US30 trade ideas

Dow JonesDOW JONES SPOT PRICE

MTF Analysis Price Time Frame Trend

Dow JonesYearly Demand 37,779 HTF UP

Dow Jones 6 Month Demand 36,952 HTF UP

Dow JonesQtrly Demand BUFL 40,077 HTF UP

38,269

Dow JonesMonthly Demand 40,077 MTF Down

Dow JonesWeekly Demand 39,628 MTF Down

Dow JonesDaily Demand DMIP 40,077 MTF Down

39,927

Dow Jones 240 M 39,027 LTF Down

Dow Jones 180 M 38,704 LTF Down

Dow Jones 120 M LTF Down

Dow Jones 60 M LTF Down

38,866

39,021

ENTRY -1 Long 39,628

SL 39,021

RISK 607

Target as per Entry 44,575

RR 8

Last High 44,575

Last Low 37,612

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

US30 BULLS WILL DOMINATE THE MARKET|LONG

US30 SIGNAL

Trade Direction: long

Entry Level: 41,378.4

Target Level: 43,046.4

Stop Loss: 40,263.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

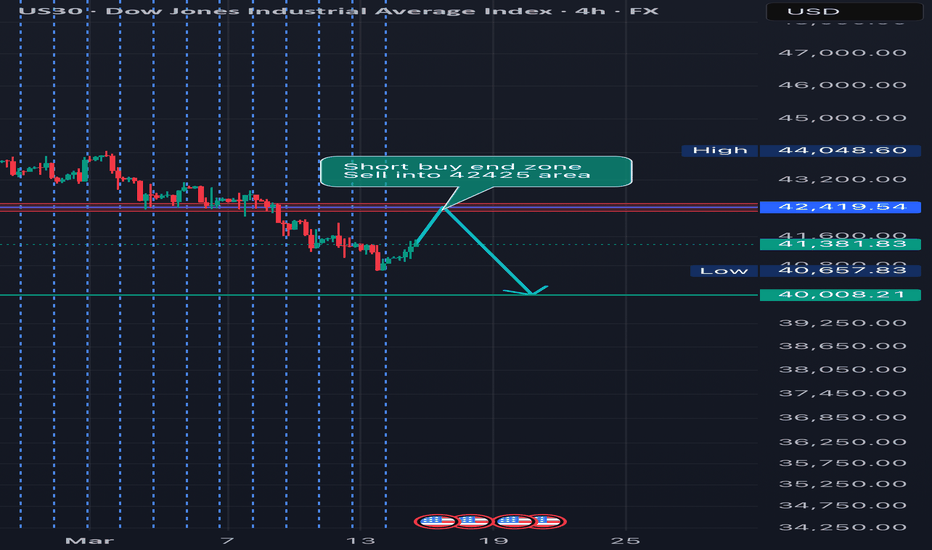

US3O 4H #DOWJONES – Key Levels & Trade Setups

🔻 Sell Setup: If price fails to hold above resistance, targeting 39400.

🔹 Risky Buy: If no lower low forms, possible buy with reduced size.

🚀 Bullish Confirmation: Break & retest of 41760 activates 42800 → 43000 → 44300.

⚡ Market conditions favor quick reactions—stay sharp!

Major Correction $DJI 2027Using previous dates of major market corrections to try and determine the next market correction (crash). Using major crashes I concluded the amount of bars it took from one correction to the next, and created a regression equation to conclude the next predicted market crash.

660/258 = 2.55

258/132 = 1.95

132/x = x

2.55

1.95

≈0.7647

1.95×0.7647≈1.49

132/x = 1.49

x≈88.59

x= 88 Bars +-1

= Monday May 3rd 2027

This is just an idea, does not hold much weight, just thought I would publish to keep a record of my idea.

appreciate any thoughts or comments.

US30 - Testing Key Resistance.How I see it:

US30 is testing a key confluence of resistance.

A break and hold above key resistance-

Potential "LONG" Targets:

TP 1 = 41948.00

TP 2 = 42349.00

Rejections @ key resistance-

Potential "SHORT" Targets:

TP 1 = 40335.00

TP 2 = 39825.00

Thank you for taking the time to study my analysis.

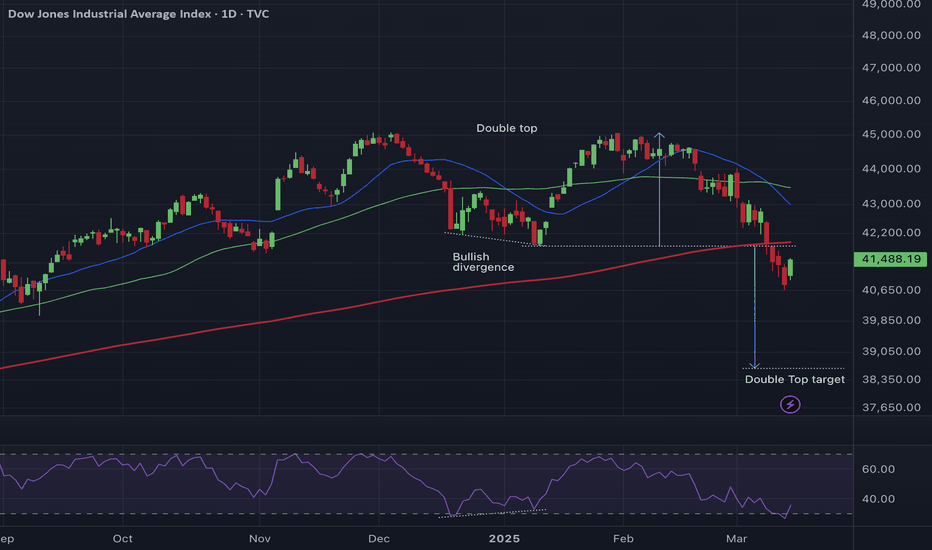

$DJI with rear green dayRear green day for the Industrial Average. Weekly charts are at crucial support trend line since 2020 low. The daily chart printed green day on Friday, but the Double Top target is further down. If we don't see a meaningful reversal in the next couple of days, the bleeding will continue

DowJones The Week Ahead 17th March '25Dow INTRADAY bearish & oversold capped by resistance at 200 DMA

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

"US30 / DJI" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30 / DJI" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (44200) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 42200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"US30 / DJI" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

🟣Fundamental Analysis

Earnings: Q4 2024 EPS growth strong (e.g., 16.9% for S&P 500 proxies)—bullish, but US30 firms face tariff uncertainty.

Rates: Fed at 3-3.5%, no cuts signaled—real yields ~1% (10-year Treasury 3.8%) pressure equities—bearish.

Inflation: PCE 2.6% (Jan 2025)—persistent inflation supports Fed stance, bearish for stocks.

Growth: U.S. consumer spending wanes (Schwab)—mixed, neutral impact.

Geopolitics: Trump tariffs (25% Mexico/Canada, 10% China)—short-term volatility, long-term bullish for U.S. firms.

🟤Macro Economics

Federal Reserve Policy: The Federal Reserve has been raising interest rates to combat inflation, which has led to a strengthening of the US dollar.

US Economy: The US economy has been showing signs of slowing down, with GDP growth rates decreasing.

Global Economy: The global economy has been experiencing a slowdown, with many countries experiencing recession.

⚪Commitments of Traders (COT) Data

Speculators: Net long ~55,000 contracts (down from 65,000)—cooling bullishness.

Hedgers: Net short ~60,000—stable, locking in gains.

Open Interest: ~125,000 contracts—steady global interest, neutral.

🔴Market Sentimental Analysis

Bullish Sentiment: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Sentiment: Many investors expect a correction, with a potential target of 42200.

Risk Aversion: The market is experiencing risk aversion, with investors seeking safe-haven assets.

🔵Positioning Analysis

Long Positions: Some investors are holding long positions in US30, expecting a breakout above 45,000.

Short Positions: Many investors are holding short positions in US30, expecting a correction.

🟠Quantitative Analysis

Technical Indicators: The 14-day Relative Strength Index (RSI) is at 45, indicating a neutral sentiment.

Moving Averages: The 21-day Simple Moving Average (SMA) is at 44,404, providing resistance for US30 prices.

🟡Intermarket Analysis

DXY: 106.00—USD softness aids equities—bullish.

XAU/USD: 2910—gold rise signals risk-off, bearish for US30.

NDX: ~20,000, tech softening—correlated pressure on US30—bearish.

Bonds: U.S. 10-year 3.8%—yield stability neutral.

🟢News and Events Analysis

Federal Reserve Meeting: The Federal Reserve is scheduled to meet on March 15-16, with investors expecting a potential rate hike.

US Economic Data: The US economic data, including the Non-Farm Payrolls report, is being closely watched for its impact on US30 prices.

🟣Next Trend Move

Bullish Trend: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Trend: Many investors expect a correction, with a potential target of 42,200.

🔴Overall Summary Outlook

Bullish Outlook: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Outlook: Many investors expect a correction, with a potential target of 42,200.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DOW JOUNES WEAK TREND

41600-41300

Support: This is a price level where a downtrend can be expected to pause due to a concentration of demand. For the DJIA, support levels are often identified by looking at previous lows or using technical indicators like moving averages.

Resistance: This is a price level where an uptrend can be expected to pause due to a concentration of supply. Resistance levels for the DJIA can be identified by looking at previous highs or using technical indicator

dow up sideDow up side best move ment dow

Support: This is a price level where a downtrend can be expected to pause due to a concentration of demand. For the DJIA, support levels are often identified by looking at previous lows or using technical indicators like moving averages.

Resistance: This is a price level where an uptrend can be expected to pause due to a concentration of supply. Resistance levels for the DJIA can be identified by looking at previous highs or using technical indicator

Dow Jones 3-daily OutlookLooks like a confirmed double-top, might turn into a Head/Shoulders even.

Head Shoulders:

A common scenario with these is, it looks like a double top, then has a strong reclaim of the neckline, which is around 41.9k, and then a 2nd loss of it shortly after w/ yet another re-test with failure to reclaim.

Double Top:

Another common scenario is just a re-test and failure to reclaim, and this is a textbook double-top.

50/200 3-daily EMAs and MAs:

After losing the 50 EMA and MA, we keep dropping below the 200 EMA and MA on the 3 daily chart during stronger dips, and then finally recovering back above both.

Recovery or Recession?

Recovery:

If we want to see a recovery, we need to do that again. So, a strong move back above the 200 and 50 EMAs/MAs after losing both, down to around 38.5k and then 37.5k, possibly as low as 36.3ish.

Or, for a more immediate flip to bullish, we need to reclaim ~41.9k during any re-tests, and then head to a new ATH above 45k.

Recession:

If we don't bounce from just below the 200 EMA and MA, we might see an extended move down or even a recession.