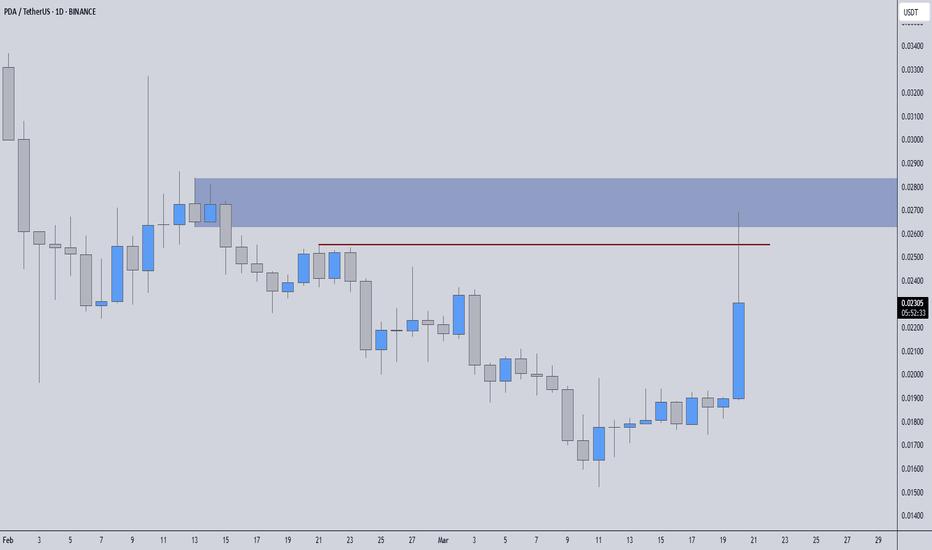

Growth to 150-250% by pda in the coming week.As I wrote earlier, April is the most powerful seasonal growth period in the first half of the year. The first half of the month was under selling pressure against the background of the continuation of the trend of the previous month and quarter, but as we approach the middle of the month, the activity of buyers is likely to begin to increase and from the second half of this week we can expect breakouts in coins with a subsequent trend. To date, coins with the monitoring tag that are not included in the delisting announcement have a high probability of growth, because They are the most oversold due to concerns related to the announcement, but now they have time to wait for the next announcement. Wing was the first to react, and it retains the probability of a new wave of up to 50%+ this month. But today I want to focus on the pda, where the main goal is to retest the range of 0.021-25 at least and attempt a test of 0.035-50 with sufficient volatility. Even with growth towards the immediate goal, the profit will be up to 150%+. VIB and alpaca have similar potential.

More interesting assets for speculators are only the coins from the delisting announcement, because due to the minimal capitalization, even a small influx of buyers gives a large percentage of growth. In this regard, before the actual delisting, there is a possibility of powerful exit pumps this week, as it already was on vidt. In particular, according to uft, the momentum may reach several x's by the end of the week. Cream and troy have less potential, but they can also show profitable growth impulses in the event of increased customer activity in the market. I would like to note that uft and troy have very high non-closed targets on the retest of 0.21-25 and 0.0031-35, which may lead to growth after delisting from binance at the expense of other exchanges.

PDAUSDT trade ideas

PDA ( SPOT)BINANCE:PDAUSDT

PDA / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

PDAUSDT – Liquidity Grab & Rejection! Watching for Shorts🚨 PDAUSDT – Liquidity Grab & Rejection! Watching for Shorts 🚨

“Classic move—liquidity swept, rejection confirmed. Now, we hunt for the breakdown!”

🔥 Key Insights:

✅ Liquidity Cleared – No more excuses for price to push higher.

✅ Resistance Holding Strong – Sellers stepping in, rejection in play.

✅ LTF Breakdown = Entry Signal – We wait for structure, not emotions.

💡 The Game Plan:

Monitor 1H Downward Breakouts – Confirmed weakness = sniper short entries.

CDV & Volume Profile Must Align – Smart money must support the move.

Retest of Broken Support = Ideal Short – Precision matters, no chasing.

“Patience wins. If the structure confirms, we pull the trigger—clean & calculated!” 🚨🔥📉

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

#PDAUSDT Getting Ready for a Massive Breakout or Not? Key LevelsYello, Paradisers! Can #PlayDapp bulls get enough momentum for a bullish breakout or not? Let's look at the latest analysis of #PDAUSDT and see what's happening:

💎#PDA is trading within a descending channel formation, showing a clear downtrend structure that has persisted for months. While the price is testing key levels, the next move will determine whether the #PlayDapp breaks free from its bearish grip or continues its downward slide.

💎The immediate focus is on the $0.067 resistance zone, which aligns with the channel’s upper boundary. A decisive breakout above this level would signal the start of a trend reversal, opening the door for a move toward the major resistance zone at $0.126. Such a breakout would likely bring renewed bullish sentiment and attract new buyers.

💎However, if #PDAUSDT fails to break above $0.067, the $0.045 support zone will become crucial. This zone has consistently acted as strong support and a bounce from here could allow bulls to regroup for another attempt at breaking resistance. Failure to hold will send it to the $0.037 demand level.

💎If the #PDAUSD closes below $0.037 on the daily chart, it would confirm a bearish breakdown, invalidating any bullish recovery. In this scenario, we could see a continuation of the downtrend toward lower levels, potentially testing $0.025 or below, which would further reinforce bearish sentiment.

#PDA 247% Potential – Time to Watch Closely!#PDAUSDT is showing a textbook descending channel pattern on the daily chart. Currently trading at $0.0438, this setup hints at a potential breakout towards the $0.1077 level, offering a massive 247.59% gain. As the price consolidates near the channel's lower boundary, traders might want to keep an eye on this possible breakout for a significant upside move!

PDA/USDT Looking Ready PDA/USDT Breakout Potential 🚀

PDA/USDT is showing signs of a potential breakout 📈. The price action seems to be approaching a critical resistance level, and a successful breakout above this level, followed by a strong retest, could signal a solid bullish move 💪.

🔍 Key factors to watch:

1. Breakout confirmation: A decisive close above the resistance zone.

2. Retest: Look for price to revisit the breakout level and hold it as new support.

3. Volume spike: Increased volume during the breakout could further confirm momentum.

⚠️ Keep a close eye on this pair for the next move. However, this is not financial advice. Always DYOR (Do Your Own Research) before making any decisions. 📊

#PDA/USDT#PDA

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 0.0400

We have an uptrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 0.0506

First target 0.0700

Second target 0.0864

Third target 0.1050

PDA: Analysis and Update in a Daily TimeframeHello traders,

Today, let's analyze a token named PlayDapp (PDA).

GETTEX:PDA has formed a falling wedge pattern and is likely to break out above the resistance trendline.

The price is at its absolute bottom range, and a bullish rally could be forthcoming.

Once a bullish rally begins, I expect the price to reach Resistance 1 at $0.0725 and Resistance 2 at $0.11, with a long-term target of $0.31.

Accumulating this token between $0.038 and the current market price (CMP) can be considered.

Make sure you do your own research and analysis before investing.

Regards,

Team Dexter.

#PDA @playdapp_io #Crypto

Will #PDAUSDT Surge or Stumble? Crucial Levels to Watch NowYello, Paradisers! Are you ready for the next big move of the #PDA? Let's dive into the critical analysis for #PDAUSDT and explore the potential outcomes:

💎Currently, #PDA is navigating a pivotal demand zone, hinting at a possible bullish surge. The token has been on a descending resistance trend, but recent price action within the $0.052-$0.057 range shows promising momentum.

💎This zone is essential for sustaining any bullish movement. If #PlayDapp can hold its ground, we could see a push towards the significant resistance level at $0.087.

💎But what if GETTEX:PDA can't sustain above the Bullish Order Block at $0.062? In that scenario, we should prepare for a retest of the lower support between $0.052 and $0.057. A successful bounce here could set the stage for a strong bullish reversal, possibly leading to a breakout above this major support area.

💎However, caution is key. If #PDAUSDT loses momentum and drops below the previous low, it would negate the bullish setup and potentially trigger a substantial price decline.

Keep your eyes on the charts, and don't let market noise distract you.

MyCryptoParadise

iFeel the success🌴

PDA ANALYSISIt has a bullish structure and we have a bullish CH and BOS on the chart and the trigger line is broken.

We are looking for Buy/Long on the demand range

The targets are marked on the picture

Closing a daily candle below the invalidation level will violate the analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

PDA/USDT I BUY SETUP✔︎📈 BINANCE:PDAUSDT SIGNAL

✔︎ENTRY : 0.2266

🏓 TARGETS :

✔︎ T1 : 0.2480

✔︎ T2 : 0.2695

✔︎ T3 : 0.2960

✔︎ Long term T4 - T5

✘ STOP : 0.2120

🚦Stop Trigger:

• If you make capital management: Stop is activated when one candle opening and closing

below the stop level of the same time frame of the signal.

• If you don't make capital management: Stop is direct without waiting for the candle to close.

💡Risk management :

• Enter the trade with 10% to 20% of your capital to reduce risk and save cash to enter other opportunities.

• Sell (25% to 50%) on (T1) and don't move your stop-loss.

• Sell 50% on (T2) and move your stop loss to the entry point.

• You are safe now, and the next 25% is up to you.

💡Reason for this trade:

BINANCE:PDAUSDT gives my trading system a sign of strength:

• My trading system is based on liquidity and reversal zones.

• When the liquidity is swept from one side under certain conditions, we will wait for the price on the other side.

The liquidity will attract the price like a magnet.

• the first side that has been swept:

1- range low deviation

2- valu area deviation

3- run all time low level

• Opposite side targets:

1- engineering liquidity

2- fair valu gap

3- range high

💡Entry setup

1- reclaim valu area low after deviation

⚠️WARNING:

• I'm not a financial advisor.

• Do your own research (DYOR).