USTEC trade ideas

NAS100 I Potential Gap Fill and More Growth to 21,000Welcome back! Let me know your thoughts in the comments!

** NAS100 Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

NAS 100 LONG 2000 POINT MOVE TO BE CAUGHT LIVE TRADE Nasdaq 100 Technical Analysis

The Nasdaq 100 has broken above the 20,000 level, an area that, of course, has a lot of psychology attached to it in the pre-market trading on Monday, and as a result, I’m watching this index very closely because one of my main criteria for getting interested in buying the NASDAQ has been whether or not we can close above this level. If we can, then it’s very possible that we will continue to go higher. After all, it would make a certain amount of sense to see a bear market rally, especially after the extreme negativity of this market. But as things stand right now, I would anticipate that volatility continues.

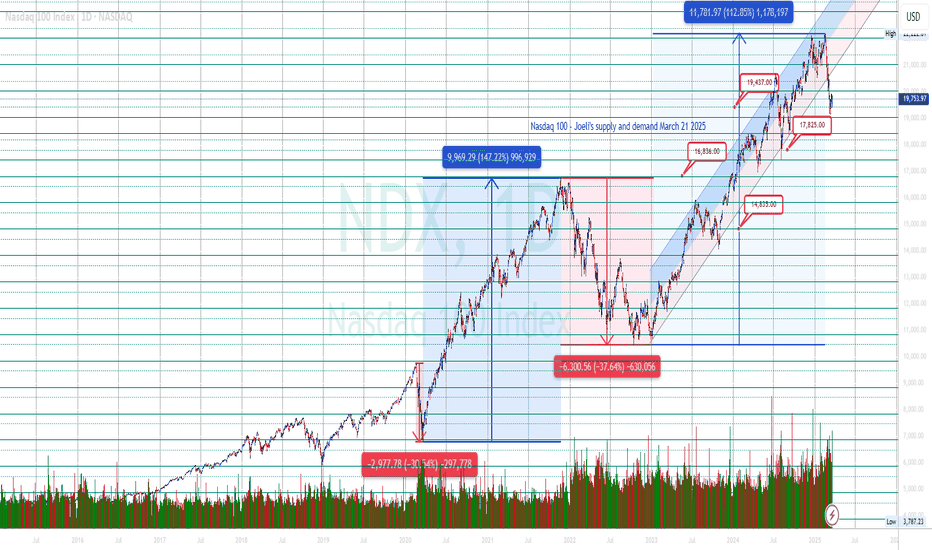

NASDAQ The recovery has officially started.Nasdaq (NDX) has been trading within a 2-year Channel Up and with today's opening, it broke above the Lower Highs trend-line of February's Bearish Leg. Even though the confirmed bullish reversal signal technically comes above the 1D MA50 (blue trend-line), we already have the early bottom signals.

First and foremost, the 1D RSI rebounding from the same oversold (<30.00) level where all major Higher Lows of the Channel Up did (August 05 2024, April 19 2024, October 26 2023). Every time the price reached its -0.5 Fibonacci extensions following such bottoms. Also each Bullish Leg tends so far to be smaller than the previous.

As a result, targeting a +24% rise (-3% less than the previous Bullish Leg) at 23500 is a very realistic Target technically, as it is considerably below the -0.5 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

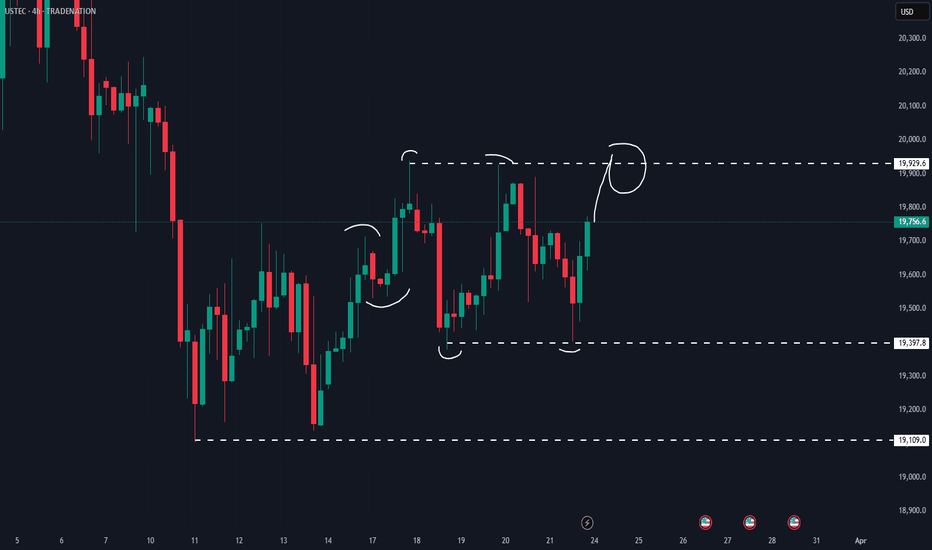

USTEC (NASDAQ 100) Analysis – 30M Timeframe

1️⃣ Market Structure & Current Position

Current Price: 19,758

Recent Swing Low: 19,200 (March 14)

Recent Swing High: 19,900 (March 20)

Key Observations:

The market is ranging between 19,200 – 19,900.

Breakout above 19,900 could trigger a strong rally due to thin liquidity above.

If rejected, price could retest 19,600 or 19,200 before resuming upside.

2️⃣ Key Technical Levels (Support & Resistance)

Support Zones (Demand Areas)

19,600 – 19,650 → High volume node, key retest level.

19,200 – 19,250 → Major liquidity zone, potential bounce area.

Resistance Zones (Supply Areas)

19,900 – 19,950 → Immediate resistance, key breakout level.

20,400 – 20,450 → Fibonacci 1.618 extension.

20,850 – 20,900 → Fibonacci 2.618 extension, potential exhaustion zone.

📌 Gann Confluence Levels:

19,800 – 19,850 → 1/8th division of the last major range.

20,250 – 20,300 → 2/8th division, possible reaction point.

3️⃣ Probable Scenarios & Probability (%)

📈 Bullish Scenario (70% Probability)

Break & Retest of 19,900 → Target 20,400 – 20,850.

Confirmation: Volume spike above 19,950 & bullish close on H4.

Wave 3 of Elliott Cycle could push price to 20,900 if momentum is strong.

📉 Bearish Scenario (30% Probability)

Rejection at 19,900 → Drop to 19,600, possibly 19,200.

Confirmation: Bearish engulfing candle below 19,750 & increase in sell-side liquidity.

If 19,200 breaks, expect deeper pullback to 18,900 – 18,800.

4️⃣ Conclusion & Trading Strategy

🎯 Bias: Bullish above 19,900, cautious if rejected.

✅ Long Entries:

Break & Retest of 19,900 → TP1: 20,400, TP2: 20,850, TP3: 21,300

Aggressive Buy: Bounce from 19,600 with strong bullish rejection.

❌ Short Entries:

Rejection from 19,900 → Target 19,600 & 19,200.

Aggressive Short: If price fails to break 19,750 with increasing sell volume.

🎯 Stop Loss Levels:

For Longs: Below 19,500.

For Shorts: Above 20,600.

🚀 Final Thoughts

If USTEC clears 19,900 with volume, we could see an explosive move to 20,400 – 20,850.

If rejected, price may revisit 19,600 – 19,200 before another breakout attempt.

NQ: Weekly/Daily AnalysisGood Week and Day!

Finally, buyers showed up late Friday and market opened with a gap up. Both Asian and European sessions continued the move up. We should expect NY session to continue up.

Few notes here:

1- As I mentioned it few times now, this is not "buy the dip", this is just to allow large hands to clear their positions. The chart identifies the VA area to sell.

2- The ST/MT/LT outlooks for all US Equities is Sell. Unless, major change happens to US policy (i.e., tariffs, bullying) which it has 0.0001% chance! The self-inflicted destruction is so amazing! Three months ago, US economy was almost the only solid economy worldwide!

3- April 2nd: tariffs come into effect.

3- Money is fleeing US market towards BRICS and European Markets.

So, for this week, price will continue up until 20500-20700 area.

We have key economic data to fuel the move up. But it won't change anything fundamentally. The damage is structural. So good news is good news for Equities, but bad news it will be neutral.

NAS100 - Potential TargetsHow I see it in the shorter term:

KEY LEVEL OF CONFLUENCE, NOW SUPPORT @ 19960.00

Potential "LONG" -

TP 1 = 20490.00

TP 2 = 20834.00

Potential "SHORT" - To Fill Imbalance

(Requires a break and hold below KEY SUPPORT)

TP 1 = 19975.00

Keynote:

Stocks had a GAP weekly open, which indicates potential bullish momentum.

At some point the GAP needs to be filled.

Thank you for taking the time to study my analysis

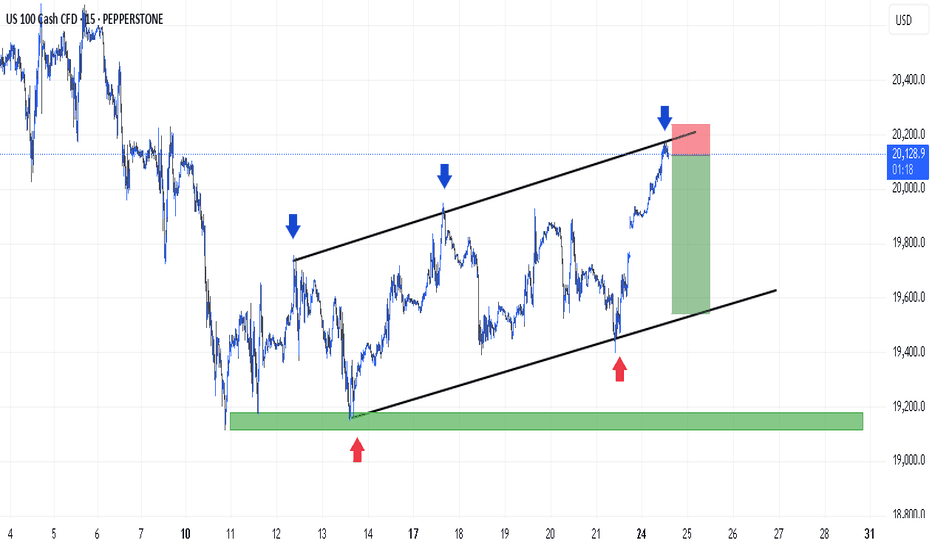

Nasdaq short: Hit Previous High and 2 Fib Ext TargetsAs explained in the video, I have 3 hits that suggests that we have hit the peak for Nasdaq:

1. Hit previous high made on 20th March 2025.

2. Fibonacci Extension where wave 5 = 1.618x Wave 1.

3. Entire wave e = 2.618x Wave 1.

Important here is the stop loss of around 19978. This is a positional play, meaning to ride this position if it goes in our favor.

Good luck!

NAS100 Analysis: Potential higher timeframe pullback in playOn the higher timeframe, NAS100 remains bullish. However, recent price action suggests that a higher timeframe pullback may be underway, providing a discounted price opportunity.

On the daily chart, a market structure shift occurred when NAS100 broke below the 20,477 level. The most recent price action indicates a short-term pullback to the upside on lower timeframes, potentially to mitigate the internal supply zone and reach premium price levels.

I am closely watching the 61.80% Fibonacci retracement level around 21,028 for potential selling opportunities, with downside targets at 19,113 and 18,297.

How Are You Trading NAS100 This Week?

Share your thoughts in the comments!

If you found this analysis helpful, please support it with a boost. Also, follow for more updates!

NAS100 Sell-Off Isn't Over Yet! | Watch This Key Level for the NAfter a major sell-off, NAS100 still shows strong bearish potential. We're currently seeing price consolidate in a 4-hour range, and all eyes should be on a potential pullback to the trendline or range high. In this video, I break down exactly what I’m watching for the next high-probability short opportunity.

NDX using HiLo Ema Squeeze bandsUsing Hio Ema Squeeze band you can quickly find support/resistance levels as confirmed here with the trend lines. Here I have used 1000 for all the bands, this makes it look cleaner.

Another trick is use two bands one with 200,1000,1000 and the other with 1000,1000,1000 and you will double squeeze bands resulting in one with 200 and other with 1000

Nasdaq 3DThe price is moving within an ascending channel and, after a retracement to its resting zone around the 0.5 and 0.618 Fibonacci levels, it is showing signs of a bullish reversal.

Given this structure, look for long trade opportunities in the lower timeframes in the upcoming week, especially if bullish price action confirmation appears.

NAS100 - Market BreakdownHi all,

Here we have NAS100 and we will be assessing what price has done and where it might be going

So far we can see that price has made a hard run down to sell side Liquidity, although we have seen some consolidation at this current zone we can also notice that price still has an area to fill further down with left over Imbalance

I would like to see either of the two following situations happen before getting into any trades

1. Rejection this Resistance level and take sell side Liquidity further down and reject the Demand zone from that level.

OR

2. Break out of this current consolidation range and break above resistance to further retest that level before looking for buy trades, in this situation we will have seen a Shift in the market taking out this Protected high of which would give me confluence to buy

Follow me if you would like to see more or message for any questions.

Cheers and good luck

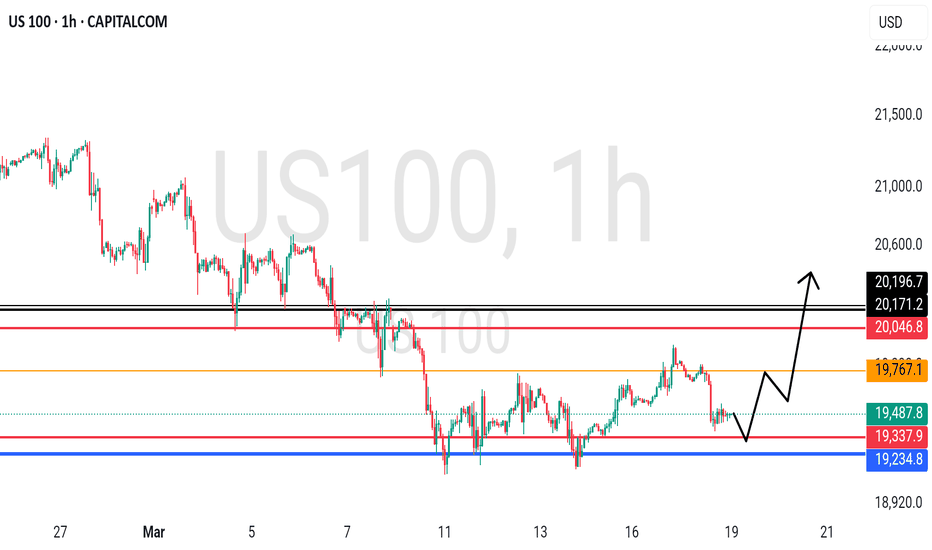

Nasdaq 100: First Stage of a Major CorrectionThe Nasdaq 100 has plummeted over 11% from its record high of 22,222. With prices now testing key support at 19,437, the index closed slightly higher at 19,753 (+0.39%) on Friday. However, weakness remains evident, indicating the first stage of a potential major correction. Historically, corrections unfold in four stages as part of a healthy market reset.

If support at 19,437 holds, a short-lived rebound could target 19,932, 20,054, 20,433, 20,744, and potentially 21,050. Failure to maintain this level could trigger stage two, aiming for 17,825. Historical patterns suggest a possible four-stage correction of around 33%, targeting approximately 14,835.

US100 NASDAQ TRADE IDEA 24 MARCH 2025The Nasdaq 100 (US100) recently broke below its long-term ascending channel, signaling a potential shift in market structure. A Break of Structure (BOS) around the 19,800 level suggests that sellers are taking control, with a possible retest of the 19,700 - 20,200 supply zone before further downside. The price action indicates a liquidity grab above 20,758, followed by strong bearish momentum, confirming institutional participation. Additionally, a fair value gap (FVG) between 19,000 - 18,155.9 suggests that price may seek to fill this imbalance before reaching demand at 18,155.9 - 17,699.3, with a deeper support zone at 16,572.0 acting as a key target for bearish continuation.

From a fundamental perspective, ongoing US-China trade tensions, particularly restrictions on semiconductor exports, could weigh on major tech stocks such as Nvidia and AMD. If China retaliates with bans on rare-earth metal exports, it could disrupt global supply chains, further pressuring the Nasdaq 100. Additionally, Federal Reserve policy uncertainty plays a crucial role. If inflation remains stubbornly high, the Fed may delay rate cuts, leading to higher bond yields, which typically make riskier tech stocks less attractive. This environment could drive further downside for Nasdaq-listed companies. Moreover, the upcoming earnings season presents another risk. If major tech firms like Apple, Microsoft, and Google report weaker-than-expected earnings or issue cautious forward guidance, investor sentiment could deteriorate, accelerating the bearish trend.

Given this confluence of technical and fundamental factors, a short trade setup becomes favorable. The ideal entry would be around the 19,700 - 20,200 supply zone, with a stop-loss above 20,500 to invalidate the bearish setup. Take profit targets include 18,155.9 (first demand zone), 17,699.3 (major liquidity level), and 16,572.0 (higher timeframe support and strong demand zone). However, if price reclaims 20,500+, a bullish reversal may occur, with potential upside towards 22,138.3. This trade aligns both Smart Money Concepts (SMC) and supply and demand principles, while also factoring in macroeconomic risks that could influence Nasdaq 100 price action in the coming weeks.