SILVER h4 bullish pattansilver bullish mode Bearish Disruption Scenario:

Fake bounce to ~$37.00

Rejection → Break $36.00 support

Bear momentum pushes to $35.00–34.50

Neutral/Range Disruption:

Price oscillates between 36.00 and 36.80 for longer than expected — builds up coiled energy before either sharp breakout or breakdown

Only Bullish IF:

Clean reclaim of 37.25 with strong close above

XAGUSD trade ideas

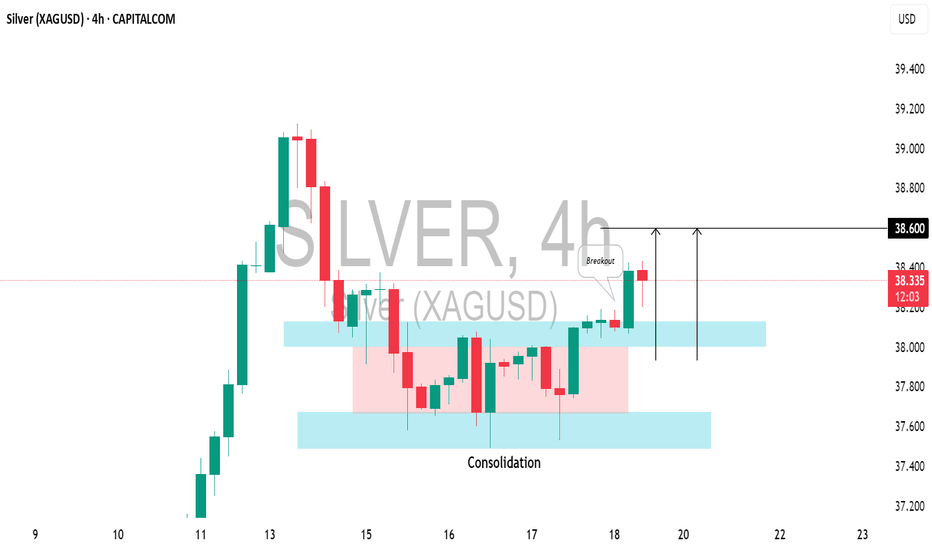

SILVER (XAGUSD): Bullish Move ConfirmedIt appears that the local correction on 📈SILVER has completed, and the pair is shifting back to a bullish trend.

Today's US economic data caused the pair to break through a resistance level within a narrow consolidation range on the 4-hour chart.

The price is expected to rise to the 38.60 level.

XAG/USD (Silver) - Triangle Breakout (09.07.2025)The XAG/USD (Silver) pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3749

2nd Resistance – 3781

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis

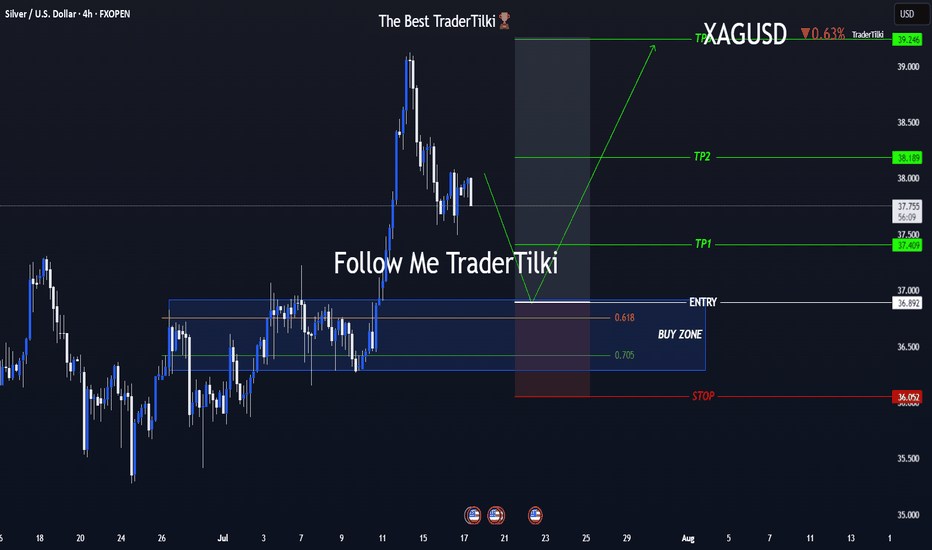

One Shot, Clear Strategy – Silver Buy Zone in SightHey everyone 👋

📌 BUY LIMIT ORDER / XAGUSD-SILVER Key Levels

🟢 Entry: 36,892

🎯 Target 1: 37,409

🎯 Target 2: 38,189

🎯 Target 3: 39,246

🔴 Stop: 36,052

📈 Risk/Reward Ratio: 2,79

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me! Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!

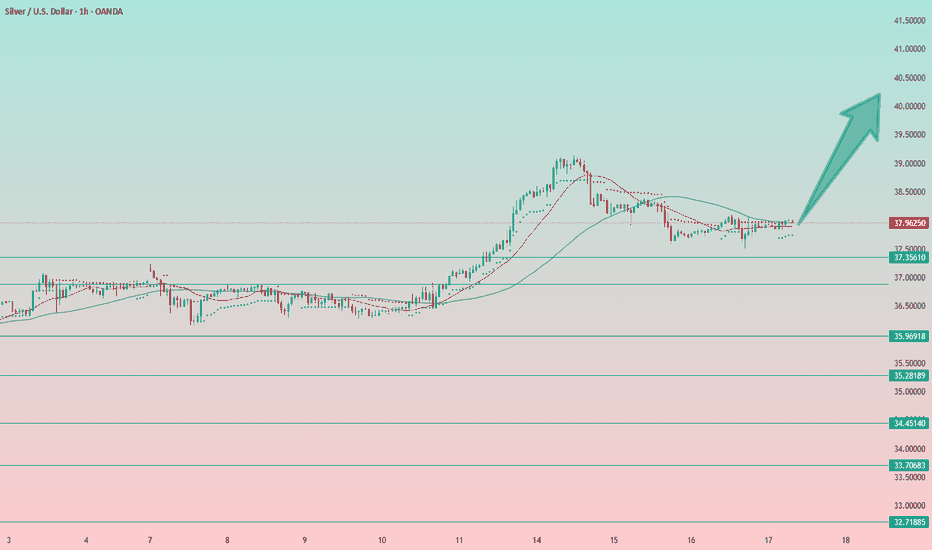

Silver Analysis – Strong Bulls and a Clean Setup AheadLast month, Silver printed a new multi-decade high, a major technical milestone.

Since then, price has entered a sideways consolidation, forming a rectangle — but what stands out is this:

👉 Silver bulls have absorbed every dip, even when Gold dropped.

That’s strength. And strength usually precedes breakout.

🔍 Current Situation

At the time of writing, price is trading around 37.20,

and from the current structure, it looks like nothing is standing in the way of an upside break.

We don’t predict — we prepare...

And this chart looks ready.

🎯 Next Target: 40.00 USD?

A push to 40.00 looks like the next “normal” target.

But don’t forget: that’s a 3,000 pip move.

This type of move will require patience

Plan your trade.

Respect your risk.

Let the bulls work. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Silver Update (XAGUSD): Eyeing the Next Move After the $39 SurgeAs mentioned in my Friday analysis, Silver ( TRADENATION:EURUSD XAGUSD) was preparing for an important breakout — and indeed, the market delivered. The clean break through resistance triggered a strong acceleration, pushing the metal up to $39, pretty close to the psychological $40 level.

Now, we’re seeing a healthy correction after this steep rise, and this could turn into a buying opportunity for the bulls.

📌 Key support zone:

The ideal area to watch is between $37.20 and $37.50 — this is the sweet spot where bulls might step back in.

But be aware:

👉 After strong breakouts, the broken resistance doesn’t always get retested — sometimes the price rebounds from higher levels.

🎯 Plan of Action:

• Monitor price action under $38

• Watch for reaction patterns and structure shifts

• Don’t force entries — let the market confirm

Silver remains strong as long as the structure holds, and this pullback might just be the market catching its breath before another leg up. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SILVER (XAGUSD): Correction is Over?!

It looks like Silver has finally completed a consolidation within

a wide horizontal parallel channel on a daily.

A new higher high formation today indicates coming growth.

Because if its Friday, I suggest looking for trend-following buy from Monday.

Let the market close above the underlined resistance to let it set a Higher Close

as well.

Look for buying after a pullback, aiming at 38.0 as the first goal.

❤️Please, support my work with like, thank you!❤️

Setupsfx_ | SILVER: Preparing For Another Bullish Move! There are two buying areas we believe could reverse the price trend, which would be a significant move in silver price history. We may even see it go above $40 for the first time. Silver is becoming a secondary best option to invest in the global market, but it will never surpass gold at least for now.

Good luck and trade safely!

Team Setupsfx_

Bullish continuation off pullback support?The Silver (XAG/USD) is falling towards the support which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level too ur take profit.

Entry: 37.24

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss: 36.49

Why we like it:

There is an overlap support that lines up with the 71% Fibonacci retracement.

Take profit: 39.12

Why we like it:

There is a swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

It was good that you waited. Now here's a way to get involved. Over the weekend we took a look at Silver and predicted that we'd probably see an emotional reaction on the open where a lot of (casual traders) look to get involved (due to the headlines) and unfortunately, pay the price for being late.

Now that, that initial group has been shaken out of the market, I want to revisit the metal and show my preferred area for entry along with a conservative approach that you can use if you want to get in earlier.

Please leave any questions, comments, or your trading ideas below.

Give me a follow that way you don't miss my next trading idea.

Akil

04.07.2025 #XAGUSDSELL 36.9000 | STOP 38.5000 | TAKE 34.7000 - 33.9500 | Medium-term investment forecast on silver deal for the next 2-3 months. On the D1 chart we observe the technical structure of the completion of the ascending wedge. Formation of double top of highs. We also consider a probable potential for the output of volumes in this instrument and a gradual decline to a pronounced support range on the background of growing interest and the potential of the US dollar until the end of summer.

Silver set to break Higher? chart patterns suggest big moveSilver has been stuck in a sideways range for nearly a month, but a breakout may be near. A large ascending triangle hints at a possible move toward 41.37. Depending on how the market reacts, traders could aim for short-term targets with a 2.75 to 5.87 reward ratio or ride it longer for a potential 9.54. Classic markets are messy, so timing matters. Here's how I’d trade it and where I'd place stops. Let me know what you think in the comments.

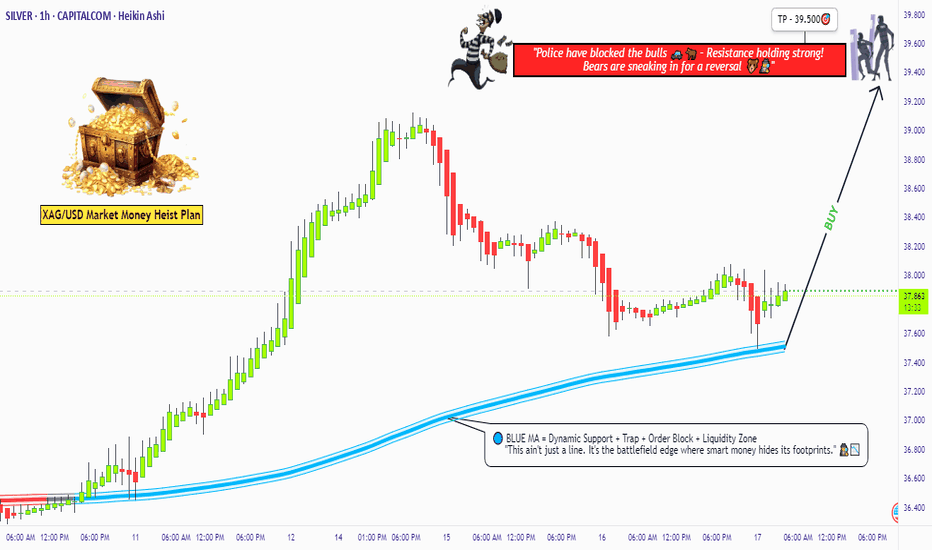

"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

"XAG/USD: BULL FLAG FORMING? LAST CHANCE TO JUMP IN!"🔥 XAG/USD "SILVER RAID" – Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

Based on the 🚨Thief Trading Style🚨 (a ruthless mix of technicals + fundamentals), we’re plotting a day/swing trade heist on XAG/USD (Silver). Our mission? Loot bullish gains before hitting the police barricade (resistance zone). Stay sharp—this is a high-risk, high-reward escape plan with overbought signals and bearish traps lurking!

📜 THE HEIST BLUEPRINT

🎯 Entry (Bullish Swipe):

"Vault is OPEN!" – Long at any price, but for smarter thieves:

Buy limit orders near swing lows/highs (15m-30m TF).

DCA/Layering strategy: Spread entries like a pro bandit.

🛑 Stop Loss (Escape Route):

Nearest swing low/high (1H candle body/wick) → 36.700 (adjust based on risk & lot size).

Risk management is key! Don’t get caught by the market cops.

🏴☠️ Take Profit (Escape Before Handcuffs!):

First Target: 38.500 (or bail earlier if momentum fades).

Scalpers: Only play LONG! Use trailing SL to lock profits.

💡 WHY THIS HEIST? (Market Drivers)

Bullish momentum in Silver (XAG/USD) fueled by:

Macro trends (COT report, sentiment shifts).

Intermarket moves (Gold correlation, USD weakness).

Potential breakout from consolidation.

⚠️ News Risk: Major releases can trigger volatility—avoid new trades during high-impact events!

🚨 THIEF'S PRO TIPS

✅ Trailing SL = Your getaway car.

✅ Small accounts? Ride the swing traders’ coattails.

✅ Big wallets? Go full-throttle.

✅ Boost this idea 💥 to strengthen our robbery squad!

📌 DISCLAIMER (Stay Out of Jail!)

Not financial advice! DYOR, manage risk, and adapt to market changes.

Silver is volatile—trade smart, not greedy.

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🕵️♂️

🔗 Want the Full Intel?

Check the fundamentals, COT reports, and intermarket analysis for deeper clues! (Klick the 🔗🔗).

💬 Drop a comment if you’re joining the heist! 👇

SILVER: Short Signal with Entry/SL/TP

SILVER

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell SILVER

Entry Level - 38.415

Sl - 38.910

Tp - 37.378

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Silver: Bullish Setup from Accumulation ZoneSilver touched its support level at $37.50 and quickly bounced back into the accumulation zone.

From the current levels, I expect an upward breakout. The setup looks very bullish.

I'm going long from the current price of $38. Stop-loss is placed just below the local low at $37.50. A break below $37.50 would signal further downside toward the next strong support around $36.75–$37, where I’d reassess the long opportunity. But honestly, I see this scenario as unlikely.

Targets are all the round numbers: $40, $41, and so on (classic—markets are psychological, and people tend to focus on clean, round numbers). Additional targets include $43.50 and $48.25, which align with levels from 2011–2012.

And look at how harmonious the chart looks.

Volatility is decreasing, the entire structure is stretching out on the hourly timeframe.

We're seeing accumulation followed by an expected breakout, and based on all external factors, an upward move seems likely.

📝Trading Plan

Entry: Entry at current prices and in the 37.75–38.25 range — the long position remains valid.

In fact, the long setup remains valid even at slightly higher levels (but not below), although the stop-loss starts to widen and exceeds 2%. If you're okay with that, then it's still a viable long opportunity.

Stop Loss: Below yesterday's low at $37.50

Target: The first target is $40, and the global target is $ 48.25.

However, it's unlikely we'll reach that level in one move — there will likely be re-entries along the way.

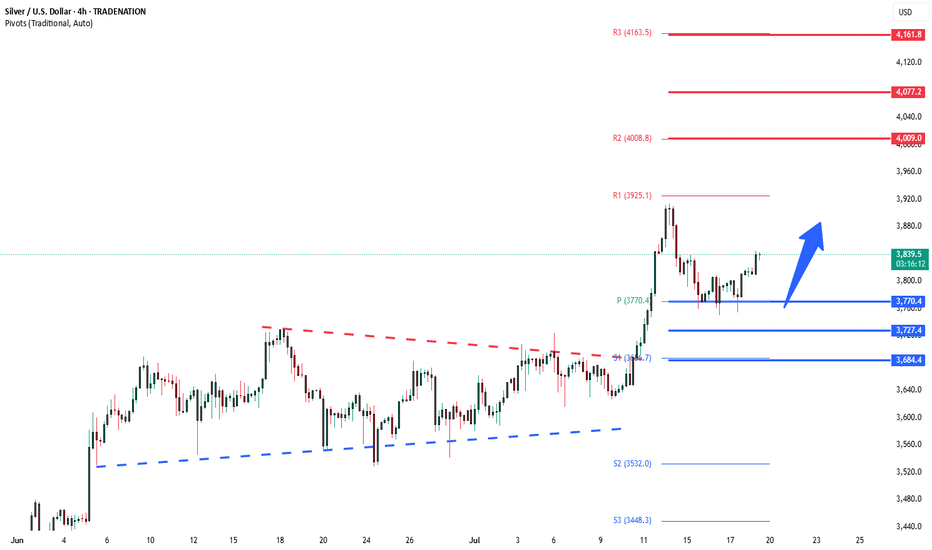

Silver bullish above 3770The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3770 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3770 would confirm ongoing upside momentum, with potential targets at:

4000 – initial resistance

4077 – psychological and structural level

4160 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3770 would weaken the bullish outlook and suggest deeper downside risk toward:

3727 – minor support

3685 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3770. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

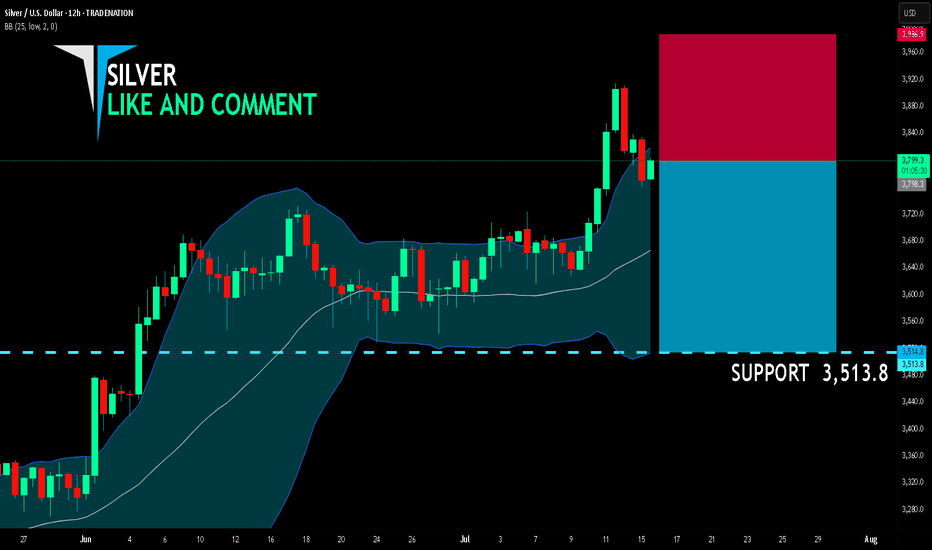

SILVER SELLERS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,798.3

Target Level: 3,513.8

Stop Loss: 3,986.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAGUSD Weekly Analysis (MMC) : Bullish Channel Toward Target🧠 1. Trend Shift Confirmed – Silver in Full Bullish Momentum

Silver has officially broken free from its multi-year sideways range and has entered a well-defined ascending channel, pushing toward higher highs week after week. The momentum is strong and supported by a combination of technical elements, structure shifts, and clean retests.

The trend is now clear: bullish, with the price aiming for the Next Reversal Zone between $46 and $48 — a level not seen since mid-2020.

🔷 2. Blue Ray Break – Start of the Rally

The breakout began with a clean move above the Blue Ray trendline, a key structure that had suppressed Silver’s growth for several years.

As the chart notes:

“Blue Ray Always Continue Trend” — until broken.

Once Silver broke above this resistance, it not only confirmed the trend reversal but also triggered the formation of a new bullish market structure, supported by aggressive buying.

🔁 3. SR – Interchange Zone Holding Strong

The SR Interchange zone (around $27 – $30) has played a critical role in this breakout. It acted as:

Resistance during the multi-year range.

Then Support after the breakout, confirming a classic Support-Resistance Flip (SRF).

This zone now serves as a solid demand base, giving the rally a stable foundation to push higher.

🪙 4. QFL Formation – Momentum Confirmation

The breakout also aligns with a QFL (Quick Flip Level) structure — a powerful bullish continuation pattern.

QFL setups form when price breaks above a former base, pulls back slightly, and then quickly resumes the upward trend.

This indicates that buyers are aggressive and unwilling to let price fall too far, fueling a rally.

Combined with the ascending channel, the QFL structure gives extra confidence that Silver is on track to reach the $46–$48 Reversal Zone.

📏 5. Trendline & Channel – Price Structure in Control

Silver is currently moving cleanly within an ascending parallel channel, respecting both upper resistance and lower support trendlines. The inner trendline has been tested multiple times, and price is now riding its upper half.

This shows:

Buyers are in control.

Each correction is shallow.

Market confidence is growing week after week.

Expect volatility to increase as Silver approaches the next target area.

🎯 6. Next Reversal Zone: $46 – $48

The green box at the top marks the Next Reversal Zone, where Silver might:

Stall temporarily and consolidate.

Or face a pullback back toward the mid-channel line or lower support.

This zone corresponds to:

Historical supply area (2020 highs)

Strong psychological resistance

Potential profit-taking by institutions or swing traders

🔭 Trade Scenarios to Watch

✅ Bullish Continuation:

If Silver maintains support above $36 and remains inside the ascending channel, we may see a smooth ride into the reversal zone. Look for:

Break-and-retest of the midline

Bullish candles with long wicks on dips

⚠️ Short-Term Rejection:

If price reaches $46–$48 and shows signs of exhaustion (like long upper wicks, evening star, or bearish engulfing), expect a healthy pullback toward $35–$36 or even $32.

As long as the ascending structure holds, bulls remain in control.

🧩 Key Technical Levels

Element Zone / Level Action

SR Interchange Support $27 – $30 Strong demand zone

Blue Ray Breakout Confirmed Trend reversal signal

QFL Zone Around $36 Retest and rally confirmation

Reversal Zone $46 – $48 High-probability reaction area

Trendline Support Dynamic ($35–$36) Bullish channel continuation

📌 Final Thoughts:

Silver is now playing in the big leagues again. With the Blue Ray broken, QFL confirmed, and price following a disciplined trendline channel, this rally looks both technically sound and fundamentally strong.

Watch the $46–$48 zone carefully. Whether price rejects or breaks through, there will be high-probability setups for both breakout traders and dip buyers.

Stay disciplined, don’t chase, and let price give you confirmation.