USDMYX trade ideas

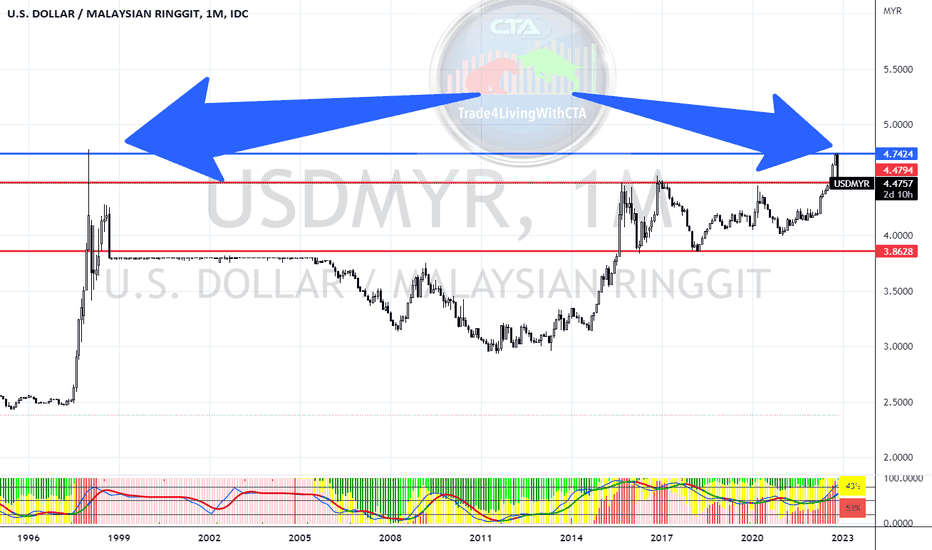

USDMYR : Double TopAfter a quarter of a century , we may see the strengthening of the Malaysian Ringgit. The completion of a 5 wave pattern implies potential weakness in Dollar against the Ringgit augmented with the possible double top formation.

Again, 3rd quarter 2023 to 1st quarter 2024 displayed a triple top with persistent resistance just under 4.8000 also suggest a major top is in place. The subsequent downward thrust fortifies that implication.

USDMYR Prediction for 2025Resistance Zone at 4.75 - 4.80:

The highlighted red zone represents a strong resistance area, where the price has struggled to break through in the past.

The chart indicates a potential test of this resistance.

Potential Price Reversal:

After reaching the resistance zone, the blue arrow suggests an anticipated reversal, where the price could decline significantly. This is consistent with the technical analysis principle of resistance acting as a ceiling for prices.

Bearish Target:

The second part of the blue arrow points toward a significant decline, possibly below 4.00, indicating a bearish outlook for USD/MYR after the potential rejection at the resistance level.

Awesome Oscillator (AO):

The histogram at the bottom shows the Awesome Oscillator, which is slightly negative but appears to be recovering.

If the momentum shifts, it could align with the upward move toward resistance before reversing.

Key Levels to Watch:

4.75 - 4.80: Resistance zone where the price could face selling pressure.

4.00 - 4.20: A potential support zone if the price declines.

U.S. DOLLAR / MALAYSIAN RINGGIT

Price Action: The price appears to be attempting a consolidation near the lower band, which could suggest that the sharp bearish trend may be slowing down or preparing for a reversal.

Recent price action is forming what looks like a potential base around the 4.25 - 4.30 range, though it is too early to confirm a reversal or bottom formation.

Support: The current support zone lies near the 4.30 level, where the price has stalled.

Resistance: Immediate resistance is near the 4.45 to 4.50 range, aligned with the moving average and the upper Bollinger Band. A break above this could suggest a potential shift in the trend or at least a relief rally.

However, strong bearish pressure persists as shown by the successive red candles, suggesting continued selling pressure.

Bearish: The current momentum suggests further downside could occur unless we see a reversal pattern or a break above the moving average.

Title: Ringgit Rally Fuels Foreign Bond Inflows: A Deep DiveThe Malaysian ringgit has experienced a substantial appreciation, driven by robust foreign investment in the domestic bond market. A surge in capital inflows, totaling RM5.5 billion in July alone, has propelled the ringgit's performance. This analysis delves into the underlying economic factors driving this trend, examining key indicators and assessing the outlook for sustained growth. While the current trajectory is promising, investors must remain cognizant of potential global economic headwinds.

Key Points:

Strong foreign inflows into Malaysian bonds

Ringgit's appreciation driven by multiple factors

Deep dive into economic indicators shaping USD/MYR

Assessment of Malaysia's economic fundamentals

Cautious outlook amid potential global challenges

Key Drivers of the Ringgit Rally:

Currency Appreciation: Investors are buying bonds unhedged, betting on further ringgit gains.

Strong Domestic Economy: Malaysia's economic robustness and expected interest rate stability bolster investor confidence.

Global Factors: Anticipated Federal Reserve rate cuts weakening the USD benefit the ringgit.

Economic Indicators Influencing USD/MYR:

Interest Rate Differentials: Higher local rates attract foreign capital, strengthening the ringgit.

Inflation Rates: Low inflation supports currency value.

T rade Balance: Surpluses strengthen the ringgit, reflecting Malaysia's export strength.

Economic Growth: Domestic consumption and government spending drive economic growth, enhancing the ringgit's appeal.

Political Stability: A stable political climate attracts investment, supporting the currency.

Global Economic Conditions: Global trends and geopolitical events affect investor risk appetite and currency flows.

Outlook:

Malaysia's diversified economy, fiscal prudence, and growing middle class underpin the ringgit's strength. Efforts to boost foreign direct investment and exports further support currency appreciation. However, global uncertainties, US monetary policy shifts, and geopolitical tensions could introduce volatility.

near-term target of 4.70RHB Research has not ruled out that the Ringgit may hit RM5.00 against the US dollar in the medium-term.

The forecast from the research house comes as the initial short-term target of 4.60 was surpassed today, leading to a revised near-term target of 4.70, with a potential print at RM4.75.

i like this analysis a lot.leave a commenthi every one

complete pullback to the trendline with 1% profit Potential

The information provided on this Page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. this page does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisio

usdmyr going above 5.0USDMYR successfully retraced and rebounded at weekly 200 moving average.

USDMYR is very bullish uptrend when still above 200 ma weekly.

It will over the previous high 4.8 (might reach 5.2 or more higher), all is depended on the strength of USD index (DXY).

Disclaimer: Own study research, not trading advice.

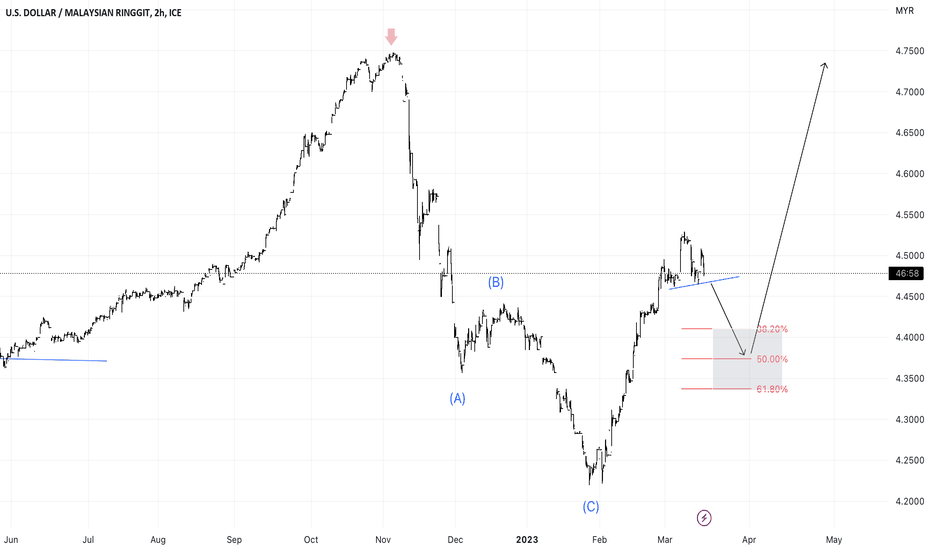

Does MYR make corrections before continuing to surge?We use Elliott Wave Theory to forecast future prices. as simple as the rules. i.e., if wave 4 exceeds wave 1, the counting is wrong, etc., it shall be recounted and changed. The main point is to get the forecast and project the main direction in which we may find opportunities for entries. It is impossible to predict perfect patterns or price points.

USD/Malaysian Ringgit : Major Top ???Prices resisted 2008 high 4.7750 providing a potential double top scenario if further slide in coming days. This week's close was on top of the triangle and at 0.618 retracement value may say otherwise.

Projected values appear at around 5.17-5.22 zone. Are we going to see the recovery of Ringgit against USD with the new Government in place??

USDMYR Simple Chart AnalysisUSDMYR - This chart can use to monitor our country economy too, hopefully the double top here can indicate that our MYR can continue to be strengthen under the unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX