Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

GOLDPETALF2025 trade ideas

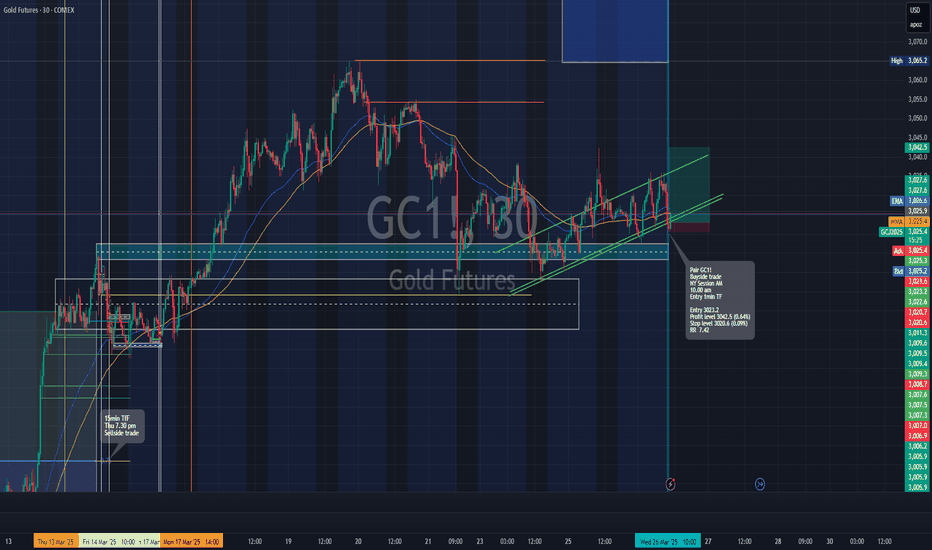

Long trade

30min TF overview

1min TF Entry

Pair GC1!

Buyside trade

NY Session AM

10.00 am

Entry 3023.2

Profit level 3042.5 (0.64%)

Stop level 3020.6 (0.09%)

RR 7.42

Reason: Looking left at previous price action and respected levels along with the Periodic Volume Profile (PVP) indicator and ascending channel seemed to suggest we were at a prime demand level indicative of a buyside trade.

Tesla es Mini Gold oil3.24. 25 in this video it looks like the Market's going up on the ES and Tesla. the oil Market has only traded a little bit lower than its recent High and it's not clear if the Market's going to make another move to a new high or if it's going to go a little bit lower and you can see that in the bars which are very narrow in their range and this looks different from when the market was actually actively going higher until it went to the end of the ABCD pattern which is a reversal pattern. Because the gold went to the end of the ABCD patterns going higher I am concerned that the Market's going to make a significant correction lower.... but I would be prepared for retest and minor Moves In the goal going higher and lower and that's what I tried to show to you in the video and I'm sorry that my presentation was so scattered and probably not easy to follow. the way you trade a market has to do with the kind of Trader you are... do you scalp a market or do you trade for longer trades. you could have made a few trades in gold and you could have made nice returns if several $1000 trades are suitable for you... and you could have traded as a buyer and a seller if you recognize the reversals.... but that is not an easy way to live. you could do it with discretion and not take every trade and if that works you may not need to take antacids and ulcer medication.... most people are not geared to that kind of trading and probably have a very low chance of being profitable. I am not a stop and reverse Trader.... but I show the patterns because I believe markets trade to the buyers and the sellers and that it is evident on a chart. if you don't care to be a stop and reverse Trader it is still to your advantage to know how markets trade and retest. to my thinking it's much better to at least know what it looks like as opposed to staring at your chart and having no real point of view other than the fact that you're not quite sure what the Market's going to do and all you can think about is losing money..... and even worse stay in a good trade too long and give all the money back because you don't know when to get out of a good trade. when you learn how to trade you still have to deal with the reversals in the market it's never going to stop... the need that you have to evaluate the price action that can work against you. my personal belief is that it's not easy to trade, I personally don't enjoy Trading but I don't mind making money if I do trade. my mission is to show you the trade location and the direction of the market. and the stop and a little Target without hitting the stop first... and if you can do that then the market should trade in your favor for at least a while and if it gets to that initial Target you have a reasonable reward and if it continues going in a Direction that could take some of your gains back.... but you haven't lost money yet.... that's okay..... it's still better than getting into markets and immediately losing money because you're not reading the market and you don't have a reasonable plan. I am sorry for my delivery during the videos... it's not intentional... and if it gets worse I'm going to have to stop. a fully intend to trade at this point Until evidence shows that I'm not trading well. I will go with the flow it's been fun.

Gold Above $3,000 and MoreAccording to the World Gold Council, more than 600 tons of gold — valued at around $60 billion — have been transported into vaults in New York. Why are they doing that?

Since Donald Trump election in November, there is around $60 billion worth of gold that has flowed into a giant stockpile in New York.

The reason why physical gold is flowing into the US is because traders are afraid Trump might put tariffs on gold.

Gold Futures & Options

Ticker: GC

Minimum fluctuation:

0.10 per troy ounce = $10.00

Micro Gold Futures & Options

Ticker: MGC

Minimum fluctuation:

0.10 er troy ounce = $1.00

1Ounce Gold Futures

Ticker: 1OZ

Minimum fluctuation:

0.25 per troy ounce = $0.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD Reached it's Apex and is ready for a dumpIn my earlier posts I said that Gold has the potential to reach the U-MLH, which has become true.

Up there, the price of Gold is stretched. Yes it can go up even more beyond the Upper-Medianline-Parallel. But the overall numbers of occurrences are small.

So, at this natural stretch, price has a high probability to revert to the mean. And this is supported by the fact, that the overall indexes are heavenly oversold and already showing the signs of a pullback to the North (see my last NQ post).

Why not just watch how it plays out, and make a decision for a trade after the FOMC, or even tomorrow. Don't rush into these unknowing situations. Be patient and wait for clear signs to take action.

Gold ExpansionCOMEX:GC1! reversed off the weekly average zone and is gradually working through that 4H FVG.

Looking for a clean break above it, then a retrace back to that zone. My target is the Daily Major Buyside Liquidity, with an eye on a potential extension toward the Weekly Average Expansion area if momentum holds.

The New week can give us a Pullback on Gold!Waiting for the bigger move and for that bigger move to happen we need a solid pill back to fill in some gaps. Focused on the patience for this in order to maximize the reward. Allow Monday and Tues to show if they will reach for the lows and set up. Logically the best entry should come after Tuesday. But you never know. Just wait for it cause price will show when it is ready.

The day's rebound is mainly highAt present, the gold market has been fluctuating in the range for some time, and the market has not made a directional choice, which means that the gold price will continue to fluctuate during the day, and it is a downward flag adjustment range. For our operation layout, we should keep high-altitude and low-multiple in the range.

In the oscillating market, we mainly focus on the recent direction. It is obvious that it is a short-selling oscillation after the top falls. In the range, high-altitude and low-multiple are the first to focus on the opportunity of shorting. In this market at noon, we still need to continue to wait for the opportunity to short. From the four-hour trend, the upper pressure is focused on the 3036 line, and the lower support is near the support level of 3010!

Gold operation suggestions: short near 3032-3036, stop loss 3042, target 3015

GC1! : Buy opportunityOn GOLD, we have a strong likelihood of seeing a strong uptrend after the rebound off the support line. However, you must wait until all the analytical conditions are met before entering a buy position.

Furthermore, you can strengthen your buy position after the Vwap indicator breaks.

Bullish Gold Trajectory and Fundamental Analysis of XAU/USDThe gold market (XAU/USD) has been exhibiting strong bullish momentum, as evidenced by the price patterns and macroeconomic conditions.

Bullish Price Trajectory: Historical Patterns

The attached chart highlights two distinct bullish patterns in gold's price movement:

1. Pattern 1 (July 18, 2024 – October 30, 2024)

Initial Price: $2,394

Closing Price: $2,762

Percentage Increase: Approximately 15.37%

This pattern reflects a steady upward movement within a defined bullish channel.

2. Pattern 2 (January 7, 2025 – March 14, 2025)

Initial Price: $2,706

Anticipated Closing Price (March 14): $3,100

Applying the same percentage increase from Pattern 1 to Pattern 2 predicts a potential price of $3,121.96, suggesting further upside.

Argument for Repetition of Pattern

The market structure in Pattern 2 closely mirrors that of Pattern 1, with consistent higher highs and higher lows.

The current price trajectory remains within the bullish channel, reinforcing the likelihood of continued upward momentum.

Fundamental Drivers Supporting Bullish Gold Prices

Gold's bullish outlook is supported by several macroeconomic and geopolitical factors:

1. Safe-Haven Demand

Economic Uncertainty: Persistent economic instability, including geopolitical tensions (e.g., wars in Gaza and Ukraine) and global trade disputes, has increased demand for safe-haven assets like gold.

Market Sentiment: Consumer confidence has been declining due to inflation fears and policy uncertainty, prompting investors to hedge risks by buying gold.

2. Central Bank Accumulation

Central banks worldwide have been aggressively buying gold to diversify reserves amid geopolitical risks and concerns about fiat currency stability. This trend provides strong support for gold prices.

3. Easing Monetary Policy

Recent data shows U.S. inflation easing to 2.8% year-on-year in February 2025, down from 3% in January. This has fueled expectations of Federal Reserve interest rate cuts.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

4. Weakening U.S. Dollar

A weaker U.S. dollar often boosts gold prices as it becomes cheaper for international buyers. Current monetary policies and fiscal challenges in the U.S., including rising debt levels, are likely to put downward pressure on the dollar.

5. Inflation Hedge

With persistent inflationary pressures globally, gold continues to serve as a reliable hedge against inflation. Analysts expect this trend to persist through 2025.

Technical Analysis Supporting Bullish Outlook

1. Support Levels

The chart shows that gold has rebounded strongly from a well-defined support region around $2,600–$2,700.

This region aligns with prior consolidation zones, indicating strong buyer interest.

2. Moving Averages

Gold prices remain above key moving averages (e.g., EMA-65), signaling sustained upward momentum.

3. Oscillator Signals

The Stochastic Oscillator indicates that prices are rebounding from oversold levels, confirming renewed bullish momentum.

The combination of technical indicators and fundamental drivers strongly supports a bullish trajectory for gold prices in the near term:

Historical price patterns suggest that the current bullish channel could push prices beyond $3,100 by mid-March.

Macroeconomic factors such as easing inflation, central bank buying, geopolitical risks, and monetary policy shifts create a favorable environment for further upside.

Given these conditions, investors and traders should remain optimistic about gold's performance in 2025 while closely monitoring key support levels and macroeconomic developments.

Gold Analysis Futures Pricing: Gold, The Revival....A clear pattern emerged as liquidity exited cryptocurrencies, equities, and indexes, redirecting into gold amid significant institutional short positioning ahead of its break above $3,000. This capital rotation indicated a well-orchestrated move, aligning with broader macroeconomic and geopolitical interests.

Given this dynamic, there is reason to believe the Trump administration may favor a stronger gold market, potentially as a strategic measure to ease geopolitical tensions with Russian President Vladimir Putin. Putin has previously expressed dissatisfaction with gold’s position relative to digital assets in global markets, making this shift particularly noteworthy.

I am requesting reputation points to contribute further insights. Engage with this post—like, follow, and comment to continue the discussion.

Gold inertia accelerates towards 3000 markAfter gold broke a new high overnight, it further increased to around 2990, and the daily line finally closed with a big bald sun. The previous sideways squat gave the bulls sufficient power, strong kinetic energy and fast speed, and the closing price was high at the end of the day, indicating that the strong trend will continue, and there is still room for further upward movement. In the 4H cycle, after breaking through the previous high pressure of 2956, the inertia of rushing up caused the indicators to deviate slightly. In the white market, we will first look at the correction space for the decline, and then look at further upward movement after the correction. The top and bottom support below is around 2956, and the 1H cycle support is at 2967. In terms of operation, we will continue to treat it as a long-term idea, and then gradually look at the 3000 mark on the top. Do not blindly guess the top and empty.

Operation suggestion: Buy gold near 2967-68, stop loss at 2960, look at 2981, 3000!

Gold is strong and looking for a second rise pointU.S. Treasury bonds rose on the back of risk aversion, and U.S. Treasury yields fell collectively. The benchmark 10-year Treasury yield closed at 4.273%; the two-year Treasury yield, which is more sensitive to monetary policy, closed at 3.98%. As the global trade war intensifies and stimulates risk aversion demand, spot gold hit a new record high, approaching the $2,990 mark, and finally closed up 1.9% at $2,988.89 per ounce. Spot silver closed up 2.15% at $33.86 per ounce. In terms of interest rate cuts, the latest CME "Fed Watch" data shows that the probability of maintaining interest rates unchanged in March is 98.0%, the probability of a 25 basis point rate cut is 2.0%, the probability of maintaining the current interest rate unchanged by May is 79.9%, the probability of a cumulative 25 basis point rate cut is 19.8%, and the probability of a cumulative 50 basis point rate cut is 0.4%. U.S. gold continued to rise, breaking through the integer mark of $3,000 per ounce during the session. Note that the volatility of the market is increasing. Gold fluctuated upward on Thursday, with a large positive line recorded at the daily level. The gold bulls performed very strongly and there is a probability of further continuation. Today's operation considers retracement and layout of long orders first, and high short orders as a supplement.

Gold plan: Gold retreats above 2966 and stabilizes more, with a target of 2978-2990, and a stop loss of 5 US dollars.

If the gold price breaks below $2940/ounce, it will stop the expected bullish trend and push the gold price to regain the main trend of fluctuations.

It is expected that the gold price will trade between the support level of $2960/ounce and the resistance level of $3000/ounce today.

Latest real-time market trend analysisIn the early Asian session, spot gold fluctuated at high levels and is currently trading around $2,986.08 per ounce. Gold prices surged more than $50 on Thursday, hitting a new record high as heightened tariff uncertainty and bets on the Fed's loosening of monetary policy keep gold prices attractive. As geopolitical tensions intensify, investors flock to safe-haven assets, and Zhang Desheng predicts that the average price of gold may reach $3,150 per ounce between July and September. Putin supports a ceasefire but emphasizes details, resulting in an unclear ceasefire outlook, which tends to push up market risk aversion and continue to support gold prices. If Russia-US relations ease or energy cooperation is reached, it may ease safe-haven demand and put pressure on gold prices, and then gold prices will fall back.

From the technical perspective of gold: yesterday, gold broke through and rose sharply. Gold is in a rising cycle at the daily level, and this cycle has not yet ended. Under the strong push of continuous positive lines, the gold price will most likely continue to move towards 3000-3010. In the daily K, the stochastic indicator golden cross continues, the indicator golden cross, and the bullish pattern continues. In the 4-hour period, the stochastic indicator golden cross state, the MACD double line adhesion upward, are all main long signals, and the support position of the top and bottom conversion is near 2955. Therefore, the 4-hour period can be treated as a strong and weak conversion point according to the top and bottom conversion of 2955; today, there is no doubt that gold continues to be bullish and long, and there is still room and demand for further rise. Today, gold focuses on the support below at 2980-2970. The gold bulls are very strong and there is a probability of further continuation. The upper side can look at the 3000 mark and the 3010 line. In terms of today's operation, consider retreating to arrange long orders first, and high-altitude as a supplement.

Gold operation strategy: Operation suggestion: Buy at 2970-2975, stop loss at 2965, target at 2990-3000

We Need a Retrace before the breakout IMO on GoldI want to go long. I am long on gold. but I need to see it pull back and establish a low for he week first before I'm interested in attempting the long. This would make for a much stronger move. Just have to be patient and wait for it all to line up inside of the killzone.

Gold Breaks $3,000: Bulls Maintain Strong Control in the MarketGold Trading Update: The $3K Target Achieved

Gold has reached the $3,000 target as expected. Technical analysis indicates there's still room for further upside, potentially towards the overbought line of the larger uptrend channel. Notably, we're not seeing any signs of supply entering the market yet.

The $3,000 level was our focus, and gold has just hit that today. We've been watching this breakout, which tested on low volume. The upward momentum continues with an extension forming, and volume is now picking up, showing improvement in the trend.

What's Next for Gold Trading?

The current technical indicators suggest we can still move higher. Gold has been advancing for five to six consecutive days, demonstrating persistent improvement to the upside. Supply on the way up is comparable to the previous strong area we've discussed.

What makes this move particularly noteworthy is the absence of significant reactions or pullbacks. The market is showing only very small retracements, indicating bullish strength.

This continued strength without substantial corrections suggests the bull run in gold may continue in the near term. Traders should watch for potential targets at the overbought line of the larger uptrend channel as mentioned in our analysis.

This analysis is for informational purposes only and should not be considered investment advice.

Year ahead 25' GoldGOLD Analysis

The uptrend channel remains intact, with price currently trading near the uptrend line. I’ll shift to lower timeframes to explore intraday opportunities.

Always consider all potential price movements and prioritize trades with the highest probability of success. Remember, patience and precision are essential for maintaining an edge in the markets.