GOLD Will Go Higher From Support! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,113.45.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,137.18 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

XAUUSD.F trade ideas

GOLD (#XAUUSD): Bullish Move After BreakoutThe price of GOLD violated a intraday resistance level and closed above it.

After retesting this level, the price bounced back and broke above the neckline of an ascending triangle pattern.

This suggests that there is a strong likelihood of the bullish trend continuing.

It is highly likely that the price will soon reach its all-time high.

There's a Time to Trade and a Time to Watch Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to trade and a time to watch.

Conservation of Capital is Essential 💰

The best traders understand that their capital is their lifeline. It’s not about making trades; it’s about making the right trades.

The market doesn’t reward effort; it rewards patience and precision.

Instead of jumping into mediocre setups, learn to appreciate the value of patience .

Every time you enter a trade that doesn’t meet your criteria, you risk your capital unnecessarily. And every loss chips away at your ability to capitalize on the real opportunities when they come. Capital preservation should be your priority.

Focus Only on A+ Signals 📌

Not every setup is worth your time and money. The goal should be to only enter positions that offer a clear edge – signals that you’ve identified as high-probability opportunities through your experience and strategy.

A + setups are those that offer:

• A clear technical pattern or setup you've mastered.

• A favorable risk-to-reward ratio, ideally 3:1 or better.

• Alignment with your overall strategy and market context.

If these criteria aren't met, it’s often better to do nothing. Waiting for the right setup and market conditions is part of the game.

The Power of Doing Nothing 🤫

Inaction is a skill. It requires discipline to avoid the urge to "force" trades. But the market will always be there tomorrow , and so will the opportunities.

By learning to watch rather than trade during uncertain or suboptimal conditions, you avoid unnecessary losses and conserve your capital for when the market truly presents an edge.

Conclusion 🚀

Trading is about quality, not quantity. Respect your capital and recognize that sometimes, the smartest move is to wait. Let the market be clear.

Remember, there’s a time to trade and a time to watch. Master this balance, and you’ll be miles ahead of most traders.

Gold Market Update (XAUUSD) – April 3, 2025Gold (XAUUSD) has been highly profitable after breaking a key resistance level and reaching a new all-time high. The strong bullish momentum has created a parabolic move on the daily time frame (TF), which often signals an impending retracement or correction as the market seeks stability. While the overall trend remains positive, a pullback could occur soon as price action cools down.

On the 1-hour time frame (TF), key support levels are emerging where gold may find temporary stability. The first major support to watch is around $3,080, where the 200 EMA could act as a dynamic support level. If this level fails to hold, a deeper correction could push prices toward the next significant support at $3,050, which has previously acted as a strong demand zone.

Despite the possibility of a short-term pullback, the broader outlook for gold remains bullish, driven by geopolitical uncertainties, inflation concerns, and central bank policies. Traders should closely monitor these support levels to assess potential buying opportunities or signs of a further downward move before the next leg higher.

#XAUUSD #Bitcoin #ethereum #forextrading #forex #cryptocurrency

XAU/USD 10 April 2025 Intraday Analysis H4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 04 April 2025.

Since last analysis price has printed a bearish CHoCH which is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,187,835

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed as I mentioned in yesterday's analysis whereby I commented that it would be worthwhile to note that price could potentially print a bullish iBOS as H4 TF has printed a bullish reaction from discount of 50% EQ.

Price subsequently printed a bearish CHoCH, however, price quickly once again formed a higher high, therefore, I will apply discretion and not classify previous CHoCH in order not to distort internal structure as the move was most probably an outlier due to Trump announcing 90 day pause on tariffs.

Price has printed a further bearish CHoCH, however, I will continue to monitor price.

Price is now trading within an established internal range.

Intraday Expectation:

Price to continue bearish, react at either discount of 50% internal EQ, or M15 demand zone, of which one is well positioned at 50% of internal EQ, before targeting weak internal high priced at 3,132.630

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

4/11 Gold Trading StrategyFresh High Above 3170 – Momentum Continues, but Chasing Longs Is Risky

Gold delivered a strong one-sided rally yesterday, rising from around 3078 to above 3170, setting a fresh short-term high. While CPI and jobless claims data were modestly bullish, most of the rally occurred before the data release, suggesting that the move was primarily technically driven rather than fundamentally triggered.

As we anticipated yesterday, the price did reach above 3170 , and as clearly stated, we did not recommend chasing long positions at those highs. This view remains unchanged today.

🔍【Technical Insights】

The recovery from 2955 back to 3160+ took just 2 sessions, versus 4 sessions for the prior drop from 3167 — a clear sign of momentum dominance.

The daily chart shows two strong bullish candles, typically a sign of follow-through potential.

However, new highs reached under this structure tend to attract profit-taking and possible pullbacks.

If a technical correction occurs, look to 3143–3128 as a meaningful support zone for long opportunities.

🎯【Today's Gold Trade Setup】

🔻Sell Zone: 3188 – 3215

Look for short entries near resistance after overextension

🔺Buy Zone: 3134 – 3112

Wait for a healthy pullback to consider long positions

🔄Range Zone: 3178 – 3143

Flexible trading range — favor quick in/out trades in the zone

Tariffs accelerate gold's peakGold's 1-hour moving average is still in a bullish arrangement with a golden cross upwards. The strength of gold bulls is still relatively strong. Pay attention to the next adjustment. Pay attention to the support of the 3185 line below, and then gold will fluctuate widely to complete the adjustment. Then gold may maintain a narrow range of fluctuations above 3200, and then seek a breakthrough. In this case, gold is still in a strong form, and there will be a rapid rise after the adjustment.

Investment strategy: Gold 3220 long, stop loss 3210, target 3260

Bearish Reversal Setup on Gold After Key Resistance TestThe chart presents a 4-hour analysis of Gold (XAU/USD), showing a potential bearish reversal scenario after price tests a major resistance zone near $3,218 - $3,220. The price has surged strongly, currently at $3,218.924, but the forecast suggests that once price reaches the highlighted resistance zone (blue circle), a reversal could occur.

The anticipated movement is:

A short-term bullish push into the resistance zone.

Followed by a bearish reversal with multiple targets:

TP1: $3,150

TP2: $3,070

TP3: $2,950

This outlook implies that traders should watch for signs of exhaustion or rejection near the marked resistance before considering short positions. Key support levels are clearly marked for possible take-profit zones or entries for long re-entries in case of strong bounces.

Let me know if you want a breakdown for trade execution or risk management based on this setup.

Recovery on Both sides GOLD is on Inverse M pattern .

What possible scenario we have?

I'm expecting the drop towards 3035 where we have buyying opportunities if 3035 got rejection we'll have good buy trade and my target will be 3060 then 3080 in extension for intraday.

OR market start climbing directly so above 3060 we have 3100 on mark.

On the other hand, below the 3035 we have again Bearish momentum towards 3000 them 2980.

#XAUUSD

Today's market analysis, gold continues to riseAt present, the general trend of gold is still bullish. Although the daily line closed with a cross negative line, this does not mean that gold will fall sharply in the short term. From the weekly line, gold is still in the upward channel. Yesterday, it rebounded quickly after stepping back to around 3195, indicating that the short-term correction is just to accumulate momentum for subsequent gains. The integer mark 3200 is the key support. Once it is broken, the lower support moves down to around 3175. If a waterfall-like drop occurs, it must effectively fall below 3175. The upper resistance is initially seen at 3215, and it is possible to break through here and continue to rise. However, it should be emphasized that we only go long when it falls back, and resolutely do not chase high, and beware of the risks brought by the high and fall back.

Summary strategy:

3220 long, stop loss 3209, target 3235

Important reminder:

1. Steady type maintains ≤5% position.

2. Aggressive traders with sufficient funds can enlarge to 8%, but they need to strictly set a stop loss or flexibly move the stop loss manually to avoid accidental losses!

3. The stop-profit and stop-loss positions need to be adjusted dynamically for every 10 USD fluctuation in the short term.

Trading is not easy, but requires meticulous thinking and rigorous operation. If you want to get out of the quagmire of losses as soon as possible and get on the right track of steady gains, it is very simple. Find Quid and follow his guidance!

For more trading signals, you can join my free channel.

XAU / USD Hourly ChartHello traders. I just wanted to follow up from my last post a few hours ago. As I had said, I was of bearish mindset and sure enough it played out perfectly. I took no trades today. Now I am watching the current area to see if we keep pushing down, or move up a bit to take out the short positions being held. Big G gets my thanks. Let's see how the next 4 hour and 1 hour candle play out. Be well and trade the trend. Happy Tuesday.

GOLD: Long Trading Opportunity

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3225.9

Sl - 3218.11

Tp - 3240.8

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

DeGRAM | GOLD retest of resistanceGOLD is above the descending channel between the trend lines.

The price has already reached the upper trend line and resistance level.

The chart has formed a harmonic pattern.

The indicators on the 1H Timeframe indicate a bearish divergence.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD broke the upward structureGOLD is in an ascending channel between trend lines.

The price has already reached the lower boundary of the channel, the lower trend line and the support level, which has already acted as a rebound point.

The chart has broken the ascending structure, but a descending top must now be formed to continue the decline.

On the 1H Timeframe, the indicators are forming a bullish convergence.

We expect XAUUSD to rebound after consolidating above the important psychological level of $3000.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

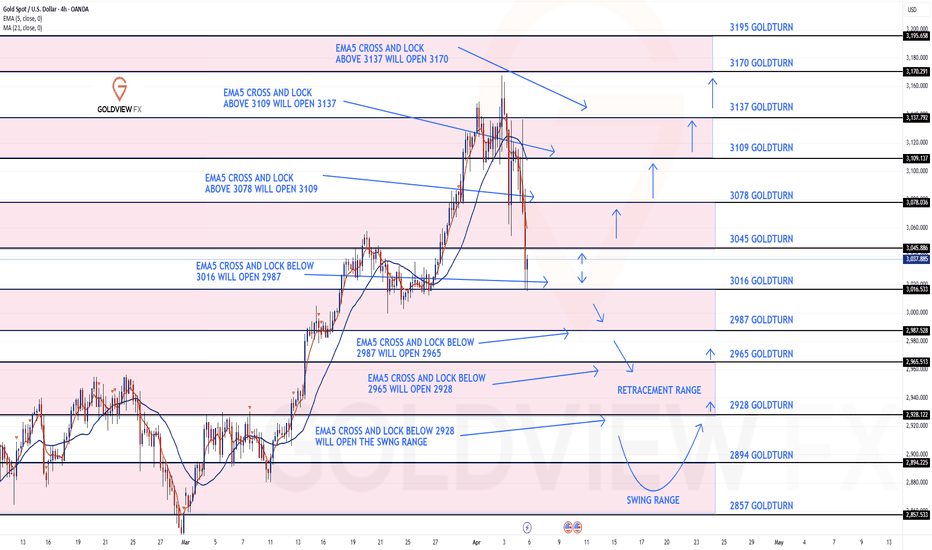

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3045 and 3078 due to ema5 lagging behind and a gap below at 3016. We will need to see ema5 cross and lock on either weighted level to determine the next range. We have a bigger range in play then usual.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3045

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3109

EMA5 CROSS AND LOCK ABOVE 3109 WILL OPEN THE FOLLOWING BULLISH TARGET

3137

EMA5 CROSS AND LOCK ABOVE 3137 WILL OPEN THE FOLLOWING BULLISH TARGET

3170

BEARISH TARGETS

3016

EMA5 CROSS AND LOCK BELOW 3016 WILL OPEN THE FOLLOWING BEARISH TARGET

2987

EMA5 CROSS AND LOCK BELOW 2987 WILL OPEN THE FOLLOWING BEARISH TARGET

2965

EMA5 CROSS AND LOCK BELOW 2965 WILL OPEN THE FOLLOWING BEARISH TARGET

2928

EMA5 CROSS AND LOCK BELOW 2928 WILL OPEN THE SWING RANGE

SWING RANGE

2857 - 2894

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Lingrid | GOLD Weekly Outlook: Bullish Momentum Faces CorrectionOANDA:XAUUSD market has been bullish; however, Friday turned bearish with a nearly 3.8% decline. After such bullish momentum, this pullback seems normal. In the current timeframe, price completed the ABC move, which is typically followed by a pullback—exactly what we've seen recently. On the weekly timeframe, the price formed a long-tailed bar, indicating it may retest the support zone below the 2900 level. However, considering the upward momentum in the market and the fact that price did not close below the previous week's low, this scenario seems less likely.

I believe we're facing a similar scenario to what we saw in the last week of February, when the market fell around 4% but subsequently reached all-time highs. Right now, areas to consider going long include just below the week's low and the psychological level at 3000. Additionally, we have the channel border as well as the upward trendline serving as potential support. Another scenario worth noting is what happened before the US election last November, when prices fell around 9%, which could mean a retest of the 2900 level. Overall, next week the price may move sideways for a couple of days after bearish impulse leg or bounce off the 3000 level.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

XAUUSD - END OF THE BULLISH MOVE?Confluences

-Growth does not last forever, profit taking imminent, FOMO traps in play soon

-Price approaching weekly channel resistance - 4 touches

-RSI Overbought Territory/RSI Divergence

Selling Price Point - 3272, 3300 if overextended with wicks rejection

TP Range to downward channel support; 2350-2400 region