, followed by 1.3140. This scenario aligns with the current market structure, assuming continued weakness in the USD or sustained risk appetite.

❌ Bearish Rejection:

Failure to break the resistance zone, especially with bearish reversal candles, could trigger a drop toward 1.2680, and possibly 1.2520. A daily close below 1.2520 would be a strong technical warning for bulls.

📌 Conclusion:

GBP/USD is sitting at a technically significant level. The prevailing trend favors the bulls, but the outcome at 1.2850–1.2900 will be decisive. Watch price action closely for confirmation — breakout or rejection, the next move could be sharp.

💬 What’s your take on this setup? Do you see a breakout or a reversal ahead? Drop your thoughts in the comments 👇

My Fav Res Forced The Price To Go Down Hard , Will Continue ?As we see , the high area forced teh price to go down as i mentioned in my last analysis post on GBP/USD , It`s now +80 Pips , i closed 50% from my contracts and let he rest running , but do you think it will continue or max 100 pips ?

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

GBPUSD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish momentum

No opposite signs

Expecting bearish continuation until the two Fibonacci resistance zones hold

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.