USDJPY.1000.DUB trade ideas

Explosive Rebound on USD/JPY? This Zone Has It ALL...Hi traders! Analyzing USD/JPY on the 1H timeframe, spotting a potential rebound within a descending channel:

🔹 Entry: 144.35

🔹 TP1: 145.59

🔹 TP2: 147.29

🔹 SL: 142.993

Price is currently testing the lower boundary of a well-structured descending channel — a zone that has held as dynamic support multiple times. The RSI is in oversold territory, suggesting the potential for a bullish correction.

If buyers defend this area again, we could see a strong bounce toward the midline and possibly the upper boundary of the channel. Wait for bullish confirmation (e.g., strong candle or volume spike) before entering.

⚠️ DISCLAIMER: This is not financial advice. Every trader must evaluate their own risk and strategy.

5th wave downWe've been tracking this setup for the past few weeks. The market has formed an Elliott Wave structure, and it looks like Wave 4 is now complete. We're likely entering Wave 5 to the downside.

Stop-loss is placed above the wick, with a minimum target at last week's low.

Game of probability lets see how it goes...

USDJPY UPDATESHello folks, this might be trend for next week.

see chart above, might make a new low?

This is only my view, we still have PPI tomorrow friday.

The idea is LONGS.

This is not a financial advice or trade signals.

Trade wisely base on your own understanding.

Good luck.

SEE you next week for new charts on new pair of shoes, joke. new pair of forex market or indices or crypto.

pewwpeww.

SEE the description not the chart, I totally base on my idea on weekly to this USDJPY.

are we going down?

USDJPY: Long Signal with Entry/SL/TP

USDJPY

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USDJPY

Entry Level - 145.33

Sl - 144.41

Tp - 147.41

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY Moment of truth for the long-term bullish trend.The USDJPY pair has been trading within a Channel Up since the October 17 2022 High and right now the current 1W candle is very close to its bottom (Higher Lows trend-line). This offers a low risk trading set-up.

Confirmed buy will be if the price breaks and closes a 1W candle above the 1W MA50 (blue trend-line), in which case our Target will be July's Resistance at 161.500 (similar to the 2023 Bullish Leg).

If on the other hand it breaks and closes a 1W candle below the Channel Up, turn short and target the 1W MA200 (orange trend-line) at 139.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

usdjpy update live trade and educational breakdown USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

USDJPY, the market continues downwards hoping to close fvgUsdjpy has been down and ranging this week, and the usd has suffered against major pairs since the reciprocal tariff announcement by Donald Trump.

With the feds pressured to cut rates, the only hope for a rebounce of the Dollar is today's CPI and Jobless claims report, alongside the inflation report.

USDJPY; The pair is currently at 146, looking to close the fvg at 144, and if it all goes right, we look for further downside, but in all this let's take into consideration the the high impact news reports coming later today, that will highly impact rest of the week.

Fundamental Market Analysis for April 10, 2025 USDJPYThe Japanese yen (JPY) showed strength during the Asian trading session on Thursday, reacting to the release of producer price index (PPI) data that exceeded market expectations. This macroeconomic signal reinforced speculation about possible further monetary policy tightening by the Bank of Japan (BoJ), keeping the probability of an interest rate hike in the future. Additional support for the yen was provided by positive expectations of a potential trade agreement between Japan and the United States.

Amid the weakening of the US dollar (USD), the USD/JPY pair showed a pullback and fell below the psychologically important level of 147.000, which was also supported by a limited correction of the US currency amid a general recovery in market confidence.

The divergence in monetary expectations between the Bank of Japan and the Federal Reserve remains significant. While Japan is increasingly likely to tighten monetary policy, markets in the US are pricing in a scenario of multiple cuts in the Fed's key interest rate in 2025. This discrepancy has prevented the US dollar from maintaining momentum after an overnight recovery from a weekly low, prompting a reallocation of capital in favor of the more stable yen despite its status as a low-yielding currency.

Improved global risk sentiment, driven by US President Donald Trump's announcement of a temporary suspension of retaliatory tariffs against key trading partners, may also help strengthen the yen as a safe haven asset, especially amid continued uncertainty in international markets.

Trade recommendation: SELL 146.800, SL 147.400, TP 145.400

Yen Climbs as Trump Softens Stance on Japan TariffsThe Japanese yen strengthened past 147 per dollar on Thursday, moving in a volatile range as trade tensions persisted. Markets reacted to President Trump’s 90-day pause on tariffs for non-retaliating countries, offering Japan some relief with a reduced 10% baseline tariff. However, tensions remained elevated as Trump raised tariffs on Chinese imports to 125% in response to Beijing’s retaliation. The EU may be excluded from the pause due to its own countermeasures. Meanwhile, the U.S. confirmed plans to begin trade talks with Japan after Trump’s call with Prime Minister Shigeru Ishiba.

Key resistance is at 148.70, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

Possible bearish movement from price level 147.300Setup Description:

Price is approaching a major resistance zone between 147.200 – 147.530, which previously acted as a strong rejection area. Market structure shows signs of a lower high, indicating potential bearish continuation. No clear breakout above resistance, suggesting bulls are losing momentum.

Entry Reasoning:

Previous strong rejection from 147.530

Bearish market structure (lower high)

Potential for large risk-reward if price rejects this zone

Clean traffic down to next support zones

USD/JPY(20250410)Today's AnalysisToday's buying and selling boundaries:

146.66

Support and resistance levels:

150.90

149.32

148.29

145.03

144.01

142.42

Trading strategy:

If the price breaks through 148.29, consider buying, the first target price is 149.32

If the price breaks through 146.66, consider selling, the first target price is 145.03

USD/JPY) Bullish reversal analysis read the Caption EA GOLD point update

This chart is for USD/JPY on the 1-hour time frame,and it presents a bullish trade setup.Let's break down the idea

Key Observations ;

1.Current Price;

USD/JPY is trading Around 146.281.

2.Overall Bias

Bullish setup expecting a bounce from demand into a higher target zone.

3.EMA 200;

price is currently below the 200 EMA (147.942).which usually suggests a bearish trend _but this setup is aiming for a short-term Bullish retracement.

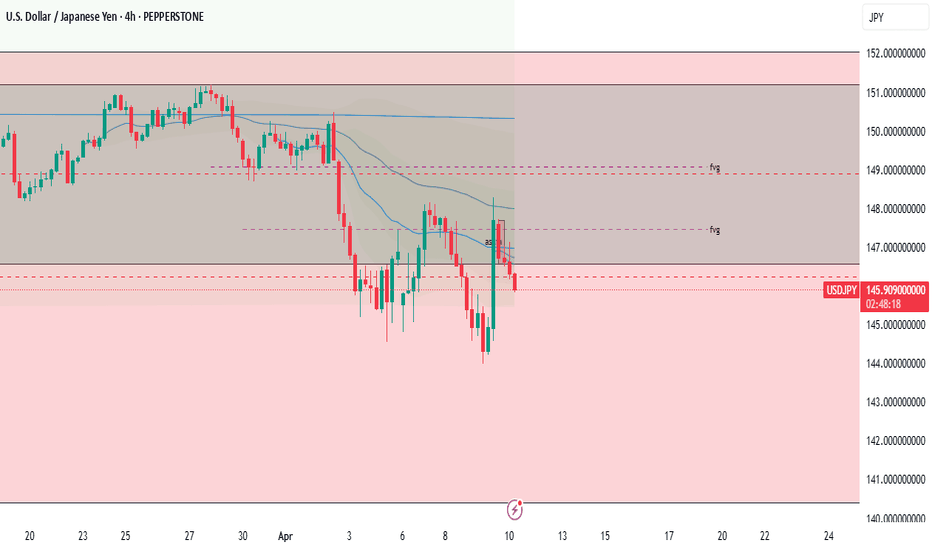

USD/JPY 4H Chart – Technical & Fundamental AnalysisUSD/JPY 4H Chart – Technical & Fundamental Analysis

On the 4-hour time frame, price is in a clear downtrend, forming lower highs and lower lows. As the downward movement continues, we’ve identified a minor key resistance level at 148.800, along with two minor key support levels — one at 146.000 near the current price, and another at 140.400.

Price has already broken below the minor support, triggering sellers’ pending orders. This also serves as an accumulation phase for market makers. As expected, price did not immediately continue pushing lower below the next support level. Instead, market makers aimed for a liquidity hunt — which has now occurred, pushing price upwards and liquidating sellers' stop-losses, creating a clear liquidity zone.

Our current objective is to wait for price to break below the minor key level and then place a sell stop order at 145.920, with a stop-loss at 148.100 (above the liquidity zone), and take-profit at 140.960 — the next minor support. This setup offers a 1:2 risk-to-reward ratio.

Fundamental Outlook:

USD/JPY remains under pressure amid a weakening U.S. dollar, driven by soft labor market data and heightened economic uncertainty. This week’s U.S. Unemployment Claims are projected at 223K, up from 219K, reflecting potential labor market softening. A higher-than-expected print may dampen expectations for additional rate hikes by the Federal Reserve, weighing further on the dollar.

In contrast, the Japanese yen has strengthened on the back of improved domestic data and renewed safe-haven demand. Upward revisions to Japan’s GDP, along with stable inflation figures, have increased confidence in the yen. Furthermore, recent remarks from the Bank of Japan hinting at a more hawkish tone have added to the currency’s appeal. Global geopolitical risks — including potential trade tensions tied to former President Trump’s resurgence — are also reinforcing the yen’s safe-haven status.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.