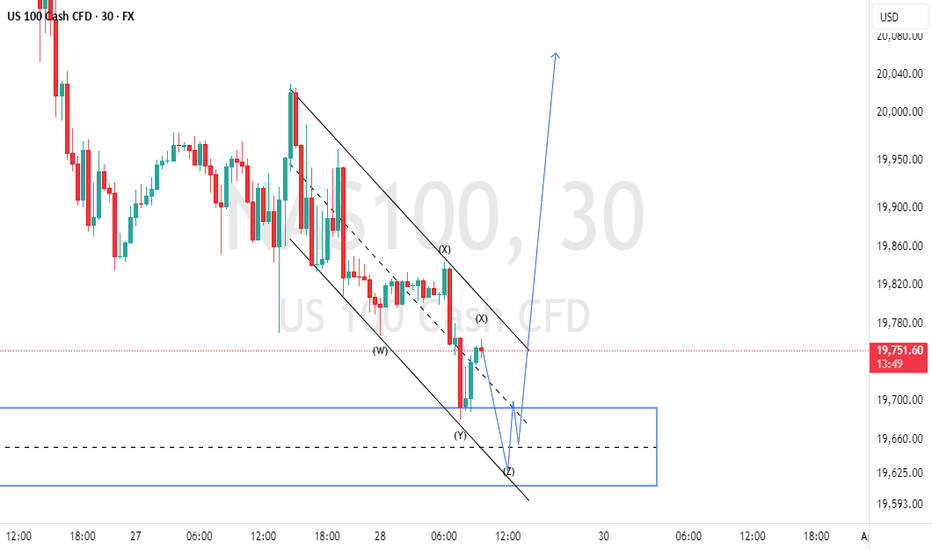

Us100 Upward or downward?In the 5-minute timeframe, you can sell at the top of the trading range and buy at the bottom of the trading range (by observing reversal candles and patterns).

Alternatively, you can wait for a breakout and enter in the direction of the breakout.

Be mindful of fake breakouts.

USTEC trade ideas

NAS100 EYESI am honestly intending to see some buys, so I did not draft for this video hence my mind was all over the zones and the gaps, I wannit to talk bias but I ended up analyzing to trade. I am sorry about that but we will fix it as soon as possible. Happy Trading.

Lastly, if your plan fail, don't reconsider another entry, especially on the same day.

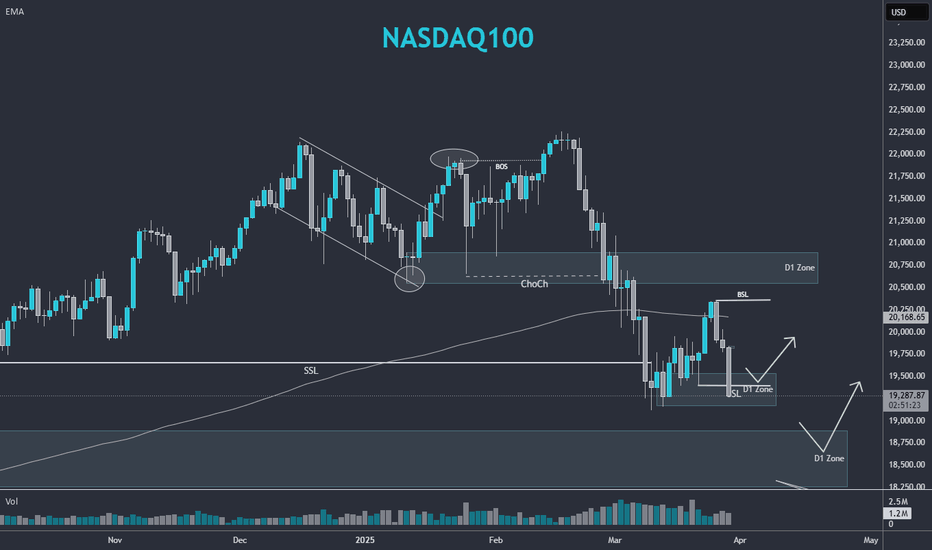

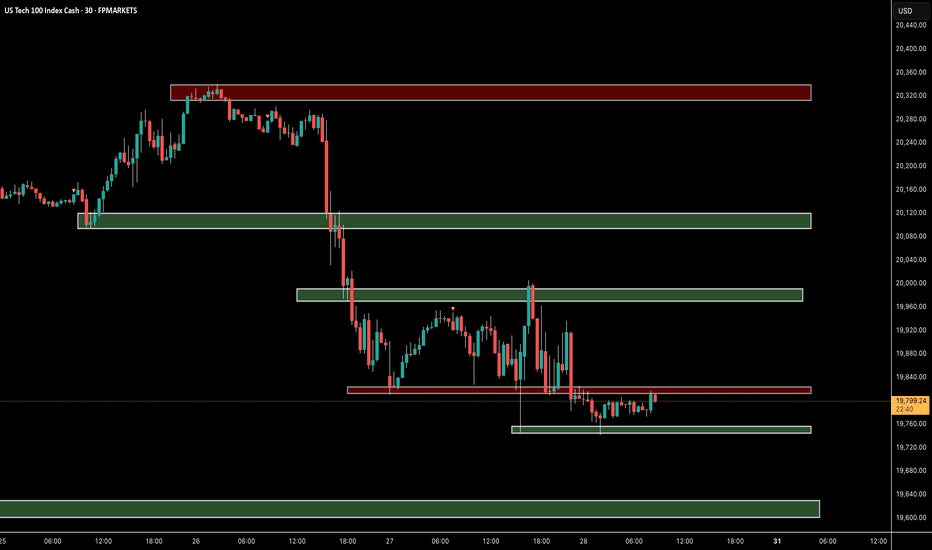

Precision Trading – How Our Trade Played Out PerfectlyIn trading, precision and patience are everything. We don’t chase trades—we wait for the perfect confluence of technical factors to align. This trade idea followed our systematic approach, utilizing ranges, Fibonacci levels, internal & inducement liquidity, break of structure (BOS), entry confirmation patterns, and harmonics. Here’s a breakdown of how it all unfolded.

1. Identifying the Range

Before executing, we mapped out the market structure to establish a clear range. The price action showed a well-defined consolidation zone, which helped us anticipate liquidity grabs and potential reversal points.

2. Fibonacci Confluence – 38.20% Level

Using the Fibonacci retracement tool, we identified the 38.20% level as a strong reaction point. This aligned with other key technicals, increasing our confidence in the trade setup.

3. Internal & Inducement Liquidity

Liquidity is key in trading. We spotted internal liquidity zones where price was likely to manipulate weak hands before the actual move. Inducement liquidity was also present, providing additional confirmation that price would tap into deeper levels before reversing.

4. Break of Structure (BOS) and Entry Confirmation

Once BOS occurred in alignment with our anticipated liquidity grab, we looked for our entry pattern. The market printed a textbook confirmation, allowing us to enter with precision and minimal risk.

5. Harmonic Pattern for Additional Confluence

The final piece of confirmation was a harmonic pattern, further validating our entry. These patterns, when combined with our overall strategy, add an extra layer of probability to our trades.

Trade Outcome

The execution was flawless! 🎯 The price respected our levels, moved in our favor, and hit our target zones with precision. This is the power of structured analysis and disciplined execution.

📉 Key Takeaway: Never trade blindly! Always have a solid confluence of technicals before taking a trade.

🔎 What’s your go-to confirmation before entering a trade? Let’s discuss in the comments! 📩

#ForexTrader #ForexLifestyle #ForexSignals #DayTrading #TradingMindset #ForexMoney #PipsOnPips #ForexSuccess #ForexMotivation #MillionaireMindset #TradingStrategy #FXMarket #ForexWins #TradeSmart #MarketAnalysis #WealthBuilding #Investing #PriceAction #ChartAnalysis #Scalping #SwingTrading #FinancialFreedom #MakingMoneyMoves #HustleHard #NoDaysOff #MoneyMindset

Monday NasDaqMorning Buddy, Today I hope to see 2 things that I have put on my Journal, 1 : Nas is within a daily FVG which seems weak to hold, but enough to create a manipulative retracement, either into the highlighted zone, which is a weekly bullish candle. 2 : The gap gets slowly taken, increasing FOMO trading and then retraces leaving $ lows, should this happen I expect to see the market retrace in a way that makes 15 minutes charts going down to 5, seem completely bullish.

I will drop a video later today to keep up with the charts. Stay tuned. Happy Trading

NASDAQ Pullback Loading? Small Retrace or Massive Opportunity AhThe NAS100 looks primed for more downside, but the real question is: how deep will the pullback go? Right now, we’re trading into key lows — a shallow retrace could offer a lower RR setup, but if we get a bigger move back, it could set the stage for a high-probability, high-reward trade.

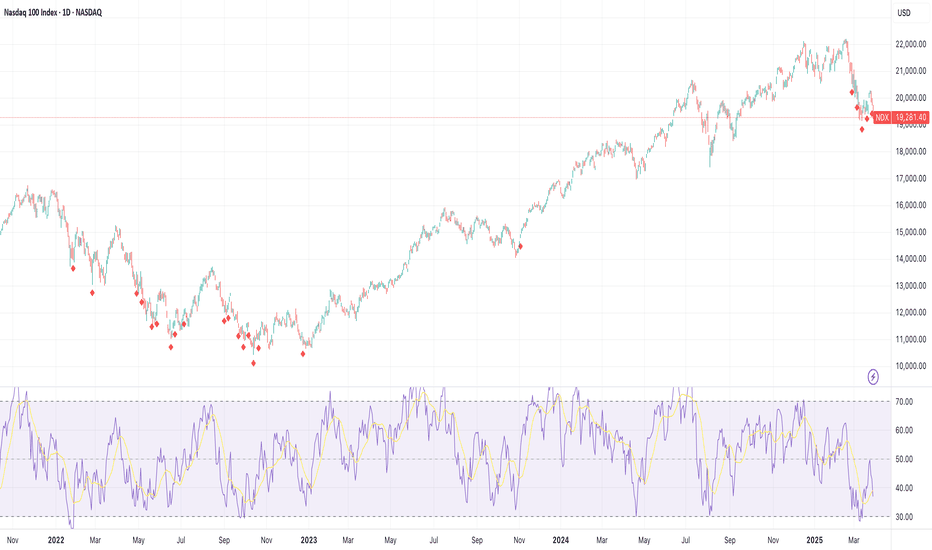

$NAS100 in correction mode. Is a bounce coming?Market experts will say 10% is a correction 20% is a bear market. In the last 5 years NASDAQ100 has been in the bear market 2 times. Once during COVID19 and another time during the FED Rate hike cycle. And it has been in correction mode in Aug 2024 when the Yen carry trade unwound.

Since Aug 2024 PEPPERSTONE:NAS100 has shown great strength with higher highs and higher lows and perfectly within the upward slopping Fib Retracement channel as shown in the chart below respecting the major fib levels and bouncing off from the 0.618 Fib retracement level every time it had a drawdown. The current correction in PEPPERSTONE:NAS100 is very close to the 0.618 Fib retracement level which is currently at 18700. This will indicate another potential downside of 2-3 % and if the Fib levels are supposed to holds then we will see a bottom @ 18700 and a bounce back from those levels. This will also bring down the RSI to low 30s which will indicate an oversold position.

Verdict: Start DCA into $ NAS100 and go long 18700.

NASDAQ Bearish, What's Next? Is 18.5k feasible?Price respected Weekly's bearish imbalance to continue lower. Still price is within the weekly's context area to which is suitable to look for entries in lower timeframes targeting weekly's swing low (POI).

Once, the Weekly POI get's tagged we might look to continue to the next POI (Point of Interest). Likely, the daily swing lows.

What's Next?

Potential target price is 18,537.88.

KEEP TRADING SIMPLE - NDXGood Morning,

Hope all is well. We saw some rejection at the 20,288 mark. Volume is still holding in a bearish partner. Trend is now signalling a bearish pattern. I will re-evaluate any accumulation until 19,100 to see if support holds.

Currently my portfolio is 75% SQQQ. I am holding No Crypto at the moment and have 25% in stocks and etfs.

Have a great day!

NSDQ100 INTRADAY bearish reaction to US PCE data US PCE Inflation – Market Impact (NASDAQ Focus)

Headline PCE YoY: 2.5% (steady, in line with expectations).

Core PCE YoY: 2.8% (higher than 2.7% prior, above forecasts).

MoM Figures: Headline +0.3%, Core +0.4% (showing steady inflation pressure).

Market Implications for NASDAQ:

Slightly hawkish as Core PCE remains elevated—could delay Fed rate cuts.

Tech stocks (NASDAQ) may face short-term selling pressure as yields react.

If risk appetite holds, dips could present buying opportunities in growth stocks.

Watch Treasury yields & Fed commentary for further market direction.

Key Support and Resistance Levels

Resistance Level 1: 20000

Resistance Level 2: 20350

Resistance Level 3: 20650

Support Level 1: 19,440

Support Level 2: 19,140

Support Level 3: 18880

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Nasdaq100 Update: Another Leg Down Likely After Recent Reversal?For quite some time, I have been highlighting the possibility of a strong correction in the Nasdaq 100 ( TRADENATION:USTEC ), with the 17,500 level remaining a realistic downside target.

In my more recent analyses, I argued that while a reversal from the 19,100 support zone was likely, it was merely a dead cat bounce , and the index could decline further from the 20,300-20,500 resistance zone. The lower boundary of this range was tested, and as expected, the index has started to fall again.

Although a temporary rally above 20,000 cannot be ruled out, my overall outlook remains unchanged—I still anticipate another leg down.

In conclusion, selling into rallies continues to be my preferred strategy, with 17,500 as the medium-term target.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

20323.3-20647.3 The key is whether it can rise above this level

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

Let's talk about the NAS100 chart.

--------------------------------------

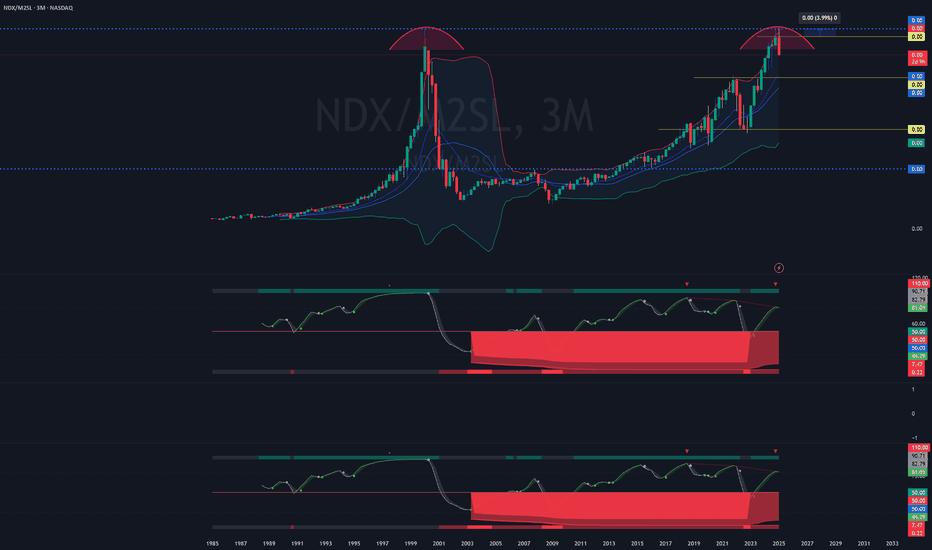

(NAS100 1M chart)

I think the stock market is fluctuating due to the rapidly changing situation and various economic issues.

Therefore, I think it is not easy to analyze index charts such as NAS100 and US30.

However, since the HA-High indicator of the current 1M chart is newly generated and is showing a downward trend, if it does not rise above 20647.3 when the competition starts, it is likely to eventually fall.

If it falls below the M-Signal indicator of the 1M chart, it is necessary to check for support near the Fibonacci ratio range of 0.5 (15898.2) ~ 0.618 (17130.8).

-

(1D chart)

The key is whether it can receive support near 19598.6, the HA-Low indicator point of the 1D chart, and rise above the M-Signal indicator of the 1W chart.

If not, it is expected that it will eventually meet the M-Signal indicator of the 1M chart and determine the trend again.

Currently, the price is being maintained above the M-Signal indicator of the 1M chart, so it is maintaining an upward trend in the medium to long term.

Therefore, when the competition starts, you should respond depending on whether the price is being maintained above or below the M-Signal indicator of the 1D chart.

Currently, the short-term support zone is 19269.9-19598.6, and the medium to long-term resistance zone is 20323.3-20647.3.

Even if it is supported and rises in the short-term support zone, if it fails to break through the medium to long-term resistance zone, it will eventually fall.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------