Nifty Futures Daily Trend analysis for April 17, 2025As mentioned in my post yesterday (April 15, 2025), we have been eyeing the Nifty Futures resistance level at 23,460. Today, the price is approaching this level. Our Masters Cycle has confirmed a buy signal today, with a stop-loss set at 21,859.

Now, how should we approach intraday trading for tomo

Nifty Futures intraday analysis for April 17, 2025As explained yesterday, I foresee a bearish trend and the support1 zone at 23358 and Support 2 is at 23313. A breakout below 23313 will bring the Nifty Futures down to 23237. Our Market Timing indicator is in line to our analysis.

This is just my view for the day. Traders must use their own technica

NIFTY Futures | Liquidity Sweep + Bullish Structure Shift NIFTY Futures (15min) – Technical Analysis using SMC | ICT | Price Action

1. Price took liquidity below 22,405, sweeping sell-side stops — a common smart money move

before reversing.

2. A clear market structure shift occurred as price broke previous swing highs after the liquidity

grab.

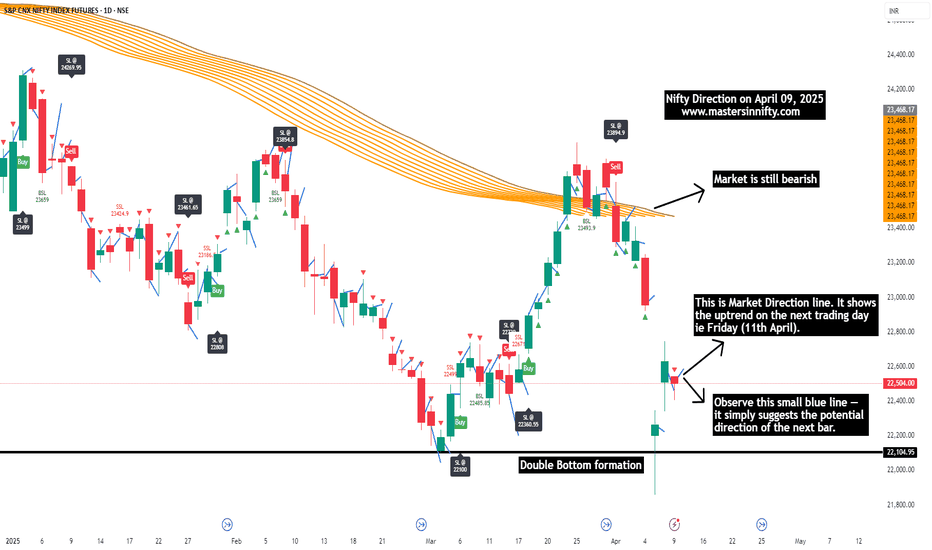

Nifty Daily view on Friday (April 11, 2025)According to my analysis, the Nifty is still bearish on a daily basis. However, I foresee an opportunity in the bullish signals on April 11, 2025. Since I am considering the gaps on the either direction, traders should follow technical analysis before entering into trades.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Related futures

Frequently Asked Questions

The current price of S&P CNX NIFTY INDEX FUTURES is 24,182.10 INR — it has risen 1.17% in the past 24 hours. Watch S&P CNX NIFTY INDEX FUTURES price in more detail on the chart.

The volume of S&P CNX NIFTY INDEX FUTURES is 4.88 M. Track more important stats on the S&P CNX NIFTY INDEX FUTURES chart.

The nearest expiration date for S&P CNX NIFTY INDEX FUTURES is Apr 24, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell S&P CNX NIFTY INDEX FUTURES before Apr 24, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For S&P CNX NIFTY INDEX FUTURES this number is 11.87 M. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for S&P CNX NIFTY INDEX FUTURES shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for S&P CNX NIFTY INDEX FUTURES. Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of S&P CNX NIFTY INDEX FUTURES technicals for a more comprehensive analysis.