XAUUSD.F trade ideas

Go long gold, target: 3030-3040Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to continue its rebound momentum with this strong technical support!

So I think the short-term decline of gold is not a risk for us, but the best gift for us. So I advocate going long on gold from now on. After gold repeatedly tests the support, it will rise to the 3030-3040 area without hesitation.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

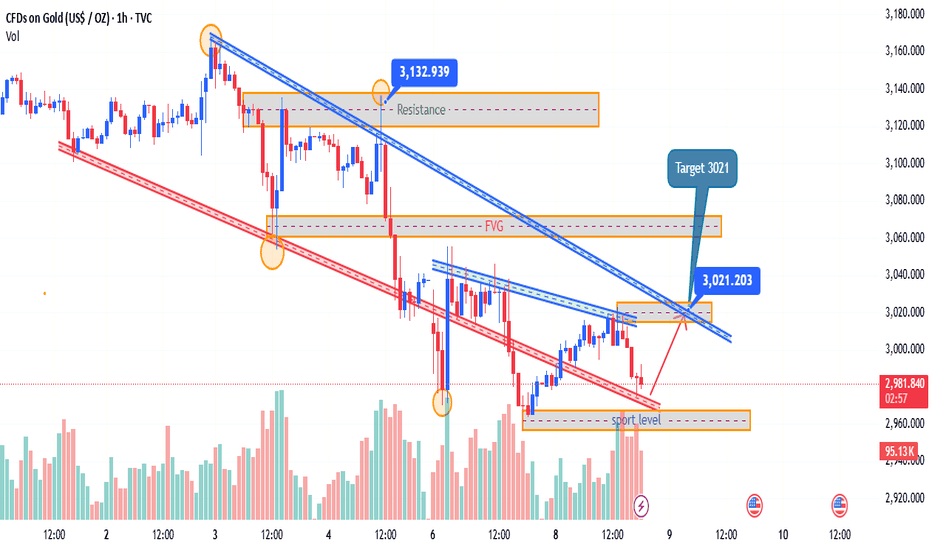

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

GOLD Will Fall! Short!

Please, check our technical outlook for GOLD.

Time Frame: 8h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 3,035.98.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 2,937.76 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

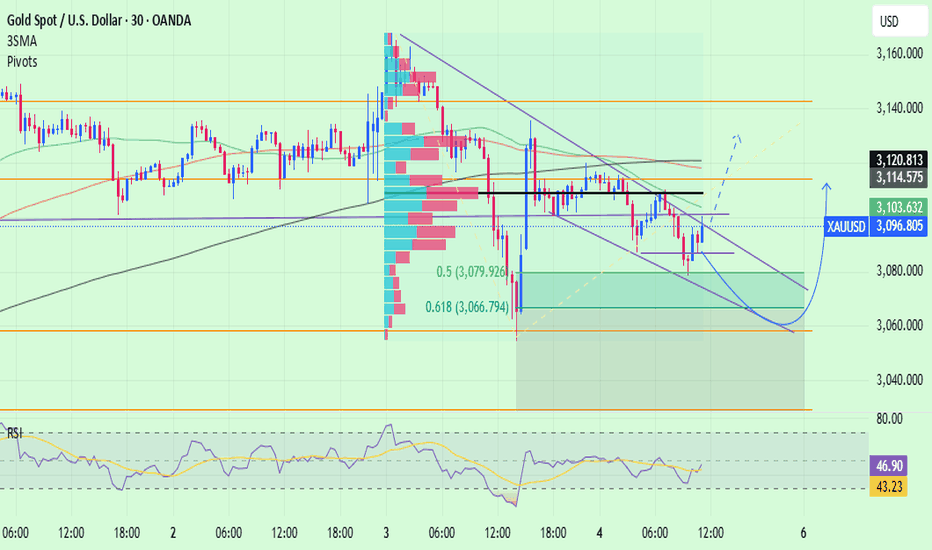

Maintain bearish trend awaiting US NFP news✍ ✍ ✍ Gold news:

➡️Gold extended its correction ahead of Friday's Non-Farm Payrolls release, falling below $3,100 as markets remained volatile. Investors remained uncertain about the direction of the market following Trump's retaliatory tariff announcement. Meanwhile, gold continued to face profit-taking pressure while seeking support for its recovery.

Personal opinion:

➡️ With the upcoming NFP news, gold prices are expected to remain in a short-term downtrend zone pending this important news.

➡️Analysis based on important resistance - support zones and Fibonacci combined with trend lines and SAM to come up with a suitable strategy

Resistance zone: 3112– 3133 -3165

Support zone: 3079 - 3067 - 3058

Plan:

🔆Price Zone Setup:

👉Buy Gold 3077- 3079 (Scalping)

❌SL: 3074| ✅TP: 3082 – 3085 – 3090

👉Buy Gold 3058- 3060

❌SL: 3053| ✅TP: 3065 – 3070 – 3080

👉Sell Gold 3108 - 3110 (Scalping)

❌SL: 3115 | ✅TP: 3104 – 3100 – 3096

👉Sell Gold 3033- 3035

❌SL: 3140 | ✅TP: 3128 – 3122 – 3115

FM wishes you a successful trading day 💰💰💰

XAUUSD:Wait for Nonfarm Payrolls to boost upward trendOn Thursday, the price of gold plummeted by $110 initially. Subsequently, it rebounded from $3,054 to $3,135, surging by nearly $80. This was a typical market scenario of a double whammy for both bulls and bears in a washout. Whether it was those who chased long positions at high levels or those who chased short positions expecting a pullback, they all suffered losses. The level of $3,054 witnessed a perfect conversion from a top to a bottom.

Today, when it comes to the resistance levels of gold, there are two key positions to focus on. One is the morning's high point at $3,120, and the other is the high point of the pullback at $3,135. As for the support levels below, we should pay attention to $3,080 and $3,065. There will be a market movement influenced by the Nonfarm Payrolls data tonight. It is expected that before the release of the data, the price will fluctuate within a range above and below $3,100, which serves as the demarcation line. When the price surges, look for a pullback towards $3,100; when it dips, look for a rebound towards $3,100. It is recommended to mainly take long positions at low levels. Tonight, we need to pay attention to whether the Nonfarm Payrolls data will help gold prices rise again.

Here, I would like to caution all traders once again to protect their accounts. Wait until the washout of both bullish and bearish forces is over before resuming trading!

Trading Strategy:

buy@3080

TP:3110

Sell@3135

TP:3100

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

4.4 Analysis of gold short-term operation strategy!!!On Thursday (April 3), spot gold experienced a surprising volatility, with a single-day fluctuation of nearly $114, and the price of gold finally closed down.

Analyze the technical outlook of gold intraday.

The 4-hour chart of gold shows that the price of gold is trading below the currently flat 20-period SMA, but it is still well above the bullish 100-period SMA, which provides support near $3040/oz. At the same time, technical indicators have recovered from near oversold readings and stabilized within negative levels. If the price of gold falls below the above-mentioned $3040/oz area, the price of gold may fall sharply.

Support: $3086.70/oz; $3073.90/oz; $3061.10/oz

Resistance: $3123.10/oz; $3136.70/oz; $3150.00/oz

Is gold going to be eclipsed?

-------------------------

Timeframe: 240 Min

-------------------------

The price action suggests a completed impulse structure originating from the 2833 low, with gold now trading at an all-time high. Based on cluster zones and Fibonacci extensions, wave (5) still has the potential to extend toward the 3150-3200 range. This zone represents a key resistance level where buying momentum may slow down, signaling an impending shift in market dynamics.

Once wave (5) completes, it will mark the end of wave ((3)) of a higher degree, setting the stage for a corrective move. A retracement toward the previous wave (4) level is expected as wave ((4)) develops, aligning with historical corrective behavior after extended rallies. This phase will provide crucial insights into the market’s next major move. Stay tuned for further updates.

Price Reacts to Every Zone I Mark – No Coincidence.Every level you see on this XAU/USD chart is mapped based on institutional moves, order blocks, and real market intent. These aren’t just random zones—each one is backed by experience and a deep understanding of how smart money operates.

Price respects precision. I deliver it every time.

Let the chart speak.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3095) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (3140) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3030 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAUUSD 15M Analysis: A Potential Reversal for Gold Prior to NFPGold (XAUUSD) is approaching a key demand zone, which could offer a potential buying opportunity. Here’s a breakdown of my analysis and trade expectations:

1️⃣ Market Structure & Trend Analysis

• Price is currently in a short-term downtrend, creating lower highs and lower lows.

• However, a Monitor Buy Zone has been identified, where price previously found strong support and liquidity.

• A reaction from this level could trigger a bullish reversal.

2️⃣ Expected Price Movements

• Bullish Scenario: If price reaches the Monitor Buy Zone (3,067 - 3,047) and shows bullish confirmation (e.g., wicks, engulfing candles), we could see a rebound toward 3,095 - 3,100 as the first target.

• Bearish Scenario: If price breaks below the 3,047 support level with strong bearish momentum, it could invalidate the buy setup and push lower toward new demand levels.

3️⃣ Key Levels to Watch

• Resistance Levels:

• 3,095 - 3,100: Initial target zone for a bounce.

• 3,120: Potential extended target if momentum continues.

• Support Levels:

• 3,067: First reaction level in the Monitor Buy Zone.

• 3,047: Last level of defense before a deeper drop.

4️⃣ Trade Plan & Risk Management

• Entry: Looking for bullish confirmations at the Monitor Buy Zone before entering a long position.

• Stop Loss: Below 3,047, ensuring minimal risk if the trade setup fails.

• Take Profit Levels:

• First TP at 3,095 - 3,100 (safe target).

• Extended TP at 3,120 (if bullish momentum continues).

5️⃣ Confluences for a Long Setup

• Liquidity Grab Possibility: Price could sweep below previous lows before reversing.

• Historical Support: Price has bounced from this region before, adding strength to the buy zone.

• Fibonacci Levels: Possible alignment with key retracement zones for added confirmation.

Final Thoughts:

I’ll be closely watching price action at the Monitor Buy Zone before entering a trade. If price respects this area and bullish momentum builds, we could see a strong rebound.

What’s your bias on XAUUSD? Drop your thoughts in the comments!

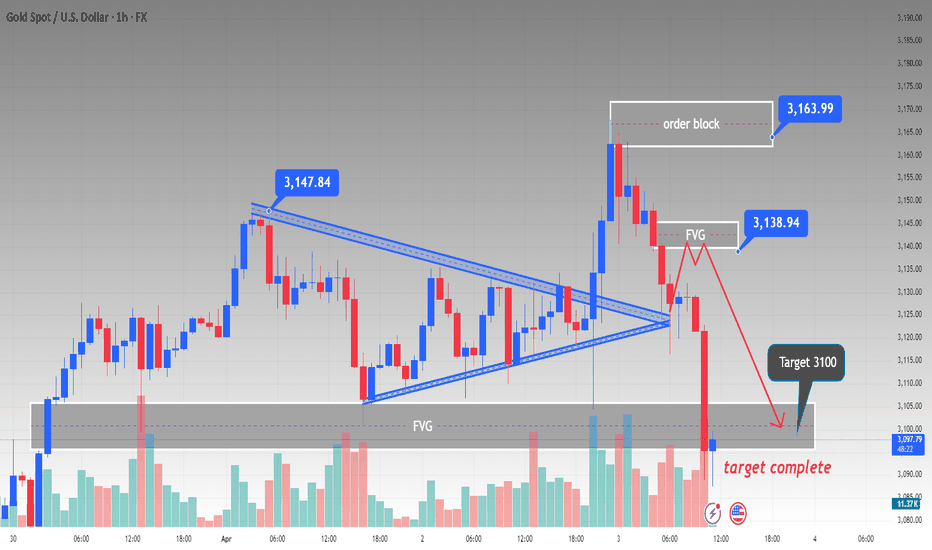

XAUUSD SELL TARGET SUCCESSFUL HITTING READ IN CAPTIONSThis chart shows Gold (XAU/USD) on a 1-hour timeframe, with various key technical levels identified, including order blocks, FVG (Fair Value Gap), and target zones. Here's an analysis based on the chart:

Key Observations:

1. Price Action:

- The price of Gold has been moving in an ascending triangle pattern (denoted by the blue trendlines). Ascending triangles are typically bullish continuation patterns, where the price makes higher lows while encountering resistance at the top. In this case, the price is pushing upwards but facing resistance at around 3,147.84.

- The price recently tested the FVG gap near 3,138.94, suggesting that the market might be filling an imbalance before continuing its movement.

2. FVG (Fair Value Gap):

- The FVG identified between 3,138.94 and 3,147.84 represents an area where the price imbalance exists. In many cases, the market tends to revisit this gap to "fill" it before continuing its direction. The price has already started filling the gap, and traders often look for reversals in these areas.

3. Order Block:- The order block located around 3,163.99 indicates a zone of heavy selling pressure or institutional activity. This is an area where price previously faced rejection, making it a potential resistance zone. It might play a significant role if the price tries to move upward again.

4. Downward Move & Target:

- After filling the FVG, the price has made a sharp downward movement, indicating that the bearish pressure has taken over. The target for this move is set at 3,100, which could be the next area of support. If the price continues its downward trajectory, it may eventually test this target area.

- The target completion at 3,100 was reached, showing a strong bearish reaction after filling the gap.

5. Volume Analysis:

- The volume bars indicate increased selling volume during the downward movement, especially around the time the price hit the FVG gap. This suggests that the market is more willing to sell after filling the gap, signaling strong selling interest.

Potential Scenarios:

1. Bearish Continuation:

Gold (XAU/USD) Bullish Breakout Setup – April 9, 2025Gold has broken above a key resistance zone around 3068, signaling a potential bullish continuation. A buy trade is triggered at 3074, expecting further upward momentum toward the next resistance levels.

Trade Setup:

🔼 Buy Entry: 3074

🎯 Target 1: 3078

🎯 Target 2: 3082

🎯 Target 3: 3086

🛑 Stop Loss: 3060

Bias: Bullish

Timeframe: 15-Minute (M15)

The breakout candle and strong bullish momentum suggest that gold is gaining strength, with multiple profit targets to the upside.

XAUUSD Today's strategyYesterday, the market trend on the trading chart continued to decline. However, it did not set a new low compared to the previous low point. Instead, the lows gradually showed an upward trend. Today, the crucial price level of 3,025 US dollars requires our close attention. Once it is successfully broken through, the market will continue to make an upward assault on the range between 3,045 and 3,055 US dollars. Overall, the current market is mainly characterized by a washout and sideways movement, and it is still too early for the price to reach its peak. Given the continuous impact of the trade conflicts, this will serve as a powerful factor driving the price of gold to new heights rather than causing the price of gold to collapse.

In particular, we must keep a close eye on the breakthrough of the 3,025 US dollars level. After this price level is broken through, we should focus on the pullback and confirmation movement. If the pullback does not break below this level, we can set the area below 2,980 US dollars as the stop-loss line. Under this premise, we can consider entering the market to go long, with the target set at the range between 3,040 and 3,045 US dollars, so as to capture the profit opportunities brought about by the rebound.

Gold's HUGE drop - Where we going next?📉 Gold Market Update: Key Levels & Strategy Ahead

Gold has experienced a significant decline, dropping over 1,000 pips in just the past three trading days. Currently, we’re seeing consolidation just above the $3,000 mark, with the price struggling to hold this psychological level.

While the broader trend appears bullish, we are now in a range-bound phase, which often leads to false breakouts and stop hunts. Given the current conditions:

🔸 Short Bias: The overall setup favors short positions, but patience is key. Look for higher price levels to enter shorts with better risk-to-reward ratios.

🔸 Scalp Opportunities: If you’re considering a long position, it should be strictly short-term (scalping) and only from well-defined support levels.

🔸 Capital Protection: This is not the time to over-leverage or chase moves. Gold is known for volatility in tight ranges—stay protected and use tight risk management.

⚠️ Bottom line: Gold is in a bearish consolidation zone. The safest play is to wait for clearer setups, preferably at resistance for shorts or strong support for scalps. Avoid getting chopped up in the range.

If you found this breakdown helpful, don’t forget to give it a boost! 🚀

XAUUSD: 8/4 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 3055, support below 2950

Four-hour chart resistance 3055, support below 2981

One-hour chart resistance 3015, support below 2981

Gold news analysis: The market is currently in a two-way power game between risk asset selling and rising risk aversion demand. Although gold is a safe-haven asset, it is also facing the pressure of liquidity withdrawal. In the context of the unclear Fed policy and the continued escalation of global trade concerns, gold prices may continue to maintain a volatile pattern.

Gold operation suggestions: Gold rebounded quickly in the Asian session yesterday and was under pressure at 3054, then fluctuated and fell, and continued to fall in the European and US sessions, breaking through the new bottom, and finally accelerated downward to break through the 2960 mark to reach 2956 and stabilize and rise.

From the current trend analysis, today's upper short-term resistance focuses on the one-hour level 3015 and the daily level 3055, and the lower support focuses on the 2981 line support. In terms of operation, the rebound pressure at this position continues to sell bearish. Yesterday's daily line closed below 3015. Today we continue to look for a new bottom, and buying needs to be treated with caution.

Sell: 3055near SL: 3060

Sell: 3015near SL: 3020

Sell: 2981near SL: 2988