USDJPY.1000.DUB trade ideas

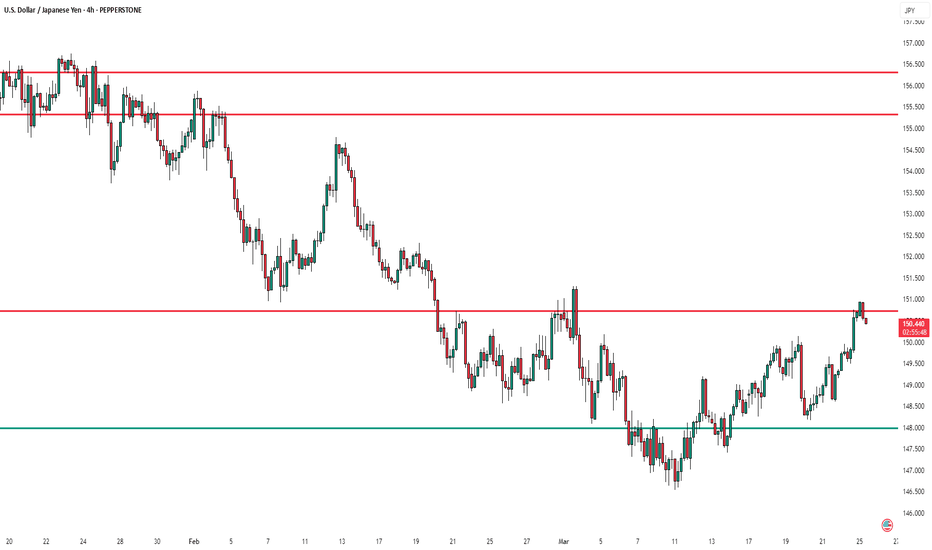

USD/JPY – Key Resistance Tested After Strong RallyThe USD/JPY pair has been in a steady uptrend after finding support near the 147.800 level, leading to a breakout above key levels. The price is currently testing a significant resistance zone around 150.500, where previous rejections occurred.

Key Levels to Watch:

📌 Resistance: 150.500 (current test), 155.500, 156.500

📌 Support: 147.800

If buyers sustain momentum above 150.500, we could see a move toward the 155.500 - 156.500 zone. However, rejection at this level could trigger a pullback toward 147.800 support.

Traders should monitor price action at this level to determine whether a breakout or rejection occurs.

What are your thoughts? Will USD/JPY break higher, or are we due for a pullback? 🚀📉

USD/JPY (30M) Analysis – 25-03-2025📊 USD/JPY (30M) Analysis – 25-03-2025

📉 Current Price: 150.547

🟢 Demand Zones (Support):

149.851 - 149.955 – First potential reversal zone.

149.500 - 149.537 – Key support area.

🔴 Supply Zone (Resistance):

150.600 – Recent high acting as resistance.

📌 Market Outlook:

Price is rejecting the supply zone and showing signs of reversal.

Scenario 1: If price breaks below 150.500, expect a drop towards 149.851 (TP1) and 149.500 (TP2).

Scenario 2: If price holds above 150.500, bullish continuation may occur.

⚡ Trade Setup:

🔻 Sell Setup: If price breaks 150.500 with confirmation.

🎯 TP1: 149.851

🎯 TP2: 149.500

🛑 SL: Above 150.650

#FXFOREVER #FXF #USDJPY #Forex #SmartMoney #PriceAction

Fundamental Market Analysis for March 25, 2025 USDJPYThe Japanese yen (JPY) declined against its US counterpart for the fourth consecutive day, taking the USD/JPY pair to 151.000, or a three-week high, during Tuesday's Asian session. Sentiment regarding global risk is being fuelled by hopes that US President Donald Trump's so-called retaliatory tariffs will be narrower and less harsh than originally anticipated. In addition, optimism over a possible peace agreement between Russia and Ukraine, and reports that China is considering including services in a subsidy programme to boost consumption, have further bolstered investor confidence, undermining the safe-haven yen.

Meanwhile, minutes from the Bank of Japan's (BoJ) January meeting showed that policymakers discussed under what conditions the central bank should raise interest rates further. However, the minutes gave no clues as to the likely timing of the BoJ's next move and failed to make much of an impression on the JPY bulls. The Bank of Japan's hawkish outlook is at odds with the Federal Reserve's (Fed) forecast of two 25 basis point rate cuts before the end of this year. This could deter dollar bulls from making aggressive bets and support a low-yielding yen, which should limit the upside of USD/JPY.

Trade recommendation: BUY 151.000, SL 150.200, TP 152.150

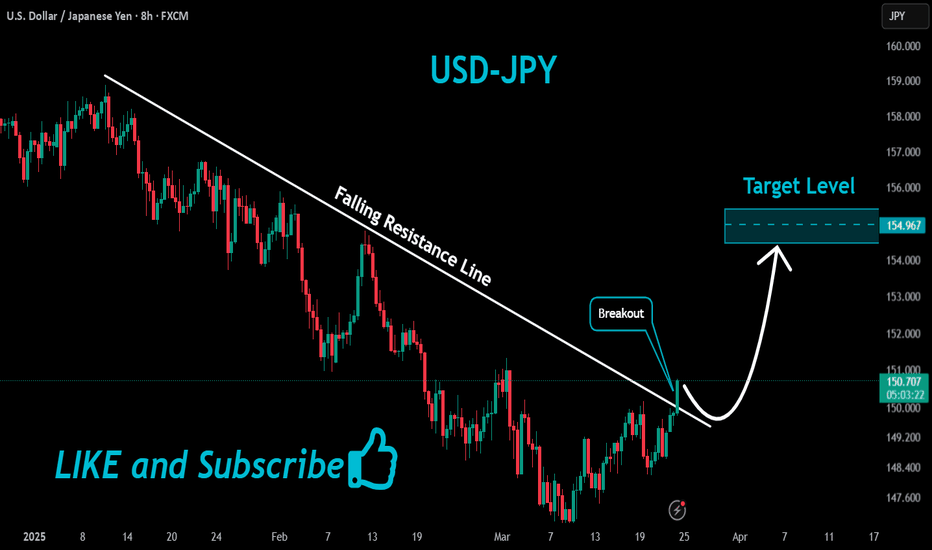

USD/JPY TRENDLINE BREAK OUT BUY ZONETrade Setup Rationale

Entry Point: 149.500

Likely triggered by a bullish breakout above a descending trend line (resistance). Entry might be near the breakout level, assuming the price retests the trend line (now support).

Example: If the breakout occurs around 150.00, a pullback to the 150.00-151.00 zone could serve as the entry point.

Take Profit (TP) Targets

TP1: 152.60 (near prior resistance or a measured move).

TP2: 154.80 (extension of the bullish momentum, possibly a multi-month high).

Stop Loss (SL)

148.25 (placed below the trend line/swing low to protect against false breakouts).

Risk-Reward Considerations

Scenario: Entry at 150.00, SL at 148.25 (175 pips risk).

TP1 (152.60): +260 pips (1:1.5 risk-reward).

TP2 (154.80): +480 pips (1:2.7 risk-reward).

Note: Wider stops may suit swing traders, but ensure alignment with your strategy.

Key Factors to Validate

Trend Confirmation: Confirm bullish momentum with indicators (e.g., RSI > 50, MACD crossover).

Fundamentals: Monitor BoJ intervention risks or Fed policy shifts impacting USD/JPY.

Price Action: Watch for a clean breakout with volume.

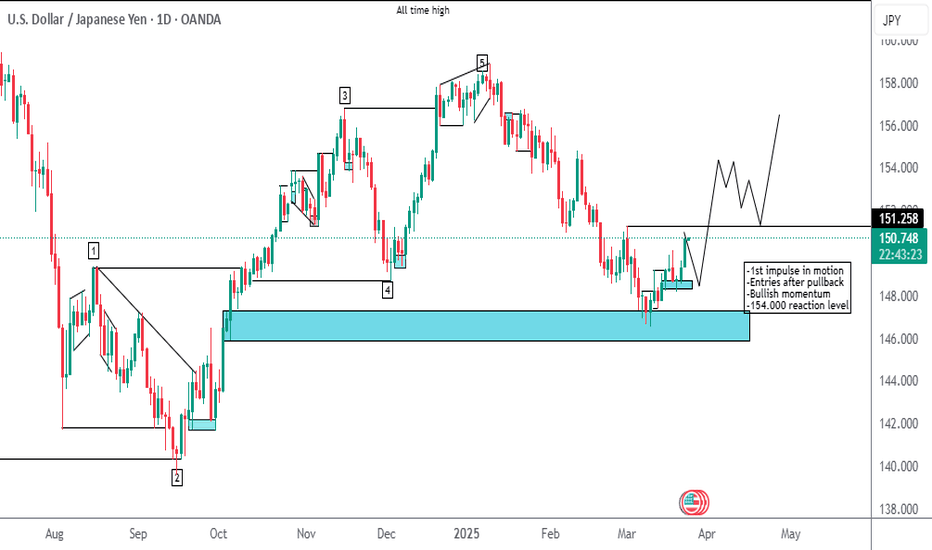

Elliott Wave View: USDJPY Rallying in Double ZigzagShort Term Elliott Wave view in USDJPY suggests that rally from 3.11.2025 low is in progress as a double zigzag structure. A double zigzag structure is a 7 swing double three Elliott Wave structure. There are 2 sets of ABC zigzag structure connected together, thus why the name is double zigzag. Up from 3.11.2025 low, wave A ended at 149.2 and wave B ended at 147.4. Wave C higher ended at 150.1 and this completed the first zigzag structure and end wave (W) in higher degree as the 45 minutes chart below illustrates. Pullback in wave (X) ended at 148.1 and pair has resumed higher in wave (Y).

Internal subdivision of wave (Y) is unfolding as another zigzag structure. Up from wave (X), wave ((i)) ended at 149.66 and wave ((ii)) pullback ended at 148.6. Up from there, pair is nesting higher in wave ((iii)). Wave (i) ended at 149.95 and wave (ii) pullback ended at 149.48. Wave (iii) higher ended at 150.94. Expect pullback in wave (iv) to find support for more upside. Near term, as far as pivot at 148.16 low stays intact, expect dips to find buyers in 3, 7, or 11 swing for further upside.

USD/JPY(20250325)Today's AnalysisToday's buying and selling boundaries:

150.25

Support and resistance levels:

151.62

151.11

150.78

149.73

149.40

148.89

Trading strategy:

If the price breaks through 150.78, consider buying, the first target price is 151.11

If the price breaks through 150.25, consider selling, the first target price is 149.73

USDJPY THE BULLS ARE IN 500 PIPS TO BE MADE USD/JPY falls from near 150.00 after Japanese commentary

USD/JPY turns south after facing rejection just shy of 150.00 in the Asian session on Monday. The pair pares gains following the commentaries from Japanese Finance Minister Kato and BoJ policymaker Uchida. Hopes of the next BoJ meeting being the 'live one' and weaker US Dollar also cap the pair's upside.

USDJPY INVERTED HS PATTERN BREAKOUT 350 PIPS CAN BE EXPECTED

In the event that a head and shoulders pattern develops in USDJPY, please refrain from risking more than 2% of your capital investment. It is crucial to perform your own research before making any trading decisions. To ensure the pattern's accuracy, it is advisable to use the premium version of the TradingView Auto Chart Indicator, as the free version may not offer dependable indicators for this pattern. While the free version can be used to check the auto chart pattern, it may not display it correctly. Those with access to the premium version are invited to share their observations in the comments section.

Thank you All

BUY opportunities on USD JPYRR 1:1 - conservative

RR 1:2 - aggresive

Please do not trade as my analysis might be incorrect.

I encourage constructive feedback.

If you did trade, make sure the drawing is respected, don't use exact values as they might differ from a broker to another.

Explanations:

MIN - last minimum point

MAX - last maximum point

BOS - break of structure

SMS - shift in market structure

SL - stop loss

TP - take profit

RR - risk reward

OB - order block

OB (15) - order block (based on M15) timeframe

USDJPY Wave Analysis – 24 March 2025

USDJPY: ⬆️ Buy

- USDJPY broke the resistance zone

- Likely to rise to the resistance level 151.35

The USDJPY currency pair rose strongly after breaking the resistance zone between the resistance level of 150.00 and the resistance trendline of the daily down channel in January.

The breakout of this resistance zone accelerated the active intermediate impulse wave (3) from the start of March.

Given the strongly bullish US dollar sentiment seen today, USDJPY currency pair can be expected to rise to the next resistance level 151.35 (the high of wave iv from last month).

USD/JPY - Strong rejection of lower pricesOn USD/JPY , it's nice to see a strong buying reaction at the price of 148.890.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Strong rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale