GBPUSD.1.MINI trade ideas

GBPUSD LONGMarket structure bullish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection from EMA

Daily rejection at AOi

Previous Daily Structure Point

Around Psychological Level 1.29000

H4 Candlestick rejection

Levels 3.45

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

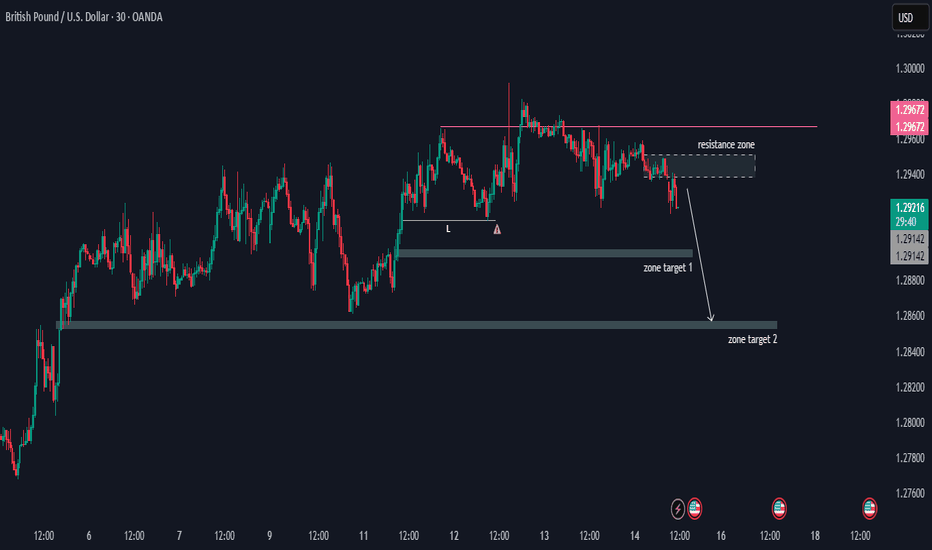

GBPUSD Bearish IntradayGU is bearish on the M30, pushing down from 1.29400, which is below a resistance zone. The price does have the potential for a minor retracement above the low of 1.29142, so bears should exercise a bit of caution there.

1.28583 is the directional bias, with one price target zone.

Happy Trading,

K.

Not trading advice.

Pound Drops to $1.29 After Unexpected ContractionThe British pound fell to $1.29 after UK GDP unexpectedly shrank by 0.1% in January, missing forecasts of 0.1% growth, mainly due to weakness in the production sector.

The Bank of England recently cut its Q1 growth forecast to 0.1% from 0.4%, with rates expected to stay at 4.5% in next week’s policy decision. Markets also await Chancellor Rachel Reeves' fiscal plans and the OBR’s economic outlook on March 26. Meanwhile, US economic concerns and trade tensions have limited the pound’s losses.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

GBP/USD Trend Next Week - New Uptrend?🔔🔔🔔 GBP/USD news:

👉The British Pound (GBP) remained mostly unchanged in trading after the UK’s GDP data showed a 0.1% decline in January. The rolling three-month measure increased by 0.2%, aligning with forecasts. The weak performance in January was driven by global uncertainty and concerns over tariffs.

👉Next week, the UK's economic focus will be on the Bank of England's interest rate decision, with expectations that rates will remain unchanged on Thursday.

👉Meanwhile, weak U.S. CPI and PPI data have reinforced market expectations that the Federal Reserve may ease monetary policy sooner. However, with U.S. President Donald Trump set to impose reciprocal tariffs on April 2, the outlook remains uncertain.

Personal opinion:

👉Recent weak U.S. data is fueling fears of a recession in the country. This has caused the US dollar to start to decline again

👉The GBP/USD pair has been under pressure from sellers, but the 1.2900 level has held firm after several attacks by sellers. If this level is not broken early next week, it may be a stepping stone for another price increase after the sellers are exhausted

Resistance zone: 1.2960 1.3000

Support zone: 1.2900 1.2860

Analysis:

👉Based on resistance-support levels combined with fibonacci and SMA to come up with a suitable strategy.

Plan:

🔆Price Zone Setup:

👉Buy GBP/USD 1.2910 – 1.2900

❌SL: 1.2860 | ✅TP: 1.2950 – 1.2990 – 1.3030

FM wishes you a successful trading day 💰💰💰

GBPUSD: UP After the News 🇬🇧🇺🇸

GBPUSD looks bullish after the release of the US news.

I see a bullish breakout of a resistance line of a falling wedge pattern.

The price is going to retest the current high first - 1.2987,

and continue growing to 1.3 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BUYING INTO THE CORRECTION BEFORE WE SHORTGBP/USD 1D - As you can see this is my mid to long term set up for this pair, I am expecting price to trade us lower longer term due to the higher timeframe BOS to the downside that we have had.

As you can see though we are in the mids of a corrective wave that is currently trading us higher, we can look to take part in this corrective wave once price trades us down and into a valid area of Demand.

You can see I have gone ahead and marked out a hidden order block that I could see price trading down and into to clear before taking us higher in the market. There is also alot of liquidity present there given the red candles, giving us more confluence.

Once price trades us lower and into this area of Demand I will wait patiently for confirmation before I look to take part in this market. Confirmation will come from a penetration and break to the upside.

GBPUSD INTRADAY Bullish breakout supported at 1.2930 The GBPUSD currency pair price action sentiment appears bullish, supported by the prevailing uptrend. The recent intraday price action appears to be a sideways consolidation towards the previous resistance.

The key trading level is at 1.2930 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back from the 1.2930 level could target the upside resistance at 1.2994 followed by the 1.3056 and 1.3123 levels over the longer timeframe.

Alternatively, a confirmed loss of the 1.2930 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 1.2866 support level followed by 1.2799 and 1.2740.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Day Ahead Economic Data due this week:

Monday: US retail sales (February), China industrial production and retail sales (January to February).

Tuesday: Germany economic sentiment (March). Earnings: XPeng.

Wednesday: US interest rate decision, Japan interest rate decision.

Thursday: UK unemployment rate (January), UK interest rate decision.

Earnings: Nike, FedEx, Lululemon, Micron, Accenture.

Friday: Japan inflation (February), Earnings: NIO.