USTEC trade ideas

NASDAQ 55% dip coming? The next two weeks are critical...I haven't posted on here in a minute but the NAS is looking weak, along with the SP and DOW, but mainly the SP and NAS. The next two weeks are critical to the remainder of the year. If we breach the 2024 high and close below it in January, I anticipate more lows. If we breach above it, and can hold above it through mid-February, we're probably looking at another bullish year.

My analysis points to a consolidation with bearish intent on the horizon, with a potential target of 9,800.

The tools I used in this video are liquidity techniques.

This is a macro/yearly analysis.

There is no "setup" I only use yearly outlooks to help me gauge sentiment.

The possible catalyst for us to breach and reverse the 2024 high could be inauguration. The time window to monitor is now through the Super Bowl.

If you want to learn my style of trading I'm opening a group this summer, give me a follow on trading view and I'll reach out to you when it launches.

....

I apologize for any noises in the background, and my explanations being a little scattered, I'm busy but wanted to get this analysis done real quick before it was too late, or I forgot, I've been meaning to post this since early December.

Nas 3/31/2025I am working on looking at the bigger picture, and this is what I am seeing with NAS.

I do not have the percentages and what not correct on my GANN box just FYI, but that would be the zone I am watching. I think she may go a little higher, but then after that, there is a strong support line from August 2024 not far below, that I think she will continue to drop down too, and then decide which trend she want's to go for from there. lol

Yes, NAS is a girl to me.

She is too indecisive, not to be, lol

Nasdaq 100 Opens the Door to a New Bearish TrendThe Nasdaq has been one of the indices showing the strongest selling bias in recent sessions. Over the past four trading days, it has fallen by more than 7% , as the market remains gripped by uncertainty surrounding White House trade policies and the threat of a new trade war. The proposed 25% tariffs on several countries are expected to take effect on April 2, and so far, there has been no official indication of a change in schedule. This has increased fears of a potential global economic slowdown, and if these conditions persist, it could further pressure equity indices, especially those already showing strong short-term bearish momentum.

New Potential Downtrend

Since February 20, the Nasdaq has been experiencing consistent selling pressure, driving the index below the 19,000-point level. Recent bullish attempts have so far failed to break through this new downward trendline, which now stands as the dominant technical structure for the index. If selling pressure remains intact, the current bearish trend could extend over the coming sessions.

ADX Indicator

Although the ADX line remains above the 20 level—generally considered the threshold for trend strength—it has been sloping downward, suggesting that the recent buying momentum may be losing strength, potentially leading to a short-term pause in market activity.

RSI Indicator

The Relative Strength Index (RSI) shows a similar picture. The RSI is hovering near the oversold zone at 30, and a bullish divergence has formed, as the Nasdaq has made lower lows, while the RSI has posted higher lows. This could indicate that selling momentum may be weakening, potentially paving the way for a short-term bullish correction.

Key Levels:

20,500 points – Distant resistance: This level aligns with the 200-period moving average. Price action approaching this area could revive bullish sentiment and potentially invalidate the current downtrend visible on the chart.

19,700 points – Near resistance: This level marks the upper boundary of the short-term descending trendline. It may serve as a tentative area for corrective upward movements in the upcoming sessions.

18,800 points – Key support: This level corresponds to 2024’s neutral price zone. If the price breaks below it, it could reinforce the current bearish trend and lead to further downside.

By Julian Pineda, CFA – Market Analyst

US 100 Index – All Eyes On President Trump!Risk sentiment crumbled on Friday, taking the US 100 down 3% and within touching distance of its 2025 lows at 19113 from March 11th. More importantly it brought the index to a potentially crucial first retracement support level at 19065. Further details on this in the technical section below.

The weekend brought little in the way of positivity, with protests against Tesla and Elon Musk across Europe, and comments from President Trump stating he ‘couldn’t care less’ if automakers raise prices in response to his 25% tariff on imported vehicles, as US consumers will buy American cars.

Regarding ‘Liberation Day’, as he calls it, which is Wednesday April 2nd, where he has previously promised to impose reciprocal tariffs on all trading partners, he stated late on Sunday that ‘You’d start with all countries, so let’s see what happens’, which indicates he is in no hurry to back down. Although, as we all know, President Trump is unpredictable, so anything is still possible!

So, at the start of a potentially pivotal week for the direction of the US 100 index moving forward into the start of Q2 its probably no surprise to see it probing lower levels again. The focus for traders is likely to remain on the scope and size of the tariffs President Trump imposes, whether there are any reprieves or reductions provided to certain countries, and the extent of retaliatory action taken by trading partners such as the EU.

Concerns over the strength of the US economy also remain a hot topic for traders and in that regard, there is some tier 1 data to consider across the week. The ISM Manufacturing PMI (Tuesday 1500 BST), ISM Services PMI (Thursday 1500 GMT) and then the Non-farm Payrolls (Friday 1330 BST) update all have the potential to impact the direction of the US 100 index.

Oh, and did I forget to mention that the week finishes with Fed Chairman Jerome Powell speaking at 1625 BST on Friday? It really is a week that has it all!

Technical Update: 38% Retracement Support to Hold Again or Give Way?

Perhaps with the benefit of hindsight, it wasn’t too much of a surprise that having seen the US 100 index trade to the March 11th low of 19113, a reactive recovery materialised.

As the chart above shows, the decline was a 14% move within a 4-week period between February 18th to March 11th, although perhaps more importantly, it approached support at 19065, which is the 38.2% Fibonacci retracement of October 2023 to February 2025 strength.

Traders will often focus on retracement levels within sharp phases of price activity, as potential support or resistance, from which reactive moves can be seen. It might be argued this was the case within the US 100 index.

Interestingly, as impressive as the recovery from the March 11th low appeared, this was held and reversed by resistance at 20307, which is the 38.2% Fibonacci retracement of February to March weakness. See chart above.

What Now?

It would seem within the coming week, the first potential support to monitor on a closing basis is still the 19065 retracement, with 20307 continuing to represent possible resistance.

While closing breaks of either of these levels won’t guarantee a significant price movement with much still dependent on the outcome of events across the week, a closing breakout may lead to a more extended price move in the direction of any break.

Support: Closing breaks under the 19065 support might suggest resumption of recent declines, with risks possibly then emerging to test 18111, which is the deeper 50% retracement, may be even further if this is in turn breached.

Resistance: If 20307 is broken to the upside on a closing basis, it may lead to a further retracement of the February to March weakness, with the 50% level standing at 20679, or even 21050, which is the higher 62% retracement.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

NAS100 - Stock market still in a downtrend?!The index is trading below the EMA200 and EMA50 on the 4-hour timeframe and is trading in its descending channel. If the index moves down, it will be clear that it is heading for further moves. At the channel ceiling, I could be close to the next sell-off.

As the new US tariffs are set to take effect on April 2, new evidence suggests that they may be less than the markets had expected. According to a recent report in the Toronto Star, Canada is likely to face the lowest level of tariffs, while Mexico, another member of the US trade agreement, is likely to face a similar situation. In addition, Trump’s recent statements about significant progress in controlling fentanyl (an industrial drug), are seen as a positive sign for improving trade relations.

In this regard, CNBC reported that VAT and non-tariff barriers will not be taken into account in calculating the tariff rate, or at least not fully. The main concern is that by threatening to impose a 25% tariff, Trump is actually preparing Canada and Mexico to accept higher rates than the current conditions. It seems that his goal is to impose the highest possible tariff level. This decision could be an incentive to increase tariff revenue to reduce taxes. Of course, such an approach is associated with high risks, since any level of tariffs can lead to retaliatory measures from trading partners.

In the case of Europe, tariffs imposed on American goods are higher than in other countries, but a large part of them relate to the automotive industry. Europe has previously announced that it is ready to reduce these tariffs. The question now is whether the EU will take a different approach than Mexico and Canada? That is, first impose higher tariffs and then negotiate to reduce them.

This scenario could ultimately benefit the US economy, as the bulk of its trade is with Mexico and Canada. Meanwhile, China remains a complex challenge, as it is the main target of Trump’s tariff policies. In addition, the US president recently proposed imposing tariffs on Venezuela, which could be a pretext for intensifying trade pressure on China. Polls show that 50% of the market expects new tariffs on China, which indicates the level of investor concern.

The European Union has reacted to the Trump administration’s decision to impose new tariffs on imported cars and expressed regret over the move. European Commission President Ursula von der Leyen has said the bloc will seek a negotiated solution to ease tensions, but she has also stressed that Europe’s economic interests will be protected against US trade policies.

The US credit rating has risen to a new low, according to a new report from Moody’s, which warns that tax cuts and trade tariffs could widen the country’s budget deficit.

Analysts at Goldman Sachs and Deutsche Bank say investors expect the effective tariff rate on all imports to be between 9% and 10%, although some analysts at Goldman Sachs have suggested a rate of 18%. However, inflation and exchange rate expectations point to lower figures.

If Trump’s promise of “reciprocal tariffs” is implemented, the effective tariff rate could be even lower than 5 percent, although this depends on whether the agricultural sector is also subject to tariffs. Some reports also suggest that non-tariff barriers may be completely ignored.

According to Deutsche Bank, it is very difficult to determine market expectations precisely. But if the tariff rate ultimately falls between 5 and 7.5 percent, markets are likely to react with more confidence. Otherwise, more volatility and turbulence in financial markets are expected.

At the beginning of the year, markets were in a positive and optimistic mood. The Republican victory in the election, the continuation of tax breaks and the possibility of new support packages were among the factors that reinforced this optimism.

However, factors such as the high US budget deficit, the deadlock in Congress and the high inflation rate have now challenged this optimism. Meanwhile, two important support tools that were effective in the past may no longer be as effective:

1. During Trump’s first term, the stock market was of particular importance to him. Even during the COVID-19 crisis, he constantly talked about the stock market and considered it part of his successes.

The term “Put Trump” meant that even if he made harsh statements, he ultimately acted in the market’s favor.

2. But now, in Trump’s second administration, he talks about “short-term pain” and “economic detoxification.” Tariff threats, reduced investment and policy uncertainty have caused the S&P 500 to fall 10% since February. Trump still considers the market important, but he is no longer as staunchly supportive of it as he used to be.

In addition, this week will include the release of a series of key economic data. Including:

• Tuesday: ISM Manufacturing PMI and JOLTS.

• Wednesday: ADP Private Employment Report

•Thursday: ISM services index and weekly jobless claims.

One of the big risks to the markets is that economic data remains weak while the ISM price sub-indices rise. Such a situation could signal a deflationary tailwind. In such a situation, even if the Federal Reserve moves to lower interest rates, it will still be difficult for the stock market to grow.

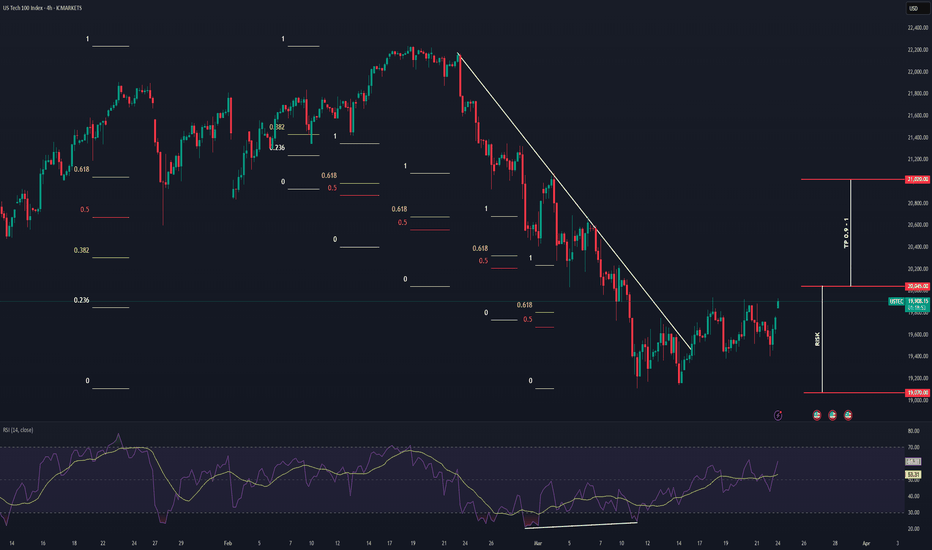

NASDAQ Bullish Reversal (Potential Tariff Resolution?) NASDAQ price action went through a massive correction with a drop from the top worth approx. 14%.

However after the passing of the latest FOMC Meeting, we may finally see a direction towards the resolution of widespread tariff based uncertainty across the macro economic landscape.

This presents us with a potential Reversal opportunity if we see the formation of a credible Higher High (given a potential proper break out) on the 4 HR and shorter timeframes.

Trade Plan :

Entry @ 20045

Stop Loss @ 19070

TP 0.9 - 1 @ 20923 - 21020

2018 - "this time it'll be different"Not really.

Market sentiment echoes an unstable whiplashing and overcooked economy that is accompanied by a hawkish Fed unwilling to slash rates. Sound familiar? So let's overlay 2018 and see if that's when the twists and turns come....

Apr 2 low, Apr 14 high, May 5 low.

As good a guess as any right?

Nas tariff trade idea Looking for nas sells with escalations in tariff war. I will make sure global equities push lower alon with oil pushing lower and recession fears coming back in the market

looking for buys on nas if de escalations happen and we can see oil above 60 and global markets pushing up

NAS100 Stuck in Limbo – Breakout Brewing or Breakdown Coming?The NAS100 is caught in a see-saw of indecision, dancing between trendline resistance above and support below. No need to guess the outcome—momentum will tip its hand soon. We're planning to straddle the move with a one-cancels-the-other (OCO) setup and let the market choose the direction. Stay patient, stay ready.

US 100 - Ranges overview Let's see what the charts are telling us on US 100.

Just like US 30 US 100 retraced and is currently in a redistribution phase.

From a HTF, as long as we hold 16771.6 expect us aggressively trade towards 19000 and 20500.

IF we fail to hold 16771.6 expect us to retrace towards the 16771.6 and 15201 range. Any clean close below 16771.6 and the market will aggressively seek the sellside liquidity around 15201.

As always WAIT FOR THE MARKET TO SHOW YOU ITS HAND.

Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

How I Traded A FULL Multi-Timeframe Wave - AND got PAIDThis week, I tracked NASDAQ from a technical + psychological level most traders avoided… but I saw the opportunity 🔎

While others sat on the sidelines calling it “too choppy,” I:

✅ Identified Wave 5 structure on the 4H + 1H timeframes

✅ Mapped out entries using price action + liquidity zones

✅ Held through 6+ rejections at resistance

✅ Executed with discipline, not emotion

✅ Took partial profits, protected capital

✅ Watched price explode — and I got my 💸

✅ Then wrapped the week with a real withdrawal

📚 KEY LESSONS I’M DROPPING FOR YOU:

📊 Technical Analysis = The "What"

→ Chart patterns, structure, liquidity zones, entries/exits.

🌍 Fundamental Analysis = The "Why"

→ News, interest rates, sentiment.

I stayed focused on the “what” — not the fear headlines.

💡 Liquidity Isn’t Noise. It’s a Signal.

Every rejection I held through was just price loading up.

I didn’t flinch. I let smart money do the work.

💥 Wave 5s test your strategy AND your patience.

I saw smaller TF Wave 5 complete before 4H — so I waited.

I didn’t FOMO back in — I planned for the pullback and possible short flip.

🧠 MINDSET WINS > CHART WINS

🧘🏽♀️ My biggest move this week?

I walked away with clarity — not just profit.

That’s trader growth.

💬 Final thoughts:

You don’t need 100 trades. You need 1 well-managed setup and a calm mind.

📲 Follow me to keep learning how to trade structure, not stress.

NAS100 Triangle Apex – Breakout or Breakdown ImminentBullish View:

• Price is forming higher lows and holding above the lower ascending trendline.

• A breakout above the upper descending trendline near 18,500 would confirm bullish

momentum.

• If the breakout is sustained, potential upside targets include 18,650 and 18,800.

Bearish View:

• Price has tested the lower support trendline and shown weakness near the apex of the

triangle.

• A breakdown below 18,100 would indicate bearish momentum and invalidate the ascending

structure.

• If the breakdown is sustained, potential downside targets include 17,950 and 17,700.

Short Day TradeTook a Short position at the daily EMA9

Entry: 18440

SL: 18690

TP 17950

Went short because today China reacted with a tariff increase on Trump action and Tesla does not take orders in China anymore. Was thinking about shorting Tesla but I decided to stick to the index.

Entry Level was choosen because I expected the price to touch the daily ema9 again (when I woke up it was way below it). The TP is just the intraday low which I expect to be hit again. The SL is a little high, thought about taking the premarket high but considered that this might be the SL for many shorts and it might hit at market open to erase some shorts from the market.

So the Risk Reward Ratio is bad for this trade. If I weren't so bearish for the market I probably would not have taken the trade

In my opinion the upstick of the market was just market manupulation by Trump (who should be impeached over this) and the uncertainty will bring the market much lower

I trade on the 4h chart, the 1h is just to see the progress.

I will close the trade before the market closes, no matter where it is.

NASDAQ BuyPossible reverse to the upside, markets are very volatile and great opportunities to buy at a discount are there. Given the current political climate we could see unexpected large moves in short spaces of time. please exercise proper risk management and dont overtrade, and stick to your plan.

Maybe fast we VA V-shaped recovery in stocks refers to a very sharp and rapid decline in the market (or a particular stock or index), followed by an equally fast and strong rebound. If you look at a price chart, the movement resembles the letter “V”.

🔍 Key Characteristics:

📉 Rapid drop: Often caused by panic, crisis, or a major economic shock.

📈 Quick rebound: Recovery begins quickly after the bottom and moves upward with strong momentum.

⏱️ Short duration: The total period of decline and recovery is relatively brief.

💼 Investor sentiment: Confidence returns quickly, and buying pressure increases.

Im in 17.860 out 18,364 - SL in profit - 18.051

NasDaq100 1 Hr Trade analysis After president trumps tariffs pause announcement on 4/09/2025 Nasdaq rallied saw bullish momentum to $19,200 levels. Price consolidated after around $19,194(resistence) & $18,609 (support) levels. As a break-out trader, we waited for price to break the support level of $18,609. Forming our indication, correction and continuation analysis on the 15min time frame a explained in the video.

Follow on Insta:@phoenixtradingx

IS it about Money or The love of itA lot of us get wavered to the side by the pressure of not having any money at our age, whereas on our sides are boys - girls who are killing it. Sometimes though I feel like if we cared less about money itself and were patient about our existence, we would achieve more, not lazy, but patience, in a content manner. The pressure is not from within, the pressure is external and justified by our fear of not being worth any thing. Let is relax, more years of a solid foundation of overnight success.

Nas100 continuation lower?Good evening traders, I am busy with my market recap and I saw this beautiful idea on nas100/US100 or whatever name your broker uses.

Indices have been pretty bearish from our understanding as we saw price crush, well my thought process when analysing chart is question based, question like did price move above our weekly opening price to give us our manipulation phase in the power of 3, and in this case or in the case of this analysis the answer is yes it moved higher following this week’s open. Today in the 1 hour TF we have a structure shift lower and before we can do anything we need to see price come higher to Atleast the FVG that is marked on the chart, I know ICT teaches deeper about FVG but for me it’s fine for price to completely cover it. Or if maybe the OTE(optimal trade entry) is the method you use to enter trades it’s still fine or even order blocks if maybe you can see any than it’s also completely fine.

Currently price is showing momentum lower and maybe it’ll close prices lower but if we close the daily candle above the midpoint of the weekly gap we can expect price go than trigger the limit.