BPTH could be in for a bull market in 2025!One new low cap stock pick with my research described below, please do your own research aswell and remember these are risky moves - thus small allocation. I will be back with many crypto charts for next year as well, don't worry!

Bio-Path Holdings (BPTH) Overview: Bio-Path Holdings, Inc. is a biotechnology company focused on developing nucleic acid cancer drugs using its proprietary DNAbilize antisense RNAi nanoparticle technology. This technology allows for the development of drugs that can be administered through intravenous transfusion, targeting specific genes associated with cancer.

Last week, Bio-Path Holdings announced preclinical results for their drug candidate BP1001-A. The study demonstrated that BP1001-A enhances insulin sensitivity, suggesting its potential as a treatment for obesity in patients with Type 2 diabetes.

In 2025, Bio-Path Holdings plans to initiate a first-in-human Phase 1 clinical trial for BP1001-A, focusing on validating its safety, measuring pharmacokinetics, and establishing dosing for potential pivotal trials. This trial is aimed at further exploring BP1001-A's potential as a treatment for obesity and related metabolic diseases in patients with Type 2 diabetes.

A successful trial would likely lead to a significant increase in Bio-Path Holdings' stock price. The news of positive clinical results would be seen as a validation of the drug's potential, attracting more investor interest and possibly leading to partnerships or buyouts from larger pharmaceutical companies.

SPECULATION:

Estimating the yearly revenue potential and a fair valuation for Bio-Path Holdings (BPTH) based on BP1001-A's market entry involves several speculative assumptions, as we lack specific data on market penetration, pricing, competition, and long-term efficacy. Here's a theoretical breakdown:

Revenue Potential:

Market Size and Share:

Obesity and Type 2 Diabetes Market: The global market for treatments of obesity and Type 2 diabetes is substantial. For context, the global diabetes market alone was valued at approximately $51.1 billion in 2022, expected to reach $81.6 billion by 2030, growing at a CAGR of around 6.5% (). However, BP1001-A would be competing in a segment of this market focused on novel treatments or those with a unique mechanism like insulin sensitivity enhancement.

Assumed Market Share: Assuming BP1001-A captures a niche segment, let's speculate it achieves a 1% to 5% market share due to its novel mode of action and targeting a specific subset of Type 2 diabetes patients with obesity.

Pricing and Usage:

Drug Pricing: New diabetes drugs, especially those with innovative mechanisms, can be priced high. For instance, if we assume a yearly cost per patient of $10,000 (considering the high cost of biologics and similar therapies),

Patient Population: If we estimate that 1% of the diabetic population globally (approximately 537 million adults in 2021 according to IDF) could benefit from this drug, that's about 5.37 million patients. At 5% market share, this would mean 268,500 patients.

Revenue Calculation:

Annual Revenue: If 268,500 patients use BP1001-A at $10,000 per year, the potential annual revenue would be approximately $2.685 billion. For a 1% market share (53,700 patients), it would be around $537 million.

Valuation:

DCF Approach: A Discounted Cash Flow (DCF) analysis would be the traditional method to value BPTH if BP1001-A were to generate such revenues. Here's a simplified speculative approach:

Cash Flow: Assuming 50% of revenue translates into gross profit (considering R&D, marketing, and other costs), a 1% market share would yield $268.5 million in gross profit, and 5% would yield $1.3425 billion.

Discount Rate: Biotech companies often have high discount rates due to risk. Let's assume a 15% discount rate for this speculative valuation.

Growth & Terminal Value: Assume growth stabilizes after initial high growth years, with a terminal growth rate of 2% post-patent exclusivity period (which might be around 20 years from patent to market).

Valuation Calculation:

With a 1% market share scenario:

Present Value of Cash Flows for first 10 years (assuming rapid growth then stabilization): $268.5M * Annuity Factor at 15% = $1.4 billion (very roughly).

Terminal Value (Gordon Growth Model) = $268.5M * (1+0.02)/(0.15-0.02) = $2.14 billion.

Total Equity Value = PV of cash flows + Terminal Value = $3.54 billion.

With a 5% market share scenario:

Present Value of Cash Flows for first 10 years: $1.3425B * Annuity Factor at 15% = $7 billion (again, very roughly).

Terminal Value = $1.3425B * (1+0.02)/(0.15-0.02) = $10.7 billion.

Total Equity Value = $17.7 billion.

Market Multiples: If we use industry multiples (PE ratios for biotech can be very high, especially for novel treatments), with a PE ratio of 20-30 for a company with significant growth potential, the valuation based on earnings from BP1001-A alone would range from:

1% Market Share: $5.37 billion (20 * $268.5M) to $8.055 billion (30 * $268.5M).

5% Market Share: $26.85 billion (20 * $1.3425B) to $40.275 billion (30 * $1.3425B).

Fair Valuation:

Given these speculative numbers, a fair valuation for BPTH based solely on BP1001-A's potential would be somewhere in the middle of these ranges, adjusted for the company's current financials, other pipeline drugs, and market conditions. Considering the above, a conservative estimate might place BPTH's valuation in the range of $3 billion to $10 billion, depending on market penetration optimism, with the understanding that this is highly speculative and subject to countless variables including regulatory approval, actual market acceptance, and competitive landscape.

CONCLUSION & TA:

This simply means, IF(!) this drug is succesfull the market cap of this company would significantly rise. Currently we're sitting at a 5.43 million market cap (at close, so lower now), thus its a 100 to 1000x potential or it drops to zero. Last note, price needs to stay above $1 to stay compliant with Nasdaq rules or else there could be an inverse stock split 2 to 1 for example or they face delisting by the end of Q3 2025. I'm not too worried because this is the same as SEALSQ faced before it 10x'd in the last few weeks.

TA wise: we're retesting previous resistance and the bull market support band. Chart has been down only for years, capitulation after capitulation thus chance of a rebound should be there. I grabbed a small allocation to sit out for 2025, if the clinical trials are successful, we'll in for a big bull market. If not succesfull, we'll likely lose our money. A very decent risk / reward ratio of you invest an amount you can afford to lose and not more than 5% of your portfolio.

This is one of my low cap stock picks, next to LAES (10x since entry) and MOBX (entry last week, flat pa for now). I will be scouting for more but for now, happy holidays!

BPTH trade ideas

(BPTH): An Advanced Technical Breakdown and Future OutlookExecutive Summary:

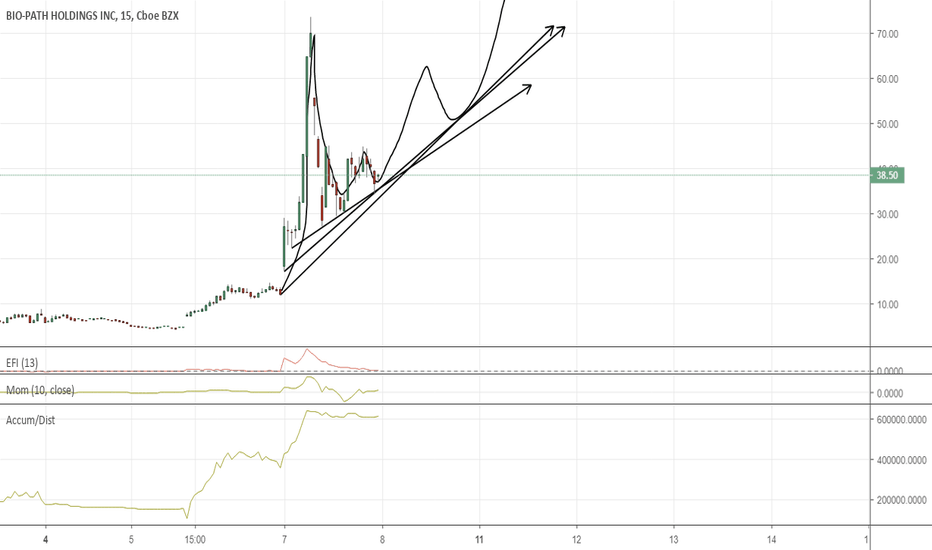

Bio-Path Holdings Inc. (BPTH) experienced a monumental surge in trading activity and price valuation following the announcement of successful clinical trial results. The charts present a compelling case for both bullish sentiment and caution due to the exceptional movements. In this advanced technical analysis, we'll dissect the current patterns, indicators, and momentum to speculate on the stock’s future trajectory and establish potential price targets.

Technical Indicators and Price Action:

The sharp increase in BPTH’s stock price is prominently displayed on the candlestick chart, with a significant gap up, indicative of strong buying pressure and investor enthusiasm stemming from the clinical trial news. The volume accompanying this price action was substantially above the average, signaling robust conviction behind the move.

Fibonacci Retracements:

The Auto Fibonacci Retracement tool highlights key levels of potential support and resistance. After such an explosive move, retracements to levels such as 38.2% or 61.8% are commonplace as stocks often retrace their steps before continuing the trend or consolidating. Traders should watch these levels closely for signs of stabilization.

Ichimoku Cloud:

The Ichimoku Cloud, prior to the price jump, suggested indecision, with the stock price oscillating around the cloud. The latest candlestick closing above the cloud is a bullish signal, potentially leading to a new uptrend. However, the cloud itself should be monitored as it may present dynamic resistance in the future.

Relative Strength Index (RSI):

The RSI has leaped into the overbought territory. Traditionally, an RSI above 70 suggests that a stock may be overextended and could face a pullback or consolidation phase. Watch for the RSI to retreat from these highs as a sign of short-term momentum waning.

Moving Average Convergence Divergence (MACD):

The MACD line crossing above the signal line is a traditional buy signal, and the histogram corroborates increasing bullish momentum. Traders will need to assess if the histogram bars continue to expand, which would support the continuation of the trend.

On-Balance Volume (OBV):

The OBV line has shown a steep incline, indicating that volume is confirming the price move. This confluence adds weight to the sustainability of the current price levels.

Speculative Price Targets and Outlook:

Given the potent combination of positive clinical trial news and technical indicators, BPTH's stock has transformed its narrative. From a technical perspective, if the stock consolidates above the 61.8% Fibonacci level, this could serve as a launchpad for future price appreciation. On the downside, a fall below the 50% Fibonacci retracement might signal a bearish reversal, prompting a reevaluation of bullish targets.

As we extrapolate the data, a speculative bull case would put the next price targets at Fibonacci extension levels, particularly at 1.618 (around $10.55), aligning with the psychological resistance of double digits. On the other side, a conservative approach would anticipate a pullback to the $5.34 level, near the 0.618 Fibonacci retracement, before another potential leg up.

Conclusion:

BPTH's stock has demonstrated a significant technical and sentiment shift, with the market responding favorably to the latest developments. Traders and investors should carefully monitor the aforementioned technical levels, volume, and indicator signals to align their strategies with the evolving market dynamics. Caution is advised, given the volatility associated with biotech stocks and clinical trial outcomes. While optimism is justified, maintaining stringent risk management protocols is paramount in such speculative environments.

$BPTH Bio-Path Holdings Inc (% of Vol Shorted- Mar 11: 60.93%) NASDAQ:BPTH Bio-Path Holdings Inc (% of Vol Shorted- Mar 11: 60.93%)

Sky High!!!

Target PTs 486 - 1,236 and higher

Bio-Path Holdings, Inc. operates as a clinical and preclinical stage oncology focused RNAi nano particle drug development company in the United States. The company develops products based on DNAbilize, a drug delivery and antisense technology platform that uses P-ethoxy, which is a deoxyribonucleic acid (DNA) backbone modification intended to protect the DNA from destruction. Its lead drug candidate is prexigebersen, which is in Phase II clinical trials for the treatment of acute myeloid leukemia (AML) and myelodysplastic syndrome. It is also developing Liposomal Bcl-2 (BP1002) for the treatment of refractory/relapsed lymphoma and chronic lymphocytic leukemia; Liposomal STAT3 (BP1003) for the treatment of pancreatic cancer, non-small cell lung cancer, and AML; and BP1001-A for the treatment of solid tumors. Bio-Path Holdings, Inc. was founded in 2007 and is based in Bellaire, Texas.

BPTHBio-Path Holdings Inc (NASDAQ:BPTH) I've covered this low floater in the past, and it appears the stock is getting attention again. I've always felt this stock has potential to rally. From a technical standpoint, it needs to break through $6.20 to really get going. A break of that figure brings $7.80 into focus. Keep a close eye on this one the next few days.

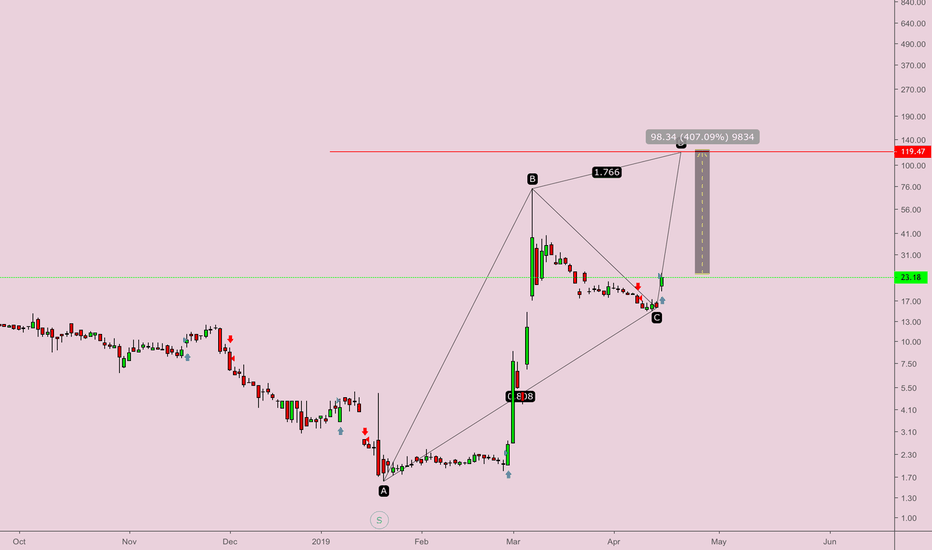

BPTH Case StudyI remember seeing this move live in real-time when it happened. It was amazing!

Thought of doing a study case of this pattern.

The chart is self-explanatory.

First, you wait for the first part of the pattern to happen ----> Huge gains + Huge Volume

Second, you watch it does the first pullback, and keep an eye on the HIGH.

Third, when the stock is making a new high, you enter with momentum, risking to the previous low.

The previous low is almost 50% away but it is fine, it is safer this way, being conservative protects you in the long run, putting 1 unit of risk on this trade.

Either to take profit on the way up somewhere when the profit seems substantial, or according to the gap theory, or take profit when touching the EMA, or when you see the move is drying up.

You can see that the move is drying up when there is no substantial volume on the rallies + the rallies don't follow through.

Note to self: I noticed that when there is a downtrend on drying volume, odds that the downtrend will continue ---->>> POTENTIAL SHORT SETUP

*** Could possibly look at options if they are profitable or not for this trade.

$BPTH skyrockets on Received Third U.S. Patent GrantBio-Path Receives Third U.S. Patent Grant Related to Manufacture of Platform Technology

Provides Expanded Protection to Seminal Patents Related to DNAbilize

The new patent builds on earlier patents granted that protect the platform technology for DNAbilize®, the Company’s novel RNAi nanoparticle drugs.

finance.yahoo.com

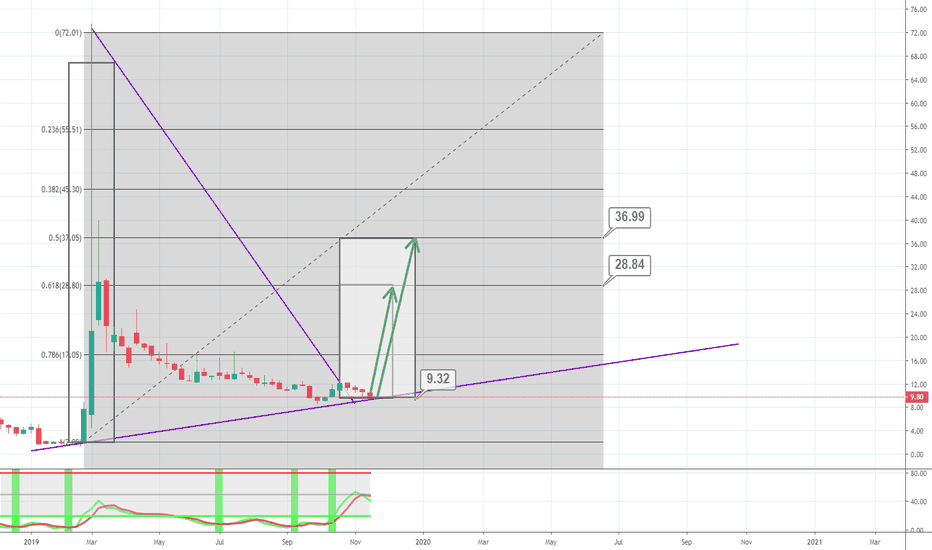

BPTH - Good News in Dec = Enormous ProfitsBPTH, the ticker to the company Bio Path Holdings is currently trending down. This ticker has been a poor performer for the entire year with small time periods where day traders may make an easy 20-60 percent. Bio Path may seem like a decent day trading target where it follows the downward trending line and tends to bounce up a few days after coming into contact with it. If this continues, one can easily make short term gains and find value in this, but it will make much more sense to wait.

Bio Path will be releasing news on its number one drug, Prexigebersen for Acute Myeloid Leukemia (AML). This drug with good data has the potential of making Bio Path a multi billion dollar company. As you can see last year, Bio Path jumped from a startling ~$1 per share to ~$70 per share with one good news release. It is not easy to find these opportunities very often, that's why timing is the key.

Bio Medical companies tend to slowly decrease in value or, "bleed" waiting for positive news from the company. This is due to the companies being unprofitable and often seek financing deals creating stock dilution. The good news is what makes the stock relatively value because of the opportunity for day traders to capitalize on large percentage gains with a simple news release, but at the same time, you could also lose a large amount if it were negative.

Bio Path will release news on Prexigebersen this December and if you don't know enough about it, I recommend you do a little research on your own.

Any investment in this company is indeed speculation. Investing with small positions is the proper strategy with bio-med.

Cheers,

AC

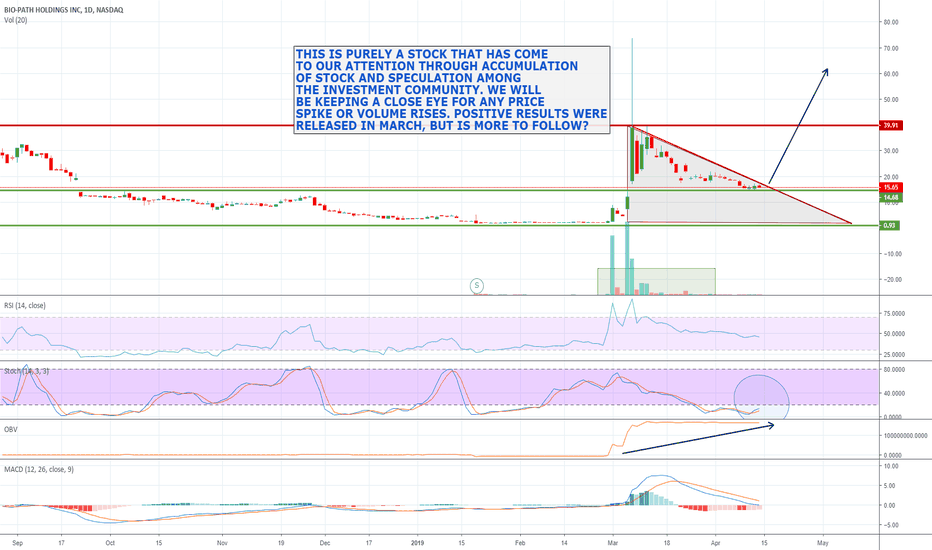

BIO PATH HOLDINGS, HOT STOCK FOR TUESDAY, UP15% PREMARKET ANALYSTS UPGRADE WITH $28 TAGRGET

H.C. Wainwright analyst Yi Chen started Bio-Path Holdings with a Buy rating and $28 price target. The company possesses an "intriguing" technology platform, DNAbilize, consisting of a novel and proprietary way to achieve sustainable systemic delivery of antisense oligonucleotides, Chen tells investors in a research note. Further, the analyst believes prexigebersen could have broad applicability within hematological malignancies as well as solid tumors. Source The fly

COMPANY PROFILE

Bio-Path Holdings, Inc. is a biotechnology company, which engages in the development of therapies for acute myeloid leukemia (AML) and chronic myeloid leukemia (CML). Its product pipeline include Prexigebersen, BP1002, and BP1003. The company was founded by Peter Nielsen, Douglas P. Morris, Gabriel Lopez-Berestein and Ana Tari Ashizawa on May 10, 2007 and is headquartered in Bellaire, TX.

$BPTH ***Possible breakout in BIo-Path holdings***** Keep watch Stock picking has no certainties and often the greatest signals are from whispers among the investment community. Bi-Path Holdings has had quite a lot of good news recently that has brought it to the attention of many investors. Despite this we think that the price is gearing up for a significant move upwards, so we have alerts set on price and RSI spikes. This is definitely one to keep your eye on longer term also, but is off-course speculative like any drug manufacturer.

$BPTH Posts Positive Phase 2 Trials for Leukemia DrugBio-Path released updated Phase 2 data for its lead candidate prexigebersen, codenamed BP1001, for treating acute myeloid leukemia, or AML, and also divulged a plan of action for taking the compound through clinical development toward registration.

Updated data from the Stage 1 of the Phase 2 study that evaluated the efficacy and safety of prexigebersen in conjunction with the low-dose chemotherapy regimen cytarabine in 17 newly diagnosed AML patients revealed that the proportion of patients showing a response increased from 47 percent when assessed in April 2018 to 65 percent.

Of the patients showing a response, 5, or 29 percent, showed a complete response compared to the benchmarked percentage of 7-13 percent.

AML: A Cancer Of Blood Cells:

AML is a form of blood cancer that develops in the bone marrow, where blood cells originate. It afflicts a group of white blood cells called myeloid cells that develop into mature blood cells such as red blood cells, white blood cells and platelets.

A patient with AML will see rapid accumulation of immature myeloid cells in the blood, resulting in a drop of other blood cell types.

BP1001's Mode Of Action:

Prexigebersen is a neutral-charge, liposome-incorporated antisense drug designed to inhibit protein synthesis of growth factor receptor bound protein 2, or Grb2.

Grb2 has a role to play in cancer cell activation via the RAS pathway.

Inhibition of Grb2 is found to halt cell proliferation and enhance cell killing by chemotherapeutic agents without added toxicity.

A Lucrative Market:

AML accounts for roughly 36 percent of all leukemias, with about 20,000 new cases diagnosed each year, Bio-Path said, citing National Cancer Institute estimates.

A critically unmet need exists for non-toxic therapies for older, fragile AML patients who are unfit or ineligible for high-dose chemotherapy or a stem cell transplant.

What's Next:

Bio-Path said it believes it now has a plan with definable paths to registration.

It plans to amend the Stage 2 prexigebersen + decitabine Phase 2 AML cohort in untreated new patients to add untreated high-risk myelodysplastic syndrome, or MDS, patients.

The company also intends to cancel the Stage 2 prexigebersen + LDAC Phase 2 AML cohort in untreated de novo patients.

It also plans to test a triple combo of prexigebersen + decitabine + venetoclax for untreated AML and high-risk MDS patients in a registration-directed trial to determine if more durable responses and longer survival are observed compared to patients treated with the decitabine + venetoclax combination.

The next major catalyst for Bio-Path will be the fourth-quarter results expected sometime in the next month.