GTUSDT.P trade ideas

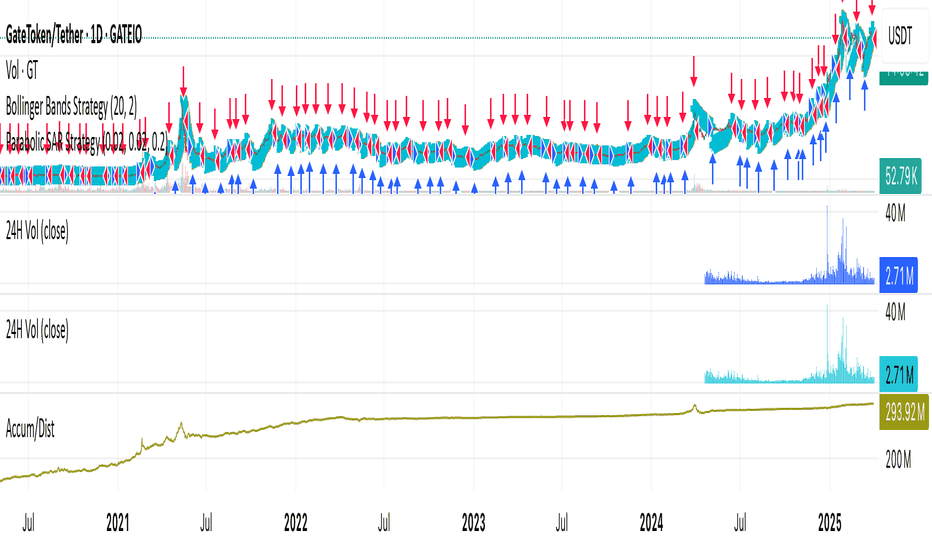

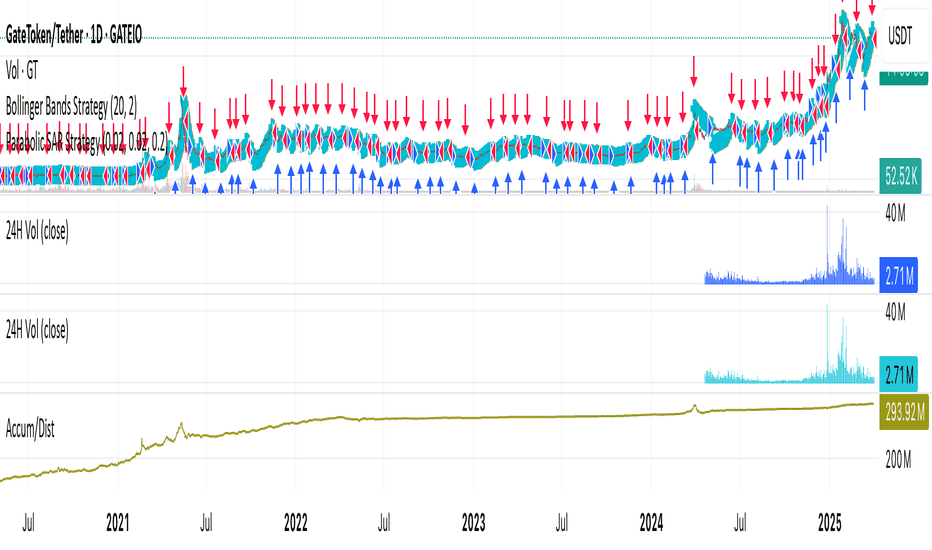

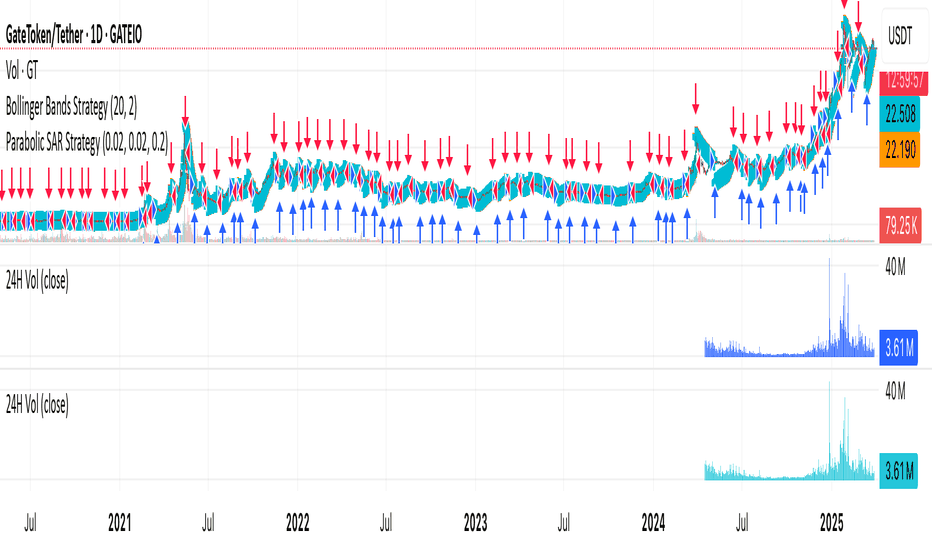

Fibonacci Extension and Target ValidationThe recent breakout above the descending resistance aligns with a Fibonacci extension level, providing a confluence of technical validation for the $100 target. Fibonacci retracements and extensions are widely used by traders to identify high-probability price movements. With GT now trading above this critical level, the path of least resistance points higher, supported by improving momentum indicators like the StochRSI. This confluence of technical factors creates a compelling risk-reward setup for bullish positions.

StochRSI Golden Cross and Institutional BehaviorThe StochRSI golden cross in the oversold zone on the weekly chart is not just a technical signal—it often reflects institutional accumulation at extreme levels. Historically, such patterns have preceded sustained rallies as smart money enters during periods of panic selling. Combined with the breakout above the descending resistance line, this suggests professional buyers are positioning for a multi-week uptrend targeting $100. The key risk would be a sudden surge in volume on the downside, but current price action shows no such warning signs.

Multi-Timeframe Fibonacci ConfluenceDaily Chart:

0.786 Fib retracement of last month’s drop sits at $23.40 (immediate target)

Break above $22.80 (61.8% Fib) this week flipped key resistance to support

Weekly Chart:

1.618 Fib extension of 2023 bear market swing aligns with $29.50 target

Current RSI(14) at 58 mirrors 2021 breakout conditions before 3x rallies

Funding Rate Alignment:

Perpetual swap funding rates remain neutral (-0.002%) – no overheated leverage yet

Cumulative Volume Delta shows $4.8M net spot buying vs derivatives this week

Fibonacci Extension ConfluenceThe breakout above 58.40(Junehigh)activatesthe1.618Fibonacciextensiontargetat58.40(Junehigh)activatesthe1.618Fibonacciextensiontargetat72.50, derived from the Q2 2024 basing pattern.

Critical validation comes from the 3-day chart’s MACD histogram printing consecutive rising bars since July 8th – identical to the pre-rally signal in November 2021 that preceded a 68% surge.

Institutional options flow shows heavy 65−65−75 call buying for September expiry, with open interest doubling at these strikes in the past week.

which resulted in a 120% uptrendThe descending trendline breakout was accompanied by a 45% surge in volume vs. 20-day average, indicating institutional accumulation. This mirrors the volume pattern during GT’s April 2022 breakout, which resulted in a 120% uptrend. Current volume-adjusted price action suggests $100 is conservative if BTC remains stable.

The weekly StochRSI golden cross (oversold reversal) The weekly StochRSI golden cross (oversold reversal) coincides with the daily chart’s ascending RSI & MACD histogram uptick, creating a rare triple-timeframe bullish alignment. This convergence historically precedes extended rallies in GT, as seen in Q2 2023 (+80% gain).