USDCAD_LMAX trade ideas

Weekly Buy Trade Plan – USD/CAD (April 2025)This is a weekly timeframe bullish setup on USD/CAD, focusing on a high-probability buy opportunity based on key support structure and RSI dynamics.

🧠 Technical Outlook:

Price has strongly rejected a major historical support zone around 1.37781 – 1.38800, highlighted by the green horizontal line.

This level has acted as strong support multiple times in the past, making it a key demand zone for potential reversal.

After a strong bearish leg, the current price action suggests exhaustion in selling pressure, indicating a likely bounce from this level.

💹 Why Long?

Price is sitting right above the support zone, with buyers stepping in around the 1.38800 level.

This area aligns with previous structure and is a likely zone where institutional buyers may accumulate.

📊 RSI Analysis:

RSI (14) is at 39.99, entering the oversold territory and showing early signs of potential reversal.

Although momentum is still bearish, this is where contrarian entries often occur—anticipating a bounce back toward midline (50+) or higher.

✅ Trade Setup Details:

Entry: Around 1.38800 zone (current support zone)

Stop Loss: Below 1.37781 (to protect against deeper correction)

Take Profit: Targeting the 1.42000 – 1.43000 resistance zone

Risk-Reward Ratio: Around 1:2.5 or better, offering a solid return potential if price rebounds

⚠️ Trade Management Tips:

Watch for bullish confirmation candles on the daily or H4 for added confluence.

Monitor USD and CAD fundamentals for short-term volatility (e.g., interest rate decisions, oil prices).

Secure partial profits near 1.41000 and trail your stop.

USDCAD - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCAD has been overall bullish from a macro perspective trading within the rising blue channel.

This week, USDCAD has been in a correction phase trading within the falling red channel.

Moreover, the green zone is a strong resistance turned support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red/blue trendlines acting non-horizontal support.

📚 As per my trading style:

As #USDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CAD 1H – Bearish Setup with SBR & DBD Zone | Trendline BreakKey Zones:

🔵 Entry Point (Sell):

Around 1.41300–1.41500 (Supply Zone: SBR + DBD zone)

Price is expected to pull back here before dropping

This is the ideal place to look for bearish confirmation

🟦 Supply Zone (Resistance)

🔴 Stop Loss:

Just above 1.41804

If price hits this, the bearish idea is invalidated

⚠️ Protection zone

🟡 Demand Zone (Support):

1.40000–1.40500

Price may bounce here temporarily

Watch for consolidation or breakout

🟢 Take Profit / Target Point:

1.39320

This is the final target for the short position

Potential -1.36% move / 192.7 pips

💰 Profit zone

Visual Summary with Dots:

🔵 Sell Entry: Around 1.41400

🔴 Stop Loss: Above 1.41800

🟢 Take Profit: At 1.39320

Short trade

Day TF overview

📉 Trade Breakdown – Sell-Side (USDCAD)

📅 Date: Thursday, April 10, 2025

⏰ Time: 10:30 AM (New York Time) – NY Session AM

📈 Pair: USDCAD

📉 Trade Direction: Short (Sell)

Trade Parameters:

Entry: 1.40162

Take Profit (TP): 1.39390 (–0.55%)

Stop Loss (SL): 1.40307 (+0.10%)

Risk-Reward Ratio (RR): 5.32 ✅

Reson: Try to attempt the NY reversal narrative assuming bearish sentiment

30min TF overview

USD/CAD(20250411)Today's AnalysisMarket news:

The annual rate of the US CPI in March was 2.4%, a six-month low, lower than the market expectation of 2.6%. The market almost fully priced in the Fed's interest rate cut in June. Trump said inflation has fallen.

Technical analysis:

Today's buying and selling boundaries:

1.4013

Support and resistance levels:

1.4170

1.4112

1.4073

1.3952

1.3914

1.3855

Trading strategy:

If the price breaks through 1.4013, consider buying, the first target price is 1.4073

If the price breaks through 1.3952, consider selling, the first target price is 1.3914

USD/CAD bears eyeing deeper downside flushUSD/CAD bears will be eyeing a meaningful downside flush with the pair breaking and closing beneath the 200-day moving average on Thursday, hitting fresh year-to-date lows in the process.

The price now finds itself below 1.3947, the high set in August last year. The break may encourage others to join the bearish move, generating a setup where shorts could be established with a stop placed above the level for protection.

1.38115 screens as an initial target, with other minor levels such as 1.3748, 1.3700 and 1.3647 also in play. Momentum indicators favour retaining a bearish bias, with RSI (14) trending strongly lower but not yet oversold. MACD further bolsters the bearish signal.

If the price were to reverse back above the 200DMA, the overall bearish bias would be invalidated.

Good luck!

DS

USD_CAD REBOUND AHEAD|LONG|

✅USD_CAD is falling again to retest the support around 1.3900

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD: Growth & Bullish Forecast

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current USDCAD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCAD → Weak dollar provokes continuation of downtrendFX:USDCAD under the pressure of a weak dollar and downtrend may renew its lows. The fundamental background for the dollar is weak, the market reacts accordingly.

The dollar continues to fall - a reaction to the tariff war. Besides, additional pressure is created by the issue of interest rates reduction.

The currency pair is under the pressure of the downtrend. After a false resistance breakout, the price is consolidating in the selling zone. The trend change is confirmed by the cascade of resistances. Emphasis on the local range 1.4245 - 1.42018. The price exit from the consolidation will provoke the continuation of the fall

Resistance levels: 1.4245, trend boundary

Support levels: 1.4202, 1.415

Possible retest of resistance before further decline. But the price exit from the current range and consolidation of the price below 1.4202 - 1.4205 will provoke the growth of sales and further fall to 1.405 (zone of interest).

Regards R. Linda!

Crowd's Bullish Narrative Meets Structural Reality📅 Week of: April 7–11, 2025

🚩 USD/CAD

Bias: Bearish

Trade Duration: 2–5 Days

Status: Breakdown Confirmed – Retest Completed

Current Reflexivity Phase: Phase 4 – Emotional Flush & Capitulation

Strategy Type: Structural Breakdown + Sentiment Dislocation

Execution Style: Reactive, not predictive

Theme: "Crowd's Bullish Narrative Meets Structural Reality"

🧠 Strategic Thesis

USD/CAD has clearly broken and successfully retested previous support (1.4248) as resistance. The market now enters an emotional flush phase as late bullish positions unwind, reinforcing bearish momentum driven by strengthening CAD due to bullish crude oil dynamics.

🔍 Structure Breakdown Highlights

Clean structural rejection at the retest (1.4248 resistance zone)

Strong bearish momentum confirmed; consistent lower highs

Sellers firmly control price action, no fresh demand emerging

📊 COT & Sentiment Snapshot

Leveraged Funds: Unwinding longs slowly

Institutional Traders: Accumulating CAD positions steadily

Retail Sentiment: Persistently bullish on USD despite structural evidence

📌 Translation: Institutional flows quietly pivoting to CAD; retail optimism still providing contrarian fuel.

🧠 Behavioral Finance Triggers

“Crowds trust the story. Price tells the truth.”

Emotional denial among bullish USD traders, fueling further downside upon forced exits

Rejection confirmed; sentiment lagging clear structural signals

🔄 Reflexivity Model – Phase Breakdown

Phase Description

Phase 1: USD bullish narrative builds retail optimism

Phase 2: Structural breakdown—completed

Phase 3: Retest & crowd denial—completed

Phase 4: ✅ Current – Emotional flush underway

🛠️ Execution Plan

Entry: Short already executed at 1.42354

Risk Management: Stop-loss above confirmed retest (1.42567)

Exit Plan: Scale out strategically on downside momentum

🕰️ Execution Timeline

Wednesday–Friday: Maintain short bias, trail stops, secure partial gains into weekend

✅ Strategic Summary

USD bullish crowd now forced to reckon with structural realities—stay positioned for emotional flush continuation.

"You don’t need to predict. Just follow the failure."

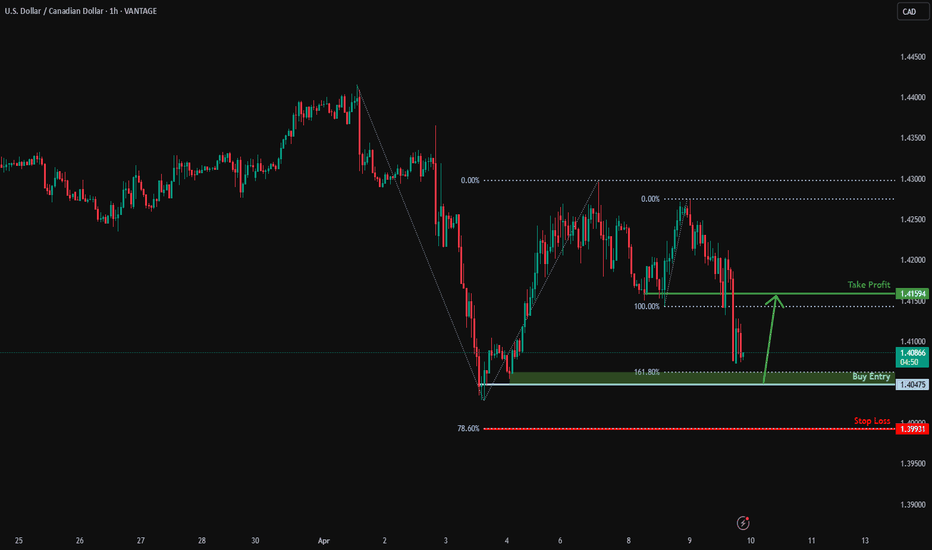

Bullish bounce?USD/CAD is falling towards the support level which is a pullback support that is slightly below the 161.8% Fibonacci extension and could bounce from this level to our take profit.

Entry: 1.4047

Why we like it:

There is a pullback support level that is slightly below the 161.8% Fibonacci extension.

Stop loss: 1.3993

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci projection.

Take profit: 1.4159

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Take profit: 1.4159

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

USDCAD Trendline Breakout Ready for a Long SellHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts