THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

It’s been a decent week on the markets even with extreme movement we’ve managed to navigate the charts and end yesterday with a what looks like a full house of targets completed. For that reason, we have made the decision to not come back to the markets until next week. We’re sharing the levels, they are extreme, but it’s moving like there’s no tomorrow. Take it with a pinch of salt, less experienced traders, don’t even think about it. NFP and FOMC are the days most traders lose money and blow accounts, can you imagine what can happen during these market conditions.

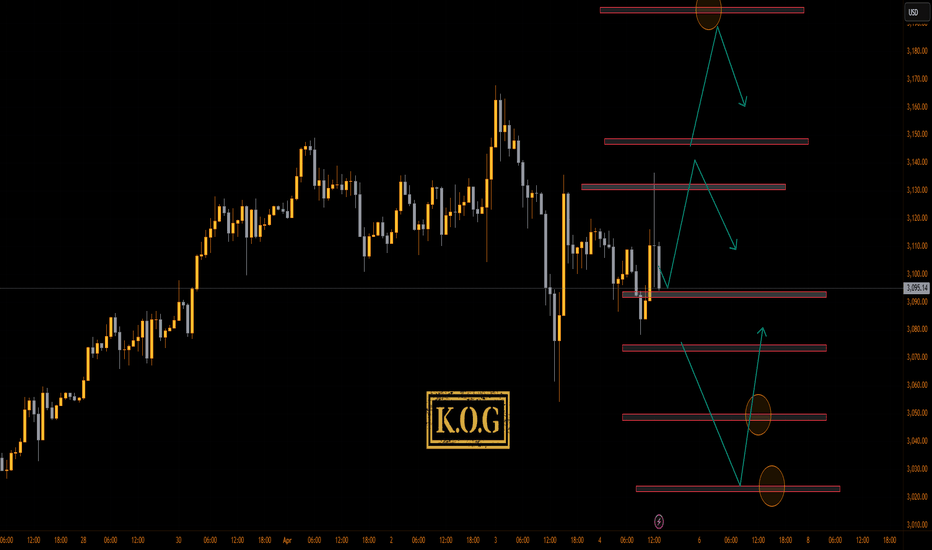

Key level here 3135 to 3140, price needs to break above and support to target 3155-65, which in this scenario can be broken so above that the extreme level 3190-95.

Below, the break of 3110, this time could give us the breaker swing attempting to break and hold below 3000, this is what we ideally want to see, with price attempting to target that 3050 level again.

If it plays it plays, we’ll watch and the better trade set ups will come next week.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

USCGC trade ideas

XAUUSD Outlook: Bull or Bear Move Ahead? Manage Risk📊 XAUUSD Market Insight 🌍

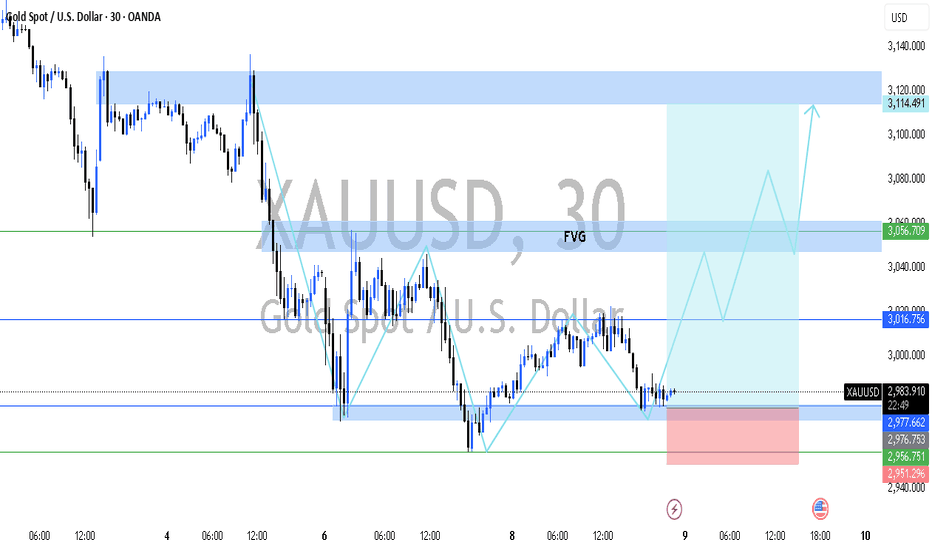

Gold is heating up once again, currently testing a tight range between 3080 and 3095. A breakout in either direction could set the tone for the next big move.

🔻 If price breaks below, we may see a slide toward 3060 and 3050—potential areas to watch for bearish momentum.

🔺 However, a strong push above 3095 could spark bullish energy, aiming for short-term targets at 3115 and 3127.

💡 Trade Smart

The market is full of opportunity, but don’t forget: risk management is key. Use proper position sizing, set clear stop-losses, and never overexpose your capital. Stay sharp, trade safe, and let the market come to you. 🧠💼

XAUUSD Today's strategyYesterday, the market trend on the trading chart continued to decline. However, it did not set a new low compared to the previous low point. Instead, the lows gradually showed an upward trend. Today, the crucial price level of 3,025 US dollars requires our close attention. Once it is successfully broken through, the market will continue to make an upward assault on the range between 3,045 and 3,055 US dollars. Overall, the current market is mainly characterized by a washout and sideways movement, and it is still too early for the price to reach its peak. Given the continuous impact of the trade conflicts, this will serve as a powerful factor driving the price of gold to new heights rather than causing the price of gold to collapse.

In particular, we must keep a close eye on the breakthrough of the 3,025 US dollars level. After this price level is broken through, we should focus on the pullback and confirmation movement. If the pullback does not break below this level, we can set the area below 2,980 US dollars as the stop-loss line. Under this premise, we can consider entering the market to go long, with the target set at the range between 3,040 and 3,045 US dollars, so as to capture the profit opportunities brought about by the rebound.

Gold will continue to rise to target 3080Gold appears to be in a bullish trend following a successful test of an important daily/intraday horizontal support level.

The price violated a minor falling trend line resistance and formed a local Change of Character (CHoCH).

There is a strong possibility that the price will continue to rise with a target of 3080.

Waiting for the right Gold setupWe need to watch how gold handles the 3137 level, which is acting as strong resistance. At the moment, it’s neither a buy nor a sell.

For a buy, the upside is too low—the risk-reward ratio isn’t great. For a sell, there’s no confirmation for a short yet.

On both the daily and weekly charts, there’s still no confirmation for either a long or a short. So for now, we observe and wait for a potential setup to form.

If you didn’t participate in this rally, don’t get hung up on it! There have always been and will always be new opportunities to make money in the market. The key is to stick to your plan, look for the best and safest setups—those with high upside and low risk. Learn to wait for your trades. There are days and even weeks when it’s better not to trade. But then, boom—your clear and solid setup appears, and you make money on it.

It is hard not to make a profit by trading CPI like thisI have to say that gold is indeed in a bullish pattern at present. After all, gold did not even fall below 3110 during the correction process. However, the current fluctuations are relatively cautious, and we are waiting for the guidance of CPI data, which may exacerbate short-term fluctuations!

To be honest, although gold is in a bullish pattern, the resistance above cannot be ignored, especially the 3150-3155 area and the previous high of 3167. It is not ruled out that gold will form a secondary high during the rise and form a double-top structure with the previous high of 3167, so I will not be a radical in the short term and set the target at 3200.

In addition, during the CPI data period, it is not ruled out that gold will rise and then fall back, so I do not advocate blindly chasing gold. On the contrary, I will definitely try to short gold in the 3050-3060 area. However, the market's long sentiment is high, and it is not advisable to have too high expectations for the magnitude of the correction in short-term trading. The first retracement target area is: 3105-3095, followed by 3080!

Accurately capture the gold pullback, shorting is the right timeDuring this period, spot gold has been like a rocket, advancing all the way and firmly in the upward channel. I have repeatedly reminded everyone before that once the US tariff stick is swung, the gold price will definitely rush up like a chicken blood. No, the facts prove that our prediction is quite reliable!

Tonight, the market ushered in another "big news" - the release of CPI data. As soon as this data came out, it directly gave the gold price a "heart shot", and the gold price was instantly pushed to around US$3160. This rise is too crazy! Interpret this data as soon as possible and pay close attention to the reaction of the gold market.

However, when the gold price rose to the previous high of US$3158-3168, it was like hitting a wall and began to "struggle". From my technical analysis point of view, there is a relatively strong resistance level in this range. It's like a person climbing a mountain, climbing to a certain height, and encountering a steep cliff. If you want to continue to go up, you have to work hard. At present, the gold price is under pressure at this position, and there are some signs of a correction. This provides us investors with a small opportunity to consider trying a short position here and earn some spread profits. I also suggest that investors can properly seize this short-term opportunity.

For example, the current gold market is like a fierce football game. The long team is strong and has been attacking all the way, and is in a dominant position. The short team can only seize the opportunity occasionally and make a quick counterattack. We investors are like coaches, and we must arrange tactics reasonably according to the situation on the field. When the long side is dominant, we can use short selling to increase our profits in a timely manner. I hope everyone can accurately grasp the market rhythm like an excellent coach.

Gold Potential Bullish Continuation (Potential HH formation)With with continued global tariff war between USA and China, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity.

Trade Plan:

Entry : 3178

Stop Loss : 2946

TP 0.9 - 1 : 3399 - 3408

XAUUSD Elliott wave opportunityLooking for a buy by leveraging on the reaction of the support trendline.

The aim is to buy on the discounted zones & monitor for TP / Selling opportunities on the roadblock zones ( previous trading range )

This is a MACRO view on XAUUSD combined with elliottwave counting

Gold Holds Steady Amid Trade Tensions and Rate Cut HopesHello,

Gold edged higher on Tuesday, supported by a weaker dollar and escalating U.S.-China trade tensions, despite pressure from rising U.S. Treasury yields. Spot gold rose 0.1% to 2984.16 per ounce by mid-afternoon, while futures settled 0.5% higher at 2990.20.

The 10-year Treasury yield hit a one-week high, dampening gold's appeal. Still, ongoing trade uncertainty and potential U.S. interest rate cuts kept the outlook bullish. A break above 3,055 could open the path to 3130, with stronger resistance near 3272.314, while weakness below 3,000 might push prices down to 2950-2930.

Market anxiety intensified after President Trump’s announcement of a 104% tariff on Chinese goods, fueling safe-haven demand. Gold, up 15% this year, also benefited from a weaker dollar, which makes it cheaper for foreign buyers.

We now await Fed meeting minutes for clues on rate cuts, with a 40% chance priced in for May. Expectations of easing could drive gold prices higher in the near term.

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1D-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

Will gold fall after a strong rise Goldmarket analysis referenceAnalysis of gold market trend: Today's gold is still fluctuating greatly under the influence of tariffs. Today, we have analyzed that gold has the risk of callback, and long positions are also falling back to lows! Trend realization analysis and ideas! From the surge on Wednesday, it can be seen that the risk aversion sentiment of gold has heated up again. The current highest is 3132, which is the first target point for the rise. If it continues to rise, it can see 3150 above, so there is still a lot of room above. Everyone should pay attention to trading with the trend as much as possible. In addition, there is another uncertain factor today. The US market will release CPI data, which will also bring abnormal fluctuations in gold. Therefore, the market will also fluctuate greatly today. Everyone should pay attention to controlling risks and managing positions well.

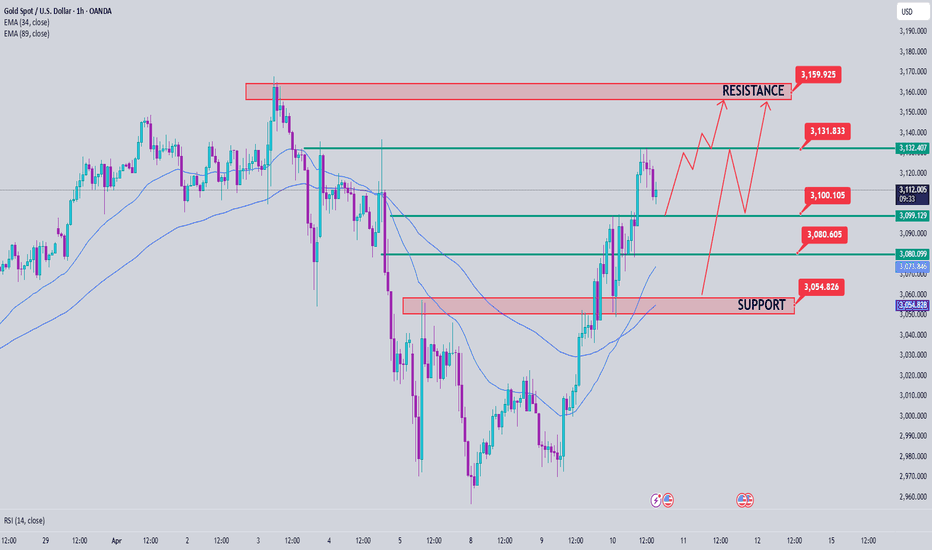

From a technical point of view, a positive line on the daily line directly changed the extremely weak adjustment state in the previous period. Now the positive line breaks the middle track of Bollinger and pulls up the moving average. Then, gold has entered an extremely strong state of bullish trend. In this state, it will continue to rise to the previous high of 3150. Therefore, the main direction today is definitely bullish. It is normal for the small cycle to adjust under the pressure of 3100. Now the Bollinger of the 4-hour cycle has just opened, and the unilateral trend has just taken the first wave of strength. There is no problem in the next wave to rise to the high point of the daily cycle. Therefore, as long as the 4-hour cycle falls back to the support of the unilateral moving average, it is an opportunity to do more. The support below is around 3070, and the rise of the hourly cycle is around 3060. Therefore, today's gold bullishness is expected to consider 3080 or 3070. The rise in the Asian and European sessions is still at 3130. If the US session breaks through 3136, consider seeing the high point of 3150. On the whole, today's short-term operation strategy for gold is to short on rebounds and to buy on pullbacks. The upper short-term focus is on the 3136-3155 resistance line, and the lower short-term focus is on the 3080-3078 support line. Friends must keep up with the rhythm. You must control your positions and stop losses, set stop losses strictly, and do not resist single operations. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market conditions.

Gold operation strategy reference: Short order strategy: Strategy 1: Short gold rebounds near 3133-3136, with a target of 3100-3090, and a break to look at the 3080 line.

Long order strategy: Strategy 2: Go long near the 3078-3080 pullback of gold, with a target of 3105-3125, and a break to look at the 3135 line.

Gold Price Analysis April 10D1 candle confirms that the buyers have returned to the market with an increase of more than 100 prices. The retest points are considered buying opportunities to break ATH

3100 is a notable point for the Buy signal in this European trading session. Today's trading strategy is quite simple when a strong uptrend has just formed, we will wait for the retest points to 3100-3080-3056 for the BUY signal to break ATH. On the other hand, if gold does not test before, we can Sell Scalp around 3133 again, when it breaks, do not SELL anymore but wait for the retest of 3133 to buy up to 3162.

Have a nice day everyone

GOLD NEXT MOVE (expecting a bearish move)(03-04-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (03-04-2025)

Current price- 3124

"if Price stays below 3136, then next target is 3113, 3103, 3093 and 3078 and above that 3190 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

XAUUSD: Strong sell to the bottom of the Channel Up.Gold has turned neutral on its 1D technical outlook (RSI = 46.183, MACD = 28.120, ADX = 55.711) as it made a HH rejection at the top of its 1 year Channel Up and almost reached the 1D MA50. A bounce like November 7th 2024 is expected here and then more selling to the 1D MA100. Take that chance to short and aim for a -9% decline in total (TP = 2,900).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD's under Geopolitical Tension (US-CHINA TRADE WAR, TARIFFS)Hey fellas,

Long time no see...

Technical side stays bullish.

Price has failed to break 2960 zone aimed Tariffs.

It has pushed more than 500 pips during Asian session

and clearly broke above 2920 zone.

As soon as price stays under 2920 till NY session, we

might see another push back.

However, if prices continues to breakup and hold 2920 as

support then we'll surely have new ATH soon enough.

DON'T FORGET UPCOMING'S CPI TOO.

Gold started current week within a range of 2965 to 3020. However,

geopolitical tension between US-CHINA trade war and TARIFFS ofcourse

caused huge uncertainty in the market.

GOLD has always been in favour of geopolitical situations.

Market is clearly reacting based on fundamental.

Gold (XAU/USD) Intraday AnalysisGold is currently trading within a narrow range between 3018 and 3040, reflecting clear indecision in the market. This sideways consolidation suggests neither buyers nor sellers are fully in control, with price temporarily caught in a holding pattern.

Key levels to watch:

• Potential buys above 3042: A confirmed break and hold above this level could open the door toward 3052 and beyond, especially if momentum kicks in. This area may attract breakout traders eyeing continuation toward previous highs.

• Potential sells below 3018: A clean breakdown under this support could trigger sharp downside, targeting levels around 3010 or even 3000 depending on follow-through volume and sentiment.

For now, price is respecting both edges of the range. Be cautious of fakeouts near the boundaries—wait for confirmation and clean structure before jumping in. Ranging conditions like this often precede significant moves, so staying patient could pay off big.

Gold: From Supercycle to Near-Term Target. What's Next?🧩 Gold is trading at all-time highs, and the key question is: where's the top? In this post, I present a complete picture: from the long-term supercycle to the current structure on the hourly chart, plus a full set of macro and fundamental arguments in favor of continued growth.

1. Grand Supercycle & Supercycle

I'm using the Gold Futures COMEX:GC1! chart since 1975, which gives the best long-term volume profile. According to my Elliott Wave interpretation:

Waves ① and ② of the Grand Supercycle ended before the 2000s.

The Supercycle wave III began in 2000.

Key milestones:

Wave I of the Supercycle peaked in August 2011

Wave II bottomed in December 2015

This entire period featured accumulation and reaccumulation. Since 2016, the gold market entered an expansion phase, forming Supercycle wave III. We are currently within its first cycle wave, which suggests there's still a long way to go.

📌 The ultimate upside is hard to predict, but the projected path on the chart points to targets in the $8,000–12,000 zone.

2. The Cycle Wave Since 2016: Extended Fifth

Starting from 2016, we see a classic 1–2–3–4–5 impulse structure, with the fifth wave showing clear extension — a trait commonly seen in commodity markets.

🔎 Robert Prechter pointed out that in traditional stock markets, it’s usually Wave 3 that gets extended — driven by greed and early confidence in the trend.

But in commodity markets like gold, it’s often Wave 5 that gets extended. This is because traders hesitate for a long time and only enter the market in panic, typically during crises, inflationary spikes, or physical shortages.

📌 The primary motivation here is fear, capital preservation, and flight from risk — not profit-seeking. That’s why gold often produces vertical rallies at the end of a trend, within the fifth wave.

📌 In this case, OANDA:XAUUSD CAPITALCOM:GOLD TVC:GOLD AMEX:GLD becomes a safe-haven of last resort in a world of rising fiat uncertainty.

3. Cup and Handle: A Textbook Bullish Pattern

The weekly chart shows a 10-year Cup and Handle pattern (2011–2023). The breakout above the neckline has occurred, projecting a classic target in the $3500–3600 range.

4. 2022–2025 Impulse: More to Come

Gold has been in a strong impulsive uptrend since 2022. This move already looks extended, but there is room for more, especially given the structure of subwaves.

In the near term (1–2 months), a flat correction in wave (iv) is likely before gold rallies to a new all-time high, potentially forming wave ③ around $3400–3600. After that, expect a period of distribution and range-bound price action.

5. Hourly Chart: Fifth Wave Not Done Yet

On the H1 chart, gold has bounced from the 0.618 Fibonacci retracement and key support. We are likely still inside wave (iv), with a potential final push in wave (v) ahead.

Key levels:

Support: $2920–2950

Resistance: $3250–3300

📌 A breakout above resistance could trigger a rapid rally.

Macro and Fundamental Drivers

🔹 Falling Real Rates in the US

10Y yields are near 4.3%, while CPI inflation remains above 3.2%. This creates a negative real interest rate, historically a strong tailwind for gold.

🔹 Record Central Bank Buying

2023 marked the second consecutive record year for central bank gold purchases. China, India, Turkey, and Singapore are leading the charge. This shift reflects a move away from the USD amid geopolitical tensions.

🔹 Fiat System Stress

Concerns over US commercial debt, banking instability, and growing systemic risk have made gold a preferred store of value for both retail and institutional investors.

🔹 Physical Delivery Demand

There is growing pressure on the LBMA to deliver physical gold, not just paper claims. Some sovereign and institutional players are demanding real metal delivery. This stresses London vaults and could drive prices higher in a short squeeze scenario.

🔹 US Debt Burden

Interest on US debt is expected to surpass $1 trillion in 2024 — a historic high. This challenges the USD’s reserve status and may increase long-term demand for gold.

Where Can Gold Go?

🧩 We are witnessing a rare alignment of:

✅ Technical structure

✅ Elliott Wave cycles

✅ Macro tailwinds

✅ Supply stress in physical gold

📌 $3400–3600 is just the beginning.

Consolidation may follow, but over the next few years, gold could target $5000 and beyond as this Supercycle wave unfolds.