Nasdaq 100 drops to its lowest level since January 2024Nasdaq 100 drops to its lowest level since January 2024

According to the chart of the Nasdaq 100 (US Tech 100 mini on FXOpen), the index opened this week around the 16,500 mark – a price level last seen in early 2024.

This suggests that the sharp sell-off in equities seen last Thursday and Friday may well continue today.

Stock indices respond to Trump’s tariffs

Treasury Secretary Scott Bessent said on NBC News’ Meet the Press that there is “no reason” to expect a recession.

However, equity charts reflect market sentiment described by CNN Business’s Fear & Greed Index as “extreme fear”. This wave of negativity followed President Trump’s announcement on 2 April of harsher-than-expected international trade tariffs. In response, China and other nations announced retaliatory measures.

As a result, the Nasdaq 100 (US Tech 100 mini on FXOpen) now trades roughly 25% below its 2025 peak – officially entering bear market territory.

Technical analysis of the Nasdaq 100 (US Tech 100 mini on FXOpen)

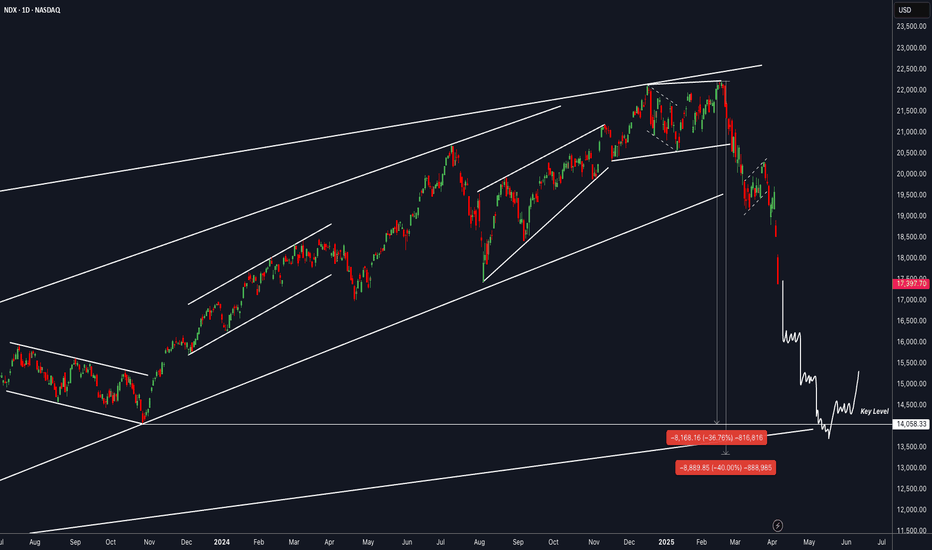

Back on 28 February, we drew an ascending trendline (line A). Bulls attempted a rebound from this support (as shown by the arrow), but their efforts were overwhelmed by the White House’s latest policy decisions.

Given the updated price action, we can now treat line A as the median of an ascending channel. From this perspective, the index is currently near the lower boundary of the channel.

Technically, this could indicate potential support. However, as long as the price remains below the bearish gap – which includes the key psychological level of 17,000 – talk of a meaningful recovery may be premature.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USTEC trade ideas

What Happens Elliott Wave Sequence Completes?Just a quick chart on Nasdaq to show what happens when the Elliott Wave count is completed?

Usually you'd see a major correction. The choice of word depends on the chart time frame. On a monthly chart its still a correction, obviously that is not true for a daily chart where it looks like a SPIKE down.

This chart shows, Wave 5 is terminating within Target zone.

$SPX $NAS100 FILL THE GAP = "LEARNED BEHAVIOR" IN PLAY🏒🏒🏒🏒🏒FILL THE GAP! FILL THE GAP! FILL THE GAP!

Hopefully, institutions want to reach 7,000 from here, as the majority of them wrote in public New Year resolutions.

A great example of learned behavior.

Let’s watch.

FILL THE GAP! FILL THE GAP! FILL THE GAP!🏒🏒🏒🏒🏒

NQ: Upcoming Weekly Analysis!FA Analysis:

ST/MT/LT Outlook: Sell

1- Tariffs came into effect on April 2nd and market reacted badly to it. This was completely expected.

2- NFP data came green but market ignored it and continued the sell-off. This tells you the fundamental change in market expectations vis-a-vis US market! So bad data will be bad for equities and good data will be also bad.

3- This week, we've CPI, PPI and Consumer sentiment as major key data. They'll be fuel to the current fire.

4- The FED was tacit and still data related. The FED is running a risk of a late intervention!

5- Additional retaliations from the rest of the world are also expected. USA is isolating itself from the world economy; the damage is here to stay even if Trump cancel those tariffs or deregulate or cut taxes.

TA Analysis:

Weekly TF:

We got a strong bearish weekly close. A gap down should be added to the weekly candle.

A continuation down is expected.

Daily TF:

NQ provided one of the largest daily candle. Market was down until the last minute Friday! There is no interest to buy the dip at all!

A gap down is expected.

In the case of a gap, price might close the gap and continue down.

Hope we get some retrace to join the sell side during NY session.

Happy week with a lot of green pips!

Potential Bearish SetupThe chart indicates that the US100 index has broken below a strong ascending trendline, signaling a possible shift from bullish to bearish momentum.

📊 Trade Idea:

Entry: On a pullback to the 18,300–18,350 zone (look for bearish confirmation like a reversal candlestick).

Target: 15,500–16,000 area

Stop-loss: Above 18,350 (above the resistance/pullback zone)

Risk/Reward: Favorable setup if confirmed

This setup is based on classic price action: trendline break + pullback + continuation.

US Technology Companies at Great Risk #NDX US Technology Companies at Great Risk

Let's take a look from a fundamental and technical perspective;

If the protests against Trump, who has been in the presidential seat for 3 months, gain strength and reach a level that disrupts economic activity, uncertainty pricing increases in the markets .

Technology-weighted indices such as NASDAQ sell faster in such periods of uncertainty because they are in the ‘risky asset’ class.

The FED's interest rate cut expectations were first postponed, and now the possibility of cancellation is on the table. This creates negative pressure for technology stocks.

2025 Q1 balance sheets have not yet been fully announced. However, growth rates are slowing in many major technology companies, which means an extra threat to NASDAQ.

Let's take a look at the scenarios that could happen this week;

🔴 Protests increase, if the security problem grows:

NDX may fall below 16,700 again.

If panic sales come into play, there may be a decline to around 15,000.

🟢 If protests are quickly brought under control:

Buying comes from 17,000 level, reaction rise starts.

18.500 - 19.000 band can be retested.

🔸This week there was a very sharp decline of -9.77

🔸It is currently at 17.397 , which corresponds to the middle band of the logarithmic channel (black dashed line).

🔸 16,764 - Persistence below this level may lead to sharper selling.

🔸If the price closes weekly below 17,000 , stronger support around 15,000 may be tested.

🔸This decline may also cause large investors to switch to ‘risk off’ mode.

NDX multiple channels, Which one is correct?Channels can be drawn in many ways because of fractal nature of markets. Every one could draw different channels and they all could be valid, So I prefer to draw a few likely ones some short term and others long term and find a cluster of convergence for high probability. No one is perfect

So just presenting what I see in NDX, mot likely ones

I expect Vix to reach 70, levels reached in 2008-GFC and 2020-covid. The tariff is a significant event in American history

NASDAQ tanks below key levels amid new Trump tariffs!The market free-falls as Trump's new tariffs send shockwaves through global sentiment.

Sellers are piling in — but it's the fear of economic fallout that's truly fuelling this drop.

The NAS100 has broken through major support zones with strong bearish momentum.

Sellers are clearly in control, and price action shows little sign of slowing down.

Structure around 18,324 failed to hold. Next major support zone: 16,968.5.

Will the bleeding stop there?

⚠️ Reminder:

No one can predict what will happen next.

Markets react to collective psychology, news flow, and big players—not forecasts.

✅ Focus on:

-Key Levels 🔎

-Market Structure 📐

-Risk Management 🛡️

❌ Don’t trade based on emotion or prediction.

🎯 Trade based on probability, not certainty.

👉 Let price confirm your bias — watch for clear breakouts, retests, or rejections before jumping in.

Stay patient, stay disciplined. 📈📉

NASDAQ Bearish, What's Next?Price respected Weekly's bearish imbalance to continue lower. Still price is within the weekly's context area to which is suitable to look for entries in lower timeframes targeting weekly's swing low (POI).

Once, the Weekly POI get's tagged we might look to continue to the next POI (Point of Interest). Likely, the daily swing lows.

What's Next?

Pontetial target price is 18,537.88.

"NAS100 / US100" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "NAS100 / US100" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (20000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (19400) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 20800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"NAS100 / US100" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US markets have a little more downsideI had posted a similar chart a few weeks ago.....US companies fundamentals may be good, but price follows technicals. There is still some more downside, which I think would be where JPow said Inflation is no longer transitory, then we see some consolidation, then another fall to shake out the bulls, by which time we would reach the bottom of the monthly channel and then uptrend can resume after a bit of consolidation. Remember the Trump tariffs are just catalyst, a reason for market to get where it wants to be sooner. Do remember that market rallied when inflation hit a peak of 9%.....All this news is just noise....You know where the level of interests are and trade accordingly....Markets will not go up in a straight line neither will it go down in a straight line.....The Fear & Greed Index is at 4 as per CNN. This is only for investors, start buying small positions in your favorite stock....only a little, bit by bit, with every fall, or you can wait....Don't put all your savings in the market because it fell substantially...Selling begets selling, the opposite is also true.....Market can head to 14000 as well, I'm not ruling that out, but i'm expecting a really nice bounce from the JPow, however, be very aware of the overhead resistance.....Bears have not had a chance for a long time, and they will squeeze every ounce of blood from the bulls while they can....Just remember, Bulls are complacent, Bears are tactical.....Throughout history that has been the case....

US100 has taken strong support at 17KUS100 has taken strong support at 17K. If it breeaks this support, it will reach to next level of 16 K. After China responded to U.S. tariffs by introducing a 34% tariff on all American imports starting April 10, stock market losses deepened on Friday. This downturn was further triggered by comments from Federal Reserve Chair Jerome Powell, who warned that the impact of a trade war could be more severe than expected. He noted that it could lead to slower economic growth and increased inflation, adding that the Fed is in no rush to cut interest rates in response.

NDX : It's time to take a step backThis is a level I'll be closely watching for making aggressive additions. Until then, only selective entries in U.S. Oil ETFs, Silver and Gold ETFs, and a few individual stocks may be considered. However, large-scale accumulation is not advisable until this level is reached.

I may also consider dollar-cost averaging into index ETFs if I start to see signs of consolidation from here onward.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

NAS100 Turn of the Month Strategy Meets Market Volatility!In this video, we dive into the Turn of the Month Strategy and explore how it could play out in the current market environment. Historically, mutual funds rebalance their portfolios at the end of the month, creating buying pressure that often leads to higher stock prices into the new month. Additionally, recurring financial inflows, such as monthly salary payments and pension contributions, tend to boost market demand during this period.

However, this month presents a unique challenge. The NASDAQ 100 has capitulated into the end of the month, driven by heightened volatility and uncertainty fueled by Donald Trump's rhetoric. With the market currently trading into a significant support zone and liquidity pool, we analyze whether the Turn of the Month effect can counteract the recent bearish momentum.

📊 Key Highlights in the Video:

Price Action Analysis: The NASDAQ 100 is deeply overextended, trading into a critical liquidity pool.

Trade Idea: A potential counter-trend rally could emerge as the market seeks to correct and rebalance.

Strategy: Look for a short-term rally into resistance, followed by a possible shorting opportunity as the market resumes its downward trend.

This video is perfect for traders looking to combine price action trading with seasonal strategies like the Turn of the Month effect. Will the market rally into the new month, or will bearish momentum prevail? Watch now to find out! 🚀

Short Position - NASDAQShort Position Entry: Consider initiating a short position if the Nasdaq-100 Index falls below 21,000.

Stop Loss (SL): Set a stop loss at 21,555 to manage potential losses.'

Market Sentiment: The combination of the Federal Reserve's cautious approach and rising inflation may contribute to a weakening market sentiment, potentially leading to a downward movement in the index.

his recommendation is for educational purposes only. Always consult your financial advisor before making any investment decisions. Stock trading involves risks, including the potential loss of capital. Ensure to evaluate your risk tolerance and conduct thorough research.

A BIGGER PICTURE OF US100 SHOWING A BREAKOUT!Take a look at the bigger picture of US100 from the monthly timeframe. We can understand the nature of price action that has occurred. We can see how price broke out of the rising channel leading to over 68% decline of the total gains made in the year 2024. This further awake traders mindset to whether there’s gonna be a further drop maybe upto a pullback support of 16426.4 or even below.

From the technical standpoint, we may expect -5% more drop before we begin to see some form of recovery.