USCGC trade ideas

GOLD TRADING PLAN – After Breaking ATH & Sharp CorrectionGOLD TRADING PLAN – After Breaking ATH & Sharp Correction

🔥 Former U.S. President Donald Trump has officially announced a comprehensive global tariff policy, targeting multiple countries and regions. This sparked:

📉 A major sell-off in risk assets

💵 A sharp weakening in the U.S. Dollar

🪙 A strong rally in gold, reaching a new All-Time High (ATH) at 3167 as a preferred safe-haven asset

📉 Latest Market Reaction – Gold Corrects from ATH

After a strong bullish breakout, gold is now pulling back from its peak, driven by profit-taking and investor caution ahead of key economic data — including the upcoming Nonfarm Payrolls (NFP) report.

Despite the short-term pullback, the overall trend remains bullish on higher timeframes.

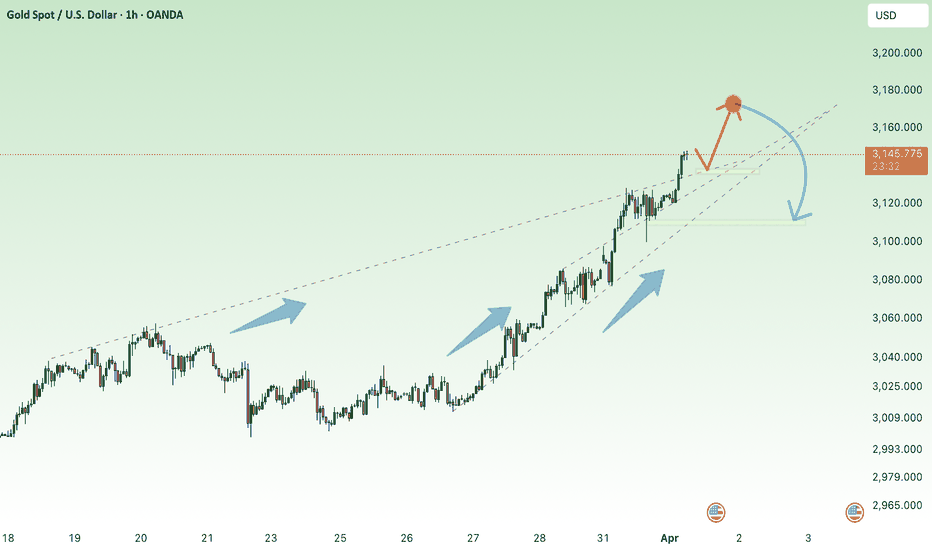

📐 Technical Overview

Yesterday, we identified and traded a symmetrical triangle pattern, which broke out sharply as expected. Now, price is retesting previous breakout zones — where new long opportunities may form.

📌 Focus on BUY setups during the Asian & EU sessions, and be cautious during the U.S. session due to expected volatility.

🔍 Key Technical Levels

🔺 Resistance Levels:

3167 (ATH) – 3175 – 3185 – 3198 – 3206

📝 (These are psychological levels & Fibonacci extensions. Wait for clear candle confirmation before entering.)

🔻 Support Levels:

3140 – 3132 – 3120 – 3112 – 3106 – 3100

🛒 TRADE PLAN

🟢 BUY ZONE: 3112 – 3110

🛑 Stop Loss: 3106

🎯 Take Profits: 3116 – 3120 – 3124 – 3128 – 3132 – 3136 – 3140

🔴 SELL ZONE: 3167 – 3169

🛑 Stop Loss: 3173

🎯 Take Profits: 3162 – 3158 – 3154 – 3150

⚠️ Final Notes

📈 The uptrend is still in play — no need to FOMO sell near the highs.

⏳ Be patient, wait for price to react at key support/resistance zones.

🚫 Avoid overtrading or rushing into trades — tariff news has major global impact.

📅 Stay sharp ahead of Friday’s NFP release — we'll reassess trend direction after the data.

✅ Stick to your risk management: follow your TP/SL strictly.

Wishing you safe & profitable trades! 💼📊

Short XAUUSD: Targeting 2870 – A Tactical PlayTechnical Analysis: Recent patterns suggest a potential bearish move. Analysts have identified key support levels at $3,048, $2,953, and $2,858, with deeper support around $2,870. These levels may present opportunities for short positions if the price retraces.

Market Volatility: The announcement of new tariffs by President Donald Trump has led to significant market fluctuations. Gold prices initially surged to record highs but experienced sharp declines shortly after, indicating potential instability and opportunities for short positions.

Central Bank Activity: While central banks have been purchasing gold, there is an expectation that these purchases may decrease if prices remain elevated. A reduction in central bank demand could exert downward pressure on gold prices.

Interest Rate Expectations: Anticipation of economic slowdowns due to tariff implementations has led markets to expect interest rate cuts. However, if these cuts do not materialize as expected, it could strengthen the U.S. dollar, making gold less attractive and potentially leading to price declines.

Gold Analysis: Key Support and Resistance Levels with Target This chart shows gold trading within an ascending channel, with key levels of support and resistance.

- Current Price: 3,092.900

- Resistance Zone: Around 3,155 (Target)

- Support Zone: Price is testing this area now, potential for a bounce.

- Major Support Zone: Below at around 3,040, acting as a secondary buy opportunity.

Key Observations:

- Rejection at Resistance: Price failed to break higher and is now pulling back.

- Potential Bounce: If support holds, price may push back toward 3,155.

- Break Below Support:** A deeper retracement to the **major support zone could happen before a stronger buy setup.

- First Target:3,155 (Resistance Zone)

- Second Target: If momentum continues, next upside levels could be around **3,180–3,200**

If the support zone fails and price moves lower:

- First Downside Target: 3,040 (Major Support Zone)

- Second Downside Target: 3,000 (Psychological Level)

The reaction at the support zone will determine the next move. If it holds, we look for buys targeting 3,155. If it breaks, we shift focus to the major support at 3,040.

GOLD reasons for shortHello fellow traders,

this idea is an absolute speculation based on a fact the tariffs were announced, indexes loss is accounted for and time for stabilisation in a market, perhaps time to buy USD instead? I am bidding 1:2 on the scenario and placing my t/p at level 2840 with sl 3240,

always protect your capital, management of risk is the crucial factor in trading no matter how much you invest, good luck

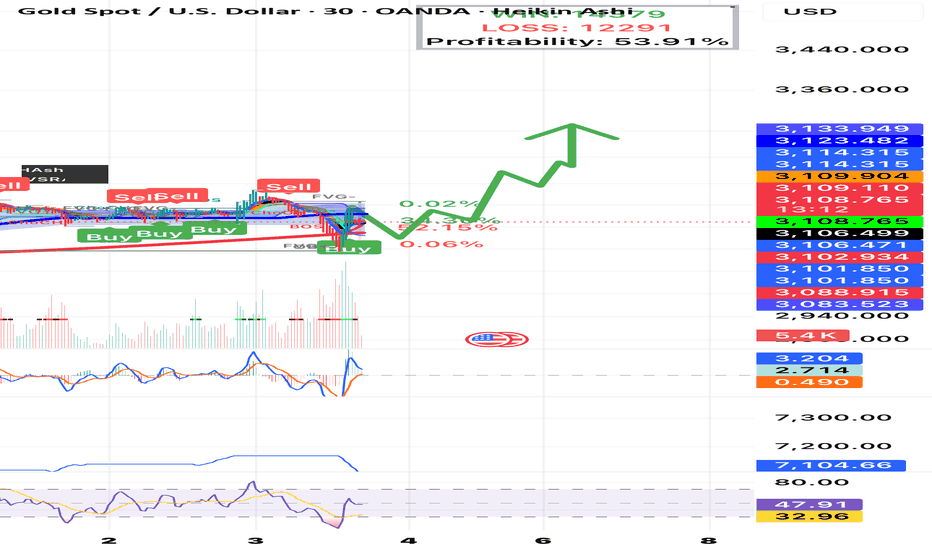

GOLD BULLS FULL TANK AND READY FOR MOON :))As you can see, gold yesterday came and fill the imbalance and grab liquidity while doing it

Now just waiting for NFP for fireworks, If we get NEGATIVE number will help the spark POSITIVE we might dip a bit and BOOM GALAXY TIME

Im in since yesterday dip

Good luck

GOLD/XAUUSD SWING UPDATESHello folks, Gold are on a trend right now. Waiting for this zone for shorts? 3180 might be the high or 3200.

The Initial targets at 3066 zone.

This idea base on my previous idea on fibonacci, Full updates once price goes 3066 zone.

Idea on the new highs maybe later on High impact news.

The idea here is short.

Trade at your own risk.

Follow for more.

I will update once this zones mitigated. Good luck! pewwpeww

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD MARKET ANALYSIS AND COMMENTARY - [March 31 - April 04]This week, the international OANDA:XAUUSD increased sharply from 3,003 USD/oz to 3,087 USD/oz and closed this week at 3,085 USD/oz.

The reason for the sharp increase in gold prices is that US President Donald Trump decided to impose a 25% tax on imported cars into the US. This seems to go against Mr. Trump's previous statement about "easing" tariffs, causing investors to worry that US partner countries will retaliate, making the global trade war more intense.

Some countries, such as the UK and Japan, have taken some steps to appease and actively negotiate to avoid US tariffs, while many other countries have announced their readiness to retaliate against US tariffs. Therefore, many experts believe that the tariff policy announced by Mr. Trump on April 2 will be very unpredictable.

If Mr. Trump still decides to impose tariffs on many countries, the gold price next week may continue to increase sharply, far exceeding 3,100 USD/oz. However, if Mr. Trump narrows the scale of tariffs as announced and does not impose additional industry-specific tariffs on lumber, semiconductors, and pharmaceuticals, the gold price next week is at risk of facing strong profit-taking pressure, especially when the gold price is already deep in the overbought zone.

In addition to the Trump administration's tax policy, investors also need to pay close attention to the US non-farm payrolls (NFP) report to be released next weekend, because this index will directly impact the Fed's interest rate policy.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

The most notable economic news in the coming week will be the US implementation of global trade tariffs on Wednesday, along with the March non-farm payrolls report due Friday morning. Experts warn that both events could increase the appeal of gold as a safe-haven asset. In addition, a number of other important US economic data will be released, including the ISM manufacturing PMI and JOLTS job vacancies on Tuesday, the ADP employment report on Wednesday, along with the ISM services PMI and weekly jobless claims on Thursday.

📌Technically, short-term perspective on the H1 chart, gold price next week may continue to surpass the 3100 round resistance level, approaching the Fibonacci 261.8 level around the price of 3,123 USD/oz. The current support level is established around the 3057 level, if next week gold price trades below this level, gold price is at risk of falling to around the 3,000 USD/oz round resistance level.

Notable technical levels are listed below.

Support: 3,057 – 3,051USD

Resistance: 3,100 – 3,113USD

SELL XAUUSD PRICE 3133 - 3131⚡️

↠↠ Stoploss 3137

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

NFP REPORT IMPACT ON XAUUSD ALERT!🚨 XAUUSD Market Alert 🚨

🔥 Current Action: XAUUSD is currently range-bound between 3101 and 3114—will it break out soon? The market’s at a critical point, and a sharp move could be on the horizon!

📉 Bearish Scenario: If price slips below this zone, keep an eye on potential support levels at 3070 and 3054. A downward shift could set up fresh opportunities for sellers.

📈 Bullish Scenario: On the flip side, a solid break above 3114 could trigger buying pressure, with targets at 3140 and 3170. A move like this could spark a new uptrend, especially with NFP data on the way, which could impact the gold market!

💬 Let’s Talk Strategy: What’s your take on the XAUUSD setup? Share your insights, and let’s navigate this golden opportunity together! 💰🚀

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold swing trade with buy and sell levelsThis week we are looking to sell Gold down to previous resistance which aligns with Fibonacci 0.382 level for a sell total pips of 309.

When we reach our take profit we will go back into a buy at 2994 and a take profit target of 3053 for an additional pip count of 588 pips.

Trade idea is based on higher time frame and uses trend lines as well as support and resistance and Fibonacci levels.

With these type of trades expect to go into some drawdown that's why I recommend using small lots and securing profit along the way .

Check out my weekly gold forecast with both buy and sell entries posted below.

Gold weekly forecast with buy and sell levelsGold weekly forecast with both buy and sell entries.

Friday Gold sold off from 2334 all the way to 2300 for a drop of 334 pips before retracing up to where we are now at 3024.

What can we expect for the coming week ?.

My plan is as follows.

For a buy I would look at entering at 3032 expecting first resistance (marked in red on chart ) to be 3038 to 3040 area.

If we break these then next target would be 3048 to 3052 (200 pip from entry) this is high resistance level , if gold continues to be bullish expect 3078 to be the next area.

For a sell I would enter at 3018 expecting 3010 to 3008 as first support, next level is 3000 to 2998 and if broken we can expect gold to fall to 2880 and 2840 levels.

As always wait for levels, take profit along the way and don't over leverage .

Ill update this as the week goes on.

Check out my other trade idea for a gold swing trade below.

Trade safe

GOLD 3000$ Key Level Ahead! Buy!

Hello,Traders!

GOLD is making a bearish

Correction just as pretty

Much everything else on

The market, but Gold is

Trading in a long-term

Uptrend so after the

Price hits an important

Psychological level

Around 3000$ a local

Bullish trend-following

Rebound is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.