Could the Loonie bounce from here?The price is currently at the pivot which is an overlap support and could bounce to the 1st resistance.

Pivot: 1.3876

1st Support: 1.3602

1st Resistance: 1.4147

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDCAD_LMAX trade ideas

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.40500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.36000 (or) Escape Before the Target

USD/CAD "The Loonie" Forex Market Heist Plan (Day / Swing Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

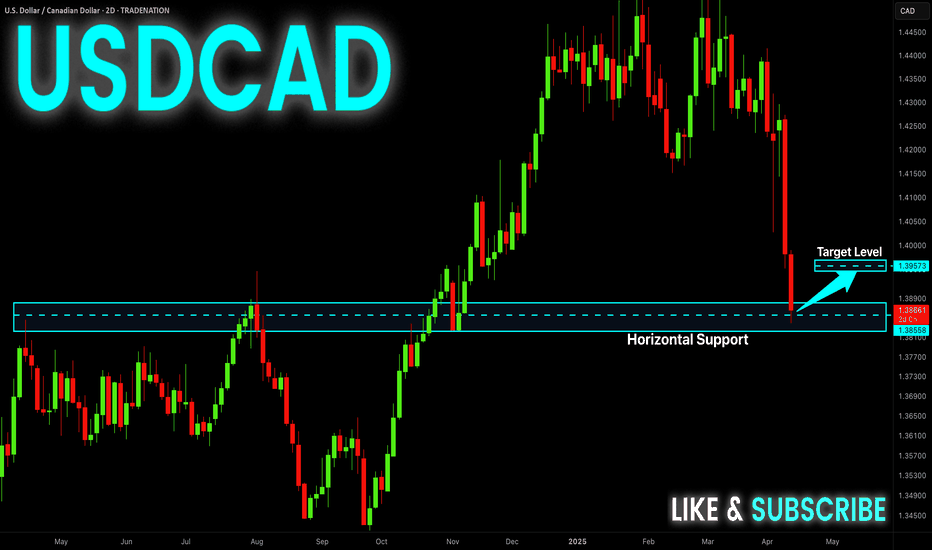

USD-CAD Swing Long! Buy!

Hello,Traders!

USD-CAD fell sharply to

Retest a horizontal support

Level of 1.3855 and as it is

A strong horizontal demand

Are we will be expecting a

Bullish correction on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Positive trade talks fuel USD recovery.🔔🔔🔔 USD/CAD news:

➡️ The USD/CAD pair rebounded from its recent losses seen in the previous session, trading around 1.3870 during Friday’s Asian session. The pair is stronger as the U.S. dollar gained traction, supported by optimism over potential U.S. trade deals. The greenback attracted some dip-buying interest after Thursday’s mild decline and found additional support from upbeat U.S. macroeconomic data.

Personal opinion:

➡️ USD is on the rebound and performing better than CAD. Therefore, the main trend for this pair is still bullish in the short term

➡️ Analysis based on resistance - support levels and trend lines combined with SMA to come up with a suitable strategy

Personal plan:

🔆Price Zone Setup:

👉Buy USD/CAD 1.3866 - 1.3850

❌SL: 1.3830 | ✅TP: 1.3920 - 1.3970

FM wishes you a successful trading day 💰💰💰

USD/CAD – Major Trendline Rejection + Bullish Reversal ZoneUSD/CAD is currently forming a bullish reversal setup on the weekly timeframe, suggesting a potential longer-term move to the upside.

Right now, the price is rebounding from a long-term ascending trendline, which has acted as dynamic support since 2021. This level also aligns with a prior resistance-turned-support zone, adding confluence. Volume has spiked recently, signaling strong market interest at this level. ⚠️

If price holds above 1.3800 and breaks above the recent weekly highs, we could see a bullish continuation toward the 1.4650–1.4800 supply zone. 🎯

🔹 Trade Setups to Consider:

1️⃣ Weekly Trendline Bounce Entry 📍 Entry: 1.3886

🛑 Stop Loss: 1.3723

🎯 Targets: 1.4140 ➡️ 1.4650

2️⃣ Breakout & Retest Entry 📍 Entry: 1.4140 (on retest after breakout)

🛑 Stop Loss: 1.3950

🎯 Target: 1.4800

📌 Risk Management Tip: This setup is based on a higher timeframe, so wider stops and longer holding periods are expected—size your positions accordingly.

💬 What’s your view on USD/CAD? Drop your thoughts below 👇

#Forex #TradingSetup #WeeklyChart #PriceAction #TechnicalAnalysis #TradeIdeas #USDCAD #TrendlineSupport #BullishReversal #MacroSetup

USDCAD accumulation phase for long 1.4050-60usdcad stopped making further lower low in daily time frame. 23rd April daily candle made a higher low, indication for strength for coming days. demand zone for long is 1.3840-3800, stop loss: 1.3780, target: 1.4050-50. even weekly trend is down. reversal/counter trend trade. use lower risk please.

USD/CAD: After the Liquidity Sweep, the Real Move Begins ?USD/CAD (4H) – Bullish Channel in Progress :

Price swept liquidity on the weekly timeframe and is now moving within a bullish channel.

Watching for a continuation toward the resistance zone above,

⚠️ Not financial advice.

– Mr. Wolf 🐺

#USDCAD #Forex #FXTrading #PriceAction #LiquiditySweep #TechnicalAnalysis #ForexTrader #TradingView #MarketStructure #BullishMomentum

USDCAD at Risk? COT Turns Bearish📊 COT Overview – CAD & USD Futures

🇨🇦 Canadian Dollar (CAD)

Asset Managers: Still net short, but recovering fast → from -150K to nearly -50K.

Leveraged Money: Strong bullish reversal from -100K to -30K and climbing.

✅ Interpretation: Institutions are flipping bullish on CAD → Bearish pressure on USDCAD.

🇺🇸 US Dollar (USD)

Asset Managers: Cutting long exposure since March.

Leveraged Money: Losing conviction → neutral to slightly long.

⚠️ Interpretation: USD is structurally weakening → adding to the USDCAD bearish bias.

🧠 Technical Analysis

Price has returned to the key demand zone (1.3700–1.3850) for the third test.

Candles are compressing → signal of upcoming volatility.

RSI remains weak, no bullish divergence → no clear reversal yet.

📌 Key Levels:

Support: 1.3700 → A confirmed break opens space toward 1.3550–1.3480.

Resistance: 1.3950–1.4100

🎯 Trade Scenarios

🔻 Breakdown trade below 1.3700 → Target: 1.3480

🔁 Pullback short on rejection from 1.3950–1.4000 → SL above 1.4100

🔼 Long only with a bullish engulfing weekly close + RSI divergence

✅ Summary

COT Bias: Bearish USDCAD → CAD strengthening, USD weakening

Technical Structure: Support under pressure, breakout likely

Preferred Play: Short continuation on breakdown or pullback rejection

USD/CAD(20250424)Today's AnalysisMarket News:

The United States hit a 16-month low in April. The total number of new home sales in the United States in March was an annualized to a new high since September 2024.

Technical analysis:

Today's buying and selling boundaries:

1.3861

Support and resistance levels:

1.3966

1.3927

1.3901

1.3820

1.3794

1.3755

Trading strategy:

If the price breaks through 1.3901, consider buying, the first target price is 1.3927

If the price breaks through 1.3861, consider selling, the first target price is 1.3820

USDCAD Short 4/23/2025USD/CAD Short Setup – Break of Daily Demand + Textbook Triangle Unwind

This short is built off both macro fundamentals and multi-timeframe technical precision.

Daily Chart:

USD/CAD has been steadily breaking structure to the downside. Yesterday's close was significant — we broke below a major daily demand zone at 1.38221, signaling a shift in longer-term sentiment.

Today’s price action has already retested yesterday’s high into that broken zone — a classic break-and-retest setup.

4H Chart:

A clear 5-wave triangle correction is printing — text-book stuff. We’re nearing the breakout point. Price is pressing against the lower boundary, and momentum looks ready to shift.

A potential Evening Star pattern is forming right now, supported by an inside bar and a follow-up bearish hammer — a stacked reversal signal.

1H Chart:

Structure confirms the 4H — all signs point toward a correction completing and a new impulsive leg down beginning.

Fundamentals:

Later today, the U.S. Flash Manufacturing PMI is expected to show contraction — a negative for the dollar. If the data misses expectations, it could amplify the bearish move on USD/CAD.

We’re also tracking oil closely — further CAD strength via crude would accelerate the downside here.

Trade Plan:

Entry: Current area near the 1.382 retest

SL: Above triangle high

TP1: 1:1 R:R – partial take profit (75%)

TP2: Let the remaining 25% run with structure-based trailing

If the setup confirms post-PMI, this could be a strong follow-through play after a major HTF breakdown.

GOLDMASTER1| USDCAD ANALYSIS MARKET ANALYSIS: USD/CAD

The market has responded as expected at the key levels I've highlighted. We saw a clear reaction in the Bearish Orderblock region, where price initially rejected the area, aligning with my expectations. Additionally, the Demand Zone near the lower levels showed significant buying pressure, reaffirming the potential for bullish movement.

KEY OBSERVATIONS:

Bearish Orderblock: Price tested this zone and dropped, confirming its relevance as a strong resistance level.

Demand Zone: The market showed resilience and bounced off this level, indicating strong support.

I'll continue monitoring these levels closely for any further developments.

GOLDMASTER1---