GBPUSD.1.MINI trade ideas

GBPUSD:Trading Strategy for Next WeekDriven by the combined factors of the resurgence of risk appetite and the weakness of the US dollar, the GBP/USD has been steadily rising. Additionally, as the US dollar is set to remain under pressure, the British pound is likely to maintain its upward trajectory. In terms of trading strategy, it is advisable to initiate long positions upon a pullback.

Trading Strategy:

buy@1.29500-1.30000

TP:1.31000-1.31500

The signals last week resulted in continuous profits, and accurate signals were shared daily.

GBPUSD What Next? SELL!

My dear followers,

I analysed this chart on GBPUSD and concluded the following:

The market is trading on 1.3089 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.2979

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPUSD. Weekly trading levels 14 - 18.04.2025During the week you can trade from these price levels. Finding the entry point into a transaction and its support is up to you, depending on your trading style and the development of the situation. Zones show preferred price ranges WHERE to look for an entry point into a trade.

If you expect any medium-term price movements, then most likely they will start from one of the zones.

Levels are valid for a week, the date is in the title. Next week I will adjust the levels based on new data and publish a new post.

! Please note that brokers have a difference in quotes, take this into account when trading.

The history of level development can be seen in my previous posts. They cannot be edited or deleted. Everything is fair. :)

----------------------------------------------

I don’t play guess the direction (that’s why there are no directional arrows), but zones (levels) are used for trading. We wait for the zone to approach, watch the reaction, and enter the trade.

Levels are drawn based on volumes and data from the CME. They are used as areas of interest for trading. Traded as classic support/resistance levels. We see the reaction to the rebound, we trade the rebound. We see a breakout and continue to trade on a rollback to the level. The worst option is if we revolve around the zone in a flat.

Do not reverse the market at every level; if there is a trend movement, consider it as an opportunity to continue the movement. Until the price has drawn a reversal pattern.

More information in my RU profile.

Don't forget to like Rocket and Subscribe!!! Feedback is very important to me!

Happy Friday GBPUSD! 4/11 10:12am updateMy Near-Term Views

Fundamental Context: The UK data mixed signals (with a stronger-than-expected GDP but a much-worse trade balance) juxtapose with softer US indicators (a negative PPI and lower consumer sentiment). Although these fundamentals create some uncertainty, they suggest that sterling might face headwinds if worsening trade data weighs on expectations. That said, the market’s reaction tends to be volatile, and right now, investors are digesting the news.

Technical Perspective: With the price currently at 1.3100, I see that GBP/USD has moved well above many short-term dynamic supports:

Dynamic Support: My HT_TRENDLINE on lower timeframes is positioned around 1.310–1.311 (on the 1‑minute, for example) but drops quickly on longer timeframes, indicating that although the current move is strong, it might be overextended relative to longer-term supports.

Momentum Signals: Some momentum indicators (like the StochRSI on very short-term charts) are spiking, which suggests that we've gone into overbought territory—raising the possibility of a near-term correction.

Support and Resistance Zones:

Support: I’m looking at a near-term support zone roughly around 1.3050–1.3080. This zone is where I expect buyers to step in should the current move lose steam—especially if negative price action or bearish patterns begin to appear in the lower timeframes.

Resistance: On the upside, resistance seems to be forming in the 1.3150–1.3200 range. Here, sellers might step in, or profit-taking could occur. In particular, the monthly indicators and previous highs cluster somewhere near 1.3195–1.3220, which would serve as a barrier if the bulls try to push higher.

My Action Plan: Based on everything, my bias for the near future is cautious—even though the fundamental situation isn’t definitively bearish, the technical picture is showing signs of overextension. If price starts trading down from 1.3100 and witnesses a clear bearish reversal pattern (like a bearish engulfing or a pin bar on a short timeframe), I'll consider that as a signal that the buyers are tiring and a pullback is underway. In that case, I might target a drop down toward the support zone (around 1.3050 or even lower) while keeping a close eye on the resistance above to avoid missing a breakout.

In short, while I'm still respectful of the underlying bullish fundamentals on GBP, the near-term technical signals indicate the pair might be overextended at 1.3100. This sets up a scenario where if the price can’t push past 1.3150–1.3200 with conviction, I’d expect a pullback to zone 1.3050 or below. The coming minutes and hours will be crucial to see whether a reversal pattern forms or if bullish momentum carries the pair to new highs.

Pound Gains on Dollar Softening, GBP/USD at $1.30The pound extended gains to $1.30 for a third session, as the dollar softened following Trump’s 90-day tariff pause for most countries. However, the 145% hike on Chinese goods kept risks elevated. While volatility persists, traders now expect 66 bps of BoE rate cuts this year, down from 79 bps a day earlier. UK GDP is forecast to grow 0.1% in February, suggesting a slow recovery.

If GBP/USD breaks above 1.3050, resistance levels are at 1.3100 and 1.3200. Support is at 1.2960, followed by 1.2900 and 1.2850.

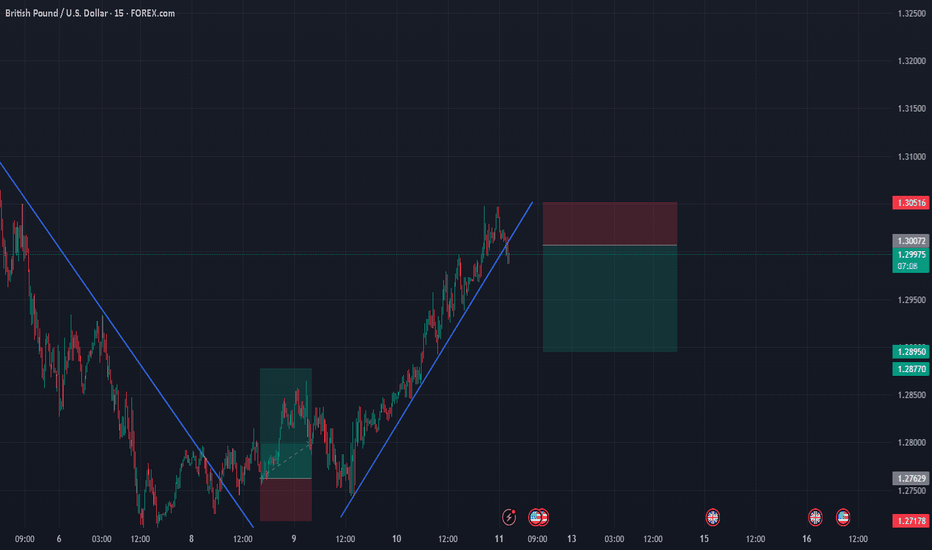

Long trade

1Hr TF overview

✅ Trade Breakdown – Buy-Side (GBP/USD)

📅 Date: Wednesday, April 9, 2025

⏰ Time: 4:00 AM (NY Time) – Tokyo to London Session Overlap

🕒 Entry Timeframe: 2-Minute (Microstructure Entry)

📈 Pair: GBP/USD

📈 Trade Direction: Long (Buy)

Trade Parameters:

Entry: 1.28700

Take Profit (TP): 1.30051 (+1.05%)

Stop Loss (SL): 1.28384 (–0.25%)

Risk-Reward Ratio (RR): 4.28

Buyside trade idea based on the sweep of Asia session lows, then I assume a reverse towards the London trend direction and bias as this time.

Analysis of the Trend of the GBPUSDThe GBPUSD is currently showing a gradually rising trend. An important support level is 1.28850, which is the lower boundary of the current range. Once it is broken below, it may suggest a reversal of the trend to a bearish one. Before that, we should still mainly choose to go long and use short selling as a supplement.

GBPUSD trading strategy

buy @:1.29200-1.29300

sl 1.28850

tp 1.29750-1.29850

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GBP/USD Breakdown Incoming? Bearish Setup Unfolding!Hi traders! Analyzing GBP/USD on the 1H timeframe, spotting a potential rejection at the descending trendline:

🔹 Entry: 1.29660

🔹 TP: 1.28652

🔹 SL: 1.30650

Price is reacting to the descending trendline after testing a key resistance zone. This level has acted as dynamic resistance in the past, and price shows signs of rejection.

The RSI is in the overbought area, suggesting a possible pullback. If the bearish momentum confirms, we could see a clean move back down to the previous support levels.

⚠️ DISCLAIMER: This is not financial advice. Every trader must evaluate their own risk and strategy.

GBPUSD TRADE SETUPPotential Trade Setup on GBPUSD

The price has successfully retested a very strong support after the 3-week rally it exhibited in March.

However there has been little to no pullback after the rally, and currently, it is firing a possible divergence at 1.2970

The price is developing, and I am waiting for a break below the support area at 1.2960 to take a possible short-term sell trade.

A BUY opportunity is at the bottom of the 50% fib at 1.2700.

You may find more details in the chart!

Thank you and Trade Responsibly!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading

I've been tracking the GBPUSD, and here's where I stand 12:10pmCurrent Price & Overextension: The price is currently at 1.29380, which is still well above the recent consolidation range of 1.281–1.285. This tells me the market remains overextended, suggesting that the strong rally may be due for a pullback.

Technical Snapshot: On the 1‑hour chart, my moving averages—such as the EMA, DEMA, and KAMA—are aligned near the price, confirming that the broader uptrend is intact. However, oscillators like the RSI, which is around 75, and the StochRSI sitting at 100, indicate that the market is extremely overbought. These overbought conditions make me anticipate a short‑term reversal.

Directional & Volatility Factors: The directional indicators still point to bullish momentum (with the PLUS_DI notably higher than the MINUS_DI), but the recent surge seems impulsive when I compare the price to the established support zone. With an ATR around 0.00538, I see that the price has moved significantly for the range, suggesting that a retracement is likely.

My Trade Setup: Given this setup, I’m watching for clear rejection signals—like a bearish engulfing pattern or a firm pin bar—around the upper levels of the range, roughly between 1.292 and 1.290. If I see these reversal signals, I'll plan to enter a short position with a tight stop just above recent highs (around 1.296–1.297). My profit target would be set toward the consolidation zone around 1.278–1.281, which offers me a favorable risk/reward ratio.

Fundamental Backdrop: Recent fundamental news, particularly the conflicting tariff policies, has spurred significant volatility. This volatility, combined with the technical overextension, reinforces my expectation that the current upward move is unsustainable in the short term.

In short, even though the overall trend remains bullish, the pair's current overbought condition and extreme price levels signal an impending short-term pullback. I'm getting ready to take advantage of that temporary reversal with careful, tight risk management.

Still pending clear confirmationPrice Action Overview:

From 1:00 AM to 10:00 AM today, I see the price steadily rising from around 1.2829 to a current close of about 1.29131. The 10:00 candle even touched a high of 1.29248. This sequence suggests that the market is testing the upper bound of the recent consolidation range.

Consolidation and Potential Overextension:

Although the movement from roughly 1.282 up to 1.292 is relatively tight, I interpret this as the price moving near the top of its recent consolidation zone. In earlier analysis, I identified the 1.281–1.285 region as a base, and a rally above that, especially reaching near 1.292, indicates that the move might be overshooting its sustainable range. This aligns with my view that the rally is overextended and a pullback could be imminent.

Candlestick Insights and Intraday Reversal Clues:

Looking at these recent candles, I notice that while the 10:00 candle closed with an upward gain (+21.8 pips) and the 9:00 candle also posted an upward move (+22.3 pips), the overall pattern shows modest moves with small bodies, suggesting that buyers are active but perhaps not strongly in control. There’s also that slight dip at 1:00 AM (a -15.0 pip move) which hints at the underlying volatility and potential exhaustion. These factors lead me to believe that the recent rally may be unsustainable.

Indicator and Fundamental Context Reinforced:

My previous analysis—supported by an overbought RSI reading on the 1‑hour and the overall bearish technical patterns (like the bearish marubozu and long-line bearish candles) on lower timeframes—remains valid. The fresh fundamental news adding volatility likely contributed to this impulsive rally, and now the market appears to be testing its high without much conviction.

What I’m Watching and the Trade Setup Going Forward:

Given this recent data, I’m focused on the area between 1.292 and 1.290. If I see a clear reversal pattern (for example, a bearish engulfing candle or a pin bar developing on the 15‑minute chart around these levels), that would confirm my expectation of sellers stepping in.

I’d look to enter a short position around 1.292–1.290, with a stop-loss set just above the current high (around 1.296–1.297) to account for typical volatility. This approach is consistent with targeting a move down toward support in the 1.278–1.281 range, offering a favorable risk/reward ratio.

GBPUSD My analysis for 4/10 8:55am. I’ve analyzed all the information—the price action, indicators, candlestick patterns, and the fresh fundamental news—and here’s why I believe this trade is compelling:

Overextension and Price Structure: Right now, the price is at 1.29490, which is significantly higher than the recent consolidation range of 1.281–1.285. This tells me that the market has pushed far beyond its comfort zone—a classic setup for a reversal pullback. I recognize this overextension as a warning sign that the rally might be overdone, especially when I consider the intraday price structure.

Candlestick Patterns and Timeframe Confluence: On the 1‑hour and 15‑minute charts, I’m seeing strong bearish candlestick formations like bearish marubozu and long-line bearish candles. These patterns show that sellers have been in control, and they typically indicate a clean, unimpeded move to the downside when a reversal begins. Even though there are some mixed signals on the weekly charts (with dojis and uncertain high waves suggesting indecision), the microstructure on the shorter timeframes tells me there's immediate selling pressure that I can exploit.

Indicator Confirmation: I’m also paying close attention to my indicators. The RSI on the 1‑hour chart is around 71, pushing into overbought territory, which signals that the upward momentum has likely peaked. Directional indicators, including the PLUS_DI versus MINUS_DI, further support a bias toward a corrective move downward. The ATR of approximately 0.00538 gives me a concrete measure of volatility, which I can use to set a well-defined stop-loss.

Fundamental Catalyst: The market’s recent surge has been partly driven by fresh fundamental news—contrasting tariff policies where the U.S. has relaxed tariffs while China hikes them. This divergence has spurred a burst of volatility and risk-off behavior. I see this fundamental news as amplifying the current overextension; the initial rally was impulsive, and now the fundamentals back the idea that the move isn’t sustainable.

Trade Setup and Risk Management: Based on this confluence, I plan to wait for a clear reversal signal on the lower timeframes—a bearish engulfing candle or a pin bar, ideally forming around 1.292–1.290. That’s when I would enter a short position. I’d set my stop-loss just above the recent highs (around 1.296–1.297) to accommodate normal volatility, as indicated by my ATR. For my profit target, I’m aiming for the support level around 1.278–1.281, which provides me with a favorable risk/reward ratio.

In summary, I believe this trade is attractive because the current price is clearly overextended relative to a recent consolidation, and the technical indicators (including bearish candlestick patterns and an overbought RSI) confirm that sellers have the upper hand in the short term. Coupled with the fundamental catalyst driving uncertainty, it makes sense for me to target a reversal pullback. Waiting for that confirmation around 1.292–1.290 with tight risk controls gives me confidence that I’m entering a high-confluence trade with strong downside potential.

GBP/USD Awaits CPI After Tariff-Driven GainGBP/USD hovered near 1.2830 on Thursday morning, holding its upward momentum for a third straight session. The pair remained supported as market sentiment improved following Trump’s tariff pause. All eyes are now on today’s U.S. inflation data, which is expected to influence the next move.

If GBP/USD breaks above 1.2860, resistance levels are at 1.2900 and 1.2940. Support is at 1.2715, followed by 1.2650 and 1.2600.