GBPUSD.1.MINI trade ideas

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.28877) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 1.29600 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.27800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPUSD Trade Idea - Hit while typing, but good for reviewEntry rules met.

Confluences:

✅ Bearish overall bias

✅ Bearish demand zone

✅ Bearish ABCD extension pattern

✅ Bearish divergence

✅ Bearish break of structure

✅ Entering London close zone

✅ Price is in entry zone

✅ Required risk:reward met

⭐ I shared this watch zone in my weekly forex outlook, you can subscribe by clinking the link in my bio.

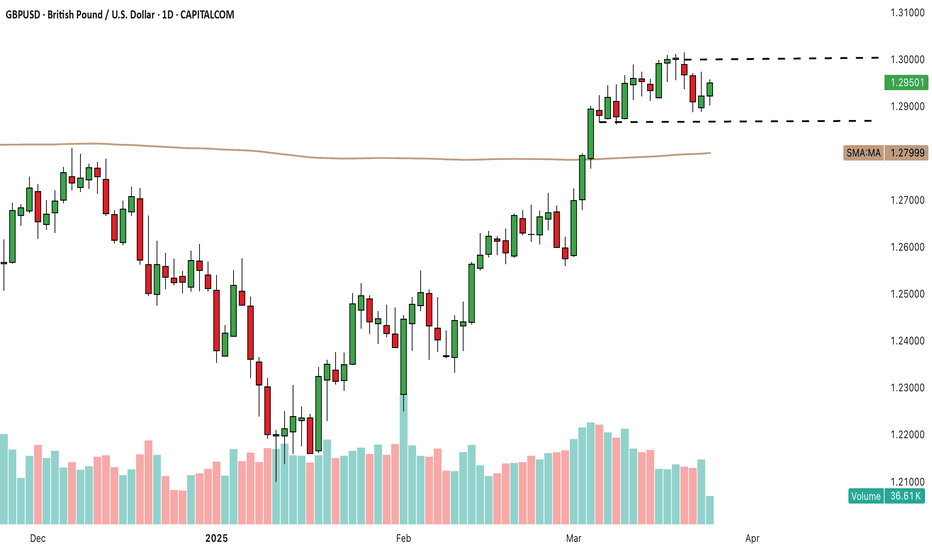

GBP/USD Holds Near Highs Ahead of Spring StatementGBP/USD remains near recent highs as traders await Wednesday’s Spring Statement from Chancellor Rachel Reeves. While major tax changes are off the table, revisions to the UK’s economic outlook and fiscal plans could provide fresh direction for the pound.

What to Watch in the Spring Statement

The key focus will be the Office for Budget Responsibility’s updated growth forecasts. Last year, the OBR had pencilled in 2% GDP growth for 2025, but weaker-than-expected data suggests that figure is due for a downgrade. Some estimates suggest it could be halved to around 1%.

Meanwhile, higher interest rates have pushed up government debt servicing costs by an estimated £10bn per year, eroding the fiscal headroom Reeves had in October. With the chancellor prioritising stability, the government is expected to balance the books through welfare cuts and slightly tighter departmental spending rather than introducing new tax measures. For markets, that means a relatively muted fiscal event—but in an environment where the pound has been grinding higher, even subtle shifts in the outlook could be enough to move the dial.

A Breakout, Then a Breather

Sterling’s technical picture has changed significantly since the start of the year. After breaking above a long-term descending trendline in late January, GBP/USD has carved out a steepening series of higher swing lows, forming an ascending trendline fan. This structure signals increasing bullish momentum, but in recent weeks, the pair has entered a consolidation phase—pulling back slightly while holding near trend highs. At the same time, trading volume has steadily declined, dipping below its 20-day average.

GBP/USD Daily Candle Chart

Past performance is not a reliable indicator of future results

On the hourly chart, this consolidation is even more defined. GBP/USD has established a clear range with horizontal support and resistance levels, offering traders well-structured reference points for reversals or breakouts, especially with Wednesday’s Spring Statement acting as a potential catalyst. At present, prices are languishing near the lower boundary of this range, but the RSI is not in oversold territory. However, if RSI does dip into oversold conditions and the hourly chart forms a bullish reversal pattern at the bottom of the range—an area that aligns with the ascending trendline fan on the daily chart—it would present a compelling buy signal within the broader uptrend.

GBP/USD Hourly Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

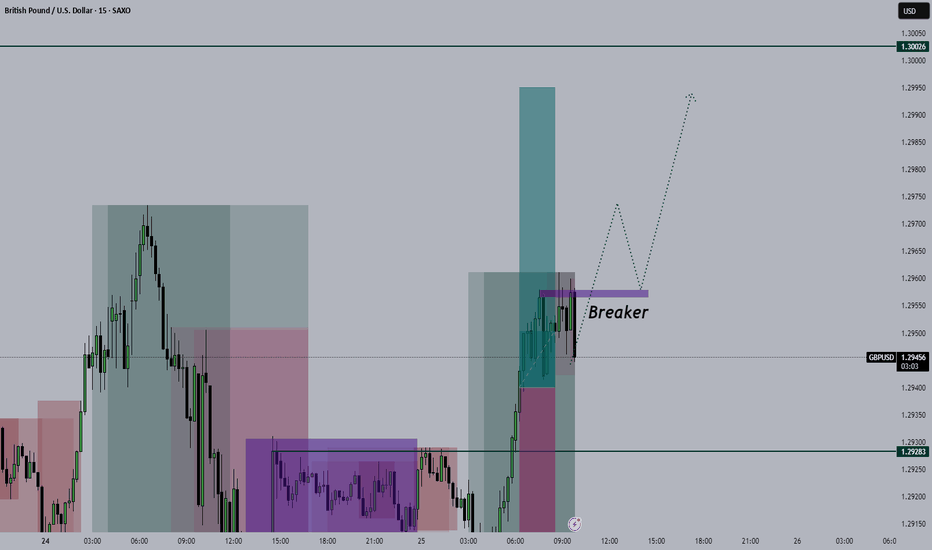

WAITING ON A PULLBACK BEFORE WE SHORTGBP/USD 1H - As you can see price is now looking as though it is going to put in this corrective wave trading us up and into the Supply Zone above, in doing so it should give us the opportunity to enter in on this market.

I want to see price trade up and into this area for two reasons, one to clear the orders which will encourage a reversal in the balance and secondly to set a Lower high within this higher timeframe bearish structure.

Once price does trade us up and into this zone we can then begin to look for those short opportunities, we will want to see price trade in, clear those orders and break structure to the downside fractally.

A break in the structure to the downside will confirm and end to the correction and the start of the next impulse, this giving us the confirmation to trade this market short following the higher timeframe structure of this market.

GBP/USD Stable at $1.292: Budget AwaitedGBP/USD is trading steadily around $1.292 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Mister Y - GU - Tuesday - 25/03/25 Top down analysisAnalysis done directly on the chart

Consistency matters, you can have bad days but

if you look at the wider picture this shouldn't bother

you. Don't give up, one mistake should not define

you as failure. We all learn from mistakes, this should

be normalized and not be punished.

Not financial advice, DYOR.

Mister Y

GBPUSD-SELL strategy Daily chart Line Brk (2)The pair is in a corrective phase and based on FIB. we may see 1.2800 - 1.2700 area in the coming sessions (week). we are negative on some indicators, which help support the viewpoint including the reds we got now at the start of the movement.

Strategy SELL @ 1.2920-1.2950 and take profit near 1.2768... just judge it whether to take back sooner.

GBPUSD(20250325)Today's AnalysisToday's buying and selling boundaries:

1.2929

Support and resistance levels:

1.3007

1.2978

1.2959

1.2899

1.2880

1.2850

Trading strategy:

If the price breaks through 1.2929, consider buying, the first target price is 1.2978

If the price breaks through 1.2899, consider selling, the first target price is 1.2880

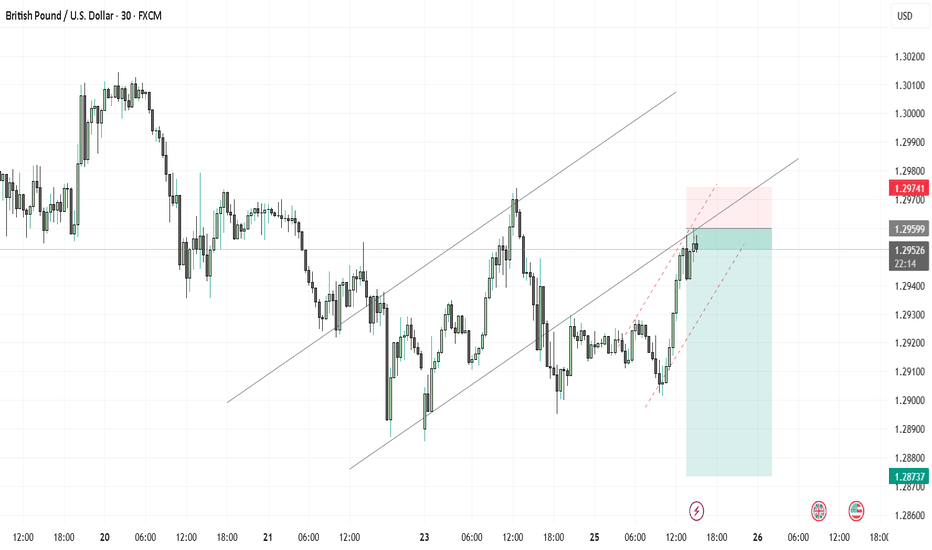

Monday Recap & Tuesday Outlook: GBP/USDMonday Recap & Tuesday Outlook: GBP/USD

📊 Market Recap – Monday’s Price Action

GBP/USD opened strong, surging to 1.29551 to grab liquidity before reversing and declining.

What I’m Watching for Tuesday

📍 Key Expectations:

✅ Liquidity grab at 1.28871

✅ Drop to my POI at 1.28800

✅ Potential rally to challenge Monday’s high at 1.29829

I’ll be watching for confirmations before executing any trades. Let’s see how the market unfolds.

💬 What’s your bias for GBP/USD tomorrow? Let me know below! 👇

#ForexTrading #MarketOutlook #GBPUSD #TradingStrategy