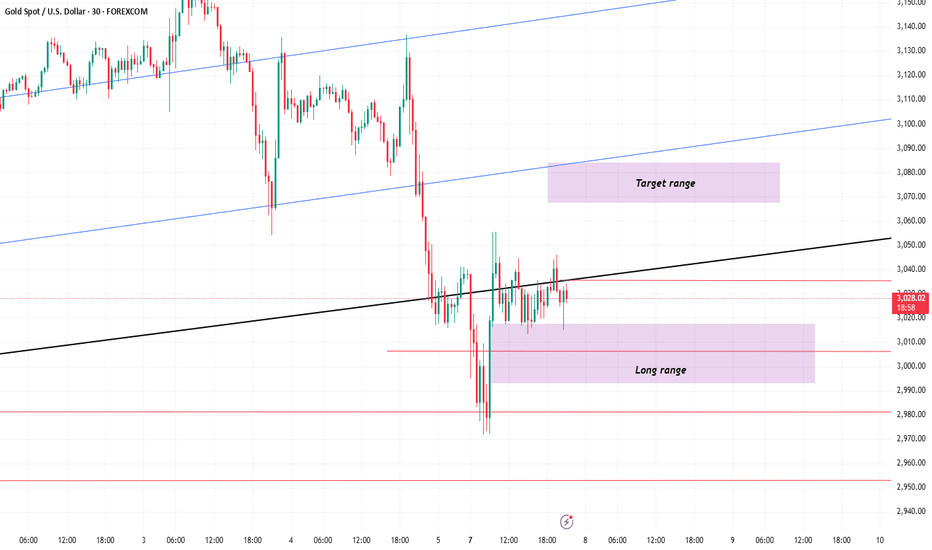

Gold: Focus Remains on Buy-the-Dip Strategy

Gold witnessed another round of extreme volatility today, plunging below the 3000 level before quickly rebounding. Since then, the price has repeatedly tested support in the 3030–3018 range. So far, this support zone has held up well, suggesting buyers remain active at lower levels.

However, traders should keep a close eye on the 3047 resistance area, which may temporarily cap upward momentum. In the short term, the overall strategy remains focused on buying at lower levels, with the potential for prices to revisit the 3080 region in the coming days.

That said, due to the sharp price swings recently, caution is advised for those looking to chase the rally above 3040. Unless your account has sufficient margin and risk tolerance to withstand a potential pullback toward the 3000 level, it is not recommended to enter aggressively at higher prices.

Trading Strategy Summary:

Bias: Short-term bullish (buy-the-dip)

Support zone: 3030–3018

Resistance: 3047 (short-term), 3080 (medium-term target)

Risk warning: Avoid chasing above 3040 unless risk control is well in place

Stay agile, and adjust your positions according to intraday price action. I will continue to provide real-time updates as the situation evolves.

USCGC trade ideas

Gold operation strategyGold plummeted at the opening of Monday, reaching the lowest point of 2972, and then rebounded to 3055. We successfully placed a short order at 3052, and have already made a profit to the target. The hourly moving average of gold crosses downward and the short position is arranged, and it continues to open downward. So gold is now the home of the short position. Whether gold rebounds or continues to be short, gold is now in a short trend below the gap. We continue to pay attention to the short-term suppression at 3055.

From the 4-hour analysis, today's upper short-term resistance is 3055, and the lower line is 3000-3008. In terms of operation, the rebound pressure at this position continues to be short and follow the trend to fall. It is necessary to rely on the rebound to rely on 3055-60 to go short once, and the lower target continues to break the bottom.

Gold operation strategy:

1. If gold rebounds to 3055-3058, short it, stop loss at 3066, target 3015-3020, continue to hold if it breaks;

2. If gold falls back to 3000-3006 but does not break, you can buy it, stop loss at 2993, target 3045-53, continue to hold if it breaks

4.7 Gold short-term operation technical strategyLast week, gold and Dow Jones started to plummet across the board, and the short-selling of the band was a carnival. First of all, our initial short-selling target of 38,500 under the Dow Jones 45,000 has been completed. The only key support is the 36,300 line, and gold has also fallen to the 2970 line. There is no bottom at present, but there is a rebound in the key support level, so don't chase the low in the morning! From the closing point of view, the weekly line finally closed with a long upper shadow line and a quasi-inverted hammer pattern. After the end of this pattern, the market has been in the short stage this week. The intraday rebound is still mainly high-altitude. The market has a large amplitude, and the small stop loss has lost its meaning. At this time, the entry position is very important. In terms of points, the intraday rebound 3045-55 area continues to be high-altitude.

Short-term support: 3038, 3018, 2980, 2960

Do a good job of pushing the position protection! ! !

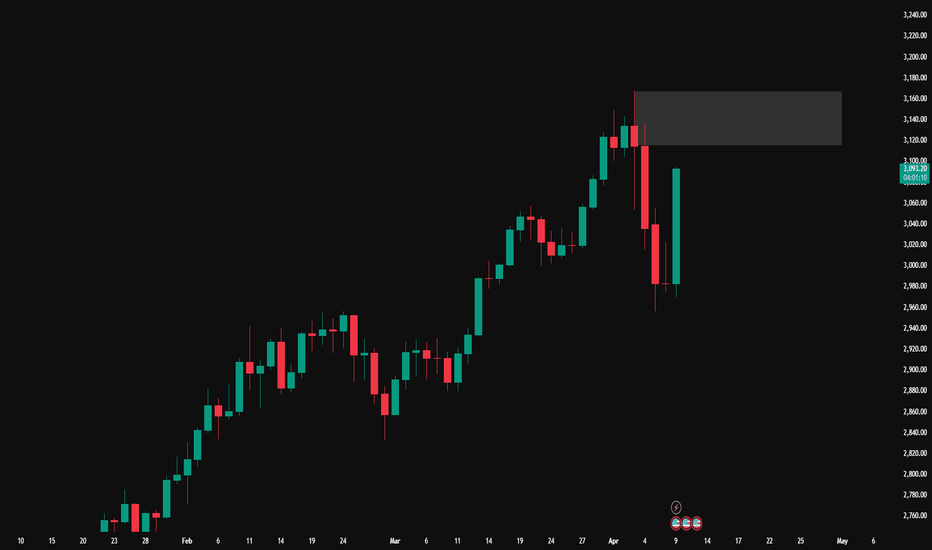

XAU-USD 07-11 April 2025 Weekly AnalysisWeekly Analysis:

Swing Structure -> Bullish.

Internal Structure -> Bullish.

Analysis and bias remains the same as analysis dated 16 March 2025.

In my analysis dated 27 October 2024 I mentioned (below) that price could potentially print higher in order to reposition CHoCH. This is exactly how price printed. CHoCH positioning has been brought significantly closer to current price action.

The remainder of my analysis and bias remains the same as analysis dated 09 February 2025.

Price has printed a further bullish iBOS.

Price is currently trading within an internal low and fractal high. CHoCH positioning is denoted with a blue dashed line.

Price Action Analysis:

In my analysis dated 27 October 2024, it was noted that the first sign of a pullback would be a bearish Change of Character (CHoCH), indicated by a blue dotted line. Price's consistent upward momentum had repositioned previous CHoCH much closer to recent price levels as expected for weeks. Current CHoCH positioning is quite a distance away from price, therefore, it would be viable if price continued bullish to reposition ChOCH.

Note:

It is highly unlikely price will "crash" as many analysts are predicting. My view is this is merely a corrective wave of the primary trend.

Given the Federal Reserve's dovish policy stance alongside heightened geopolitical risks, market volatility is likely to remain elevated, influencing intraday price swings.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

Weekly Chart:

Daily Analysis:

Swing -> Bullish.

Internal -> Bullish.

Price continued bullish repositioning bearish CHoCH positioning closer to current price action.

Price is now trading within an internal low and fractal high.

Price has very nearly printed a bearish which is the first indication, but not confirmation, of bearish pullback phase initiation.

Expectation is for price to print bearish CHoCH to indicate, bearish pullback phase initiation. CHoCH positioning is denoted with a blue dotted line.

Note:

With the Fed maintaining a dovish policy stance and the continued rise in geopolitical tensions, we should anticipate elevated market volatility, which may impact both intraday and longer-term price action.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty and the repricing of Gold.

Daily Chart:

H4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 04 April 2025.

Since last analysis price has printed a bearish CHoCH which is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,187,835

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

short 3145 with 2tp legit 3005 after trump tlk abou tarifffor me its clear here.

its a classic buy the rumour sell the news

so when Trump will talk about tariff psssssss it will back down a lot

also it go far up so fast and a legit good correction is welcome

also high price made many as electronic and other goods ewpansive

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3095) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (3140) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3030 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Gold Weekly Summary and Forecast 4/5/2025Finally we see another red candle on goldy. A lot of people said this could be the end for the bull. However, I don't think yet as currently it is only in the middle of the 4th wave. The next two weeks would be crucial. If we see another green weekly candle, we will be on the way to the final wave, which i think will be the end for the bull for this year.

For next week's setup, I will engage selling orders for the first few days while be cautious towards the end of the week. My bearish targets are 3000 and 2960. If either of the two numbers blocks the bear's path, we could a see a rebound.

Let's see how the market plays out next week.

buy opportunities The gold spot is currently bearish due to a combination of factors including rising U.S. Treasury yields and a stronger U.S. dollar, which reduce the appeal of non-yielding assets like gold. Additionally, hawkish signals from the Federal Reserve, suggesting potential for prolonged higher interest rates to combat inflation, have dampened investor demand for safe-haven assets. Market sentiment has also shifted towards risk-on, with equities and other risk assets gaining ground, further weakening gold's position. As technical indicators show downward momentum and gold prices struggle to hold key support levels, the bearish outlook remains intact in the short term.

XAUUSD Rejection from Support Reversal Expected Gold AnalysisBullish Setup Analysis

The market structure indicates a bullish momentum and I'm expecting a move towards the 3250 level Price action supports this bias and as long as it holds above the recent support zone the bullish outlook remains valid Targeting 3250 in the coming sessions

GOLDHere’s a structured breakdown of potential discrepancies or unclear elements in the provided

---

### *Discrepancies/Observations*

1. *Inconsistent Data Formatting*:

- The price "0.1,195.66" appears unusual. Is this a typo (e.g., missing a digit like "1,195.66") or a misplaced decimal?

- The target "3165,47" uses a comma as a decimal separator (European format), while other numbers (e.g., "+4.84") use a period. This inconsistency may confuse readers.

2. *Missing or Incomplete Labels*:

- *"VG"* is listed without a value or explanation (possibly "Volume Gap" or another metric).

- *"Order Block" table* lacks context. The headers ("Target", "Level") and values (1, 2, 3) are ambiguous without further description.

3. *Unclear Price Metrics*:

- The abbreviations *M3,201.00, **L3,195.55, and **C4,200.50* are not defined. Possible interpretations:

- *M* = Mid-price? *L* = Low? *C* = Close? If so, why do the values exceed typical gold spot prices (e.g., ~$2,000/oz)?

- Alternatively, these could be typographical errors (e.g., missing decimal points like "M 3,201.00" → "M 2,201.00").

4. *Chart/Image Mismatch*:

- The text mentions a chart ("Gold Spot / U.S. Dollar"), but no visual is provided in the uploaded content. Critical analysis requires the actual chart to validate trends or patterns.

5. *Date Discrepancy*:

- The note says "Apr 11, 2025" (future date at time of analysis). Ensure this is correct or a typo (e.g., 2024).

---

### *Suggested Resolutions*

- Verify the price formatting (e.g., "0.1,195.66" → "1,195.66").

- Clarify abbreviations (VG, M/L/C) and the "Order Block" table’s purpose.

- Cross-check the date and numerical values for consistency.

- Provide the accompanying chart for context.

If this is a hypothetical or placeholder image, consider adding annotations or a legend to explain the data.

---

Let me know if you’d like to refine any specific aspect!

Global central banks are hoarding gold like crazy!I believe that many friends have suffered varying degrees of losses in investment and trading this week, some in the gold market, some in cryptocurrencies, and foreign exchange! But what I want to talk about today are some special traders who have suffered heavy losses in the stock market! I have many friends and clients who have invested in the stock market. In the global stock market crash caused by tariffs this week, I talked to them about a problem. The whole world is plummeting, but the US dollar has not risen. Why does gold, as the first choice for safe havens, also have such a trend, and even achieve a double kill of long and short in one day!

I want to talk to you about my thoughts:

The market is not absolute, and there is no fixed pattern of ups and downs. Therefore, the judgment of the balance of ups and downs in the market is your magic weapon for winning. There is another word-desire! There is an Italian proverb: Let money be our loyal servant, otherwise, it will become a tyrannical master.

Shorts and longs can make money, but greed cannot. Do you control desire or does desire control you? I hope this sentence will be a mutual encouragement between us. Self-knowledge! It is important for people to know themselves. The truth is applicable to any industry, including the financial circle. If you don't know yourself, you will make mistakes, and mistakes will make you sad. People need to breathe, and perfect trading is like breathing, which requires flexibility. You don't have to trade in every wave. The secret to profitable trading is to execute simple rules, repeat simple things, and strictly enforce them for a long time.

Investment itself is not risky, but out-of-control investment is risky. Don't use your luck to challenge the market. Luck does exist, but don't expect it a second time if you encounter it once. Learn to stop loss. Stop loss is more important than stop profit, because at any time, capital preservation is the first priority, and profit is the second priority; the ultimate goal of stop loss is to preserve strength, improve capital utilization and efficiency, and avoid small mistakes from becoming big mistakes, or even lead to annihilation. Stop loss cannot avoid risks, but it can avoid greater unexpected risks, so stop loss skills are something that every investor should master. Stop loss is the lifeline of investment. Don't lose more than you gain because of small losses. Remember one sentence, when you really know how to control risks, you will turn losses into profits.

Appendix: Gold Analysis

As I expected, the price of gold rebounded and strengthened in this trading day under the continuous stop-loss pattern, and returned to the middle track and above the short-term moving average. The bulls' strength increased, and the moving averages turned into support again. The Bollinger Bands are also expected to open and extend upward, suggesting that the market will be optimistic about the future to strengthen again and refresh the historical high. Then the moving averages such as the middle track below will serve as bullish support, and the bullish operation will be carried out on dips.

From a technical perspective, gold broke through the upper track of the Bollinger Band at the daily level, and the support of the 4-hour chart moved up to 3150, maintaining a strong pattern in the short term. However, we need to be alert to the technical overbought callback risk and should not blindly chase highs. In terms of operation, it is recommended to go long after falling back to around 3150 and stabilizing, and the target is the 3185-3200 resistance zone; if it rebounds to above 3190 and encounters resistance, it can be lightly shorted. Overall, the global monetary easing expectations and risk aversion still dominate the market, and the medium- and long-term upward trend of gold has not changed.

In the 4-hour chart, 3130 is the key support. If it closes positive with support, it is expected to rise again. If it falls below, it may be adjusted sharply. However, the price is overbought and there is a need for a correction. It is expected that gold will remain strong, but be wary of a correction.

Investment strategy: buy near 3155-3175, target 3200

GOLD: Move Down Expected! Short!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 3,132.69 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

XAU/USD Technical Outlook – April 10, 2025XAU/USD Technical Outlook – April 10, 2025 🟡

🔹 Current Price: $3,121.94

🔹 Timeframe: 15-Minute Chart

📌 Key Demand Zones:

🟩 3089–3098 – Nearest bullish continuation zone

🟩 3048–3052 – Deeper demand, potential reversal if retested

📌 Key Supply Zones:

🟥 3143–3149 – Minor resistance

🟥 3162–3168 – Major supply zone, strong rejection expected

📈 Bias: Bullish until a break below 3089

🛠️ Strategy:

Monitor for bullish confirmations at 3089–3098 zone for long entries

Watch for bearish price action at 3143+ for potential short scalps

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #SupplyAndDemand #FXFOREVER #IntradayTrading

XAUUSD big fall incoming?

OANDA:XAUUSD

The price has gone crazy today. I haven't seen a daily candle like this in a long time. I will be looking to short the market, since I still stand with the statement that on Trumps' tariffs plan, and we can also see a supply zone on a daily timeframe, although I've heard that the federal reserve will cut rates, meaning bearish TVC:DXY therefore bullish for OANDA:XAUUSD . There is also an FOMC meeting today, so I will keep an eye on the decision and change of policies.

Anyone short? Any thoughts?