USDJPY_LMAX trade ideas

USDJPY BUYING SETUPOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

Market Analysis: USD/JPY Eyes Fresh SurgeMarket Analysis: USD/JPY Eyes Fresh Surge

USD/JPY is rising and might gain pace above the 151.00 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 149.55 and 150.00 levels.

- There is a connecting bullish trend line forming with support at 150.30 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 148.20 zone. The US Dollar gained bullish momentum above 148.80 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 149.55. The pair climbed above 150.00 and traded as high as 150.94. It is now consolidating gains and there was a move below the 23.6% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

The current price action above the 150.00 level is positive. Immediate resistance on the USD/JPY chart is near 150.95. The first major resistance is near 151.20. If there is a close above the 151.20 level and the RSI moves above 70, the pair could rise toward 152.50.

The next major resistance is near 153.20, above which the pair could test 155.00 in the coming days. On the downside, the first major support is 150.30 and a bullish trend line, below which the bears could gain strength.

The next major support is visible near the 149.55 level and the 50% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

If there is a close below 149.55, the pair could decline steadily. In the stated case, the pair might drop toward the 148.40 support zone. The next stop for the bears may perhaps be near the 147.50 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Yen Slides as Tariff Concerns LoomMacro:

- The Japanese yen weakened in the last few days as markets eyed the potential impact of upcoming US reciprocal tariffs on key Japanese exports.

- Minutes from the BoJ's Jan meeting showed policymakers remain open to further rate hikes, depending on wage growth and inflation data.

- Recent comments from US President Trump helped ease the concerns about the escalating tariff war, boosting the overall market's sentiment.

Technical:

- USDJPY broke the descending channel to give the first glimpse of a potential trend reversal. The price is hovering around its previous swing high, waiting for a clear breakout to determine the upcoming trend.

- If USDJPY breaks above 151.00 and EMA78, the price may surge further to retest the following resistance at 154.70.

- On the contrary, remaining below resistance at 151.00 may prompt a retest to the broken descending channel and the support at 148.60.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

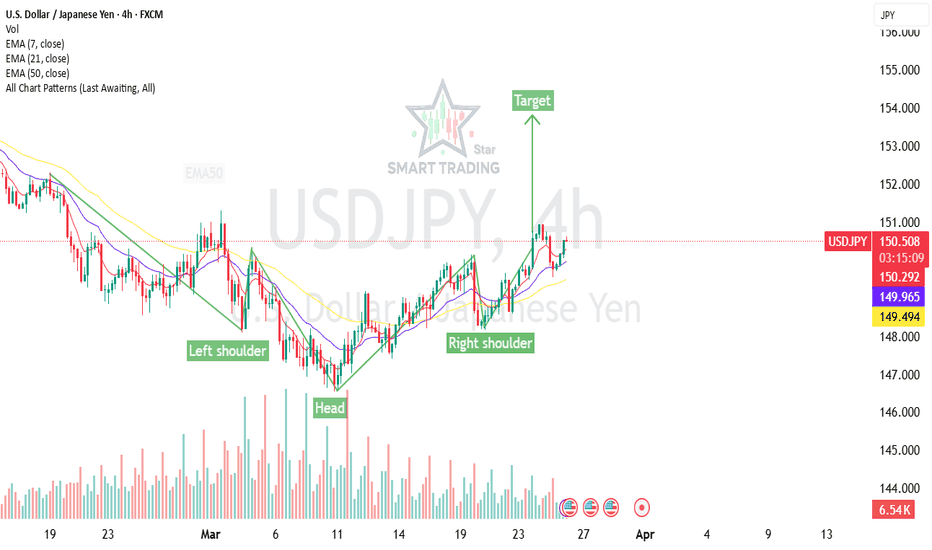

USD/JPY Buy Setup – Inverted Head & Shoulders chart pattern📌 **USD/JPY Buy Setup – Inverted Head & Shoulders** 📌

🔹 **Pattern:** 📈 **Inverted Head & Shoulders** (Bullish Reversal Signal)

🔹 **Entry Point:** ✅ **150.500** (Neckline breakout confirmation recommended)

🔹 **Target:** 🎯 **153.800** (Measured move projection from pattern breakout)

🔹 **Stop Loss:** 🔍 Ideally **below 149.800** (Neckline retest zone or recent swing low)

### 📊 **Analysis & Risk Management:**

✅ **Confluence Factors:**

- **Bullish Chart Pattern:** Inverted H&S suggests trend reversal.

- **DXY Strength:** If USD remains strong, it supports this setup.

- **Yield Differentials:** Watch US-Japan bond yields, as rising US yields boost USD/JPY.

✅ **Risk-Reward Ratio:** ~ **1:5**, making it a high-probability trade.

✅ **Trade Management:**

- If price retests **150.500** after breakout, it could be a strong entry confirmation.

- Secure profits gradually (e.g., **TP1: 152.000**, **TP2: 153.000**, **TP3: 153.800**).

- Use **trailing stop-loss** to lock in gains as price moves higher.

🚨 **Market Caution:**

📅 **Fundamental Watch:** Monitor key news such as:

- **BoJ Policy Decisions** (Any intervention risk if JPY weakens too much)

- **US Economic Data** (CPI, NFP, Fed Statements)

- **Global Risk Sentiment** (If risk-off, JPY may strengthen unexpectedly)

🔥 **Final Tip:** Confirm entry with bullish candle patterns & volume spike on breakout for added confidence.

Happy Trading! 🚀📈💰

USDJPY InsightHello, Subscribers!

I’m glad to see you all. Please share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- According to the Bank of Japan's January meeting minutes, members agreed that if economic activity and inflation outlooks materialize as expected, an additional rate hike would be appropriate due to low real interest rates.

- President Donald Trump met with reporters in the Oval Office on April 2 and stated that tariffs "will create more jobs," emphasizing that his tariffs are fair.

- The market is keeping an eye on the U.S. reciprocal tariffs set for April 2 while also focusing on the PCE price index release on Friday.

This Week’s Key Economic Events

+ March 26: U.K. February Consumer Price Index (CPI)

+ March 28: U.K. Q4 GDP, U.S. February Personal Consumption Expenditures (PCE) Price Index

USDJPY Chart Analysis

USDJPY found support at the lower trendline near the 147 level and has since broken through the upper trendline, expanding its gains to the 151 level. The key focus now is whether it can maintain its uptrend while holding the 149.500 level. If USDJPY remains above 149.500, an upside move toward the 154–155 range is expected. However, if it breaks below 149.500, the pair could decline further toward the 145 level.

USD/JPY(20250326)Today's AnalysisToday's buying and selling boundaries:

150.12

Support and resistance levels:

151.50

150.98

150.65

149.59

149.25

148.73

Trading strategy:

If the price breaks through 150.12, consider buying, the first target price is 150.65

If the price breaks through 149.59, consider selling, the first target price is 149.25

USDJPY NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

USDJPY Trending Lower - Will It Drop To 145.200?OANDA:USDJPY is currently trading within a descending channel, indicating a strong bearish structure. The price has broken below a key support zone and may now pull back for a potential retest. This level previously acted as support and could now serve as resistance, aligning with a possible bearish continuation.

If sellers confirm resistance at this zone, the price is likely to move downward toward the 145.200 target. However, a failure to reject this level could indicate a potential shift in momentum.

Traders should monitor for bearish confirmation signals, such as bearish engulfing candles, strong wicks rejecting the resistance zone, or increased selling volume, before considering short positions.

Let me know your thoughts or any additional insights you might have!

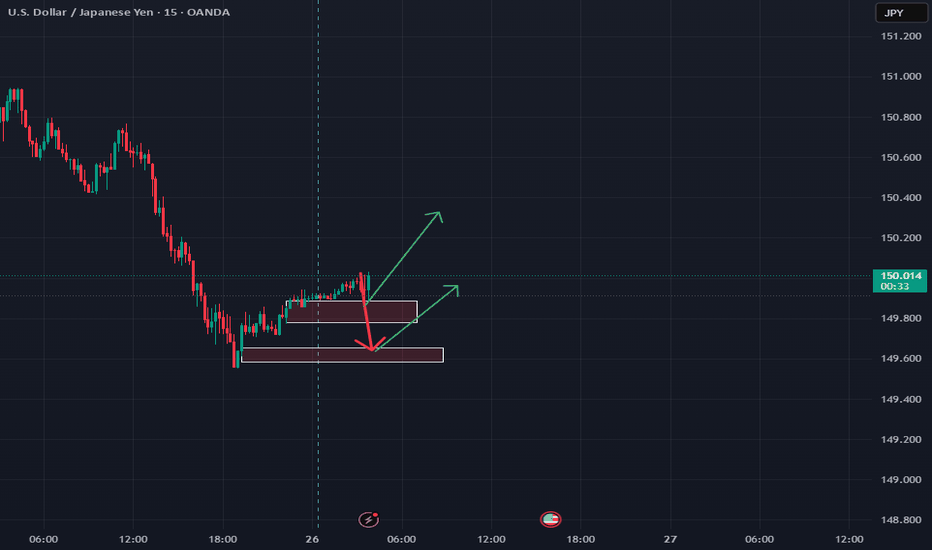

Usdjpy buy limit trade setup Usdjpy has broken structure and has pulled back to our 1hr decisional orderblock and has given a 15min internal ChOCh, best believe, we are all set to rally to the upside, buy limit set and hopefully Asian session drives prices a little lower to trigger our entry before the rally

Yen stabilizes after BoJ minutes hint at tighter policyThe Japanese yen has rebounded on Tuesday after sliding almost 1% a day earlier. In the European session, USD/JPY is trading at 150.11, down 0.39% on the day. The yen weakened to 150.94 in the Asian session, its lowest level since March 3.

The Bank of Japan raised rates at the January meeting for only the third time since the central bank started its tightening cycle in March 2024. At the meeting, the Bank raised rates by a quarter point to 0.5%, its highest level since the 2008 global financial crisis.

At the meeting, the BoJ revised upwards its inflation forecast as members have become more confident that rising wages will keep inflation sustainable close to the Bank's 2% target. The minutes noted that most members agreed that the likelihood of reaching the 2% target was rising.

The minutes reiterated that the BoJ plans to continue to tighten policy, provided that growth and inflation outlooks match the Bank's forecasts. The BoJ has telegraphed that it plans to continue rates but has left investors guessing about a timeline. The most likely dates for the next rate hike are June or July. The BoJ held rates last week, warning of uncertainty in the global outlook, particularly the impact of the new US administration's trade policy. The BoJ is keeping a close eye on the upside risk of inflation, due to the potential of a global trade war as well as rising wages.

Japan released BoJ core inflation, a key inflation indicator, earlier today. The February report came in at 2.2% y/y, unchanged from January and matching the forecast. BoJ core inflation remains at its highest level since March 2024.

USD/JPY 4H Analysis – Potential Bearish RetestThe USD/JPY pair has been in a clear downtrend, trading within a descending channel for an extended period. Recently, price action has broken above the channel, but it is now facing resistance around the 150.35 level.

Retest Zone: The pair is currently retesting the broken trendline, and if it fails to sustain above this level, a rejection could lead to further downside.

Bearish Expectation: If the price fails to reclaim 150.35, a move towards the 147.00 support zone is likely.

Confirmation: A strong bearish candle from this level could indicate a reversal, confirming the downward move.

Traders should watch for price action signals at the retest level before making decisions.

Bearish drop?USD/JPY is rising towards the resistance level which is a pullback resistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 150.14

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 150.92

Why we like it:

There is a pullback resistance level.

Take profit: 148.97

Why we like it:

There is a pullback support that is slightly below the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/JPY Pulls Back After Testing Channel ResistanceUSD/JPY has slipped to 149.67, down 0.66% on the day after stalling near the top of a rising channel. The pair failed to reclaim the 50- and 200-day SMAs, which remain tightly aligned near 151.7, now acting as resistance.

🔺 Price is still inside a short-term rising channel, but today's bearish candle suggests waning momentum.

📉 MACD remains in bearish territory, and while it’s improving, there’s no crossover yet.

📉 RSI at 49.06 hovers at the midpoint, showing a lack of conviction either way.

Key Levels:

Resistance: 151.00–151.75 (confluence of moving averages)

Support: 146.95 (61.8% Fib retracement), then 143.71 (78.6% Fib)

A break below the channel could signal a return to the broader downtrend, while a close above 151.75 would shift the short-term outlook bullish.

-MW

USDJPY Massive Short! SELL!

My dear friends,

USDJPY looks like it will make a good move, and here are the details:

The market is trading on 150.66 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 149.11

Recommended Stop Loss - 151.56

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK