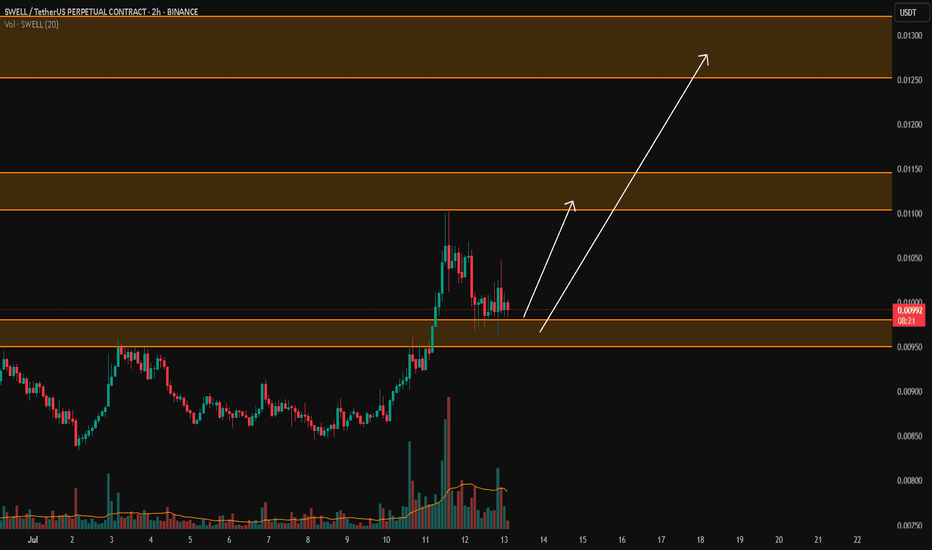

SWELL/USDTKey Level Zone: 0.00950 - 0.00980

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

- Enhanced entry timing for better precision and alignment with key levels

SWELLUSDT trade ideas

SWELLUSDT 1D#SWELL is moving inside a descending channel on the daily timeframe. Currently, it hasn’t been able to break through the channel resistance and the upper part of the Ichimoku cloud. Consider buying some #SWELL near the support level of $0.01150. In case of a breakout above the channel and the Ichimoku cloud, the targets are:

🎯 $0.01699

🎯 $0.01978

🎯 $0.02316

🎯 $0.02815

⚠️ Use a tight stop-loss.

Swell: Your Altcoin ChoiceThis is a good choice. If you are already in and waiting for a recovery, the wait is almost over. If you are out and looking to buy, then timing is great. SWELLUSDT is trading at a new All-Time Low with early reversal signals.

We have a reversal signal coming from the candles as well as a rounded bottom still in the making.

The initial drop, is a full down-move, a down-wave or bearish impulse. The last and second drop is very small. It is more likely a flush, rejection or stop-loss hunt. The second drop from late March indicates that there is no longer a bearish wave. This is the last bearish action before the market produces a change of trend.

"The bottom is in" is not necessarily a sure thing. Always be prepared for some more shaking before prices grow, just as a precaution. What is certain, is that the next major phase is a bullish cycle, anything lower would be short-lived and a manufactured market move. The downtrend is over. After going down, the market tends to grow.

I am mapping some targets for you. These are not necessarily the All-Time High, there can be more growth by the end of the 2025 bullish cycle. These can happen in the mid-term. Within 3 months. When considering the long-term, prices can go off the chart.

This is a good pair.

Thanks a lot for this Altcoin Choice.

Namaste.

SWELL looks bullish (4H)A significant trendline has been broken, and we have an iCH on the chart. Additionally, a key QM L has been reclaimed. With a pullback to the entry zones, we will be looking for buy/long positions.

The targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#SWELLUSDT longsignal📉 LONG BYBIT:SWELLUSDT.P from $0.01928

🛡 Stop Loss: $0.01890

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:SWELLUSDT.P is showing a strong upward movement after breaking out of consolidation. The price has broken key resistance levels and is now forming a retest zone, confirming bullish strength.

➡️ POC (Point of Control) is located at $0.01175, far below the current price, indicating a shift to a new accumulation phase.

➡️ Trading volumes have increased significantly, which could further strengthen the upward impulse.

⚡ Plan:

➡️ Enter LONG at $0.01928 after confirming the breakout level.

➡️ Stop-Loss set at $0.01890 to protect against false breakouts.

➡️ Primary targets – $0.01967, $0.02013, and $0.02065, where partial profit-taking is possible.

🎯 TP Targets:

💎 TP1: $0.01967

🔥 TP2: $0.02013

⚡ TP3: $0.02065

🚀 Expectation: If the current trend holds, BYBIT:SWELLUSDT.P may continue its upward movement towards $0.02065 and beyond.

SWELL/USDTKey Level Zone : 0.03260-0.03300

HMT v3.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

- The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

Wonderful trade on $BYBIT:SWELLUSDT.P Last week, on 24/11/2024, I observed a wonderful price movement on BYBIT:SWELLUSDT.P and decided to analyze it. The trade went as planned.

I identified a bullish trend on the 4H time frame.

I switched to the 1H time frame and spotted an order block and a potential entry.

It took two days for the trade to trigger. After entering, I patiently waited until the trade hit my TP.

$SWELLUSDT is about to explode and make a huge bullish moveA huge bullish pump is about to happen on BYBIT:SWELLUSDT once the pennant formed gets broken. A big pump will kick-off on BYBIT:SWELLUSDT so be on the look out. The second wave of this push is expected to reach $0.06 or slightly above, cause of the resistance zone around there before cooling off for a retracement. This is will give a decent 1:4 RR bullish setup.

Parameters

Entry: 0.04139

TP1: 0.045

TP2: 0.050

TP3: 0.055

TP4: 0.060