UKOG trade ideas

possible support and resistance lines

The bottom black line seems to be support, the above light blue line is where there had been previous resistance and support previously, my prediction is that it will either rebound off of the light blue or, due to it's high volume and increase, break through resistance and rebound somewhere in between the light blue and navy.

my strategy would be to wait, if it rebounds at the light blue then wait further to see if it bounces off of the black support line and if it begins to rise again then trade.

If it rises further at the same rate and surpass the light blue, then my strategy would be to wait for it to drop,bounce from the navy (the navy also lies on the 2.000 boundary which makes it a more likely support/resistance line) and see if it drops to the light blue and rises and if so then trade.

UKOG - ANALYSIS PARALYSISNot to sound contrarian but UKOG has options to play with and thats going to make the next moves a little tricky to predict.

I still believe there will be a bigger pull back but it might adopt some rather unorthodox patterns to get back to 5 or around the 50% retracement level.

Ultimatey i'm waiting for price to pull back and establish a value range of types where is can see traders are happy to bid again.

In the long run news will drive this higher, for now its finding the pattern and the place to get in and thats going to take some time.

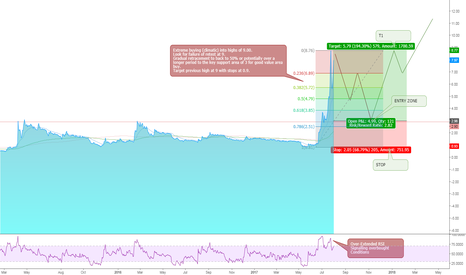

UKOG Potential Top Failure Retracement & Continuation Climatic buying into top at 9 may result in a run out of steam as commitment burns out and the price does not offer much more value resulting in a gradual pull back (time, news and economics dependent) which may offer a good entry at the 50% retracement. Should it move deeper a more significant level at 3 which was previously strong resistance would work as a good support level for a continuation bounce with targets set for 9 again and potentially higher from there.