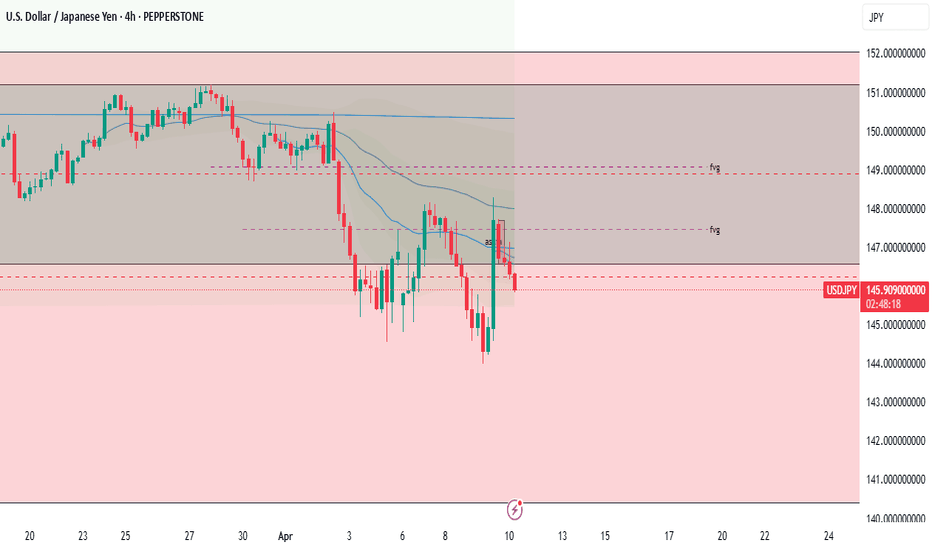

USDJPY LONG FORECAST Q2 W15 D11 Y25USDJPY LONG FORECAST Q2 W15 D11 Y25

Happy Friday Traders, It has been a week of sitting on capital. Being cautious, awaiting for breaks of structures at key areas and not not getting dragged into trades that do not fully present themselves. The clues have been there. The carrot has been continually dangled however as risk managers... You know how the saying goes.

We stay true to our trading plan.

We hold firm with what we know works.

We are aware of our market edge.

We know our "perfect" set up does present itself.

with that said, we are dynamic! We do of course entertain the "Imperfect" setup. We simply approach with caution.

USDJPY LONG FORECAST Q2 W15 D11 Y25

15' of course, bearish start to the Friday. Perhaps we are asking a lot from UJ today but let's see if we can break 15' structure before taking a deeper look.

Bigger picture, We are in a weekly order block in the long direction so all shorts are OFF until further notice.

Best of Luck Traders.

Continue to manager your capital.

FRGNT X

USDJPY_LMAX trade ideas

USD/JPY Bearish Reversal Setup – Short from Resistance ZoneCurrent Price: ~146.252

EMA 30 (Red): ~146.573

EMA 200 (Blue): ~146.662

The price is below both EMAs, suggesting short-term bearish momentum.

📉 Trade Setup:

Entry Point: 146.551 (marked on the chart)

Stop Loss (SL): 148.514 (above resistance zone)

Take Profit (TP): 142.374 (marked as “EA TARGET POINT”)

Risk/Reward Ratio (RR): Approx. 1:2.5+

📌 Zone Analysis:

Resistance Zone: 147.6 – 148.5 (highlighted in purple)

Previous highs rejected from this level multiple times.

Sellers appear to be defending this zone strongly.

Support Zone: 142.3 – 143.0

Previous accumulation zone marked for the TP.

🧠 Bias & Interpretation:

Bearish Bias: Confirmed by:

Price rejection from resistance.

Below both EMA 30 & EMA 200.

Bearish engulfing patterns near the resistance zone.

Potential Strategy: Short from 146.551 targeting 142.374 with tight SL at 148.514.

⚠️ Watch for:

Any bullish crossover between EMA 30 and EMA 200 could shift momentum.

False breakouts above the resistance zone before actual reversal.

Key U.S. or Japan news that may cause volatility.

USDJPY H4 I Bearish ContinuationBased on the H4 chart analysis, the price could rise toward our sell entry at 144.33, which is a pullback resistance.

Our take profit will be at 1141.36, aligning with the 161.8% FIbonacci extension

The stop loss will be placed at 146.47, a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Might going up, but nothing comfirmed. My bias for LSThis is my bias for London session and friday overall.

USDJPY went down alot yesterday due today USA vs CHINA, dont think i have to explain anything.

If sir Trump doesnt do some magic tomorrow we might hit and upward trend and reverse this bearish movement.

2 lines, 1 for resistance and the other for support.

:-)

USDJPY Will Continue Its Down TrendUSDJPY is in a pronounced downtrend.

We expect the price to move at least into the range of the lows from September 2024. Before entering a short trade, however, we recommend waiting for a small return to the entry area shown in order to optimize the RRR. It should also be noted that we are currently in a support zone that formed over the course of last year.

Explosive Rebound on USD/JPY? This Zone Has It ALL...Hi traders! Analyzing USD/JPY on the 1H timeframe, spotting a potential rebound within a descending channel:

🔹 Entry: 144.35

🔹 TP1: 145.59

🔹 TP2: 147.29

🔹 SL: 142.993

Price is currently testing the lower boundary of a well-structured descending channel — a zone that has held as dynamic support multiple times. The RSI is in oversold territory, suggesting the potential for a bullish correction.

If buyers defend this area again, we could see a strong bounce toward the midline and possibly the upper boundary of the channel. Wait for bullish confirmation (e.g., strong candle or volume spike) before entering.

⚠️ DISCLAIMER: This is not financial advice. Every trader must evaluate their own risk and strategy.

USD/JPY "The Gopher" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1D timeframe (148.800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 140.000 (or) Escape Before the Target

💰💵💸USD/JPY "The Gopher" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation Recap ✨

Fundamentals: Policy divergence + trade risks ⚖️ favor JPY 💪.

Macro: US slowdown 📉 + Japan resilience 🌱 lift JPY.

Global Markets: Risk-off flows 🛡️ + yield dynamics 📜 boost JPY.

COT: Speculative unwinding 📉 aligns with bearish pressure.

Seasonality: Mild JPY edge in April 🌸.

Intermarket: USD weakness 💸 across assets aids JPY.

Quantitative: Technicals confirm bearish 📉.

Sentiment: Broad bearish tilt 😟, retail as contrarian 🚨.

Trend Prediction: Downward bias 📉 across timeframes.

Outlook: Strong bearish case 🐻 with clear targets.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

5th wave downWe've been tracking this setup for the past few weeks. The market has formed an Elliott Wave structure, and it looks like Wave 4 is now complete. We're likely entering Wave 5 to the downside.

Stop-loss is placed above the wick, with a minimum target at last week's low.

Game of probability lets see how it goes...

USDJPY UPDATESHello folks, this might be trend for next week.

see chart above, might make a new low?

This is only my view, we still have PPI tomorrow friday.

The idea is LONGS.

This is not a financial advice or trade signals.

Trade wisely base on your own understanding.

Good luck.

SEE you next week for new charts on new pair of shoes, joke. new pair of forex market or indices or crypto.

pewwpeww.

SEE the description not the chart, I totally base on my idea on weekly to this USDJPY.

are we going down?

USDJPY: Long Signal with Entry/SL/TP

USDJPY

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USDJPY

Entry Level - 145.33

Sl - 144.41

Tp - 147.41

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY Moment of truth for the long-term bullish trend.The USDJPY pair has been trading within a Channel Up since the October 17 2022 High and right now the current 1W candle is very close to its bottom (Higher Lows trend-line). This offers a low risk trading set-up.

Confirmed buy will be if the price breaks and closes a 1W candle above the 1W MA50 (blue trend-line), in which case our Target will be July's Resistance at 161.500 (similar to the 2023 Bullish Leg).

If on the other hand it breaks and closes a 1W candle below the Channel Up, turn short and target the 1W MA200 (orange trend-line) at 139.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

usdjpy update live trade and educational breakdown USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.