gbpusd📊 GBP/USD Analysis – Bullish Outlook with a Short-Term Correction

The GBP/USD pair is in an uptrend and approaching a key resistance zone. A short-term correction is expected before the price resumes its upward movement from the 1.29578 support level. 📈

🔹 Resistance Zone: The red area where sellers may step in.

🔹 Key Support Level: 1.29578, which could serve as a potential buy entry.

🔹 Indicators:

✅ MACD shows weakening bullish momentum.

✅ Stochastic is in the overbought zone, signaling a possible correction.

📌 If the price breaks above this resistance zone, a stronger bullish move could follow! What’s your take? 💬🔥 #GBPUSD #ForexAnalysis #PriceAction #Forex

GBPUSD.1.MINI trade ideas

GBP/USD Stalls Beneath 1.30 – Breakout or Bull Trap?The British pound continues to grind higher against the U.S. dollar, now trading at 1.2982 (+0.46%), but price action remains capped within a tight consolidation box just below the psychological 1.30 handle.

🔹 Price is holding above the 200-day (1.2809) and 50-day (1.2704) SMAs, maintaining a bullish structure.

🔹 RSI is at 62.90, comfortably in bullish territory but not overbought.

🔹 MACD is flat but still positive, suggesting momentum is stalling but not yet reversing.

The range between 1.2875 and 1.30 has held for over two weeks. A confirmed breakout above 1.30 could set the stage for a rally toward the 0.786 retracement at 1.3148, while a downside break might trigger a retracement toward the 200-day SMA or even 1.2700.

This range won’t last forever — the bulls and bears are coiling for the next big move.

-MW

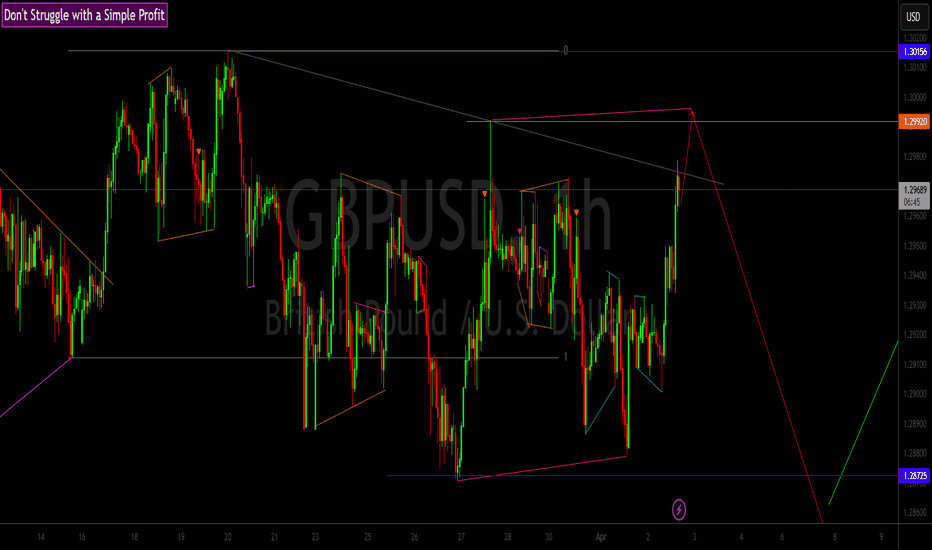

Gu outlook Weekly and daily are bullish

4h we are having a pullback.

Ihr and 15 min structure has shifted bullish.

Expecting price to push up to shift structure of 4h to bullish.

But still keep in mind price is at a supply zone which is inline with the trendline.

We may Expect Gu to have 1h oullback before the buy

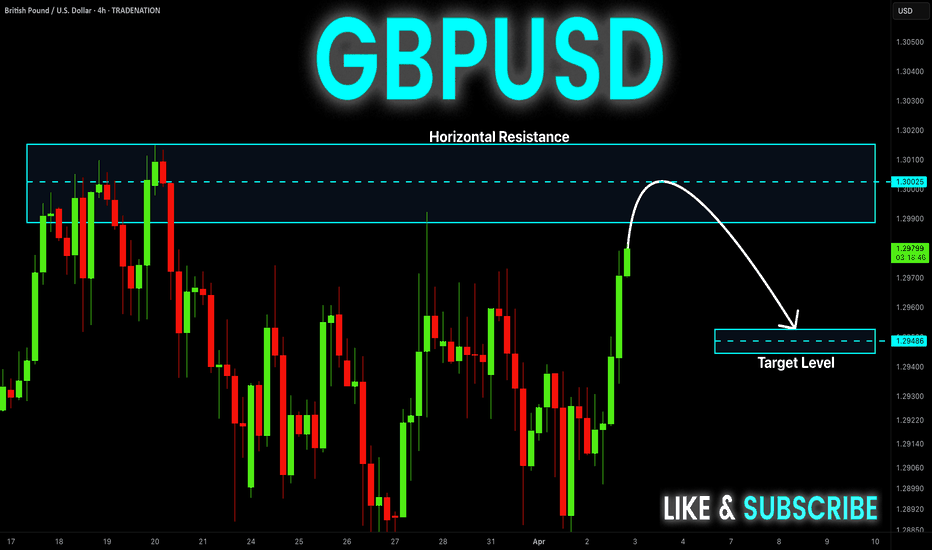

GBP-USD Risky Short! Sell!

Hello,Traders!

GBP-USD is growing now

But a horizontal resistance

Level of 1.3000 from where

We will be expecting a local

Pullback and a local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD Analysis Today: Technical and Order Flow !In this video I will be sharing my GBPUSD analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be moving to the COT data analysis, so how the big payers in market are moving their orders, and to do this I will be using my customized proprietary software and then I will be putting together these two different types of analysis.

GBP/USD Trend Before and After Tariff Announcement✍ ✍ ✍ GBP/USD news:

➡️ The US dollar is showing weakness against the British pound ahead of Trump's tariff announcement. The pair is currently trading near the 1.3000 level, following weak macroeconomic data released during the US trading session on Tuesday. The ISM Manufacturing PMI fell to 49 in March from 50.3 in February, while the JOLTS Employment Number fell to 7.56 million in February from 7.76 million in January. Both figures were below analysts' expectations. The strong ADP data still failed to stop the pair's short-term rally

➡️ US President Donald Trump will announce the new tariff regime at 20:00 GMT on Wednesday.

➡️ US Treasury Secretary Scott Bessent said late Tuesday that the tariffs announced on Wednesday will be the highest level yet imposed. Countries will then have the opportunity to take steps to lower these tariffs, he added.

Personal opinion:

➡️ GBP/USD will find it difficult to break out to the 1.3000 zone as buyers are waiting and evaluating the tariff policy.

➡️ Moreover, RSI is close to overbought territory and buying momentum is slowing down

➡️ In short, this pair will move within the trend line and may break down to 1.2870 after the tariff news is announced

➡️ Analysis based on resistance - support levels and Pivot points combined with EMA to come up with a suitable strategy

Plan:

🔆Price Zone Setup:

👉Sell GBP/USD 1.2970 - 1.2980

❌SL: 1.3010 | ✅TP: 1.2930 - 1.2890

FM wishes you a successful trading day 💰💰💰

Just broke through a high liquidity zone!!It just broke through a high liquidity zone!!

The marked line is the arrival point.

We still have plenty of profit-making possibilities left, so be patient.

Wait for a good pullback with the corresponding manipulation to find a good re-entry!!

If the market goes without us, it's better to take a loss where we don't know what we're doing.

Note: (A fairly crowded zone is always a liquidity zone.)

Keep it simple!

If you liked it, don't forget to follow me!

GBPUSD What Next? SELL!

My dear subscribers,

GBPUSD looks like it will make a good move, and here are the details:

The market is trading on 1.2947 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.2921

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPUSD BUY !I have in mind this buy , let’s hope markets plays out like this, as Trump’s tarrifs is affecting markets. We can see clearly downtrend and all the time market push itself down, i could see before Tariff announcment it could go up as we can't know what happens after announcment

2.5 RRR

GL Traders

Not Advice

POTENTIAL LONG POSITIONS ON GBP/USDGBP/USD 1H - This is another pair I have been looking at that is holding some good potential. This market has been bullish for some time on the higher timeframes.

We saw that price was breaking lows and respecting areas of Supply within this ranging market, however we have now seen that these characteristics have reversed and price is actually starting to breaking highs, protect lows and trade higher.

You can see that the last high that set the lowest low within what looks to be a potential corrective wave was broken, giving us our first break to the upside. We have then seen another one take place after price has traded into another area of interest.

This second break is giving us further confluence to suggest potential bullishness. Aligning with our GBP/JPY analysis. I want to see price now trade down and into the Demand Zone I have marked out, deliver us with another break to the upside. This would give me confirmation to look to go long.

The Day AheadWednesday, April 2

Data Releases: US March ADP report, February factory orders, Japan March monetary base, France February budget balance.

Central Banks: Speeches from Fed’s Kugler, ECB's Schnabel, and Escriva.

Trump Tariff Announcement: Trump’s team is finalizing options for a 4 p.m. announcement, considering a tiered system with flat rates or a customized approach.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPUSD A clear downward move toward downside find out the targetHello Guys,

Wish you and Your Family a Very Happy Eid.

I Found out one very easy to target GBPUSD trade setup for the week . here i can see GBPUSD is building a short term wave towards downside to target 1.2780 or below .

As we have created a Higher time frame OTE model

GU-Wed-2/04/25 Top down analysis-Have patience on GUAnalysis done directly on the chart

Not the best week even for the best traders.

Don't feel discouraged, quality over quantity.

Have you seen good setups in this messy

Market condition and amid uncertainty? Know

how to preserve and protect your capital

during hard times and maximize profits when

smooth price action with clarity in the market

comes.

Not financial advise, DYOR.

Market Flow Strategy

Mister Y

Market Analysis: GBP/USD Eyes Fresh GainsMarket Analysis: GBP/USD Eyes Fresh Gains

GBP/USD started a fresh increase above the 1.2900 zone.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is eyeing more gains above the 1.2970 resistance.

- There is a key bearish trend line forming with resistance at 1.2935 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair formed a base above the 1.2870 level. The British Pound started a steady increase above the 1.2900 resistance zone against the US Dollar, as discussed in the previous analysis.

The pair surpassed the 50% Fib retracement level of the downward move from the 1.2972 swing high to the 1.2879 low. The pair is now consolidating near the 1.2925 zone and the 1.2420 level and the 50-hour simple moving average.

If there is another decline, the pair could find support near the 1.2900 level. The first major support sits near the 1.2880 zone. The next major support is 1.2870.

If there is a break below 1.2870, the pair could extend the decline. The next key support is near the 1.2820 level. Any more losses might call for a test of the 1.2800 support.

Conversely, the bulls might aim for more gains. The RSI moved above the 50 level on the GBP/USD chart and the pair is now approaching a major hurdle at 1.2935 and the 61.8% Fib retracement level of the downward move from the 1.2972 swing high to the 1.2879 low.

There is also a key bearish trend line forming with resistance at 1.2935. An upside break above the 1.2935 zone could send the pair toward 1.2970. Any more gains might open the doors for a test of 1.2995.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBPUSD(20250402)Today's AnalysisToday's buying and selling boundaries:

1.2913

Support and resistance levels

1.2973

1.2951

1.2936

1.2889

1.2875

1.2852

Trading strategy:

If the price breaks through 1.2936, consider buying, the first target price is 1.2951

If the price breaks through 1.2913, consider selling, the first target price is 1.2889