GBPUSD: Forecast & Technical Analysis

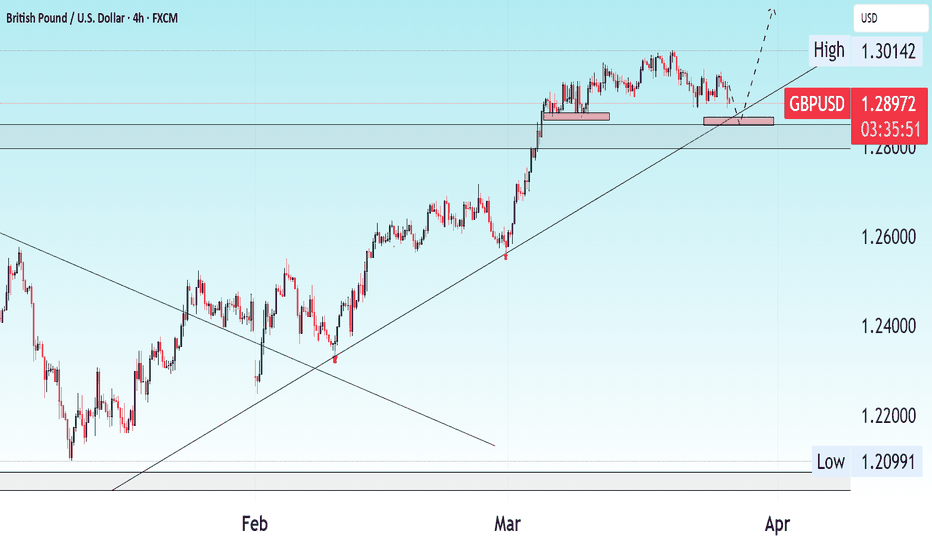

The recent price action on the GBPUSD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD.P trade ideas

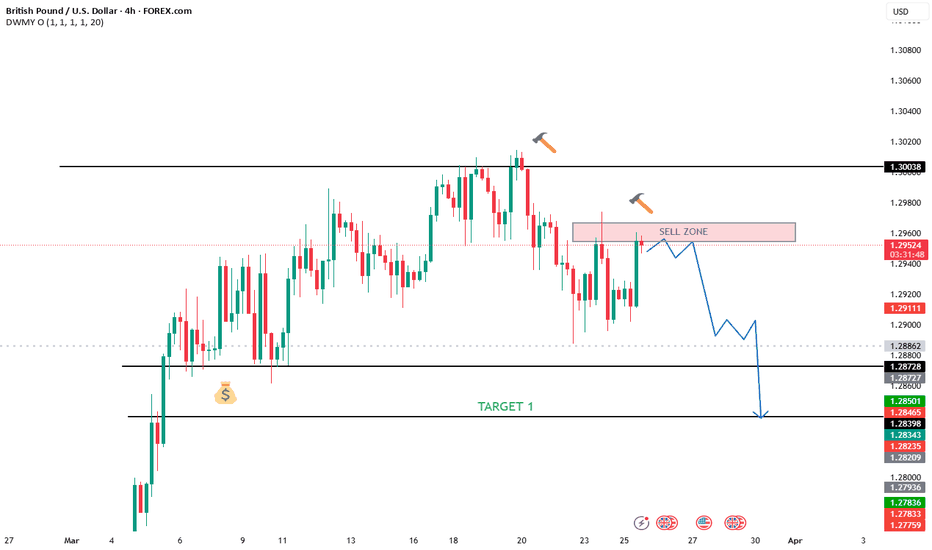

GBPUSD Is due a correctionThe GBP/USD pair has been in a sustained uptrend for some time, and while I maintain a bullish outlook, a pullback or correction appears likely. Below, I’ve outlined key target levels where I anticipate potential price movements.

I’d love to hear your thoughts—let me know your perspective. If you found this analysis valuable, consider giving it a boost!

The Day AheadWednesday March 26

Data: US February durable goods orders, UK February CPI, RPI, January house price index, France March consumer confidence, Australia February CPI

Central banks: Fed's Musalem and Kashkari speak, ECB's Villeroy and Cipollone speak, BoC summary of deliberations from the March meeting

Earnings: Dollar Tree, RENK

Auctions: US 2-yr FRN, US 5-yr Notes

Other: US CBO Federal Debt and the Statutory Limit report, UK spring statement

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPUSD Sell Trade March 26 2025- Sell Limit ActivatedHello Traders!

Another great movement of GBPUSD, 1H and 15min TF confluence.

Entry: 5min TF with validity of OB (check charts for detailed annotation)

Note: This trade was a sell limit order in MT4 aiming for 1:5RR. You can see also Distribution Schematics in Higher Timeframe.

#wyckoff

#proptrader

#Riskmanagement

Pound Slips to $1.29 on Soft InflationThe British pound dipped to around $1.29 as traders reacted to softer inflation data and looked ahead to the Spring Statement. UK annual inflation eased to 2.8% in February, below the 2.9% forecast but in line with the BoE's outlook. Services inflation remained at 5%.

The BoE expects inflation to rise toward 4% later this year. Markets see a 92% chance of a 25bps rate cut in August and about a 60% chance of another by year-end. Chancellor Rachel Reeves is set to outline the economic outlook and announce major government spending cuts.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

GBP/USD: Struggles at Resistance, Risks of Weak Oscillation PersDuring the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise.

If it fails to break through these resistance levels, in the short term, it may continue the weak, oscillatory downward trend, and the downside risks still remain. The market lacks strong momentum, and overall, it stays in a weak, oscillatory pattern.

GBPUSD

sell@1.29600-1.29900

tp:1.28800

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.