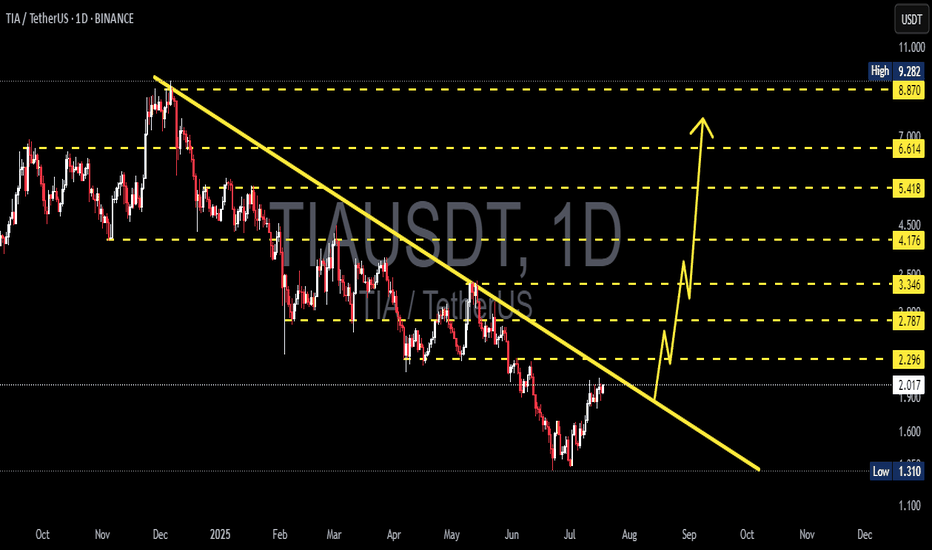

TIA/USDT – Major Breakout Incoming? Reversal in Sight!🔍 Full Technical Analysis (1D Timeframe):

TIA/USDT is approaching a critical turning point after experiencing a strong downtrend since December 2024. The chart clearly forms a Falling Wedge pattern — a classic bullish reversal signal known for explosive breakouts when confirmed.

Currently, the price is testing a key confluence zone around $2.00 – $2.30, where:

A major horizontal resistance meets

A long-term descending trendline (yellow), acting as dynamic resistance since the last local high.

🚀 Bullish Scenario (Confirmed Breakout):

If TIA successfully breaks and closes above the $2.30 – $2.78 range with strong volume, it could trigger a major mid-term rally. The potential upside targets are aligned with previous structural resistance levels:

Target Resistance Level

🎯 Target 1 $3.34

🎯 Target 2 $4.17

🎯 Target 3 $5.41

🎯 Target 4 $6.61

🎯 Target 5 (Extended) $8.87 – $9.28 (Major Weekly Supply Zone)

✅ Additional Bullish Confirmation: A volume breakout + RSI moving into the 50–70 zone would strengthen the bullish case.

🛑 Bearish Scenario (Fake Breakout Risk):

If the price gets rejected again from the descending trendline and fails to close above $2.00, the bearish pressure may push the price back toward key demand zones:

First support zone: $1.60

Last major defense: $1.31 (the current swing low)

This could lead to a double bottom structure before any meaningful trend reversal happens.

📐 Pattern Breakdown:

Pattern: Falling Wedge Breakout Pattern

Duration: Over 7 months of consolidation below trendline

Risk-to-Reward Potential: Highly favorable if breakout is confirmed

🧠 Market Sentiment:

Many altcoins are showing early signs of bottoming out and accumulation.

TIA could become a breakout leader in the next wave if it clears the current resistance cluster.

Expect momentum traders to join in once a solid bullish candle closes above the wedge.

✅ Conclusion:

TIA/USDT is at a technically golden level. A breakout from this falling wedge structure could ignite a multi-stage rally. However, caution is advised: wait for a confirmed breakout and manage risk in case of a failed breakout attempt.

#TIAUSDT #CryptoBreakout #FallingWedge #AltcoinRally #ReversalPattern #BreakoutTrade #CryptoTA #MomentumTrade #Altseason #TechnicalAnalysis #CryptoSignals

TIAUSDT trade ideas

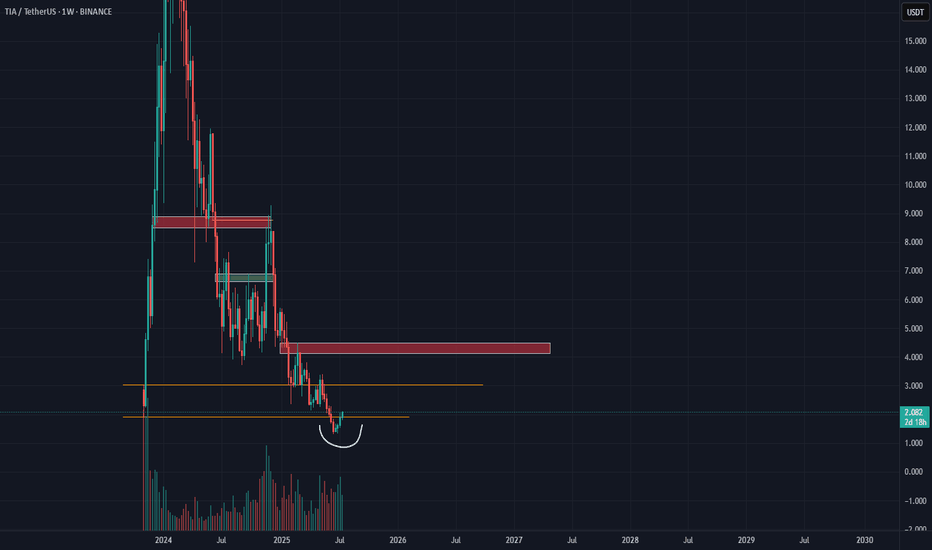

TIAUSDT Monitoring Completion of Bearish 5-Wave FormationTIAUSDT remains in a structured downtrend, nearing completion of a potential 5-wave bearish pattern similar to a previous setup that led to an upside breakout before resuming the decline. A similar scenario is anticipated this time, with plans to go long if price action confirms a strong rejection around Wave 5.

A projected ABC corrective move outlines the near-term bullish targets. The $4.648 level will act as a key pivot; a breakout above it could shift momentum bullishly, opening the path toward $9.144. However, failure at that level may trigger renewed downside toward the $1.30–$1.55 demand zone.

TIA Double Bottomed, $4.5 PossibleBYBIT:TIAUSDT.P bottomed out at the $2.3 level. From there, its initial rally took it to the $3.4 level. If a bottom formation occurs again at its current level, another rally could push it first to the $3.8 level, and if the rally is strong, potentially up to $4.5. Strength into higher levels are critical.

CelesTIA, All-Time Low Last Month, Trend Change—2025 Bull MarketI am showing multiple charts but my prediction is that the market will turn—the entire Cryptocurrency market—the altcoins market will turn bullish.

CelesTIA

There is an uptrend between late 2023 and early 2024, the same with the rest of the market. There was also a bullish wave late 2024. Huhhh, there will be an uptrend in late 2025 and early 2026.

Ok. Celestia. TIAUSDT.

It is easy to distinguish the downtrend vs no more downtrend.

The period drawn orange did produce lower lows but it is very different compared to the "downtrend," red on the chart.

So this is the transition. Strong down, then sideways, then up.

This pair is producing lower lows in its consolidation period but I also showed you many pairs that are producing higher lows, it makes no difference. Lower lows or higher lows, the action is very different compared to the "downtrend." The downtrend is no more.

My thesis concludes with a change of trend. This is where everything is leading, hundreds and hundreds of charts, more than 500 since 7-April. They all say the same.

In short, these hundreds of charts are saying that the market is about to become extremely bullish and that is something that we welcome with open arms. Actually, we have been waiting patiently, and some not so patiently, for this change to occur.

Many trust me; trusted me;

Many doubted me and that is also ok.

I love the truster and the doubter...

I love the reader and the follower...

I love TradingView and the Cryptocurrency market; but I will be proven right in the end.

I accept the fact that it is impossible to get it always right. I accept the fact that many times I am so, so very wrong.

You have to accept the fact that time is running out, Crypto is going up.

Celestia just hit a new all-time low and this is awesome news for me and for you, because, from this bottom low we will grow. You can mark these words... Just watch!

I would like to take just a few seconds of your time to say, thank you. Time is precious, and you took the time to read this long. If you enjoy the content, make sure to follow.

Thanks a lot for your continued support.

There is only one Cryptocurrency market, this is us.

It is you and me, it is all of us. It is not the whales or the exchanges. We are the whales and the exchanges. We are the government, the institutions, the programmers, the designers; the owners, the planners, the coders, the security expert, the writer, the reporter, the auditor; the professor, the mom, the father and the son. You are the market. You are it. You are the whole thing, the whole world.

You might think yourself unimportant as just a tiny ray of light, but there is no life without the sun. You being light, you permeate everything that exist around us. So you are the Cryptocurrency market. You are Bitcoin and you are the altcoins.

Namaste.

TIA/USDT – Potential Reversal After Channel BreakTIA has broken out of a long-standing descending channel on the 4H timeframe, signaling a possible trend reversal. The price is attempting to flip structure, and bullish momentum is building.

Structure:

Clear descending channel breakout

Retest of upper trendline underway

RSI back above 50, showing recovery

Setup:

Entry: On successful retest of the breakout zone near 1.50–1.55

Stop Loss: Below 1.43

Target Levels:

1.67, 1.83, 2.25 until 2.95

This setup looks promising if the price holds above the trendline. Watch closely for volume confirmation and follow-through.

DYOR. Not financial advice

#TIA #Altcoin

TIA Coin: Unlock 118% Profit Potential (1D)From the point where we placed the red arrow on the chart, it appears the TIA correction has begun.

Despite the current bullish market trend, TIA has not yet experienced a pump, and it seems the price hasn't reached its bottom yet. This correction seems to follow a large, time-consuming diamond-shaped diametric pattern, and we are currently in the early or middle stages of wave G.

Recently, the price lost a minor trendline, marked with a red dotted line, indicating that wave G might continue its path.

We have identified a low-risk buy zone on the chart for catching the next bullish wave in TIA. We are targeting buy/long positions in this zone.

Price targets are clearly indicated on the chart.

A daily candle close below the invalidation level will invalidate this analysis and suggest a potential reversal.

invalidation level: 1.089$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

TIA/USDT buy setupAfter a recent liquidity sweep below key support, TIA/USDT is showing strong signs of accumulation. The price has reclaimed a critical zone and is now establishing a solid support base, suggesting a potential reversal in structure.

Stop Loss: Below the recent sweep low to protect against invalidation

TIAUSDT Forming Descending TriangleTIAUSDT is gaining attention as traders and investors look for fresh opportunities in the altcoin market. With good volume backing recent moves, this crypto pair shows promising potential for a 40% to 50%+ gain in the near term. Although there’s no specific pattern visible right now, the price action suggests that TIA could be entering an accumulation phase before its next leg up. As the market sentiment for altcoins improves, TIAUSDT is likely to benefit from renewed buying interest.

Celestia (TIA) is a modular blockchain project designed to tackle scalability and customization in the crypto space. Its unique architecture allows developers to deploy their own blockchains with ease, making it a key player in the next generation of decentralized applications. This innovation, combined with growing community support, is a positive fundamental catalyst for the TIA token, which could translate into solid price action in the coming weeks.

Technical traders are closely watching support and resistance levels to catch the next breakout move. The increasing trading volume and investor interest are strong signals that a significant move could be on the horizon. Keeping an eye on upcoming project milestones, network upgrades, or partnership announcements could help you stay ahead of the curve and position yourself for the anticipated 40% to 50% gain.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TIAUSDT – Potential Reversal in Play Price is showing early signs of a bullish reversal after a prolonged downtrend.

Currently testing the 200 EMA from below, a key decision zone.

Plan:

• Entry Zone: Above 1.550 (pending confirmation)

• SL: 1.519 (below recent demand zone)

• TP: 1.835

• RR: 1:5+

⚠️ If price reclaims the 200 EMA with strong volume, expect momentum toward 1.83.

Patience is key, let the setup confirm.

$ENS / USDT Daily Time frame, MAJOR PUMP?Chart Overview

- Pattern Identified: Falling Wedge Pattern

- A bullish reversal pattern, often appearing after a downtrend.

- Three major touchpoints on the lower trendline indicate strong support and pattern validity.

Demand Zone (Support Area)

- Marked near the current price level ($2.0309 - $2.6722)

- Price is testing this zone for the third time.

Supply Zone (Resistance Area)

- Around ($6.6529 – $9.2734)

- Multiple swing highs are plotted within or near this region, indicating strong historical resistance.

Volume Profile (Right side of chart)

- High volume node between $2.50 – $4.00 suggests price acceptance and a potential area for consolidation or resistance after breakout.

- Low volume area between $4.50 – $6.50 implies less resistance, so price might move quickly through it.

FVG (Fair Value Gaps)

- Several FVGs (imbalance zones) are highlighted.

- $3.8 – $4.05

- $5.8236 – $6.1663

- These zones often act as magnets for price, offering potential targets after breakout.

📏 Fibonacci Levels

- Pullback levels (0.28, 0.5, 0.618, 0.786) are marked.

- Price may retrace toward these areas as part of the bullish structure.

✅ Bullish Scenario

- Breakout from the falling wedge pattern.

- Price pushes into first FVG (~$3.8), then toward $5.8236 – $6.1663, eventually challenging the supply zone ($6.6529 – $9.2734)

⚠️ Risks

- If price breaks below the demand zone, it invalidates the wedge and opens room for further downside.

- Falling wedge breakouts require confirmation (e.g., daily close above wedge resistance).

📊 Summary

- Bias: Bullish if support holds and wedge breakout occurs.

- Trigger: Break and close above wedge resistance line.

- Targets: $3.8 → $5.8 → $6.1 → $9.5

- Invalidation: Daily close below the demand zone ($2.00 - $1.90)

Please note this is not financial Advice. This is just an analysis!

Tia short-dump continues to $1.56Just took a short position on Tia.

Target: $1.56

Stop: $1.721

roughly 3RR

Market likely to continue dumping soon

DTT applied.

OVerall market is heading down, market objective is likely to make new lower lows. Correction happening now before continuation. Market is back at supply area that sold off aggressively in past.

TIA/USDT Ascending ChannelThis chart of TIA/USDT on the 4-hour timeframe. Here's a breakdown of the chart and what it's suggesting:

1. Pattern: Ascending Channel

The price appears to be moving within an ascending channel (marked by two parallel trendlines).

The support and resistance levels of the channel are well defined, suggesting a bullish structure overall.

2. Current Price Action

Price is currently at $2.536, nearing the lower boundary (support) of the ascending channel.

There is a blue curved arrow, suggesting a bullish bounce off the support line and a move toward the upper boundary of the channel.

3. Trade Setup (Long Position)

Entry Zone: Near current level ($2.53), just above the support.

Stop Loss (Red Box): Below the channel support, around $2.15.

Target (Green Box): Near the top of the channel, around $3.80.

This sets up a favorable risk-to-reward ratio ( 1 : 5.5 )).

4. Support & Resistance

Key Support: ~$2.15 (stop-loss level), channel bottom.

Immediate Resistance: ~$2.75 (mid-channel zone).

Major Resistance (Target): ~$3.80 (channel top).

Conclusion

This chart suggests a bullish trade idea, based on:

Price rebounding from the bottom of a rising channel.

Strong risk-reward setup (target ~$3.80, stop ~$2.15).

If the support fails, the setup is invalidated with limited downside risk.