RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

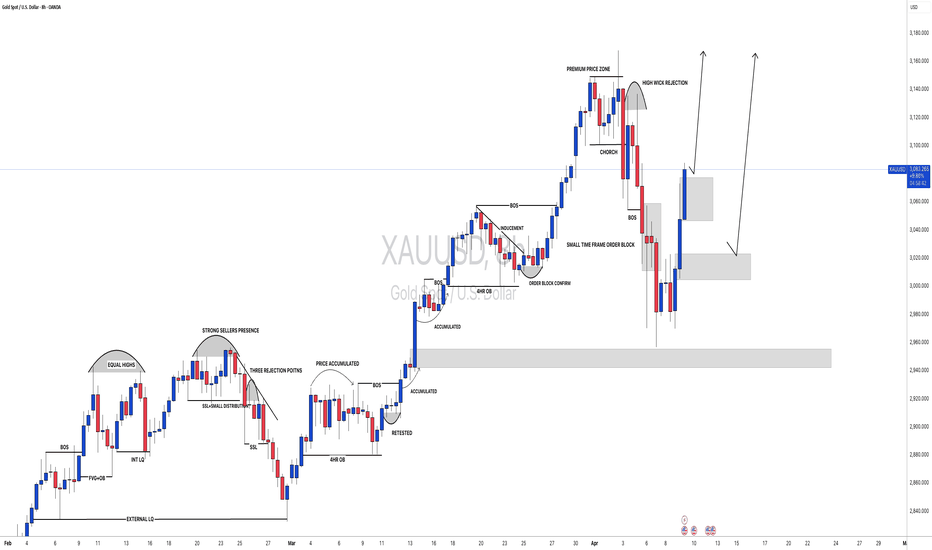

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

USCGC trade ideas

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Complete correction on the move here from Gold! Markets are extreme but there are pips to be had as long as you're trading the extreme levels. We mentioned in the morning review that the bias level was 3130 bearish below, which got a tap and bounce for over 150pips but then we flipped, and what a flip. As soon as Excalibur triggered, we mentioned not to test the level again, and then went on to complete all the bullish targets, plus the Excalibur targets up into 3172 where some got another short opportunity.

Now, a really interesting play, we're stretched but we have a key level above at 3190-95. That could be the extension of the move over the Asia session so it's a level to keep an eye on for the RIP, unless broken. Otherwise, we need to break above the recent high to go higher and the retracement tomorrow can take us down as low as 3130-35!

It's going to be interesting to see how we close. For us, we've done our job, tomorrow we'll clean up and prepare for next week.

From Camelot this morning:

Price: 3108

KOG’s Bias of the day:

Bearish below 3130 with targets below 3104 and below that 3095

Bullish on break of 3130 with targets above 3135✅, 3143✅ and above that 3150✅

RED BOXES:

Break above 3110 for 3120✅, 3127✅, 3130✅ and 3142✅ in extension of the move

Break below 3096 for 3085, 3070 and 3065 in extension of the move

As always, trade safe.

KOG

#XAUUSD: $3400 On The Way! Get Ready For Record High! Gold has rebounded to previous highs, maintaining a bullish trend. We expect it to continue this momentum, potentially reaching $3400 in the long term. To set take profit, consider $3250, $3300, and $3400. Use accurate risk management and conduct your own research before trading gold.

Please support us by liking and commenting on this idea.

Team Setupsfx_

Fundamental V Technical Analysis, who will win? SELL GOLD?All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

XAU/USD: A Huge Fall Ahead? (READ THE CAPTION)By re-examining the gold chart on the 30-minute timeframe, we can see that the price once again moved exactly as expected and finally managed to rise back above $3100, reaching as high as $3136.5! Currently, gold is trading around $3120, and I expect we will soon see further decline in gold. The potential downside targets are $3115, $3105, and $3100 respectively. This analysis will be updated again!

The Last Analysis :

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

This is an update on our weekly chart ideas, which we have been tracking, as our long term route map.

After completing 3094 target no further body close or ema5 lock above this level. Therefore no further gaps left above and followed with a rejection. We are now looking for support and bounce on the channel half line or a cross and lock below the half line will open the lower range for the channel low Goldturns.

We expect the range play between the channel half-line and 3094 and will need a break on either of these levels to determine the next range.

This is the beauty of our channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD → Rising economic risks could push the price upwardFX:XAUUSD closed inside the range 2970 - 3060 and has all chances to strengthen as the situation between the USA and China is only getting hotter, which creates additional risks.

Gold continues to rally from its recent low of $2,957, back above the $3,000 level amid a weaker dollar and a pause in rising US bond yields. The market is reacting to escalating trade tensions between the US and China, including the threat of new 50% tariffs and possible countermeasures by Beijing. Strengthening expectations of Fed rate cuts and recovering risk appetite also support gold's growth, but the instability of global trade policy keeps investors uncertain.

At the moment the price is testing resistance at 3013 and after a small correction the assault may continue, and a break and consolidation above 3013 will open the way to 3033 - 3057.

Resistance levels: 3013, 3033, 3057

Support levels: 2996, 2981

The trade war and the complex, politician-dependent fundamental backdrop allows us to strategize relative to economic risk. Technically, we are pushing off the strong levels I have outlined for you. The overall situation hints that China will not just give up and Trump will not lose face. An escalation of the conflict could send gold higher.

The price may strengthen from 0.5 fibo, or from 3013

Regards R. Linda!

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we have been tracking for a while now and finally completed last week. However, I wanted to continue to share an update on this, as its still playing out by falling back into the range on Fridays drop in price.

Historically, whenever we see a breakout outside of our unique Goldturn channels; I always state that, when price does a correction, we look for support outside of the channel top. This is playing out to perfection with Fridays drop finding support on the channel top, as highlighted by us on the chart with a circle. This was done with precision!!

We will now look for a test above at 3052 and a body close above this will follow with continuation to 3103 or a break below inside the channel top wall with ema5 will re-activate the levels below inside the channel, which we can then continue to track back up level to level, like we did before. I have also updated the levels above the channel to cover the new range.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD - Price can continue to decline to $2920 pointsHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some time ago price moved inside a rising channel, making higher highs and holding above support levels.

Later, Gold broke resistance and continued to rise, reaching the upper boundary of the price channel.

After touching $3076 zone, price turned around and exited the channel with a strong bearish impulse.

Recently, it made a breakout below $3055 level and bounced from the area without a strong upward reaction.

Now Gold trades below resistance zone and holds under broken channel, forming local bearish structure.

In my opinion, Gold can continue to decline and reach $2920 points during the next wave down.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Hellena | GOLD (4H): LONG to resistance lvl 3100 (wave B).Colleagues, at this point I have redrawn the waves a bit and realized that the upward movement is not over yet, but a rather large correction is possible within waves “ABC” and if wave ‘A’ is finished or almost finished, I expect wave “B”. I believe that the price will reach the level of 3100. After that a reversal and continuation of a small downward movement is possible.

But for now I would look at long positions.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold’s Bearish Analysis Remains Intact Gold’s Bearish Analysis Remains Intact

Analysis: Gold went into a deep correction, which was expected, but the recent surge wasn’t. After President Trump announced a 90-day pause on reciprocal tariffs, gold suddenly jumped in price—an odd reaction, considering the market was given time to breathe.

Despite this unexpected move, the bearish trend is still intact. If gold breaks above 3167, it would likely be due to manipulation rather than news-driven movement.

For now, the chart still suggests a high chance of gold moving lower.

Support zones can be found near: 3054; 3000; 2925 ; 2840

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

P.S.: If you don't like the analysis, skip it.

It's only for those members who want to learn and want to have a different perspective on how gold can develop. This is not trading advice

Buy the Dips Towards 3080 – Gold Builds a Strong Base 🟡 What happened with Gold (XAUUSD) yesterday?

In yesterday's analysis, I mentioned that I was bullish on Gold, expecting a resumption of the upward move with targets extended to 3080 and interim resistance at 3050.

Although the price rose, it found strong resistance at the 3020 zone, which prompted me to close my buy trade with around 400 pips profit (although I was aiming for closer to 1k pips).

Afterward, the market started to drop and breached under 3000 again.

However, once the price reached the 2970 zone, bulls entered the market strongly and pushed the price back above 3000.

❓So now what? Is the correction over or will it continue?

Looking at the chart, we can clearly see two things:

✅ A solid support has formed around 2960-2970 zone

✅ A double bottom is in the making, with a well-defined neckline at 3020

________________________________________

📌 Why the bullish bias remains valid:

• 2960-2970 proved to be a strong demand zone

• Price reclaimed the 3000 level after the dip

• Double bottom structure is forming = possible breakout ahead

• 3020 is the key level to break for continuation

________________________________________

🎯 Trading Plan:

The preferred strategy remains:

➡️ Buy the dips

🎯 Main target: 3080

❌ Invalidation: daily close below 2960

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD NEXT MOVE (expecting a mild correction now)(11-04-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (11-04-2025)

Current price- 3232

"if Price stays below 3250, then next target is 3222, 3200, 3170 and 3130 and above that 3270 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

Gold Technical Outlook: Bounce Likely Before Deeper Drophello guys.

The recent price action on gold suggests a potential short-term upward move, followed by a possible continuation to lower levels based on key technical factors:

🔹 1. Channel Support Touched – Expecting a Bounce

Price has touched the bottom boundary of the ascending channel, which has acted as dynamic support throughout this trend.

This technical level often brings in buyers, suggesting we may see a relief rally or bounce from this area.

🔹 2. Targeting Upper Blue Zones

If this upward correction materializes, price could reach:

The first blue resistance area around 3,090 – 3,100.

Possibly the second zone near 3,120, which aligns with previous structure and minor volume resistance.

These zones offer ideal points for watching price reaction—either rejection for shorts or breakout confirmation.

🔹 3. Potential for Further Downside

If the price gets rejected from one of those resistance areas, we could see a move down to:

The low-volume zone below 3,000, specifically the support at 2,965.

The lack of volume profile in this area (as shown on the left) suggests that once price enters this zone, it can drop quickly due to thin liquidity.

📌 Conclusion

Short-term bullish: bounce from channel support targeting 3,090–3,120.

Mid-term bearish bias: If rejection occurs in resistance zones, anticipate a drop to 2,965 or even lower.

Watch for confirmations on lower timeframes to refine entry and exit points.

GOLD H2 Outlook: Correction in progress 2900 USD in sight🏆 Gold Market Update (April 8th, 2025)

📊 Technical Outlook Update

▪️5 wave impulse completed

▪️Correction as expected previously

▪️currently trading at 3 000 usd

▪️Profit taking in progress now

▪️Price Target BEARS 2850/2900 USD

▪️Strategy: SHORT SELL rips/rallies

▪️target is 2900 USD

📢 Gold Market Update – April 2025

📈 Gold hits all-time high above $3,100/oz

🚀 Surge driven by Trump’s new global tariffs and rising trade war fears

🌍 Investors seek safety amid geopolitical uncertainty

📉 Pullback follows rally

💸 Sharp drop due to profit-taking and risk sentiment rebound

🔁 Analysts remain bullish as Fed rate cuts and tensions linger

🏦 Central banks keep buying

🛡️ China & others increasing gold reserves to hedge inflation & currency risks

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

Your Best Trading Signal Formula Revealed (Forex, Gold)

If you are looking for a way to increase the accuracy of your trades, I prepared for you a simple yet powerful checklist that you can apply to validate your trades.

✔️ - The trades fit my trading plan

When you are planning to open a trade, make sure that it is strictly based on your rules and your entry reasons match your trading plan.

For example, imagine you found some good reasons to buy USDJPY pair, and you decide to open a long trade. However, checking your trading plan, you have an important rule there - the market should strictly lie on a key level.

The current market conditions do not fit your trading plan, so you skip that trade.

✔️ - The trade is in the direction with the trend

That condition is mainly addressed to the newbie traders.

Trading against the trend is much more complicated and riskier than trend-following trading, for that reason, I always recommend my students sticking with the trend.

Even though USDCHF formed a cute double bottom pattern after a strong bearish trend, and it is appealing to buy the oversold market, it is better to skip that trade because it is the position against the current trend.

✔️ - The trade has stop loss and target level

Know in advance where will be your goal for the trade and where you will close the position in a loss.

If you think that it is a good idea to buy gold now, but you have no clue how far it will go and where can be the target, do not take such a trade.

You should know your tp/sl before you open the trade.

✔️ - The trade has a good risk to reward ratio

Planning the trade, your potential reward should outweigh the potential risks. And of course, there are always the speculations about the optimal risk to reward ratio, however, try to have at least 1.3 R/R ratio.

Planning a long trade on EURNZD with a safe stop loss being below the current support and target - the local high, you can see that you get a negative r/r ratio, meaning that the potential risk is bigger than the potential reward. Such a trade is better to skip.

✔️ - I am ok with losing this trade if the market goes against me

Remember that even the best trading setups may occasionally fail. You should always be prepared for losses, and always keep in mind that 100% winning setups do not exist.

If you are not ready to lose, do not even open the position then.

✔️ - There are no important news events ahead

That rule is again primarily addressed to newbies because ahead and during the important news releases we have sudden volatility spikes.

Planning the trade, check the economic calendar, filtering top important news.

If important fundamentals are expected in the coming hours, it's better to wait until the news release first.

Taking a long trade on Gold, you should check the fundamentals first. Only after you confirm, that there are no fundamentals coming soon, you can open the position.

What I like about that checklist is that it is very simple, but you can use it whether you are a complete newbie or an experienced trader.

Try it and let me know if it helps you to improve your trading performance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Faces Key Resistance – Will the Uptrend Continue?📊 XAU/USD Daily Technical Outlook – April 10, 2025

Gold has recently seen a strong rally, reaching an all-time high of $3167 per ounce. However, it encountered significant resistance at the upper boundary of its ascending channel, leading to a sharp pullback after the release of strong U.S. employment data, which boosted the dollar and exerted selling pressure on gold.

Currently, gold is trading around $3050, with key support levels at $2956, $2860, and $2790, which could act as potential bounce points if the decline continues.

📈 Current Market Structure:

After reaching the all-time high, the price has corrected lower. As it approaches the support levels mentioned above, the market may see fresh buying opportunities if these levels hold strong.

🔹 Key Resistance Levels:

$3100: Immediate resistance. A break above this level could signal a resumption of the uptrend.

$3167: All-time high. A breakout above this level would open the door for further gains.

🔸 Key Support Levels:

$2956: First support. The price may bounce at this level if it holds.

$2860: Major support. A failure to hold above this level could lead to further declines.

$2790: Strong support. A drop below this level would signal a shift in the market's direction.

📐 Price Action Patterns:

As the price approaches key support levels, there could be reversal patterns forming, indicating a potential price bounce. It’s crucial to monitor the price action at these levels to spot potential entry opportunities.

🧭 Potential Scenarios:

✅ Bullish Scenario:

If gold manages to hold above $2956 and bounce, the uptrend may resume toward the resistance levels mentioned above.

❌ Bearish Scenario:

If gold fails to maintain the key support levels, the correction could continue, with further declines toward lower support levels.

📌 Conclusion:

Gold is currently testing crucial support levels. Monitoring how price behaves at these levels will be key to determining the next direction. Traders should keep an eye on any economic developments that may affect market sentiment.

💬 What’s your outlook for Gold? Will it continue its uptrend or experience further corrections? Share your thoughts below.

XAUUSD SHORTSolid market moves the past few days, I thought it was going to continue and it was safe because market started to stabilize again. However, as expected, one word from Trump and made the market spiraling again. Because of the hold on tariff announcement, we are now back to 3170 level again. Howver, for me, moves like these are always good opportunity for retracement. Opening at 3170// first TP at my prev opening then final at 3000 so we can still be in profit and croos out the previous one. setting a long SL on this one just to be sure at 3270. Let's see how this rolls

Day210f100

L:6

W:5

Gold’s Bearish Trend vs. Fundamentals –What’s Driving the MarketGold’s Bearish Trend vs. Fundamentals –What’s Driving the Market?

Gold has hit our first target, just as we predicted. Some doubted this move, but it happened. The current geopolitical situation is messy, making it hard to judge what’s good or bad right now. One thing is clear—gold seems heavily manipulated. Since Trump’s controversial decisions, other countries have grown wary, and gold’s price has been hesitant to rise.

There’s a lot of talk about a U.S. and global recession, partly due to Trump’s tariffs and unpredictable policies. Yet, despite this, gold prices are moving downward.

Interestingly, when inflation was at 10% in many countries, gold stayed around $2,000. But as inflation dropped to 5% or lower, gold prices climbed. This feels like manipulation at play.

Russia recently announced plans to sell gold between April 5 and May 12. This could flood the market with liquidity and push prices down. However, other Central Banks or Hedge Funds may be also involved in these transactions. Russia might not be acting alone.

From a technical perspective, the analysis remains unchanged.

After any significant correction, gold could continue to drop further, as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

XAU/USD... Treandline breakout 1H chart Pattrenanalyzing a potential trade on XAU/USD (Gold to US Dollar) based on a trendline breakout. Here's a breakdown of your trade setup:

Entry Point: 3004 (Buy order)

Target Points:

First Target: 3040

Second Target: 3115

Third Target: 3163

If you're trading based on a trendline breakout, you would be looking for confirmation that the price has indeed broken through the trendline and is likely to continue upward.

Things to keep in mind:

1. Risk Management: Ensure you have stop-loss orders in place to protect your capital, especially with such a volatile market.

2. Market Conditions: Be aware of any macroeconomic events, news, or data releases that might affect gold prices.

3. Volume Confirmation: A higher volume during the breakout can add confidence to the move's validity.

Would you like to discuss further or need help with any specific details?

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

A decent day on gold again. We didn't get the push down for the long, however, the long came from the red box level completing most of the bias level targets as well as two mega Excalibur targets for the day. We then got the RIP from above giving the short to those who wanted more!

We're now at support 2980 which needs to break to go lower, otherwise, we'll look for price to push up again into that 3006-10 region and look for a RIP there. If we get it, we're on for our lower target which is active.

From Camelot this morning:

Price: 3007

KOG’s Bias of the day:

Bullish above 2990 with target above 3010✅ and above that 3019✅

Bearish on break of 2990 with target below 2075

RED BOXES:

Break above 3010 for 3017✅, 3020✅, 3024 and 3030 in extension of the move

Break below 2998 for 2990✅, 2985✅, 2977✅ and 2970 in extension of the move

As always, trade safe.

KOG

GOLD I H1 CLS Within Monday CLS, KL - FVG , Model 1 , Target OBHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️