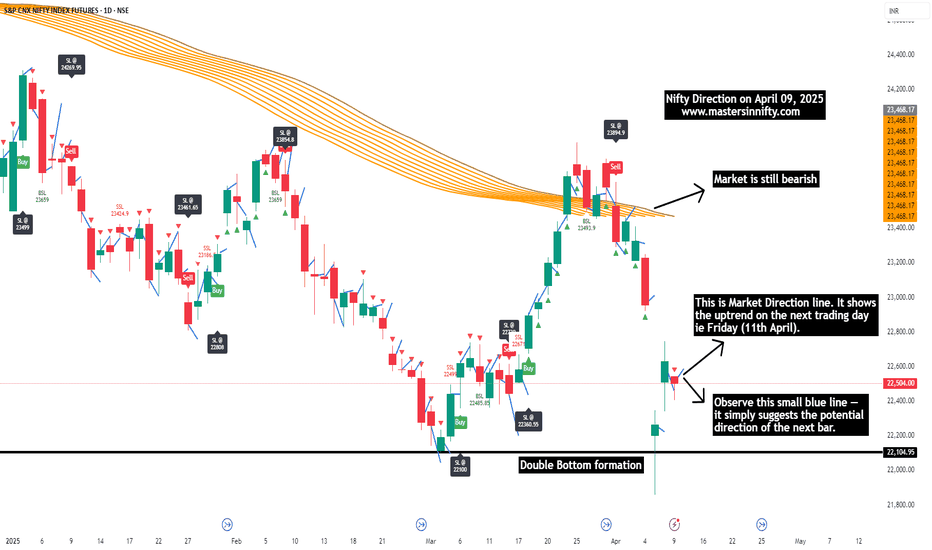

Nifty Daily view on Friday (April 11, 2025)According to my analysis, the Nifty is still bearish on a daily basis. However, I foresee an opportunity in the bullish signals on April 11, 2025. Since I am considering the gaps on the either direction, traders should follow technical analysis before entering into trades.

NIFTYK2025 trade ideas

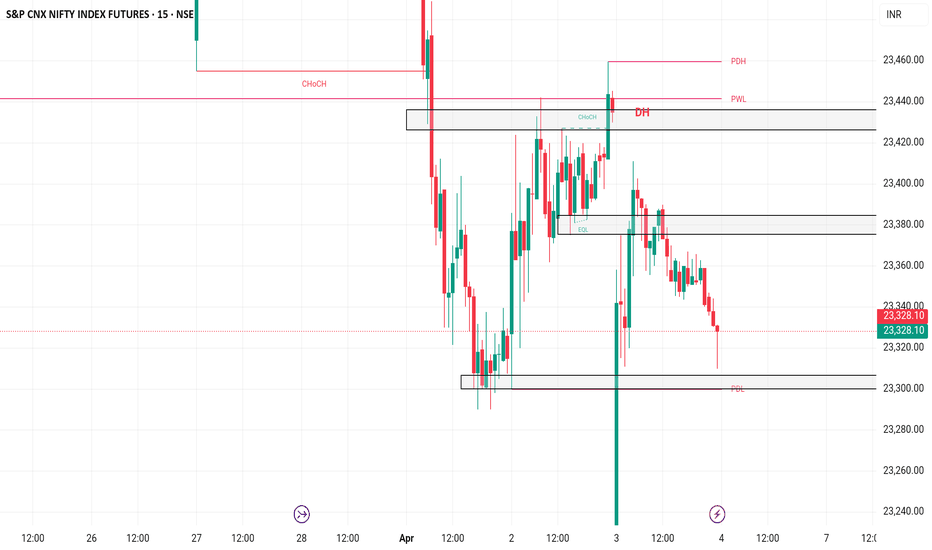

NIFTY Futures | Liquidity Sweep + Bullish Structure Shift NIFTY Futures (15min) – Technical Analysis using SMC | ICT | Price Action

1. Price took liquidity below 22,405, sweeping sell-side stops — a common smart money move

before reversing.

2. A clear market structure shift occurred as price broke previous swing highs after the liquidity

grab.

3. Price is currently reacting from a bullish order block between 22,440 – 22,480, showing signs

of accumulation.

4. The entry aligns with ICT’s Optimal Trade Entry (OTE) zone near the 61.8% Fibonacci

retracement level.

5. Price was consolidating in a tight range (5min) and has now started breaking out to the

upside.

6. There is a visible imbalance / fair value gaps between 22,760 – 22,920 that price may look to

fill.

7. Immediate targets are:

- 22,760 (start of imbalance)

- 22,920 (buy-side liquidity above recent highs)

- 23,250 (clean inefficiency zone)

- 23,310 (major resistance / previous high)

8. The setup becomes invalid if price breaks and closes below 22,405 — that’s the stop-loss level.

Thanks for your time..

Gift Nifty Support & ResistanceCurrent Context:

The last price shown on the chart is approximately 22,491.0.

The 50-period Exponential Moving Average (EMA 50) is at 23,142.2.

The Bollinger Bands (20, 2) show:

Upper Band: 23,999.4

Middle Band (SMA 20): 23,084.9

Lower Band: 22,170.4

Projected Resistance Levels:

Resistance 1: Located between approximately 23,767.5 and 24,000.0. This zone represents the first significant hurdle for an upward price movement. The Upper Bollinger Band (23,999.4) is also near the top of this range.

Resistance 2: Situated between approximately 24,783.0 and 25,000.0. This is the next major area where selling pressure might increase if the price breaks through Resistance 1.

Resistance 3: The highest resistance zone marked is between approximately 26,326.0 and 26,440.5. This level corresponds to the previous major highs seen on the chart around October/November 2024.

Projected Support Levels:

Sub Support 4: Around 22,504.0. This is the immediate minor support level just above the current price.

Sub Support 3: Around 22,745.0.

Sub Support 2: While not explicitly marked with a value line, it appears visually just below the 23,034.0 level.

Sub Support 1: Located between approximately 23,034.0 and 23,250.0. The Middle Bollinger Band (23,084.9) and the EMA 50 (23,142.2) fall within or very close to this range, potentially strengthening it as a support/resistance pivot area.

Support 1: A significant support zone marked between approximately 22,144.5 and 22,320.5. The Lower Bollinger Band (22,170.4) is near the bottom of this range.

Support 2: Marked near 21,947.0 (partially labelled "Support" on the chart). This represents a lower major support level.

In summary, the price is currently near Sub Support 4. Key areas to watch are the cluster of Sub Supports 1-3 and the moving averages above the current price, and the major Support 1 zone below. On the upside, Resistance 1 around 23,767.5-24,000 presents the first major challenge.

TIME TO BUY NIFTY AGAIN!! NIFTY SEEMS POSITIVEHello All!!

I am back with totally different opinion on Nifty Futures, I had checked with Media and some published articles, most of all are Bearish On Nifty for coming day!!

But I don't think so.......

Today on 04-04-2025, Nifty is negative by more than -1.5%.

I think it is very right time to buy Nifty!!

Nifty futures CMP:22950.00

Nifty has beached its valuable support at 23,270.00

Now, Nifty's next big support is at 22,930.00

RSI is just above it's 40 Mark level!!

If RSI manages to hold that 40 Mark level, Nifty is going to switch it's direction and start moving upwards.

Simple terms: Risk to Reward ratio is most favorable at current market price.

So, if Nifty holds 22,930.00 level and RSI holds it's 40 Mark level, Bulls are back in market.

Target: 24,000.00 with in this month.

Stoploss: Mange as per your risk tolerance capacity.

Let's hope for the best!!

Be cautious, Market is teaching us something which is not so often!!

Note: This is just my attempt to Analyze Nifty chart, I don't recommend any one to trade or invest based on this study. This is just of educational purpose.

Nifty Futures intraday trend analysis on April 7th & 8thAccording to my Trend Analysis, on 7th Nifty Futures is likely to bounce back and the raise will not sustain on April 8th. The levels provided in the chart are calculated without taking Gaps into account. In the first 15mts on 7th April, there is a bullish candle formation. Trade with Stop-Loss.

Nifty Futures Daily view for April 2025Our Precision Scalper accurately identified the sell entry for Nifty Futures two days in advance, providing traders with a strategic edge. With minimal risk per trade, this powerful tool effectively captures trends and sustains them until completion. To maximize risk management, ensure a stop-loss is set for every entry.

Nifty Futures Daily Trend AnalysisNifty Futures has been in an uptrend since closing above the SSL level at 23,018. The MastersCycleSignal indicator is currently acting as resistance at 23,460. A breakout above this level could open the path toward the next resistance at 23,801.

The Future Candle Reversal Projection indicator highlights potential upcoming intraday opportunities that contrast with the intraday trend of the day prior to the reversal. This is my personal view and shared for educational purposes only. Please conduct your own technical analysis and always trade with a stop-loss.

Nifty Futures Daily analysis for April 2025I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull back before the fall.