Gold fluctuates sharply, with bears dominatingYesterday, the gold market experienced violent fluctuations again. After hitting a high of 3055 during the session, the gold price quickly pulled back to a low of 2956, showing extremely high volatility. Recently, the fluctuation range of gold has been large, with fluctuations of about $100 for three consecutive trading days. Although this volatility is not common, it has become the norm in the current market environment.

Analysis of the causes of fluctuations:

The current violent fluctuations in the gold market are mainly affected by the global economic situation, especially the uncertainty of the international trade situation. In particular, the escalation of Sino-US trade frictions and the extreme volatility of market sentiment have provided strong momentum for gold prices. After China introduced countermeasures to increase tariffs by 34%, the market's expectations of whether the US will further increase tariffs by 50% before the 8th have made market sentiment more tense. Due to the instability of the global economy, the trend of gold will continue to be dominated by market sentiment, and volatility will be difficult to calm down in the short term.

Technical analysis of the gold market:

Daily trend analysis:

Yesterday, gold once again showed a "roller coaster" market, opening low and moving high in the morning, but fell sharply again during the European session and finally closed negative. The 100-point fluctuation range for three consecutive days indicates that market sentiment is highly tense and gold prices are under great pressure.

On the daily chart, after three consecutive negative declines, gold prices formed a large negative line with an upper shadow longer than the lower shadow, which means that they may still face adjustment pressure in the short term. Nevertheless, the market is in an oversold state and there is a need for rebound correction. Therefore, the current lower support of gold prices is around 2955, which constitutes a short-term top and bottom conversion position.

Short-term price range:

As the market still has a need for rebound correction, gold is expected to enter a range oscillation phase. In the short term, the support level of gold prices is in the 2956-2960 range, while the upper resistance is concentrated in the 3025-3030 area. In the context of range oscillation, it will be more effective to maintain a high-altitude and low-multiple operation strategy.

Operation strategy suggestions:

Short layout:

When it rebounds to 3030-3035, you can consider shorting, with a stop loss set above 3040, and a target of 3000-2995.

Long layout:

If the gold price falls back to 2970-2975, it is recommended to consider going long, with a stop loss below 2965 and a target of 2995-3000.

Since the current market sentiment is driven by external economic events and the market has not fully digested the relevant risks in the short term, it is recommended to remain flexible in operation and pay attention to changes in market sentiment and trends driven by news at any time.

Risk warning:

Volatility: The current gold market is extremely volatile. Investors need to pay attention to the impact of breaking news and remain cautious.

Time factor: Even if the gold price fluctuates sharply under the impetus of news, as mentioned earlier, a wave of topping and falling is usually not completed in just three days. Market sentiment may continue to ferment, so the short trend may still need to continue for some time.

Conclusion:

In the current market volatility, it is recommended to adopt a range oscillation strategy and operate flexibly. In the short term, the gold price may fluctuate and consolidate in the range of 2956-3030. In terms of operation, the high-altitude and low-multiple strategy can be appropriately used to arrange near the technical support and resistance levels. At the same time, keep a close eye on external news to avoid being affected by emergencies.

XAUUSD.F trade ideas

gold sell setup bearish rejection zone 3036🔻 Gold Sell Setup - Bearish Rejection Zone (3026) 🔻

This is a potential short (sell) setup for Gold (XAUUSD) around the 3026 level. The price is showing signs of rejection near a key resistance zone. The setup is based on a clear structure with multiple take profit (TP) levels and a well-defined stop loss (SL), offering a favorable risk-to-reward ratio.

📌 Sell Entry: 3026

🎯 Take Profits:

TP1: 3024

TP2: 3022

TP3: 3020

TP4: 3018

🛑 Stop Loss: 3036

🧠 Analysis Insight:

The price has tested the resistance zone multiple times and failed to break above it, indicating possible exhaustion of bullish momentum. If price holds below 3026, we can expect a bearish push towards the take profit targets. A break above 3036 would invalidate this setup.

📉 Trade with proper risk management and watch for confirmation before entering.

📉 Trade with proper risk management and watch for confirmation before entering.

XAUUSD TECHNICAL & COT ANALYSISOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will fall to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

XAUUSD on DropI'm expecting the one more Drop move from 3073-80 if the 3080 remains valid and market got rejection remains low.

What possible scenario we have?

on the opening of market can pump towards 3073-80 again then on rejection we can expect this move and my target will be 3000 then 2980 in extension for intraday.

On the other hand, 3080 is the resistance cluster ,above this region we have again bullish momentum towards 3130-35.

XAU/USD Bullish Pennant Breakout - Trade Setup Toward Target📊 Overview:

This 4-hour chart of Gold Spot (XAU/USD) presents a clean bullish pennant breakout followed by a corrective pullback to key support, offering a high-probability trading setup for bullish continuation traders.

Gold recently surged above the psychological $3,000 level, but after testing the previous resistance zone / ATH, it retraced back into a critical confluence of support. From a technical perspective, the structure remains bullish, supported by strong trendline dynamics, clean price action, and a well-defined pennant formation.

🔍 Step-by-Step Breakdown:

1. Bullish Pennant Formation

A bullish pennant is a continuation pattern that typically occurs after a strong upside rally (the "flagpole"). In this chart:

The flagpole began around March 13, with gold moving vertically from ~$2,630 to ~$2,950.

This was followed by consolidation between March 19–27, forming a symmetrical triangle pattern with converging trendlines (the pennant body).

Volume (if added) would typically decrease during this consolidation phase.

On March 27–28, price broke above the pennant, confirming the bullish bias.

📌 This breakout signals that buyers are ready to resume control after taking a breather.

2. Rally & Retest Phase

Following the breakout:

Price surged to challenge the resistance zone and all-time high (ATH) area, marked between $3,150 – $3,160.

A natural pullback occurred due to profit-taking and overbought conditions.

This retracement brought price back into the support zone at ~$3,000, intersecting perfectly with:

The rising trendline from the pennant breakout

A horizontal demand zone (former resistance turned support)

A key psychological level ($3,000)

💡 This zone acted as a confluence area, attracting buyers and creating a strong bounce — visible as a bullish engulfing candle.

3. Support & Resistance Analysis

✅ Support Level:

$2,990 – $3,010

Marked by previous highs before the breakout

Validated by the trendline and price reaction

🚫 Resistance / ATH Level:

$3,150 – $3,160

Historic resistance zone that capped the recent rally

Price must break this level for further continuation toward the target

4. Trendline Dynamics

The dotted trendline acts as a rising support structure.

Trendlines in bullish continuations are crucial as they confirm upward momentum.

As seen on the chart, price respected the trendline during the recent dip and bounced with strong momentum — a bullish signal.

5. Trade Setup & Risk Management

A trade based on this structure should follow strict risk-to-reward discipline.

🛒 Entry Zone:

Ideal re-entry lies between $3,030 – $3,040, after confirming the bounce from support.

❌ Stop Loss:

Below $2,976, which is under the support zone and trendline. If price breaches this level, the pattern is invalidated.

🎯 Target:

Measured move (height of the flagpole) projected from breakout zone gives us a target of around $3,221.

The chart also marks this clearly as the "Target" zone.

📈 Risk-to-Reward Ratio: Approximately 1:3, which is attractive for swing trades.

6. Market Psychology & Trader Sentiment

The bullish pennant represents temporary indecision, but ultimately market confidence remains strong.

The pullback to support reflects healthy profit-taking, not bearish reversal.

The bounce from support shows buy-the-dip mentality, a sign that bulls remain in control.

7. Macro & Fundamental Backdrop

While the chart is technical, it's wise to factor in macro catalysts:

🏦 Federal Reserve policy: If the Fed holds or cuts rates, gold typically rallies due to lower opportunity cost.

📉 Inflation Data: Rising inflation or expectations can push gold higher as a hedge.

🌍 Geopolitical tensions: Conflicts or economic instability drive safe-haven flows into gold.

Staying updated on these events can help validate or hedge your technical outlook.

✅ Conclusion:

This chart presents a technically sound bullish continuation setup backed by:

A breakout from a bullish pennant

A retest and bounce from a confluence support zone

A clearly defined risk (stop loss) and reward (target)

Traders looking for medium-term opportunities in XAU/USD can consider this as a high-probability setup with logical structure and strong momentum potential.

🔔 TradingView Tag Suggestions:

#XAUUSD #Gold #TechnicalAnalysis #BullishPennant #PriceAction #SwingTrade #Forex #TradingSetup #Commodities #GoldBreakout

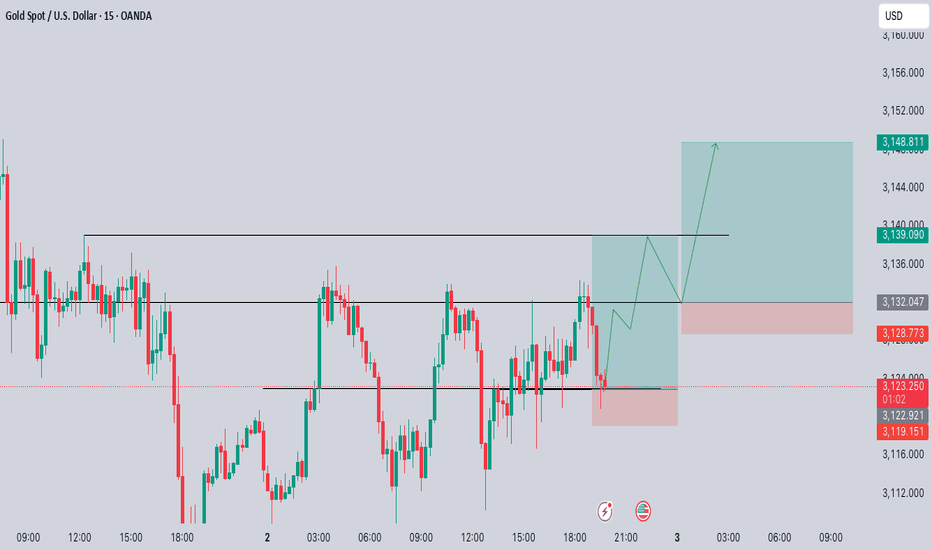

Gold's counter draw 3115-18 is still an excellent short spotGold fell after hitting a high of 3135, but failed to stand firm at the 3121 real level. The daily line closed with a long upper shadow, indicating significant selling pressure from above. The current key watershed is in the 3115-3121 area: if the closing price falls below this position, the lower side will test the strong support band of 3085, and the medium-term trend may turn to shock adjustment. Pay attention to the 3115-3118 pullback opportunity, and you can arrange short orders in place. There are two points to note: First, if the price fails to quickly pull back to 3115, it may accelerate downward; second, if it unexpectedly recovers 3115, it is necessary to adjust the strategy. Gold operation suggestions: short in the rebound 3115-3118 area, stop loss 3125, target 3085.

4/3 Gold Trading StrategiesTariff concerns and inflation have once again triggered significant volatility in gold. After yesterday’s price surge following news announcements, today’s market opened with continued bullish momentum, reaching around 3170.

For traders who managed to keep up with the market rhythm, this was a golden opportunity—but for those caught on the wrong side, it was a disaster. The persistent price rally has put short sellers under significant pressure. While I hope most of you are in long positions, I also understand that’s not always the case. For those stuck in short trades, the key now is to minimize losses or even turn the situation into a profit.

Based on the current price structure, I expect a high-level pullback. If your short position isn't causing serious damage to your account, holding on could be a viable strategy.

The expected trading range includes a high point at 3166-3178 and a low point at 3138-3123. Additionally, several key technical levels need to be monitored for potential reversals.

Trading Recommendations:

📌 Main Trades:

Sell in the 3166-3182 range

Buy in the 3136-3121 range

📌 Short-Term Scalping:

Be flexible in the 3147-3158 range

Manage your risk carefully and adjust your trades based on market movements! 🚀

Gold (XAU/USD) Bullish trend Demand Zone –Trend Analysis & ts🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

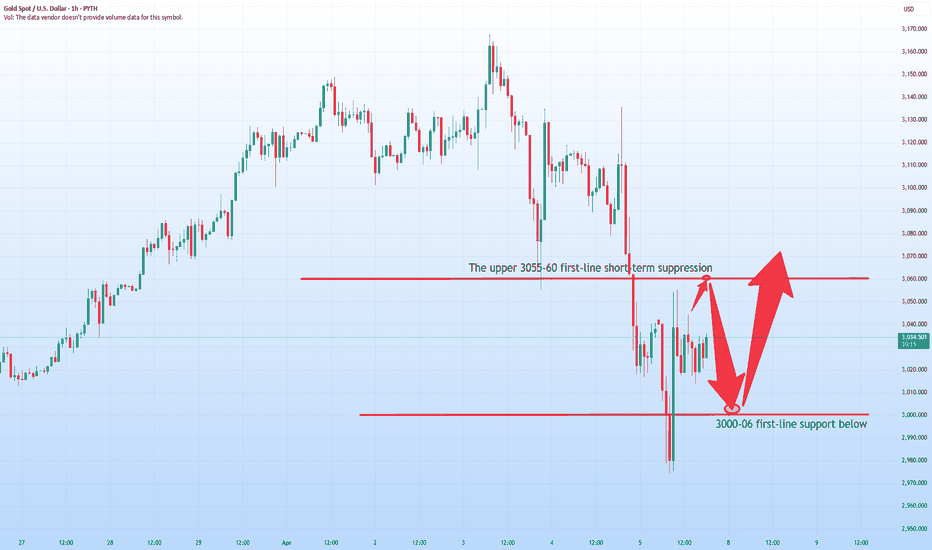

The battle between long and short will be decided in the US markFrom the 4-hour analysis, today's upper short-term resistance is at 3055, and the lower line is at 3000-3008 support. In terms of operation, if the rebound is under pressure at this position, continue to short and look for a decline. You should short once based on the rebound relying on 3055-60, and continue to look to break the bottom for the lower target. Be cautious with long orders at high levels.

Gold operation strategy:

1. Gold rebounds at 3055-3058, stop loss at 3066, target 3015-3020, continue to hold if the position is broken;

2. If gold returns to the 3000-3006 line, you can buy more if it does not break, stop loss 2993, target 3045-53 line, and continue to hold if the position is broken;

Gold Analysis April 9D1 frame is a Doji candle with unclear buying and selling power. but the market is still in the structure of a corrective downtrend.

H4 shows a strong increase from 2970 to 3050 due to data from fundamental analysis

Trading scenario: Gold is approaching the fionacci retracement zone. Pay attention to the two SELL zones today 3063-3065 and the zone 3089-3091.

For gold to move towards the upper SELL zone, gold needs to surpass 3047. If it does not break 3047 and close below 3039, wait for a retest to SELL to 3021 in the US session. If it does not break 3021, then BUY again in this zone. If it confirms closing below 3021, hold at 2990 today.

Gold Market prompts Short from 3040s to Mitigate Trend BreakoutGold market initiates a short move from the 3040s, aiming to mitigate the previous trend breakout around the 3017–3012 zone. This pullback sets the stage for a bullish countenance to potentially surface, aligning with the broader market sentimen fpollow for more insight , comment and boost idea.

Gold (XAUUSD) AnalysisPrice is currently breaking above the key resistance zone around 3020, which has acted as a strong supply area in the past. A clean close above this level could open up bullish momentum towards the next target zone around 3030-3031.

However, failure to hold above 3020 could trigger a pullback or a potential sell-off back towards the 3002-2989 demand area.

Plan:

Potential Buys: Above 3020 closure confirmation

Potential Sells: Below 3002 closure confirmation

Watch price action closely around these levels for confirmation.

XAUUSD MARKET REVERSAL (BUY)During Friday’s NFP we saw heavy selling pressure on Gold. With Gold showing clear market structure breaking the previous higher low swing high, a sign of market reversal is in place creating a new higher high.

💡Scenario 1

Waiting for price to retest demand zone, and if it doesn’t break below we can aim to enter at this demand zone for buys. Targeting previous supply zones.

💡Scenario 2

If price breaks below the demand zone I will wait to see how price reacts at the previous demand zone for a better buy entry to the upside.

🧠CONCLUS

If all this is invalid then we will see a continuation to the downside. However, looking at this market structure and a trend reversal taking place creating higher higher and higher lows, it is a clear indication that price is reversing and becoming bullish. Wait for confirmation of candlesticks on 15min & 5min time frame, for either a bullish engulfing candlestick or, a shooting star.