GBPUSD.P trade ideas

GBPUSD Analysis week 16Fundamental Analysis

The USD recovered somewhat after President Donald Trump announced a 90-day pause on tariffs and increased import tariffs on Chinese goods to 125%. This development limited the upside momentum of GBP/USD.

Despite the tariff suspension, investors are still concerned about the US economic outlook due to escalating trade tensions between the two countries. This continues to put downward pressure on the USD and supports GBP/USD to regain momentum.

Technical Analysis

GBPUSD is recovering significantly at the end of the week. and is facing a reaction at the old peak as well as Fibonacci. This pullback is noticeable at two Fibonacci zones and an old breakout zone around 1.30000 and 1.28900. The first two resistances to watch at last week's high around 1.31500 and next week's most important Resistance at 1.32900 will ensure GBPUSD avoids a sudden spike.

GBPUSD - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of GBP-USD with you.

Looking at the GBP-USD chart, I expect a small price decline towards the 1.29336 level. After reaching this price, I anticipate a price increase toward the 1.3500 level.

📉 Expectation:

Bearish Scenario: A small decline to 1.29336.

Bullish Scenario: After hitting 1.29336, expect a rise to 1.3500.

💡 Key Levels to Watch:

Support: 1.29336

Resistance: 1.3500

💬 What are your thoughts on GBP-USD this week? Let me know in the comments!

Trade safe

GBPUSD | 11.04.2025SELL LIMIT 1.30400 | 1.31150 | TAKE 1.29200 | Let's consider a local corrective movement from the nearest highs downwards, after yesterday's price growth. The level of 1.30000 is currently the key level for further development of scenarios. We should not forget about the publication of important economic indicators for the pound.

What I'm expecting on the new week open..This is basically what my gut is telling me that is going to happen on Monday's open based on technical factors thought by ICT and my own spin on it.

TLDW; It looks like we are just going to start going up with very little retracement at the start of the week.

- R2F Trading

GBPUSD I Weekly CLS I KL - OB I Model 2, Target HTF OBHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

GBP/USD - Weekly Elliott Wave Forecast | Potential B-Wave Trap!Pattern: Completed 5-Wave Impulse + ABC Zigzag Correction

Current Price: 1.3056

Forecast: Bearish B-Wave Reversal Incoming?

Technical Breakdown:

Major impulse from 2007 to 2022 marked as 1 to 5

A corrective ABC move completed at the key resistance zone

Price currently facing rejection from the C wave top

High probability of a B-Wave trap forming before a drop to the 1.14 zone

Strong confluence with historical structure and Fibonacci retracement

Next Move:

Watch for a weekly candle close below 1.28 to confirm the reversal. Bears may target the 1.14 zone in the next leg down.

Wave Structure Visualized (Top-Right Inset):

Shows possible B-Wave drop before bullish C continuation — a perfect trap zone for early bulls.

Trade Plan:

Short bias below 1.30 with SL above 1.32

Target: 1.18–1.14 zone

Re-assess price action near 1.14 for long opportunities

Stay Sharp, Stay Green!

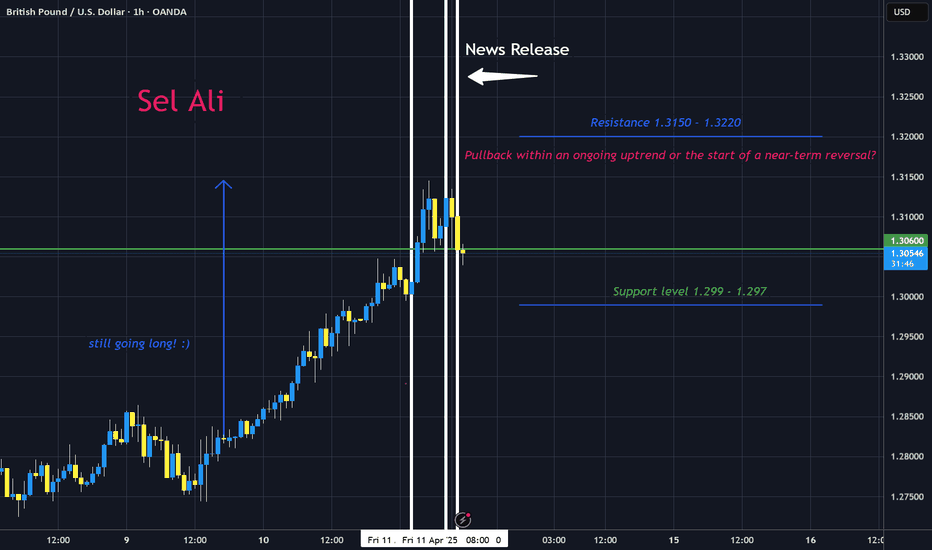

GBPUSD, Is This Just a Pullback or a Full Reversal? 4/11 11:26amI’ve been closely analyzing GBP/USD, and right now, I’m assessing whether the recent drop is just a pullback within an uptrend or the start of a full reversal into bearish territory.

Pullback vs. Reversal: What I’m Looking For

Pullback Characteristics: A pullback is typically a short-lived dip before the trend resumes. If GBP/USD stabilizes around 1.3030–1.3050 and then rebounds, it would confirm that buyers are still in control and the overall bullish trend is intact. Moving averages (like EMA and KAMA) should continue to slope upward in that scenario.

Reversal Characteristics: A full reversal happens when price breaks major support levels (like 1.2990) and shows bearish confirmation—things like a bearish engulfing candle, lower highs/lows, and negative momentum signals. If key indicators (like RSI dropping below 30 and MACD turning negative) confirm the trend shift, then sellers are fully taking control.

Current Market Signs

GBP/USD fell sharply from 1.314, forming an M-shape pattern that often signals trend exhaustion.

If price fails to bounce near 1.3050, the likelihood of a full reversal increases.

Shorter timeframe indicators (like RSI and MACD) are showing slowing momentum, which reinforces the case for further downside.

My Verdict & Trade Decision

I’ve decided that this is looking more like a near-term reversal rather than just a pullback. Since price keeps failing to reclaim 1.3050, the bearish pressure remains strong. If we break below 1.2990, I expect a deeper decline into a full downtrend shift.

Final Trading Action

Closing my trade: Given everything I’m seeing, I’m closing my current long trade now to lock in profits and avoid further downside risk.

Future trade setup: If price rejects 1.3050 and starts rebounding, I’d consider re-entering long. However, if GBP/USD closes below 1.2990, I’ll switch to a short trade, targeting further downside.

Happy Friday!

GBPUSD: Short Trade Explained

GBPUSD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GBPUSD

Entry Level - 1.3065

Sl - 1.3132

Tp - 1.2929

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Happy Friday GBPUSD! 4/11 10:12am updateMy Near-Term Views

Fundamental Context: The UK data mixed signals (with a stronger-than-expected GDP but a much-worse trade balance) juxtapose with softer US indicators (a negative PPI and lower consumer sentiment). Although these fundamentals create some uncertainty, they suggest that sterling might face headwinds if worsening trade data weighs on expectations. That said, the market’s reaction tends to be volatile, and right now, investors are digesting the news.

Technical Perspective: With the price currently at 1.3100, I see that GBP/USD has moved well above many short-term dynamic supports:

Dynamic Support: My HT_TRENDLINE on lower timeframes is positioned around 1.310–1.311 (on the 1‑minute, for example) but drops quickly on longer timeframes, indicating that although the current move is strong, it might be overextended relative to longer-term supports.

Momentum Signals: Some momentum indicators (like the StochRSI on very short-term charts) are spiking, which suggests that we've gone into overbought territory—raising the possibility of a near-term correction.

Support and Resistance Zones:

Support: I’m looking at a near-term support zone roughly around 1.3050–1.3080. This zone is where I expect buyers to step in should the current move lose steam—especially if negative price action or bearish patterns begin to appear in the lower timeframes.

Resistance: On the upside, resistance seems to be forming in the 1.3150–1.3200 range. Here, sellers might step in, or profit-taking could occur. In particular, the monthly indicators and previous highs cluster somewhere near 1.3195–1.3220, which would serve as a barrier if the bulls try to push higher.

My Action Plan: Based on everything, my bias for the near future is cautious—even though the fundamental situation isn’t definitively bearish, the technical picture is showing signs of overextension. If price starts trading down from 1.3100 and witnesses a clear bearish reversal pattern (like a bearish engulfing or a pin bar on a short timeframe), I'll consider that as a signal that the buyers are tiring and a pullback is underway. In that case, I might target a drop down toward the support zone (around 1.3050 or even lower) while keeping a close eye on the resistance above to avoid missing a breakout.

In short, while I'm still respectful of the underlying bullish fundamentals on GBP, the near-term technical signals indicate the pair might be overextended at 1.3100. This sets up a scenario where if the price can’t push past 1.3150–1.3200 with conviction, I’d expect a pullback to zone 1.3050 or below. The coming minutes and hours will be crucial to see whether a reversal pattern forms or if bullish momentum carries the pair to new highs.

Gbp/Usd 11-Apr 2025The GBP/USD currency pair has recently shown signs of strength, trading above the 1.30 level. This movement appears to be influenced by a weaker US dollar, which may be attributed to ongoing trade tensions and lower-than-expected US inflation data released yesterday. Additionally, UK GDP figures came in above market forecasts, potentially supporting the pound.

Looking ahead, upcoming US data releases—including PPI, Consumer Sentiment, and Inflation Expectations—may introduce market volatility and impact USD-related pairs.

Possible Price Scenarios (Not Financial Advice):

• If the price revisits the 1.30 level and shows signs of support, this may indicate reduced selling pressure, with a potential move toward the 1.32 level if buying interest returns.

• A move above 1.325—possibly supported by lower-than-expected PPI data—could open the door for a continuation toward the 1.343 region.

• Conversely, if the price breaks below the 1.30 level, the 1.277 area may serve as the next level of interest, where buying activity could potentially emerge.

• Should bearish momentum continue past 1.272, the 1.25 level might become the next key area to monitor for possible price reactions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

British pound keeps rolling as UK GDP shinesThe British pound is up sharply on Friday, extending its rally for a fourth straight day. In the European session, GBP/USD is trading at 1.3088, up 0.94% on the day. The pound has surged 2.9% since Monday.

UK GDP higher than expected February with a gain of 0.5% m/m. This followed a revised 0% reading in January and beat the market estimate of 0.1%. This was the fastest pace of growth since March 2024. Services, manufacturing and construction all recorded gains. For the three months to January, GDP expanded 0.6%, above the revised 0.3% gain in January and higher than the market estimate of 0.4%.

The strong GDP data is welcome news amid all the uncertainty created by US President Trump's tariff policy. The UK's largest trading partner is the US and the 10% tariffs on UK products will hurt the UK export sector (Trump has suspended an additional 10% tariff for 90 days).

Bank of England expected to lower rates in May

The turmoil in the financial markets and escalating trade tensions has the Bank of England worried. The markets have priced in a rate cut in May, betting that the BoE will ease policy in order to support the weak economy, even with inflation above the 2% target. The BoE kept rates unchanged in March and meets next on May 8.

The US-China trade war rose up a notch on Friday, as China announced it would raise tariffs on US goods to 125% from 84%. This move was in response to the US lifting tariffs on China by 125% this week, for a total tariff rate at 145%. The trade war will dampen China's economy and Goldman Sachs has lowered its 2025 GDP forecast for China to 4.0% from 4.5%.

GBP/USD Resistance Test: Will the Pound Maintain its Strength?📊 GBP/USD Daily Technical Outlook – April 11, 2025

Overview

The GBP/USD pair saw a notable rally on Friday, opening at 1.2970, reaching a high of 1.3046, and a low of 1.2967, before closing at 1.3007. This upward movement reflects the continuation of the bullish trend from earlier in the week, supported by positive economic data from the UK and a weakening U.S. dollar. The pair is currently moving in a strong bullish phase, with the market eyeing higher resistance levels.

📈 Current Market Structure

After a period of consolidation, the pair broke above key resistance levels, signaling strong buying momentum. This move follows positive GDP data from the UK, which showed a 0.5% growth in February 2025, the highest growth in 11 months.

🔹 Key Resistance Levels:

1.3046: The highest point of April 11, 2025. This is immediate resistance, and a break above it could lead to further upside.

1.3100: Psychological resistance level. A break above this could extend the rally further.

1.3200: A major resistance area, which could be a target for buyers if the bullish trend continues.

🔸 Key Support Levels:

1.2967: The low for the day, which acts as immediate support. A stay above this level reinforces the bullish outlook.

1.2900: A significant support level. A break below this could signal a short-term pullback.

1.2820: Strong support, marking the bottom of the previous price range.

📐 Price Action Patterns:

The strong bullish candles in recent days indicate dominance by buyers. The breakout above previous resistance levels and the formation of higher highs support the continuation of the uptrend. However, traders should keep an eye on potential reversal patterns as the price approaches resistance.

🧭 Potential Scenarios:

✅ Bullish Scenario:

If GBP/USD holds above 1.3046, the next targets could be 1.3100 and potentially 1.3200, driven by strong momentum from positive UK data and a weakening dollar.

❌ Bearish Scenario:

If GBP/USD fails to sustain above 1.2967, a pullback to 1.2900 could occur. A break below this level could lead to further declines towards 1.2820.

📌 Conclusion:

GBP/USD is showing strong bullish momentum, supported by positive economic data from the UK and a weakening U.S. dollar. A sustained break above resistance levels could open the door for further gains. Traders should watch for potential pullbacks at key support levels and monitor economic developments closely.

Note: This analysis is based on data available up to April 11, 2025. Always monitor the latest developments and apply appropriate risk management when trading.

GBP/USD 4H: Breakdown Brewing? Key Levels for Short Entries!GBP/USD 4-Hour Analysis

Technical Outlook — 11 April 2025

Current Market Condition:

GBP/USD on the 4-hour timeframe is showing signs of a potential short-term bounce as it trades around 1.3100. The price has recently moved above the 50-period EMA, indicating short-term bullish momentum, however nearing a death cross of 50EMA to 200MA. This will confirm bearish momentum.

Key Technical Highlights:

Price Action: The price has rallied from a recent low around 1.2700 and is now trading near 1.3100, above the 50-period EMA and 200 MA, signaling potential short-term buying interest.

Support and Resistance:

Resistance: Key resistance levels are identified at 1.3200 and 1.3300. The 200-period MA near 1.3150-1.3200 adds confluence to the first resistance zone.

Support: Key support levels below the current price are at 1.2900, 1.2700, and 1.2600, with 1.2900 being the nearest significant support.

Momentum Indicator: The stochastic oscillator at the bottom is heading in overbought territory signalling exhaustion.

Possible Scenarios:

Bearish Scenario (Higher Probability):

If the price fails to break above resistance level around 1.3150-1.3200 and shows a rejection (e.g., a bearish candlestick pattern like a shooting star), the bearish bias is likely to persist.

A drop below the 50-period EMA and the recent swing low at 1.2900 could lead to further declines toward the 1.2700 support, with deeper support at 1.2600.

Bullish Scenario (Moderate Probability):

If the price sustains above the 50-period EMA and breaks through the resistance level of 1.3200 with a strong 4-hour candlestick close, it could signal a short-term bullish move.

A confirmed break above 1.3200 may lead to a test of the next resistance at 1.3400, supported by the upward momentum in the oscillator.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results.

Pound Gains on Dollar Softening, GBP/USD at $1.30The pound extended gains to $1.30 for a third session, as the dollar softened following Trump’s 90-day tariff pause for most countries. However, the 145% hike on Chinese goods kept risks elevated. While volatility persists, traders now expect 66 bps of BoE rate cuts this year, down from 79 bps a day earlier. UK GDP is forecast to grow 0.1% in February, suggesting a slow recovery.

If GBP/USD breaks above 1.3050, resistance levels are at 1.3100 and 1.3200. Support is at 1.2960, followed by 1.2900 and 1.2850.

GBPUSD potential buy zone in inverted head & shoulder!GDP in GBPUSD had spike in actual value with the forecast has boost in this pair. Prior to data release this instrument had a break of structure has given strong liquidity grab as it has broken from long term trend line. As the market structure remain intact we may see the price to bounce back to the daily resistance line. 15m timeframe already has formed an inverted head & shoulder which signaling potential breakout. Any liquidity grab may give us potential entry in this lower timeframe.

Long trade

1Hr TF overview

✅ Trade Breakdown – Buy-Side (GBP/USD)

📅 Date: Wednesday, April 9, 2025

⏰ Time: 4:00 AM (NY Time) – Tokyo to London Session Overlap

🕒 Entry Timeframe: 2-Minute (Microstructure Entry)

📈 Pair: GBP/USD

📈 Trade Direction: Long (Buy)

Trade Parameters:

Entry: 1.28700

Take Profit (TP): 1.30051 (+1.05%)

Stop Loss (SL): 1.28384 (–0.25%)

Risk-Reward Ratio (RR): 4.28

Buyside trade idea based on the sweep of Asia session lows, then I assume a reverse towards the London trend direction and bias as this time.