Shows a structured trading plan with key technical elements 1. **Support Zone** (around 3190–3120):

- This area held price up earlier and led to a strong bullish move.

- It is marked at the bottom of the chart.

2. **BOS (Break of Structure)**:

- A structure break occurred here, indicating a shift in market momentum. This area is now acting as a resistance zone.

3. **R.S (Resistance/Supply Zone)**:

- Marked at the top around 3244–3255.

- Price is expected to reverse from this level.

---

### 📉 Trade Setup (Short Position):

- **Entry:** Between 3244–3247 (within the resistance/supply zone).

- **Stop Loss (SL):** 3255 (just above the resistance zone).

- **Target:** 3124 (around previous support level).

---

### 🔍 Other Notations:

- **L.S:** Possibly a liquidity sweep or last support before the bullish move.

- Candlesticks show a strong bullish trend leading into the resistance zone.

- There's a shaded gray box illustrating the risk/reward of the short trade.

---

### 🎯 Trade Logic:

The idea is that price has hit a resistance zone (where sellers might step in) after a strong bullish move. The trader anticipates a reversal and aims to short from the resistance zone down to the previous support level.

XAUUSD.F trade ideas

Has the Gold Rally Come to an End?Gold has proven to be an exceptional hedge against the prevailing uncertainty in global markets, with much of this volatility driven by geopolitical tensions and policy unpredictability stemming from the influence of Donald Trump. Amid this backdrop, investors have increasingly sought safety in tangible assets, and gold has emerged as a preferred store of value.

Presently, GOLD has reached a significant technical milestone — the 1.618 Fibonacci extension level from the 2015 bear market low — after delivering a remarkable 100% appreciation over the past decade. This confluence of long-term Fibonacci projections and a sharp acceleration in price suggests that gold may be approaching a key inflection point.

Given the speed and magnitude of this recent rally, a period of consolidation or even a short-term pullback appears likely. Traders and long-term holders may begin to lock in profits, especially as valuations in gold become stretched relative to historical norms. The capital generated from this profit-taking could be rotated into other asset classes that are currently oversold or undervalued, potentially igniting a broader rebalancing across financial markets.

In this context, I see gold not only as a barometer of risk sentiment but also as a potential trigger for cross-asset shifts. Should profit-taking in gold accelerate, it could act as a catalyst for renewed interest in equities, commodities, or even emerging markets — areas that may offer more attractive risk-reward profiles at current levels. As such, I’ll be closely watching gold’s price action, not just in isolation, but for the signals it may send about broader market dynamics and capital flows.

XAUUSD Rejection from Support Reversal Expected Gold AnalysisAs I shared a buy signal at 3114 to 3112 my analysis indicated that the market would move towards 3150 to 3160 and that’s exactly what happened I made my trades at the right time based on a professional approach As a professional trader I always provide precise and reliable signals analyzing market trends carefully Keep following my trading signals to make informed decisions and maximize your potential

Go long gold, target: 3030-3040Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to continue its rebound momentum with this strong technical support!

So I think the short-term decline of gold is not a risk for us, but the best gift for us. So I advocate going long on gold from now on. After gold repeatedly tests the support, it will rise to the 3030-3040 area without hesitation.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold Intraday Trading Plan 4/9/2025Yesterday good retraced further to 3020 and dropped from there. I am seeing further downside momentum but also reversal possibility. If we have a 4hrly bullish bar, we may see short term bulls picking up.

Therefore, I am monitoring closely on these two levels 3000 and 2960. Will act accordingly on price actions there.

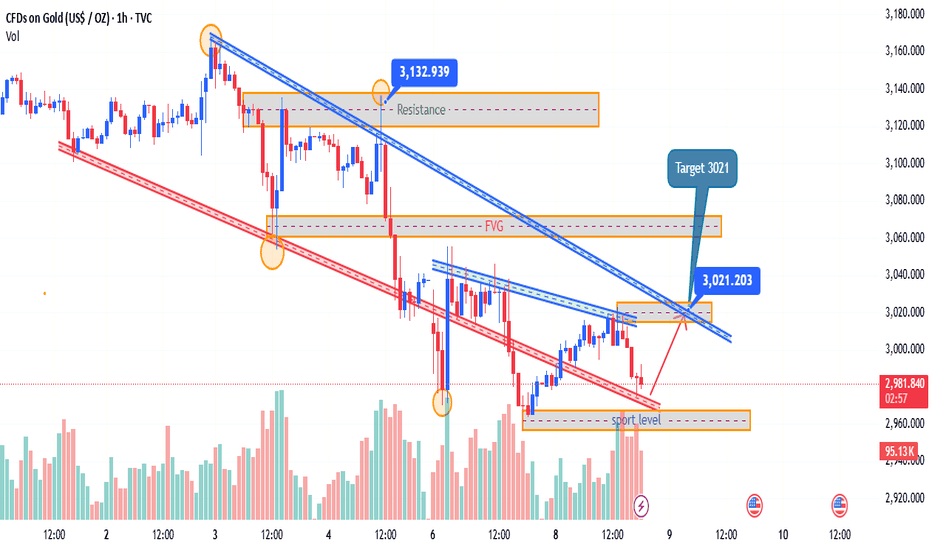

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

Gold Breaks $3240, Shorting Opportunity EmergesGold prices have now surged to around $3240, continuing the recent strong upward momentum. Based on the previous trading signal, a long position at $3220 was suggested; however, due to the high volatility, many investors may have missed the opportunity to go long at that level. At this point, with prices approaching $3240, it may be an opportune time to establish short positions, with a target profit around $3225. Please note that this is just personal advice, and actual trading decisions should be made with attention to changes in key price levels.

XAUUSD 04/10/2025Market Structure & Key Levels

BSL (Buy Side Liquidity): Above the recent swing high – potential target where sellers' stop-losses are positioned.

SSL (Sell Side Liquidity): Below the recent minor low – stop-loss area for buyers.

FVG 1H (Fair Value Gap): Between approximately 3,020–3,040 – an area of imbalance that price may revisit before continuing in the intended direction.

Analysis & Scenario

The market has formed a recent high and is now showing signs of a potential short-term pullback.

The price may seek to collect SSL and then fill the Fair Value Gap (FVG) around the 3,020–3,040 zone.

After this liquidity sweep and FVG fill, a bullish reaction is expected, targeting a break above BSL at around 3,100.

If the bullish move gains momentum, a continuation toward 3,120+ is possible.

Key Watchpoints

Monitor how price reacts around the FVG zone (3,020–3,040).

Look for confirmation such as bullish order blocks or displacement before entering.

Watch out for scheduled economic events (USD news marked on the chart), as they may cause sudden volatility.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and past performance is not indicative of future results. Always conduct your own analysis and manage risk appropriately.

Gold Breakout Alert: Bullish Momentum Continues Above 3086🚨 Gold Breakout Alert: Bullish Momentum Continues Above 3086 🚨

Trade Analysis (Trader Style):

Gold has once again shown strong bullish strength by breaking above the 3086 level. With momentum picking up, we are looking for another ride upward. This breakout confirms buyers are in control — and the path to higher targets is wide open.

🔼 Buy Gold Now @ 3086

🎯 Target 1: 3088

🎯 Target 2: 3090

🎯 Target 3: 3092

🛑 Stoploss: 3078

Bias: Bullish

Timeframe: 15-Minute (M15)

This is a clean continuation setup — those who missed the first move, here’s your second chance to ride the wave! 🚀📈

XAUUSD Breakdown Setup – Gold Bears Eye $2,845 Support ZoneGold (XAUUSD) has broken below its rising channel structure, signaling a shift from bullish momentum to potential bearish continuation. After a sharp rejection from the $3,167 high, price is currently consolidating just below the psychological $3,000 level, which now acts as resistance.

Key Technical Zones:

Current Price: $2,985

Resistance Zone: $3,000 – $3,005 (key rejection area)

Support Targets:

TP1: $2,923

TP2: $2,844

TP3: $2,832 (swing low)

Bearish Trade Setup:

📉 Entry Zone: If price retests and rejects the $3,000 resistance

📈 Invalidation Level: Break above $3,005

📉 Target Zones:

$2,923 – Previous structure support

$2,844 – $2,832 – Deeper support and channel base

Technical Confluence:

✅ Bearish flag formation following strong impulsive sell-off

✅ Channel break confirms shift in trend

✅ Lower highs and bearish momentum building beneath $3,000

✅ Strong psychological resistance at $3,000

XAU/USD – Potential Reversal with RSI Divergence (12H)XAU/USD – Potential Reversal with RSI Divergence (12H)

Keeping a close eye on Gold in the 12-hour timeframe, and I’ve spotted a clear bearish RSI divergence.

While price is making higher highs, the RSI is forming lower highs, indicating potential weakness in the bullish momentum.

🔻 The highlighted zone on the chart marks a key liquidity area, which now seems to be acting as resistance.

📉 We already saw a first rejection from that zone and a possible beginning of a correction (red arrow on chart).

📊 Confluences:

Bearish RSI divergence (white trendline on RSI)

Price at a strong resistance zone

Possible retracement towards EMA 9 or EMA 20

💡 I’m waiting for confirmation via price action (e.g., market structure break or strong reversal candle) before considering an entry.

⚠️ This is not financial advice – just my personal view of the market at the moment. Always do your own analysis and manage your risk.

Gold's Growth Sign - 11/04/2025The gold market remains highly active, supported by capital inflows seeking safe-haven assets amid escalating U.S.-China trade tensions following President Donald Trump's decision to increase tariffs on Chinese imports.

From a technical perspective, gold is in a strong uptrend. It is considered a hedge against instability, especially as the tariff war increases inflationary pressures and pushes bond yields higher. If the trade conflict persists, the U.S. dollar may lose its role in global trade, further supporting gold prices.

XAUUSD – Bearish if Trendline Breaks, Bullish Continuation AboveOn the 1H/4H chart, XAUUSD is currently respecting a rising trendline.

📉 Bearish Scenario:

If price breaks below the lower trendline, we could see a strong bearish move towards the 3125 support zone. This would indicate a potential trend reversal or deeper correction.

📈 Bullish Scenario:

If the trendline holds, bulls may take control again, pushing the price up toward the 3500 resistance zone.

🔍 Key Levels to Watch:

Support: 3125

Resistance: 3500

Trendline: Watch price action around it closely.

⚠️ This setup depends heavily on how the market reacts to the trendline. Wait for confirmation (like a strong breakout candle and volume spike) before entering.

Investors seek refuge and gold is providing it!! The US dollar, equity and bond markets have all been hit hard and money has not turned to US treasuries either. I guess confidence on anything directly related to the USA is very low right now. No surprise that investors chose to place their faith in Gold, a precious metal that has been bullish since 2016.

However, finding a suitable entry especially in a parabolic trend is not easy. I am hoping for a pullback, perhaps in the region between 3175-3153 as shown on my chart. This region has acted as resistance earlier this month and recently, price broke above it. A pullback has not occurred yet and I am hoping this will happen this week. In the event that it does, that will provide traders a good location for entry and stop placement. Price will also narrow the gap it currently has with the 20ema (mean reversion).

Initial target can be the current high of 3245.40, with the strong possibility that price will extend even higher.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk.

If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

The gold surge is over, and it has started to adjust.The gold surge is over, and it has started to adjust. The gold price has basically reached the level I predicted in my last analysis. I think gold might adjust for a few years. This adjustment doesn’t necessarily mean a sharp drop; it’s more likely to be a consolidation phase. Meanwhile, silver will decline. The trigger could be a global recession caused by Trump.

XAUUSD continues to increase pricesHello dear friends!

Spot gold (XAU/USD) surged strongly yesterday following the implementation of U.S. tariff measures, which have sparked a new wave of trade tensions.

On the analysis chart: the descending trendline has been broken, and price action is now showing strong potential for further upside. The next bullish momentum is further supported by the crossover of the EMA 34 and 89, which act as an ideal cushion for optimistic investors. Therefore, it would come as no surprise if the bulls set their sights on previous highs or the $3,165 level, with the nearest support found around $3,065.

If you find this information useful and valuable, don’t forget to like and follow to receive the latest updates!

GOLD (XAUUSD) – 4H Technical AnalysisAfter a sharp drop and rebound, gold is now testing the 50% Fibonacci level around 3122. The key resistance zone lies between 3163–3167, where a breakout could open the path to 3218 (0.786 Fibo).

🔹 Resistance levels:

• 3163 – 0.618 retracement

• 3167 – previous swing high

• 3218 – 0.786 level & target

🔹 Main Scenario:

Breakout above 3163 leads toward 3218 continuation.

🔹 Alternative Scenario:

Rejection at 3163 → retrace to 3082 or 3033 before next move.

Momentum indicators are bullish but approaching overbought territory.

GOLD BUY🥇 GOLD: Strong Resilience & Bullish Potential Despite Correction 📈

Gold is showing strong resilience in the face of recent events. Despite a recent drop — which I see as a correction toward its previous resistance around 2960 — the price reacted bullishly, breaking through several levels to the upside.

🔹 The bullish momentum remains intact.

🔹 I'm planning to enter a buy position, aiming to ride the continuation of this move — with caution.

👀 Definitely one to watch closely for confirmation of the bullish setup!