EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD.1.MINI trade ideas

Dollar Pressure Support GBP/USD at 1.2915GBP/USD is trading around 1.2915, supported by a weaker U.S. dollar and steady investor sentiment. The pound benefits from political stability and steady UK economic expectations with the focus on the upcoming April 2 U.S. tariff announcement. The pair is rebounding from recent lows but remains range-bound as traders await new drivers, especially from U.S. trade actions and global growth indicators.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

GBPUSD Week 13 Swing Zone/LevelsYour next trade could be the beginning of your success in Forex.

We’ve been performing exceptionally well so far, identifying key swing levels as always.

- Stop Loss (SL): Set between 10-15 pips from the 5-minute candle entry.

- Dynamic Take Profit (DTP): Adjusted based on price reaction to swing levels.

Let’s capitalize on the momentum!

Mister Y - GU - Monday - 24/03/25 Top down analysisAs always analysis done directly on the chart

Some Friday notes

Discussed on public chat on Friday

Sell idea was on point price tapped 1hR and

Trend line for sell continuation around 1.29500

Nice scalp buy as discussed on Friday analysis

(the bottom of Rec1 reaction)

Move happened late NY, wasn't on the chart

But posted ideas in advance played out

HTF analysis, for LTF entries. Let's have

Discussions in the comments, public chat,

If needed in private chat on Tradingview

Not financial advice, DYOR.

Market flow strategy

Mister Y

GBPUSD LONGS IDEANew week, new goals, new energy.

So, We had a good liquidity sweep on a higher t.f.

I wanna see the market pump to the PDH level for the longs idea.

Possibly after the market does that, It'll ct to more BSL(Buy-side liquidity) and in-sufficiencies or reverse back down.

We don't have the best economic calendar today so I'ma not expect much.

Follow for more updates on the same idea for longs.

Hit the boost button if you agree and comment below for any questions, queries or commentary ideas

Fundamental Market Analysis for March 24, 2025 GBPUSDThe GBP/USD pair continues to hold below the round 1.2900 mark and is attracting buyers in the Asian session on Monday.

The US Dollar (USD) started the new week on a weak note and halted its three-day recovery from multi-month lows, which in turn is seen as a key factor acting as a tailwind for the GBP/USD pair. Despite the Federal Reserve (Fed) raising its inflation forecast, investors seem convinced that a tariff-induced slowdown in the US economy could force the central bank to resume its rate-cutting cycle in the near future.

In fact, the UK central bank has cautioned against assumptions of rate cuts and has also raised its forecast for inflation to peak this year. This suggests that the Bank of England will reduce borrowing costs more slowly than other central banks, including the Fed, which lends further support to the GBP/USD pair.

Moving forward, traders are awaiting the release of flash PMI indices from the UK and the US for meaningful momentum. In addition, speeches from influential FOMC members will stimulate demand for the dollar, which, along with comments from Bank of England Governor Andrew Bailey, should create short-term trading opportunities for the GBP/USD pair.

Trading recommendation: BUY 1.2930, SL 1.2850, TP 1.3060

Correction( old gbpusd chart was invert post by mistake)

---

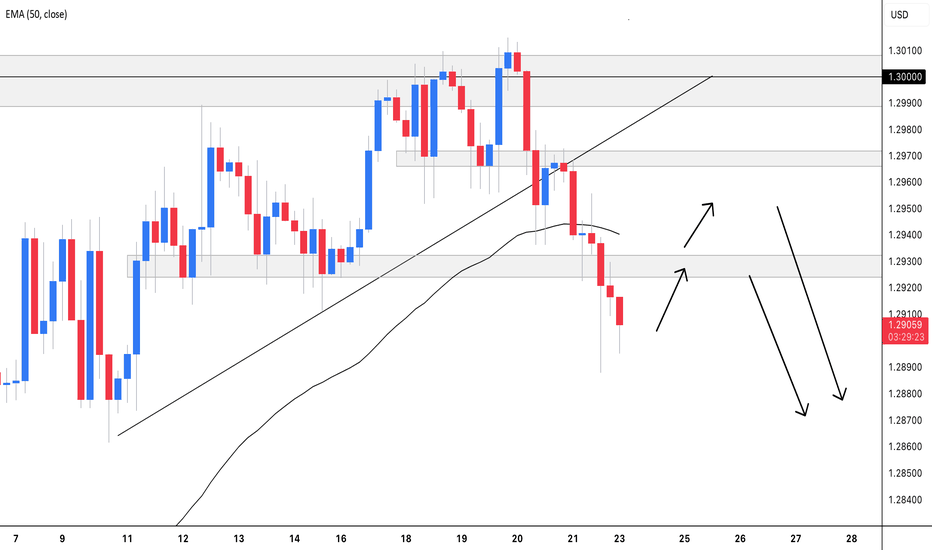

GBP/USD Bears Taking Control? 🔥

🚨 Smart Money Shift in Play! GBP/USD just broke a key Choch (Change of Character) level, signaling a potential trend reversal. The bulls are losing momentum, and smart money could be preparing for a deeper correction.

📉 Bearish Setup in Progress:

✅ Liquidity grab above previous highs

✅ Break of structure confirming weakness

✅ Retest of supply zone (1.29500) before a potential dump

📍 Target Zone: 1.27800 – 1.28000

📊 If price respects the supply zone, we could see a strong downside move into the next demand area. Watch for confirmation signs before entering!

🔥 Will GBP/USD hit the target, or will bulls fight back? Drop your thoughts below.

GBPISD Analysis As of March 24, 2025, the GBP/USD currency pair is trading around $1.2934 per British pound.

Mid Forex

Recent Developments:

Bank of England's Cautious Stance: The Bank of England (BoE) has maintained a cautious approach to monetary policy, opting for gradual interest rate cuts. This strategy contrasts with more aggressive rate reductions by other central banks, such as the U.S. Federal Reserve and the European Central Bank.

Financial Times

+1

Latest news & breaking headlines

+1

Economic Indicators: Upcoming UK economic indicators, including GDP, inflation, and retail sales, are anticipated to influence the pound's performance. Economists forecast modest GDP growth, with January's figures expected to show a 0.1% month-on-month increase, down from 0.4% in December.

Exchange Rates UK

+1

Forex

+1

U.S. Economic Data: In the U.S., recent soft Consumer Price Index (CPI) data have fueled speculation about potential early Federal Reserve rate cuts amid cooling inflation. Market participants are closely monitoring Producer Price Index (PPI) and jobless claims data for further insights into the Fed's policy direction.

Outlook:

Analysts suggest that the British pound may continue to strengthen, supported by a resilient UK economy and the BoE's measured approach to rate cuts. Investment banks project the pound reaching between $1.35 and $1.40 within the next year, citing expectations of UK interest rates remaining higher than those in other major economies.

Latest news & breaking headlines

However, geopolitical tensions, such as trade policy uncertainties and global trade tensions, could introduce volatility to the currency pair. Traders should stay informed on upcoming economic releases and central bank communications to navigate potential market fluctuations effectively.

GBPUSD DOWN NEXT MOVE BIG FALL SOON Bullish Breakout Scenario (Reversal):

Alternative Idea: Instead of reversing at the strong selling zone, GBP/USD could break above the resistance level at 1.2940 and continue upward.

Trigger: If strong bullish momentum emerges (e.g., fueled by positive UK economic news or weak US dollar sentiment), this could invalidate the bearish setup and turn the trend bullish.

Next Target: A breakout might push the price toward 1.3000 or higher, targeting previous swing highs.

2. Range-Bound Movement:

Alternative Setup: GBP/USD may fail to show any clear breakout and instead consolidate within a tight range between 1.2880 and 1.2940.

Trigger: Lack of volume or mixed economic data could lead to sideways movement, trapping traders expecting immediate directional momentum.

3. Bullish Divergence Possibility:

Technical Suggestion: Check for a potential bullish divergence on momentum indicators like RSI or MACD, where price is making lower lows, but the indicator shows higher lows.

Implication: This could signal weakening bearish pressure, increasing the chances of a reversal.

4. Fundamental Risk:

Macroeconomic Impact: The chart analysis could be disrupted by upcoming events like central bank decisions, inflation data, or geopolitical developments that may favor either currency

Mon 24th Mar 2025 GBP/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/USD Sell. Enjoy the day all. Cheers. Jim

GBPUSD Trending Lower - Will It Drop To 1.28660?OANDA:GBPUSD is currently trading within a descending channel, indicating a strong bearish trend. The price has recently tested a resistance zone within the channel and appears to be rejecting it, suggesting a potential continuation to the downside.

The current market structure implies that if this rejection holds, we could see further bearish movement toward the 1.28660 level, which aligns with the lower boundary of the channel. However, if the price manages to push above the channel with strong momentum, it could signal a shift in trend, potentially leading to a bullish breakout and a move toward higher resistance levels.

Traders should look for confirmation signals such as rejection wicks, bearish engulfing candles, or increased selling volume before entering short positions.

If you agree with this analysis or have additional insights, feel free to share your thoughts!

POSSIBLE LONG TERM SELL ON GBPUSD 1️⃣ Technical Confluences (Bearish Bias)

🔹 Resistance Trendline Touch – Price is testing a well-defined descending trendline, suggesting a potential rejection.

🔹 Fair Value Gap (FVG) Sell Area – The price might fill this imbalance before reversing downward.

🔹 Key Supply Zone (~1.3244–1.3376) – A historically strong resistance area, likely to trigger sell orders.

🔹 Lower Timeframe Confirmation (H4 & H1) – Look for a bearish engulfing, pin bars, or a break of lower highs for strong confirmation.

🔹 Bearish Divergence (Check RSI/ MACD) – If RSI or MACD is showing divergence, this strengthens the bearish case

2️⃣ Risk-Reward & Trade Setup

📍 Entry: Around 1.3244–1.3376 (after confirmation).

🎯 Target: 1.2170 (next major demand zone).

⛔ Stop-Loss: Above 1.3376 (above the resistance zone).

⚖️ Risk-Reward Ratio: Approx 1:3 or better for optimal trade efficiency.

3️⃣ Fundamental & Sentiment Check

✅ DXY Strength: If the US Dollar Index (DXY) is rising, this supports a bearish GBP/USD move.

✅ Interest Rate & Economic Data: Check for upcoming Fed/BoE announcements that could impact GBP/USD.

✅ Market Sentiment: If risk-off sentiment dominates, USD could gain strength, pushing GBP/USD lower.

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.