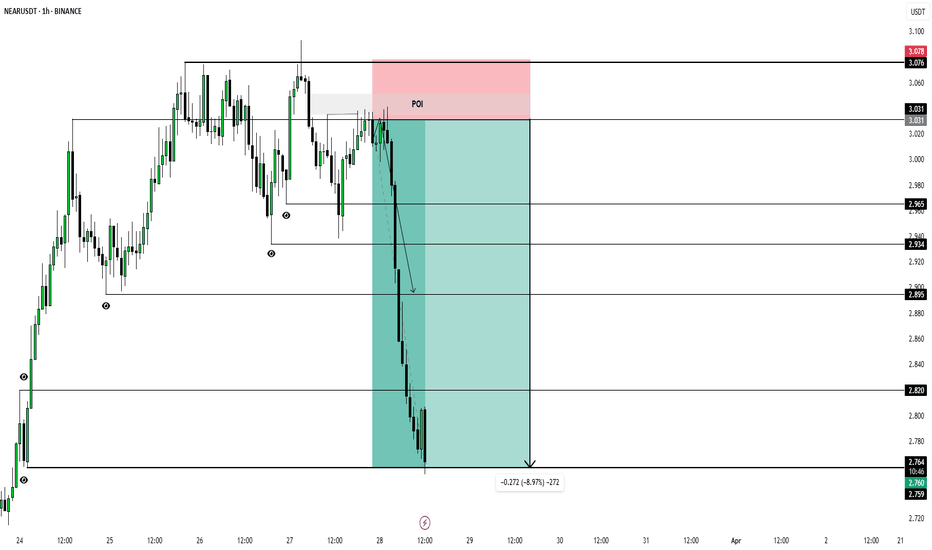

NEAR/USDT is Nearing The Daily TrendHey Traders, in today's trading session we are monitoring NEAR/USDT for a selling opportunity around 2.55 zone, NEAR/USDT is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 2.55 support and resistance area.

Trade safe, Joe.

NEARUSDT trade ideas

NEAR Protocol Hits Bottom —Cash Or Crypto?This is a short-term chart but here the candles dynamics that I showed you recently with the long-term linear charts is also present. While the bearish move has momentum, the candles are big. When this momentum is lost, wanes, the candles become really small.

The candles becoming small can reveal a transition phase. From bearish to bullish, a sideways period. The bottom is in and NEAR Protocol is set to grow next long-term. A bull market.

After the low in March, we have a lower low and bottom.

The lower low can be known as a bottom because bullish volume starts to rise. There is also a recovery right after this low is hit. This is a small recovery but the volume and marketwide action tells us the bottom is in.

We are not looking for a new All-Time High, just focusing on the fact that the bottom is in, once the bottom is in we can expect growth long-term. So this is a friendly reminder to let you know that NEARUSDT is now showing great entry timing and prices.

In a few days, or weeks, it will move up strong and trade 200-300% above the current level, to never move back below. If you are reading this now, you have the chance to get NEARUSDT before some 10-30X total growth.

There isn't much complexity in trading when you choose to buy when prices are low. This is a true buy and hold scenario, this time it will be many times better compared to late 2024. It will be the ride of a lifetime.

Thanks a lot for your amazing support.

By the time this bull market is over, Cryptocurrency will be established as the default medium of exchange all around the world.

"Here is your Pizza, would you like to pay cash or crypto?

Crypto! Of course!"

Namaste.

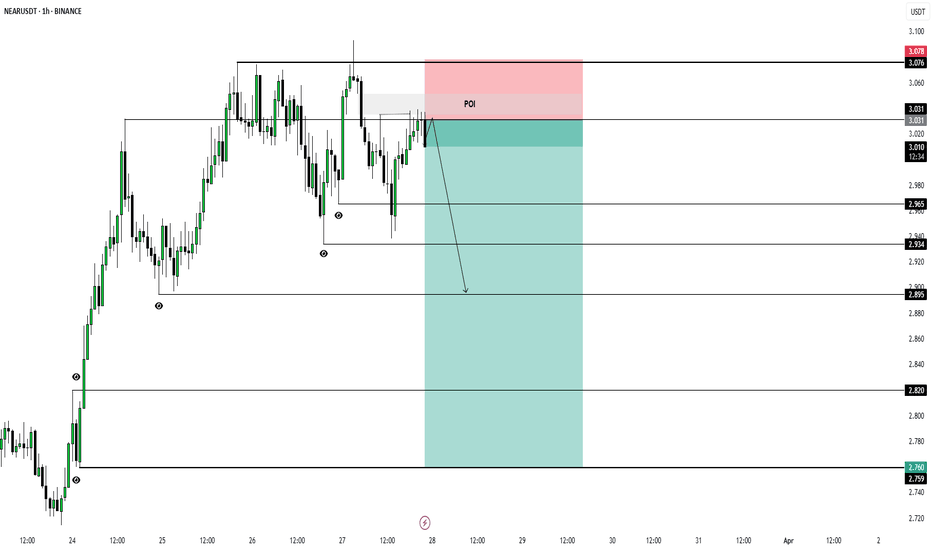

Short NEAR/USDT🔥 #NEAR/USDT

🔴 SHORT

🎲 Entry Zone 1: 2.076

🎲 Entry Zone 2: 2.097

✅ Take Profit 1: 2.038

✅ Take Profit 2: 1.987

✅ Take Profit 3: 1.921

✅ Take Profit 4: 1.850

✅ Take Profit 5: 1.737

(Extended if Momentum Persists)

❌ Stop Loss: Above 2.190

💱 Recommended Margin: 2.5% – 5%

🧳 Recommended Leverage: 5X – 15X

🧠 Narrative: NEAR is testing a supply zone at 2.076 – 2.097. A rejection here could spark downside toward the listed TP levels as sellers regain control.

📈 Market Context: Keep an eye on overall crypto sentiment and BTC’s trend; a broad market rally could negate this short bias, while renewed weakness may accelerate the move.

⚠️ Risk Management: Place stops above 2.190, size positions carefully, and stay alert for unexpected strength.

⚠️ Take Care of Risk Management for Your Account

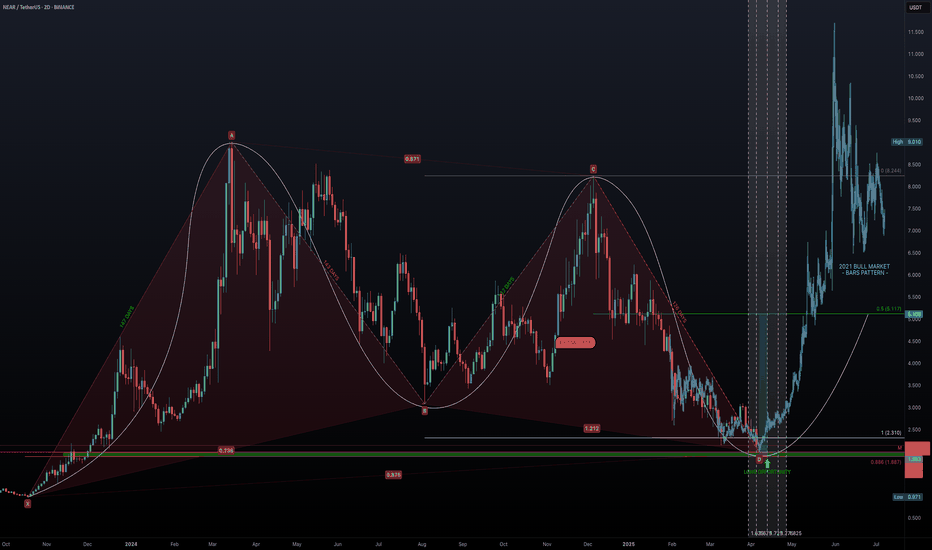

NEAR the Bottom? - The Crash Ends HereBack in October 2023, NEAR embarked on an incredible bull run lasting 147 days, surging from a low of $0.971 to a high of $9.01—an astounding +828% gain. Following this euphoric phase, the market sentiment shifted dramatically. Over the subsequent 392 days, NEAR retraced to around $2, marking a -78% decline. Now, with the market at a critical juncture, the question remains: when does the madness of the crash end, and can we finally see a reversal?

Harmonic Patterns & Fibonacci Confluence

Chart Pattern Analysis: The XABCD Framework

Using the XABCD pattern tool, we identify the following key points:

Point X: $0.971

Point A: $9.01

Point B: $3.076

Point C: $8.244

Point D: $1.978

Durations:

X-A: 147 Days

A-B: 143 Days

B-C: 122 Days

C-D: 126 Days

These durations show remarkable symmetry—with the up-move phases (X-A and A-B) nearly matching in time, and similarly for the correction phases (B-C and C-D). This time symmetry supports the presence of a harmonic structure, and the retracement levels help validate the potential for a reversal.

Fibonacci Implications

Fib Retracement of XA: Point B is at 0.738

Fib Retracement of AB: Point C sits at 0.871

Fib Retracement of BC: Point D lands at 0.875

Fib Extension of BC: Point D is at 1.212

While Point D’s retracement at 0.875 is slightly deeper than the classic 0.786 level expected for a Gartley Harmonic, it remains close enough to validate a harmonic correction, especially considering market noise. Additionally, the expansion of BC at 1.212 is close to the 1.27 range, lending further credence to this being a Gartley-type pattern.

Time Factor: Fibonacci Time Extensions & Exhaustion

147-day Bull Run: NEAR rose from $0.971 to $9.01 in 147 days.

392-day Bearish Correction: Since hitting $9.01, the price has retraced for 392 days.

Fibonacci Time Extensions:

1.618 multiplier: 147 × 1.618 ≈ 238 days. A Classic "golden ratio" reversal target. This period coincided with a +135% surge in November.

2.618 multiplier: 147 × 2.618 ≈ 385 days. High-probability exhaustion point. This is nearly equal to the current 392 days, suggesting that time-based exhaustion may be imminent.

The alignment of these time-based measures with the price retracement (approximately 87.5% retracement of the original move) signals a critical juncture where the bearish phase could soon be over.

Identifying the Support Zone & Long Opportunity

Based on harmonic and Fibonacci analyses, the confluence of key support levels points to a potential bottom:

Harmonic Point D: Trading near $2.

Monthly Level: $1.99 acts as a strong support benchmark.

Fibonacci Retracement (0.886): at $1.887.

These levels create a long opportunity window between $1.99 and $1.887. This confluence offers a solid entry region for long positions.

Additionally, other confluence factors include:

Fibonacci time extension at the 2.618 level (around 385 days) aligning with the current duration of the bearish phase.

The symmetry of the XABCD pattern adds to the reliability of the support structure.

High-Probability Trade Setup

Long Entry:

Entry Zone: Accumulate positions in the $1.99 to $1.887 range.

Target: Aim for the 0.5 Fibonacci retracement level of the bull run, approximately $5.00, which represents a potential +150% gain from current levels.

Risk-to-Reward (R:R): With the setup targeting a substantial rebound, the risk-reward ratio is very attractive, particularly if entry is taken in the defined confluence zone.

Market Outlook:

Current Sentiment: NEAR is in a significant downtrend, evidenced by a dramatic -78% retracement after an explosive bull run.

Reversal Indicators: The harmonic pattern, Fibonacci retracements, and time exhaustion (392 days approaching the 2.618 extension) all point towards a possible bottom formation in the coming month, particularly during April.

Potential Reversal: If NEAR holds within the $1.99 to $1.887 window, a reversal back towards $5.00 appears plausible, echoing the conditions seen at previous market cycle reversals.

Key Takeaways

Historic Run & Severe Correction: NEAR surged over +828% in 147 days only to retrace -78% over the following 392 days.

Harmonic Confluence: The XABCD pattern and Fibonacci levels create a compelling argument for a turnaround.

Time & Price Alignment: Fibonacci time extension around 385 days combined with an 87.5% price retracement suggests market exhaustion.

Solid Long Entry Zone: The support between $1.99 and $1.887 offers an attractive risk entry point with the potential to target a move back up to $5.00.

After decades in the trading arena, one thing is clear—the market often cycles through periods of euphoria and despair before turning a corner. NEAR's confluence of harmonic symmetry, Fibonacci retracement, and time-based exhaustion is almost too aligned to ignore. With a defined long entry window between $1.99 and $1.887, this might be the moment to consider a high-probability long trade. As always, manage your risk diligently and wait for clear confirmation.

Wrapping it up here, happy trading =)

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

NEAR is unreasonably one of the lowest stillHowever I can see it is trying to grind higher and their community have bee jumping in with buys. The 1H mean is supportive of perhaps a change in its low position and depressed percentage losses over the last 24 hours comparatively to other no brand coins. Fundamentals aside, I think it may retest down a little perhaps or rise from the point it is at by up to 4% to regain some of the ground it lost before everything came down. Enjoy!

Extra context: For those who don't know my strategy, if this comes down, get me my limit order longs fill and tries to keep going further down, I will simply add to average my entry until it retraces and usually I can get out at break even, a small gain, or if it is taking too much of my time - a (palatable) small loss.

I'm Bullish, but... NEAR / USDTHello again my brothers and sisters,

3 Drive Structure, do I need to say anything else?

I mean, look at this symmetrical triangle, when this blows, in the past, did it only touch base twice? I dont think so, 3 drive structure is needed for this and then we can be extremely bullish!

I'll be loading my boat down there.

If this helped you out, let me know!

Trade thirsty!

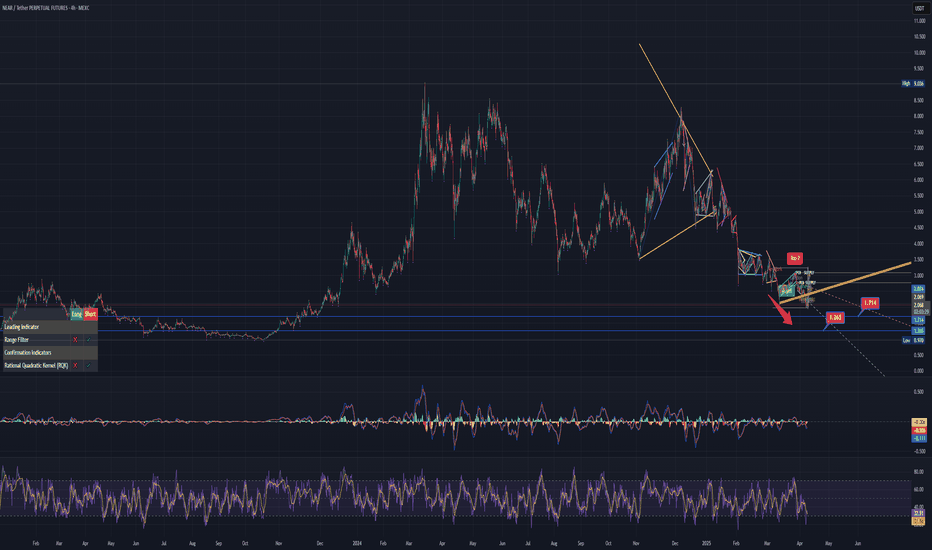

NEAR Breakdown Confirmed! More Blood Before the Reversal?Yello, Paradisers! Is #NEAR about to drop even lower, or is a major reversal brewing? Let’s break it down!

💎#NEARUSDT recently suffered a descending triangle breakdown, sending prices tumbling lower. Adding to the bearish pressure, we’ve also got a death cross formation, reinforcing the weakness in price action. Right now, before NEAR can find any long-term bottom, the probability of further downside remains high.

💎The bulls are currently struggling. Multiple resistance levels are blocking any attempts to gain momentum, with all EMAs currently sloping downward—not a good sign for any immediate recovery.

💎NEAR is expected to slowly bleed into the long lower wick of February 3rd. Strong support exists between $2.65 and $2.40, a key demand zone that could trigger a bullish reversal. But if sellers continue to dominate, they could overpower this level and drive prices down further toward $2.05 - $1.95. This is a major higher time frame support zone, where a long-term reversal could finally take shape.

💎For the bulls to negate this growing pressure, they must break above $4.50—a critical level reinforced by both horizontal and descending resistance. If the price secures a bullish breakout above this, NEAR could be in a prime position to rally over the next few months.

Paradisers, as always, patience and precision are key in this market. This isn’t a time for reckless trades—let the levels guide you, trade strategically, and stay disciplined.

MyCryptoParadise

iFeel the success🌴

WILL NEAR PROTOCOL MAKE IT ???According to current price action, Gartley Harmonic Pattern is formed on Near. Currently price is on it's PRZ. Also Near has reclaimed range low after sweep. If Near successfully breaks it's previous high, then we may see Near exploding upto Mid range & Range High targets easily.

#NEAR/USDT#NEAR

The price is moving in an ascending channel on the 1-hour frame and is expected to continue higher.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.65.

Entry price: 2.65

First target: 2.80

Second target: 2.95

Third target: 3.10

About AI's theme coin (token)...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

It seems that AI themes are currently classified into 5.

I will explain the coin (token) with the highest market capitalization in each theme.

-------------------------------------

(NEARUSDT 1D chart)

NEAR is classified as an AI & Big Data theme.

In order to turn into an uptrend, the price must be maintained above 3.756 and rise above the M-Signal indicator on the 1M chart.

Since OBV has broken through the upper line of the Price channel, the point to watch is whether it can continue to rise.

-

(FETUSDT.P 1D chart)

FET is classified as an AI Agents theme.

The key is whether it can maintain the price by rising above 0.848.

Since OBV is passing through the middle line of the Price channel, we should see whether it can be supported and rise near the M-Signal indicator on the 1D chart.

-

(VIRTUALUSDT.P 1D chart)

VIRTUAL is the No. 1 market cap ranking of the AI Agent Launchpad theme.

The key is whether it can maintain the price near the M-Signal indicator on the 1D chart and rise to around 1.1602.

-

(FARTCOINUSDT.P 1D chart)

FARTCOIN is classified as AI Memes theme.

The key is whether the price can be maintained around the Fibonacci ratio 0.236 (0.6228) and rise to around 1.4148.

If it fails to rise, it should check for support around 0.3822.

-

(TAOUSDT 1D chart)

TAO is classified as Generative AI theme.

The key is whether it can be maintained by receiving support around 271.1 and rising above 312.5.

In the meantime, it should be checked whether it can rise above the M-Signal indicator on the 1W chart.

If the M-Signal indicator of the 1W chart rises above and the price is maintained, it is expected to turn into an upward trend.

-------------------------------------------

Most coins (tokens) are showing the same flow as the coins (tokens) above.

This shows that the current section is an important turning point.

I think that in order to survive this important turning point and turn into an upward trend, an increase in trading volume must accompany it.

Therefore, I think it would be a good idea to check the current trading volume status by checking the flow of OBV of each coin (token).

There are three ways to interpret the OBV indicator.

1. If OBV is rising from the 0 point, it is an increase in buying power, and if it is falling, it is an increase in selling power.

2. If OBV is located above the EMA line of OBV, it is highly likely that buying power will increase, and if not, it is highly likely that selling power will increase.

3. Applying the formula of the Price channel to OBV, if each Price channel line breaks upward, there is a high possibility that the buying force will increase, and if it breaks downward, there is a high possibility that the selling force will increase.

In addition to the interpretation of 1, 2 and 3 can be interpreted as the possibility that the price will rise when the buying force increases, and the possibility that the price will fall when the selling force increases.

In 1, the price area around the 0 point is considered the selling area (volume profile) and is likely to play the role of support and resistance points.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Near Protocol price analysisFor many deposits, the correction of the #NEAR price was quite painful.

But if you look at the global chart of OKX:NEARUSDT , it's not so critical.

We want to believe that someday #NEAR will cost $20 again, and there are theoretical and technical possibilities for this....

But before that, buyers need to be able to fix the price of #NearUSD above $3.5, and then above $4.5 at the exit from the "bearish flag".

Only there is a safe medium-term purchase point for the #NearProtocol token in the current realities.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more