British Pound / U.S. Dollar forum

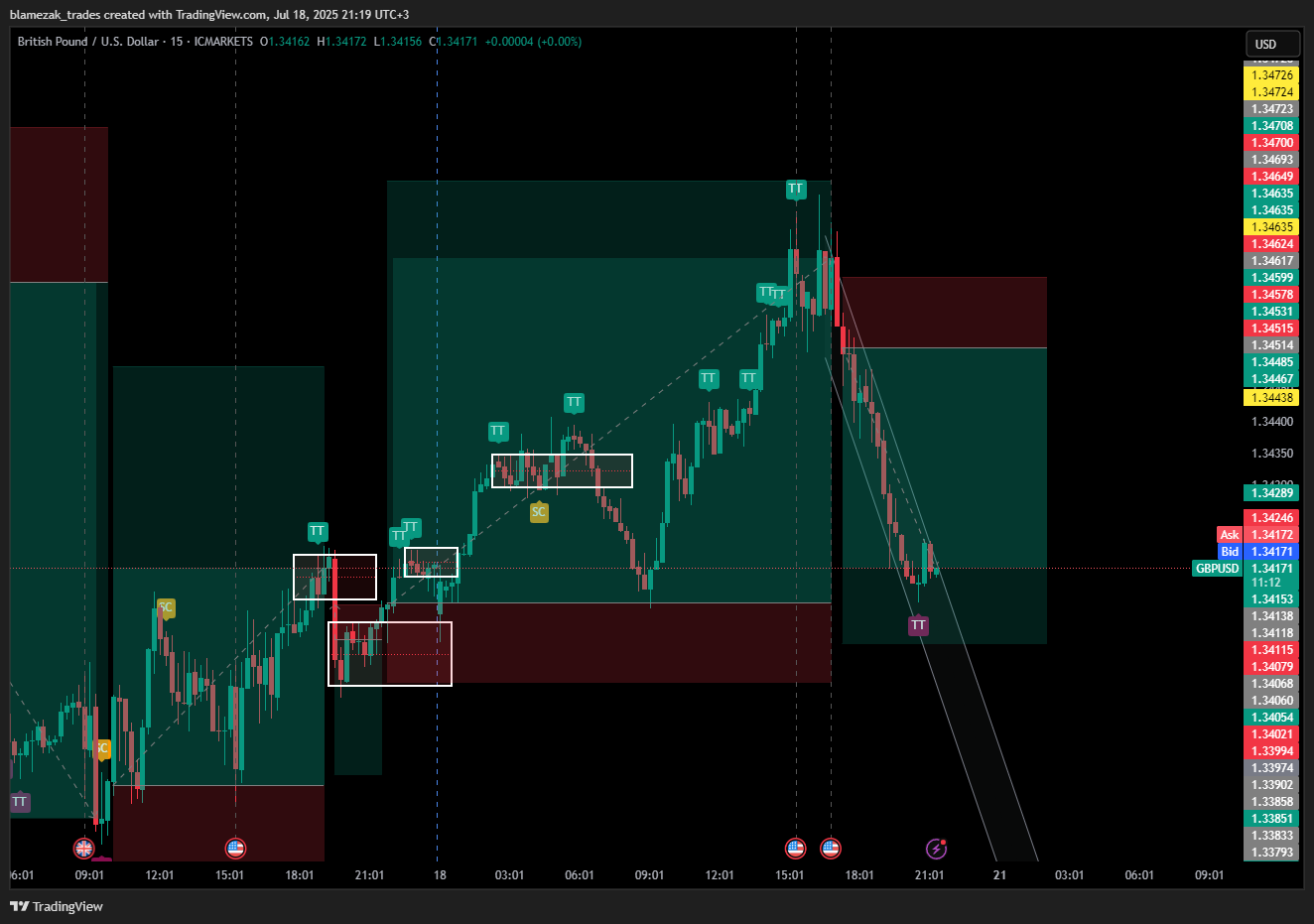

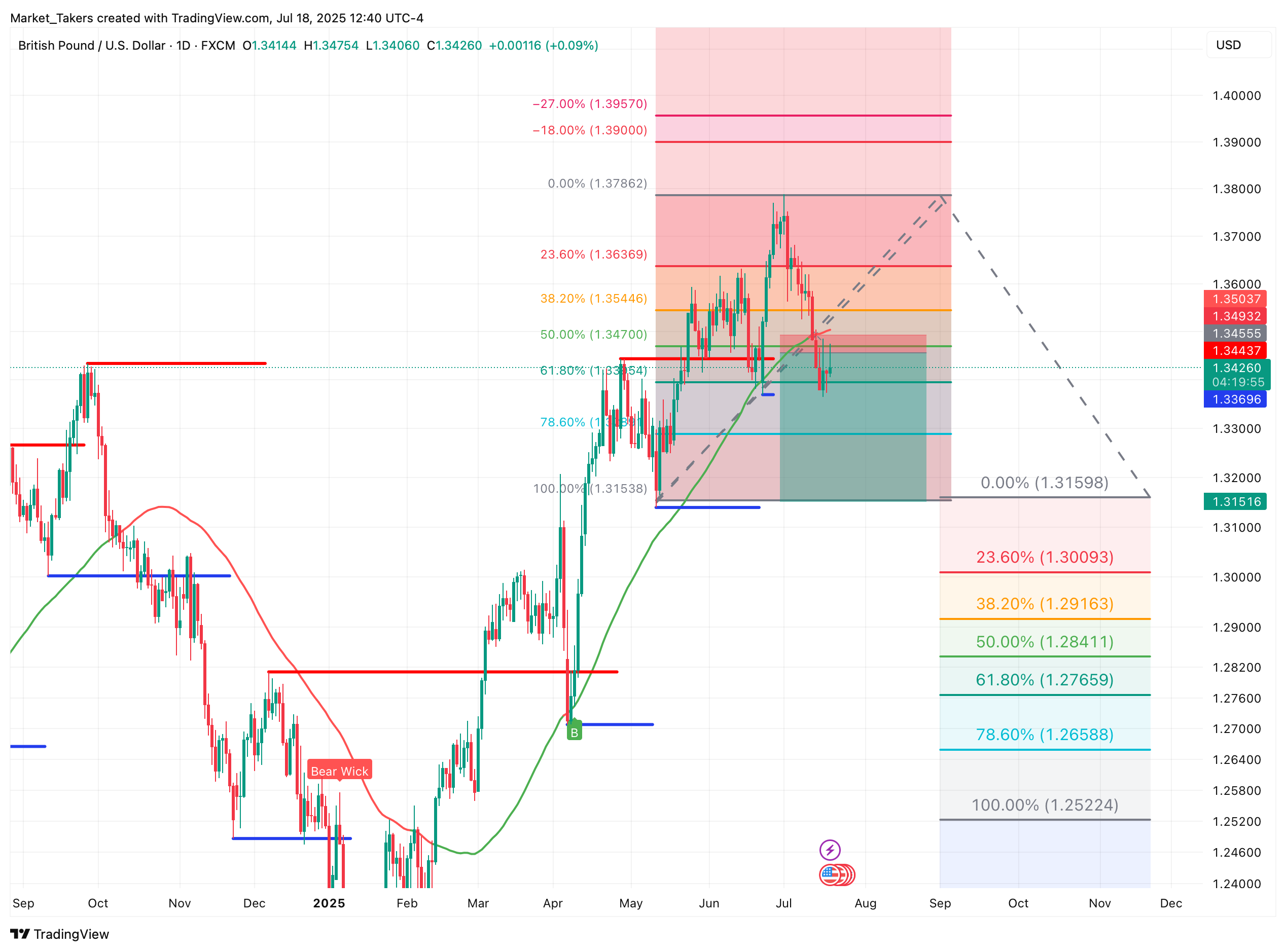

GBPUSD is currently showing signs of potential bullish momentum. If the current price structure holds, the pair may attempt to reach the 1.34700 level in the upcoming sessions.

This analysis is shared for educational and informational purposes only. It is not financial advice. Always manage your risk properly.

next target is 1.34900

tp 1.34570

tp 1.34800

tp 1.35000

sl 1.33950