GBPUSD.1.MINI trade ideas

GBPUSD H4 | Rising toward the key resistanceBased on the H4 chart analysis, the price is falling toward our buy entry level at 1.3013, a pullback support.

Our take profit is set at 1.3260, a pullback resistance.

The stop loss is placed at 1.2864, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Gbp/Usd 11-Apr 2025The GBP/USD currency pair has recently shown signs of strength, trading above the 1.30 level. This movement appears to be influenced by a weaker US dollar, which may be attributed to ongoing trade tensions and lower-than-expected US inflation data released yesterday. Additionally, UK GDP figures came in above market forecasts, potentially supporting the pound.

Looking ahead, upcoming US data releases—including PPI, Consumer Sentiment, and Inflation Expectations—may introduce market volatility and impact USD-related pairs.

Possible Price Scenarios (Not Financial Advice):

• If the price revisits the 1.30 level and shows signs of support, this may indicate reduced selling pressure, with a potential move toward the 1.32 level if buying interest returns.

• A move above 1.325—possibly supported by lower-than-expected PPI data—could open the door for a continuation toward the 1.343 region.

• Conversely, if the price breaks below the 1.30 level, the 1.277 area may serve as the next level of interest, where buying activity could potentially emerge.

• Should bearish momentum continue past 1.272, the 1.25 level might become the next key area to monitor for possible price reactions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

1 correction to decrease recovery🔔🔔🔔 GBP/USD news:

➡️ The British pound (GBP) extended its intraday rally against the US dollar (USD) at the start of the week, with the GBP/USD pair climbing toward 1.3150 during Monday’s European session. It is now aiming to retest the six-month high of 1.3207, last seen on April 3, as investors continued to sell off the US dollar following the announcement of retaliatory tariffs between the United States and China.

➡️ The US Dollar Index (DXY), which measures the greenback’s value against a basket of six major currencies, dropped to around 99.00—its lowest level in three years.

Personal opinion:

➡️ Buyers are taking profits and pausing further upside momentum to monitor further news on the pair

➡️ The RSI is showing signs of falling after entering overbought territory.

➡️ Analysis based on important resistance - support and Fibonacci levels combined with SMA to come up with a suitable strategy

Plan:

🔆Price Zone Setup:

👉Sell GBP/USD 1.3180 - 1.3200

❌SL:1.3230| ✅TP: 1.3125 - 1.3050

FM wishes you a successful trading day 💰💰💰

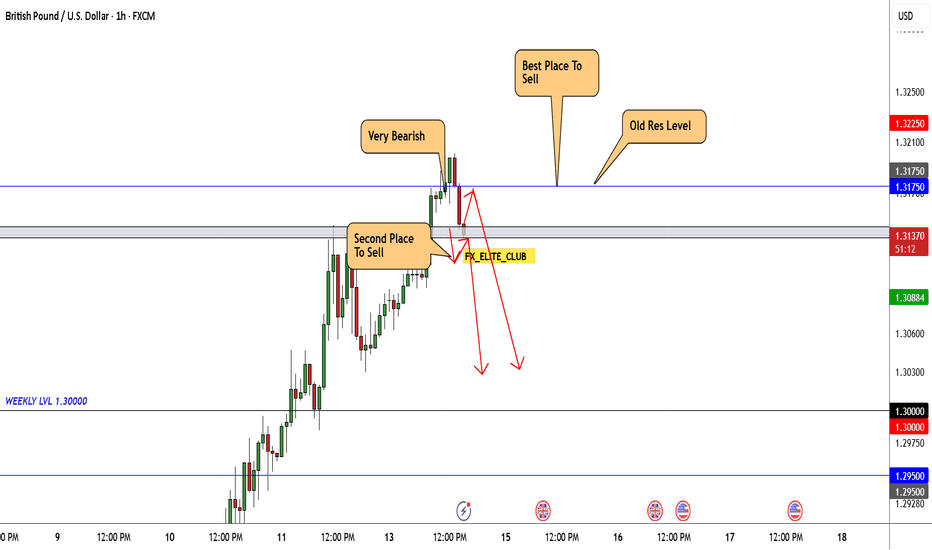

GBP/USD At Interesting Area To Sell , Should We Sell Now ?Here is my Opinion About GBP/USD , I Have an old res and the price respect it 100% and gave us a very good bearish P.A , So i think we have 2 places to sell it , first one if the price back to retest my res level 1.31750 and if the price give us a good bearish price action we can enter and targeting 200 pips . if the price didn`t back to retest the res level we can wait he price to close below support with 4h candle and then we can enter a sell trade with the same target .

The increases caused by the weakening of the US dollarTrump Mulls Firing Fed Chair Powell—Sending Financial Markets into a Tizzy 😱

Multiple sources confirm: Trump is seriously weighing the unprecedented move of ousting Fed Chair Jerome Powell, instantly fueling a storm of speculation 📢. Their long - running feud over monetary policy has reached a boiling point. Trump, via fiery social media rants, has been relentlessly demanding steep rate cuts ⬇️, while Powell stands firm, stressing the importance of data - driven decisions and patiently assessing economic ripples before pulling the policy lever 📈.

Trump has his eye on former Fed governor Kevin Warsh as the ideal replacement, but Warsh himself is sounding the alarm 🚨, urging against the risky firing. The catch? There’s zero legal precedent for a president axing a Fed chair mid - term. Powell’s response? A staunch defense of the Fed’s independence, emphasizing that policy should be a fortress shielded from political crosswinds 💪.

Inside the White House, it’s a battlefield of opinions. Treasury Secretary Mnuchin, a fierce defender of the Fed’s autonomy, likens its independence to a precious jewel ⭐️ that must be safeguarded. But other advisors are gunning for a showdown, challenging Powell’s authority head - on. This high - stakes power play isn’t just shaking US markets—it’s sending shockwaves across the global financial stage 🌐.

Adding to the concerns, if Trump's actions lead to significant disruptions in the Fed's decision - making process, it could very well trigger a weakening of the US dollar. Uncertainty around monetary policy can erode confidence in the currency. A lack of clear, stable leadership at the Fed, should Powell be removed, might make investors skittish. They could start moving their funds elsewhere, causing a sell - off of the dollar. Moreover, if the Fed, under new leadership more compliant with Trump's wishes, were to cut rates drastically in an attempt to boost the economy as Trump desires, it could lead to inflationary pressures. Higher inflation typically devalues a currency, further contributing to a weaker dollar. With so much at stake, the outcome could rewrite the rulebook for US economic policy ⚖️. Stay tuned!

💰💰💰 GBPUSD💰💰💰

🎯 Buy@1.3250 - 1.3280

🎯 TP 1.3300 - 1.3400

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

👇The accuracy rate of our daily signals has remained above 98% within a month! 📈 We sincerely welcome you to join our channel and share in the success with us! 🌟

GU-Tue-15/04/25 TDA-Heavy pullback on GU before continuation?Analysis done directly on the chart

Unpopular facts:

Win rate doesn't matter, in the end it always

comes down to how much you win versus how

much you lose. You can have high win rate

with little profits and one big loss to ruin all.

Regardless of win rate, the better trader you are

the more you profits and the less you lose.

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPUSD - Longs - Fundamental Analysis My trade idea for GBPUSD:

DXY (USD) News:

On 2nd April 2025, US president Donald Trump announced tariffs of 10% on most imports and up to 145% on Chinese goods. This has led to significant market volatility. Investors are increasingly concerned about the U.S.'s economic direction, prompting a shift away from dollar-denominated assets. This sentiment has been exacerbated by fears of a potential recession, as highlighted by JPMorgan Chase's forecast.

Major foreign investors, including those from China and Japan, are reportedly reducing their holdings in U.S. Treasury bonds. This retreat diminishes demand for the dollar, contributing to its depreciation.

Conclusion: We can expect a further decline in DXY price. Possible opportunity to long XXX/USD pairs.

BXY (GBP) News:

The UK economy grew by a faster-than-expected 0.5% in February, official figures showed.

Conclusion: With US placing tariffs globally, we can expect USD weakness over the next 2-3 weeks. GBP holds its ground with strong economic figures from Q1.

My trade position:

Between 14 - 18 Apr, I will be monitoring price action. Looking to buy below 1.32 with the first target being 1.35. 1.29 offers strong support.

[_] ONENTRYGBPUSD - ‘2FIB Strategy’ by ONENTRY

Timeframe: 30 Minutes

Session: London & New York

---

### **Step 1: Identify the Overnight Range**

- Mark the **high** and **low** of the price range between **00:00 - 06:30 (+2GMT)**.

- Mark up **50% of the overnight range**:

- Wait for a **clear breakout** with a candle *closing* above (for longs) or below (for shorts) the range.

---

### **Step 2: Apply Fibonacci Levels**

- After the breakout, use the **Fibonacci retracement tool**:

- **Anchor Point 1 (Start):** Close of the breakout candle body.

- **Anchor Point 2 (End):** Drag to the **50% level of the overnight range**

- Key retracement levels for entry: **0.5 and 0.35 Fibonacci**.

---

### **Step 3: Trade Execution**

- **Entry:** Enter on a pullback to **0.5 or 0.35 Fib level** after the breakout.

- **Stop Loss:**

- *Long trades:* Below the **low of the breakout candle**.

- *Short trades:* Above the **high of the breakout candle**.

- **Take Profit Targets:**

- **TP1:** 1.0 Fib extension (initial target).

- **TP2:** 1.25 Fib extension.

- **TP3:** 1.6 Fib extension.

- **TP4:** 2.3 Fib extension (runner position).

---

### **Step 4: Trade Management**

- Move SL to breakeven when price hits **TP1**.

- Close all remaining positions before midnight.