GBPUSD TECHNICAL ANALYSIS FOR SELL*GBP/USD Technical Analysis For Sell Zone:*

The GBP/USD pair is currently trading at 1.29k, approaching a key selling zone and resistance level at 1.3k.

*Selling Zone and Resistance:*

- *1.3k:* This level has been identified as a strong selling zone and resistance, where sellers are likely to enter the market and push prices lower.

*Support and Take-Profit (TP) Levels:*

- *1.25549:* This level is a strong support, where buyers may enter the market and push prices higher. TP level: 1.26500.

- *1.23683:* This level is another key support, where buyers may look to enter the market and push prices higher. TP level: 1.24500.

- *1.2k:* This level is a psychological support, where buyers may look to enter the market and push prices higher. TP level: 1.21000.

GBP/USD has dropped below 1.2900 due to a cautious market mood, despite the US Dollar consolidating weekly losses amid economic slowdown concerns. The pair's decline is attributed to the market's focus shifting to US data, including mid-tier jobs data and Fedspeak ¹.

Several key factors are influencing GBP/USD, including:

- *US Data*: The US Department of Labor will release the weekly Initial Jobless Claims data, with markets expecting a decline.

- *Fedspeak*: Investors will be watching for comments from Federal Reserve officials.

- *BoE Commentary*: The Bank of England's hawkish commentary, particularly from policymaker Megan Greene, has supported the Pound Sterling.

- *Trump's Tariffs*: The US President's decision to grant exemptions from tariffs has improved risk mood, but concerns remain about the economic impact.

GBPUSD.P trade ideas

CHECK GBPUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(GBPUSD) trading signals technical analysis satup👇🏼

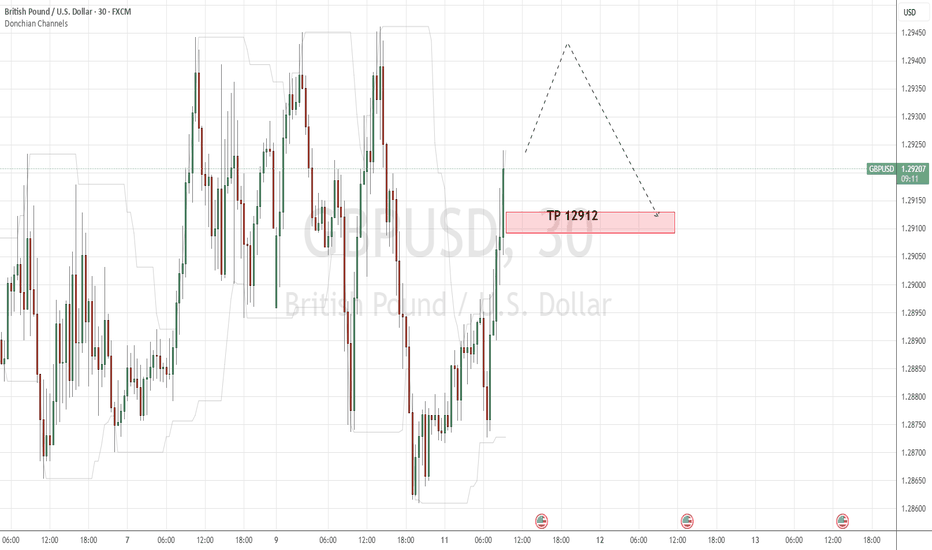

I think now (GBPUSD) ready for( SEEL )trade ( GBPUSD ) SEEL zone

( TRADE SATUP) 👇🏼

ENTRY POINT (1.29400) to (1.29350) 📊

FIRST TP (1.29200)📊

2ND TARGET (1.29100) 📊

LAST TARGET (1.28950) 📊

STOP LOOS (1.29600)❌

Tachincal analysis satup

Fallow risk management

GBPUSD WEEKEND ANALYSISTechnical summary

1D- price is in a corrective upward move in reference to the overall downtrend. Momentum has started decreasing indicating we a near a potential are where price can start falling once again....BUT it can easily go to 1.30414 before beginning the descent.

4H- RSI divergence is evident indicating a change of trend is likely to occur, I don't think it has completed forming so we shouldn't rush to sell as of now

LOWER TFs- There is no a clear CHoCH yet....so it still can rise before considering to fall

Fundamental summary

Wednesday and Thursday next week are full of high impact news such as FOMC and unemployment claims, so we should expect some crazy moves during those times.

Not advised to enter any position shortly before now release if you are not an experienced fundamental trader.

GBP/USD "The Cable" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (1.25500) swing Trade Basis Using the 6H period, the recent / swing low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.29300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

GBP/USD "The Cable" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔰Fundamental Analysis

1. Economic Indicators: The UK's GDP growth rate, inflation rate, interest rate, and employment figures are strong, supporting a bullish outlook.

2. Central Bank Policies: The Bank of England's decision to keep interest rates low has weakened the pound, but the Federal Reserve's hawkish stance has strengthened the dollar.

3. Fiscal Policies: The UK government's spending and taxation policies have been neutral, while the US government's policies have been supportive of economic growth.

🔰Macroeconomic Factors

1. Trade Balance: The UK's trade balance has improved, supporting a bullish outlook.

2. Political Stability: The UK's political stability has improved, while the US's political stability has been neutral.

3. Global Economic Trends: Global economic trends have been supportive of a bullish outlook.

🔰Global Market Analysis

1. Commodity Prices: Commodity prices have been neutral, with oil prices steady and gold prices slightly higher.

2. Currency Correlations: The GBP/USD pair has a strong positive correlation with the EUR/USD pair.

3. Global Economic Trends: Global economic trends have been supportive of a bullish outlook.

🔰COT Data

1. Commitment of Traders Report: The report shows that commercial traders are net long, while non-commercial traders are net short.

2. Open Interest: Open interest has increased, indicating a potential trend reversal.

3. Commercial Positions: Commercial traders' positions indicate a bullish outlook.

🔰Intermarket Analysis

1. Correlations with Other Markets: The GBP/USD pair has a strong positive correlation with the EUR/USD pair and a negative correlation with the USD/JPY pair.

2. Divergences: There are no significant divergences between the GBP/USD pair and other markets.

🔰Quantitative Analysis

1. Technical Indicators: Technical indicators, such as moving averages and RSI, indicate a bullish outlook.

2. Statistical Models: Statistical models, such as regression analysis, indicate a bullish outlook.

🔰Market Sentiment Analysis

1. Trader Sentiment: Trader sentiment is bullish, with a majority of traders expecting the pair to rise.

2. Sentiment Indicators: Sentiment indicators, such as sentiment indexes and put-call ratios, indicate a bullish outlook.

🔰Positioning

1. Long/Short Positions: Long positions are increasing, while short positions are decreasing.

2. Positioning Data: Positioning data indicates a bullish outlook.

🔰Next Trend Move

1. Bullish/Bearish Outlook: The outlook is bullish, with a potential target of 1.3000.

2. Trend Analysis: Trend analysis indicates a potential trend reversal.

🔰Overall Summary Outlook

1. Bullish Outlook: The overall outlook is bullish, with a potential target of 1.3000.

2. Volatility Expected: Volatility is expected to remain high in the short term.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SWING GBP/USD SELLThis swing trade highlights key points where additional sell orders might be initiated. Stay tuned for updates, as this trade will extend over several days, weeks, or even months.

This analysis relies on the provided image and should not be considered financial advice. Trading carries risks; it is essential to do your own research and seek guidance from a financial advisor before making trading decisions.

GBP/USD - Potential Support for Pullback ScenariosGBP/USD came very close to a 1.3000 test last week but fell a bit short. To be sure, the bullish breakout in Cable lacks in size and scope to that of the Euro, but with an oversold US Dollar showing potential for pullback, that highlights the possibility of pullbacks in GBP/USD and EUR/USD, as well.

In Cable, there's a couple of clear spots of support potential, and considerable confluence in the 50'ish pips from 1.2758 up to 1.2811, with the 200-day moving average also plotting within that zone. Perhaps more ideal would be a continued show of strength from buyers, holding above last week's swing-low of 1.2862; but in the event that that low is taken out, it wouldn't necessarily be a game over event for topside continuation scenarios, especially if the confluent zone can bring buyers back into the equation. - js

GBP/USD 30-Minute Bearish Trade Setup & Analysis200 EMA (Blue) at 1.29285 – Represents long-term trend support/resistance.

30 EMA (Red) at 1.29329 – Represents short-term trend direction.

Trade Setup:

Entry: The trade seems to enter near the 30 EMA after price rejects a resistance zone (highlighted in purple).

Stop Loss: Placed above the resistance zone at around 1.29564 - 1.29568.

Take Profit Levels:

TP1: ~1.29250

TP2: ~1.28996

TP3: Final target at ~1.28827

Market Analysis:

The price has rejected the 30 EMA, signaling potential bearish movement.

The downtrend projection suggests a possible break below 1.29250, aiming for the lower support levels.

The risk-to-reward ratio appears favorable, with a tight stop loss and multiple profit-taking points.

Possible Scenarios:

Bearish Case (High Probability): If price stays below the 30 EMA, it may continue down towards the target points.

Bullish Case (Low Probability): If price breaks above the resistance zone, it could invalidate the short setup, triggering the stop loss.

Would you like a deeper analysis or confirmation with another indicator?

GBPUSD Elliott Wave AnalysisHello friends

In the currency pair GBPUSD we are witnessing the completion of a 3-wave pattern.

These 3 waves can be a zigzag or 3 of 5.

But in both cases, a correction should take place.

So we expect a small increase and then a price correction.

This correction can continue to the level of 1.2800 and in the second stage to 1.2500.

Good luck and be profitable.

GBP/USD Weekly Analysis – March 14, 2025Market Overview

GBP/USD has recently shown strong bullish momentum, rebounding from a key support level and confirming a potential long-term uptrend. Based on current market structure and technical indicators, we expect the pair to continue higher towards 1.4100 and eventually 1.4700 in the coming months.

📈 Technical Analysis – Why GBP/USD is Bullish?

1. Market Structure & Trend Analysis

✅ Higher Lows and Bullish Breakout – The pair has formed a clear structure of higher lows, signaling a shift from a previous downtrend into an uptrend.

✅ Break of Key Resistance at 1.2920 – GBP/USD has successfully broken above a key resistance level, confirming bullish continuation.

✅ Next Major Resistance Levels at 1.4100 and 1.4700 – The price action suggests an upside target of 1.4100, followed by a long-term potential move to 1.4700.

2. Indicator Confirmation

📌 MACD (Moving Average Convergence Divergence):

🔹 The MACD histogram is turning positive, indicating a shift in momentum.

🔹 A bullish crossover between the MACD and signal line could confirm further upside.

📌 RSI (Relative Strength Index) – Not Overbought Yet:

🔹 RSI is currently in a neutral zone around 55-60, meaning there is room for further upside before reaching overbought conditions.

📌 Supertrend Indicator – Bullish Signal:

🔹 The Supertrend remains in a bullish phase, reinforcing the overall uptrend.

3. Key Price Levels & Market Reactions

Price Level Type Significance

1.2920 Breakout Level Retest zone and key support

1.4100 First Target Significant historical resistance

1.4700 Final Target Long-term bullish objective

📊 Trading Strategy

📍 Bullish Scenario – Buy Dips Towards 1.2920

✅ If GBP/USD holds above 1.2920, buying pullbacks with confirmation signals (bullish candlesticks) is a strong strategy.

🎯 Target 1: 1.4100

🎯 Target 2: 1.4700

⛔ Stop Loss: Below 1.2750 (previous swing low)

📍 Breakout Play – Buy on Momentum Above 1.3100

✅ If GBP/USD gains strong bullish momentum and breaks 1.3100 with volume, a continuation towards 1.4100 becomes more likely.

📍 Bearish Scenario – If Price Fails to Hold Above 1.2920

✅ If GBP/USD falls below 1.2920, we may see a temporary correction back to 1.2600 before another bullish attempt.

📌 Conclusion

📌 GBP/USD is in a strong bullish uptrend and has successfully broken key resistance.

📌 The next major resistance levels are at 1.4100 and 1.4700, which could be reached in the coming months.

📌 MACD, RSI, and market structure support further upside.

📌 Buying pullbacks towards 1.2920 is a favorable strategy, with a stop below 1.2750.

🚀 Summary: GBP/USD is set to rise, and traders should look for buy opportunities targeting 1.4100 and 1.4700 while managing risk effectively.

The Day Ahead Friday March 14

Data: US March University of Michigan survey, UK January monthly GDP, Germany January current account balance, Italy January industrial production, general government debt, Canada January manufacturing sales

Central banks: ECB's Cipollone speaks

Earnings: BMW, Daimler Truck Holding

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/USD shrugs as UK GDP unexpectedly declineshe British pound has edged lower against the US dollar on Friday. GBP/USD is trading at 1.2928 in the European session, down 0.13% on the day.

The UK economy barely registered any growth in the second half of 2024, rising 0.1% in the third quarter and flatlining in the third quarter. The New Year hasn't seen any improvement, as GDP contracted 0.1% m/m in January, after a 0.4% gain in December and missing the market estimate of 0.1%. The surprise contraction was driven by declines in the production and manufacturing sectors. The economy expanded 0.2% in the three months to January, up from 0.1% in the three months to December but shy of the market estimate of 0.3%.

The weak GDP report won't make things any easier for Finance Minister Rachel Reeves, who will announce the Treasury's "Spring Statement" on March 26. Reeves is expected to outline plans for higher taxes and spending cuts. The tax hikes on British businesses are expected to weigh on investment, hiring and growth.

The Bank of England meets on March 20 and is widely expected to maintain rates at 4.5%. The BoE trimmed rates by a quarter-point in February. Inflation rose sharply in January to 3.0% y/y, up from 2.5% in December. The rise in inflation and weak GDP has raised concerns about stagflation, which is characterized by persistent inflation and weak growth.

Another headache for BoE policymakers is US President Donald Trump's tariff policy. The UK had hoped to avoid the tariffs, but this week the US slapped 25% tariffs on all steel and aluminum imports, including on UK products. That could hurt UK growth and boost inflation.

GBP/USD tested resistance at 1.2949 earlier. Above, there is resistance at 1.2978

1.2923 and 1.2894 are the next support levels

Steady uptrend, GBPUSD continues to grow🔔🔔🔔 GBPUSD news:

👉The GBP/USD pair dips slightly during the Asian session on Wednesday, retracing part of the previous day's strong rally to a more than four-month high around 1.2965. Currently, spot prices hover near the 1.2935 level, though the decline lacks strong bearish momentum as traders await the release of US inflation data before making new directional moves.

The US Consumer Price Index (CPI) report will be a key factor in shaping market expectations regarding the Federal Reserve’s (Fed) rate-cut trajectory, which will, in turn, influence demand for the US Dollar (USD) and drive fresh movement in the GBP/USD pair. Meanwhile, some repositioning ahead of the critical data has helped the USD recover part of its previous day's decline to its lowest level since mid-October, creating a temporary hurdle for the currency pair.

Personal opinion:

👉Good growth in the context of US tariff policies not targeting GBP, good relationship between the two countries helps GBP value against USD to grow, long-term upward trend is still being maintained

Analysis:

👉Based on important resistance - support levels and Fibonacci combined with trend lines to come up with a suitable strategy

Plan:

🔆Price Zone Setup:

👉Buy GBP/USD 1.29100 - 1.28950

❌SL: 1.28650

✅TP: 40 - 70 - 120 PIPS

FM wishes you a successful trading day 💰💰💰

GBPUSD Will Go Down! Short!

Take a look at our analysis for GBPUSD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.293.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.284 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPUSD NEXT MOVE (expecting correction)(Mid term)(14-03-2025)Go through the analysis carefully, and do trade accordingly.

Anup BIAS (14-03-2025) (short term)

Current price- 1.29400

"if Price stay below 1.30000 then next target is 1.28700 and 1.27900"

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk 2% of principal to follow any position.

Support us by liking and sharing the post.

Sterling Struggles Amid Risk Aversion and US Tariff ThreatsGBP/USD extends its decline for the second consecutive session, hovering around 1.2940 during Friday's Asian trading hours. The currency pair faces difficulties as the Pound Sterling (GBP) weakens due to a negative risk sentiment, which has been further worsened by worries over global trade following US President Donald Trump's threat to impose a 200% tariff on European wines and champagne, creating market instability.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

2× Sell Limit orders GBPUSDseeing tht we are hitting a higher timeframe demand I'm looking into the lower timeframe and seeing the liquidity swept in the lower timeframe while we we are in the higher timeframe demand this therefore makes this Setup a higher probability Setup each trade Risking 1% on a personal account total risk of 2% to gain 4% no FOMo wait for each setup to play out