Gold top long and short structure conversionThe gold market has recently shown a clear bearish-dominated pattern, with the weekly closing high and long upper shadow negative line, combined with the gap of $50 opened lower this week, the technical bearish signal is strong. Although there was a violent rebound to 3055 during the Asian session, filling part of the gap, it encountered strong suppression near the 5-day moving average of 3030, which happened to be the resistance level transformed from the previous key support, forming a typical technical "top and bottom conversion".

Key technical analysis

Large cycle structure:

Weekly level: Long upper shadow negative line with low opening, confirming the top pressure

Daily level: Moving average system short arrangement, 3030 becomes the long-short watershed

Key support system: 3030-3000-2980 (downward layer by layer)

Core resistance: 3055 (gap filling position), 3030 (top and bottom conversion)

Trend evolution characteristics:

Support levels are lost one after another (3030→3000→2980) and short momentum continues to increase

The market enters a high volatility shock repair stage

Current market characteristics

Volatility characteristics:

Single-day volatility exceeds 100 US dollars

Quick conversion of long and short (violent rebound after a sharp drop in the Asian session)

Repeated testing of technical positions (3030 key position)

Trading environment:

High volatility makes stop loss more difficult

Technical position effectiveness is enhanced

Need to be vigilant against false breakthrough risks

Professional trading strategy

Short opportunities:

Entry Point: Near 3055 (top and bottom conversion suppression zone)

Risk control: Strict stop loss above 3060

Target level: 3035→3030 (take profit in batches)

Applicable conditions: Maintain validity before breaking through 3060

Long position layout:

Ideal position: 2958-2960 (weekly moving average support)

Stop loss setting: below 2953 (previous low protection)

Target outlook: 2980→3000 (step profit)

Core logic: grasp the opportunity of oversold rebound

Key risk control points

Position management:

Single risk control at 1-2%

Adopt batch position building strategy

Trading timing:

Asian session is mainly observed

U.S. session focuses on breakthrough opportunities

Emergency plan:

Short position immediately stops loss after breaking through 3060

Long position layout is temporarily suspended after breaking through 2950

Focus on the future market

3030 key position competition:

Continued pressure maintains short position thinking

Effective breakthrough requires re-evaluation

XAUUSD.F trade ideas

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

GOLD - 1H UPDATE

Gold dropped nicely today, in a strong impulsive move which normally indicates a reversal. We also saw price touch $3,057, but we did say price also needs to close below that level which it never done. There's 2 possible plays on its next move;

1. Price just carries on dropping lower in the next week as expected.

2. Gold starts to consolidate, creating a 'redistribution schematic' for a bigger sell off. But this could also mean Gold creating 1 more new ATH.

XAU/USD(20250403) Today's AnalysisMarket news:

US trade policy-① Trump signed an executive order to establish a 10% "minimum base tariff" for all countries, and will impose reciprocal tariffs, including 20% for the EU, 24% for Japan, 46% for Vietnam, and 25% for South Korea. The tariff exemption for goods that meet the USMCA will continue, and the tariff for those that do not meet the requirements will remain at 25%; ② The US Treasury Secretary called on countries not to retaliate; ③ The base tariff will take effect on April 5, and the reciprocal tariff will take effect on the 9th. In addition, the 25% automobile tariff will take effect on the 3rd, and the automobile parts tariff will take effect on May 3rd; ④ Gold bars, copper, pharmaceuticals, semiconductors and wood products are also not subject to "reciprocal tariffs".

Today's long and short boundaries:

3127

Support and resistance levels

3164

3150

3141

3113

3103

3089

Trading strategy:

If the price breaks through 3150, consider going long, with the first target price at 3164

If the price breaks through 3141, consider going short, with the first target price at 3127

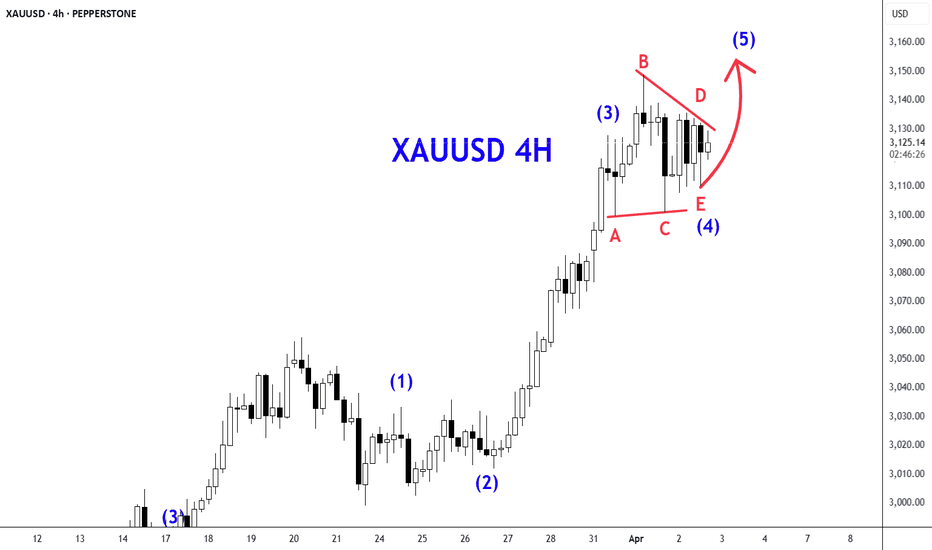

4.2 Analysis of intraday gold strategy4.2 Analysis of intraday gold strategy

Core logic:

Impact of Trump's tariff policy

If the increase in tariffs exceeds expectations (such as equal +25%), it will intensify risk aversion and directly push up gold.

If the magnitude is moderate, gold prices may correct in the short term, but they will still receive support in the medium and long term (policies slow down global economic recovery, manufacturing is under pressure, and safe-haven demand is solid).

Technical points:

Resistance level: 3140, the next target after breaking through is 3160-3180.

Support level: 3100, if it fails, look down to 3080.

Intraday rhythm forecast

If it continues to stand above 3120 and breaks through 3140, the probability of long continuation is high.

Long strategy

Entry conditions: Find a position above 3125 to go long

Target: 3160-3180, stop loss 3125

Short strategy

Entry conditions: Find a position to short below 3150

Target: 3120-3100, stop loss 3150.

Gold 1h Potential H&SGold (XAU/USD) 1H Analysis – April 2, 2025

Pattern Identified:

Head and Shoulders Formation detected, indicating a potential bearish reversal.

The neckline has been drawn as a support trendline, which, if broken, could confirm further downside movement.

Key Levels:

Current Price: $3,123.55

Neckline Support: Around $3,120

Target Area: $3,070 - $3,060 (Marked in purple)

Potential Drop: -1.32% (-$40)

Indicators:

RSI (Relative Strength Index): At 50.92, near neutral territory but leaning slightly downward, indicating potential bearish momentum.

Volume: Increased during the initial drop, suggesting sellers are stepping in.

Trade Idea:

📉 Bearish Bias (If neckline breaks)

Sell below: $3,120

Take Profit: $3,070 - $3,060

Stop Loss: Above $3,130

📈 Bullish Scenario (If neckline holds)

If price bounces from support, a move back toward $3,140+ could occur.

Buy above: $3,125

Take Profit: $3,140 - $3,150

Stop Loss: Below $3,115

Conclusion:

Gold is at a crucial decision point. A confirmed breakdown of the head and shoulders pattern could lead to further downside. However, if bulls defend the neckline, we could see a recovery toward recent highs. Watch price action closely! 🚀📉

GOLD XAUUSD – SNIPER PLAN 2 APRIL 2025👇

🦁 GOLD XAUUSD – SNIPER PLAN 2 APRIL 2025 📆

📍 Macro & Political Context

🗞️ Geopolitical Tension: Ongoing war in Ukraine + fresh tariff threats from Trump are sparking investor fear. Safe-haven flows into gold continue.

💰 Fundamentals: Inflationary fears remain strong. Market eyes the US NFP later this week. Fed is silent... too silent. 👀

🌍 Central banks are still buying gold – clear sign of institutional appetite.

🔍 Market Structure Overview

Trend: Bullish HTF ✅

Current Price: $3,113

All-Time High: $3,148 (Reached recently – likely liquidity swept!)

Last Valid BOS: H1 and H4 both show bullish structure, but a correction is brewing. 🍃

📊 Key Technical Zones & Confluences

🔻 Sell-Side Liquidity Below

📌 $3,100 – Clear liquidity pool (equal lows + psychological level)

🔥 Below $3,100 to $3,085 – Strong imbalance zone + unmitigated FVG

🧲 Expectation: Price may grab liquidity here before next leg up

🔷 Imbalance + Discount Zone

📉 $3,085–$3,095 – Massive H1/H4 imbalance. Could be a POI if price breaks $3,100

🧱 Valid Demand OB (H1) inside this zone + FIBO 61.8% retracement from last impulse

🔺 Premium Rejection

🧱 H1/H4 OB near $3,135–$3,145 = Price sharply rejected = probable redistribution zone

✂️ This was also the weekly high, which got swept = liquidity taken

🎯 Plan of Action

🟢 Scenario 1: Long Entry from Discount Zone

"Let them take the liquidity, we take the reversal!" 💸

Entry Zone: $3,085 – $3,095

Confluence:

Valid H1 OB (confirmed with PA)

Imbalance zone

FIBO 61.8% + structure break

Sell-side liquidity sweep from $3,100

Confirmation: M15 CHoCH + Bullish engulfing or low volume sweep

SL: Below $3,078

TP1: $3,130

TP2: $3,145

TP3: $3,150 (liquidity magnet again)

🔴 Scenario 2: Short if Price Pushes Back to $3,140+

Catch the premium short 🧨

Entry Zone: $3,140 – $3,148

Confluence:

All-time high sweep (liquidity trap)

HTF OB rejection

Weakness shown on M15

Confirmation: M5-M15 CHoCH + engulfing

SL: Above $3,155

TP1: $3,125

TP2: $3,100

TP3: $3,085

🧠 Final Notes

📌 Be reactive, not predictive – wait for PA confirmation at POIs

📰 Watch news – especially unexpected geopolitical catalysts or Fed surprise

🧘♂️ Stick to risk management. At ATHs, volatility is high and manipulation common.

👉 If this breakdown helped you, don’t forget to FOLLOW for more sniper setups and smash that ❤️ LIKE button to show some love!

Your support keeps this 🔥 content coming!

Monthly closing line, gold is alert to pull higher and fall backAt the end of March, the monthly and quarterly lines of gold and silver closed with saturated strong positive lines. The first trading day of the month has broken the high by inertia, which is consistent with expectations. Next, the focus should be on guarding against the potential scenario of pulling up shipments in the first half of the month, and the possibility of extreme volatility.

There are a lot of heavy news data from the 2nd to the 4th. I think there is a high probability that there will be an obvious turning point. However, given that the global political and economic situation has not cooled down significantly, even if there is a turning point and a correction, or even a sharp correction, it is still difficult to make a real judgment of a reversal of the big cycle trend. Therefore, I think the general idea of the short and medium-term line should be to maintain short first and then long.

The small resistance is around 3145--3155, and the important support during the week is around 3050. Given the recent volatility, it is obviously necessary to continue to be prepared to deal with continued large fluctuations.

The above strategy is based on current market analysis, and specific operations need to be combined with real-time data!

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

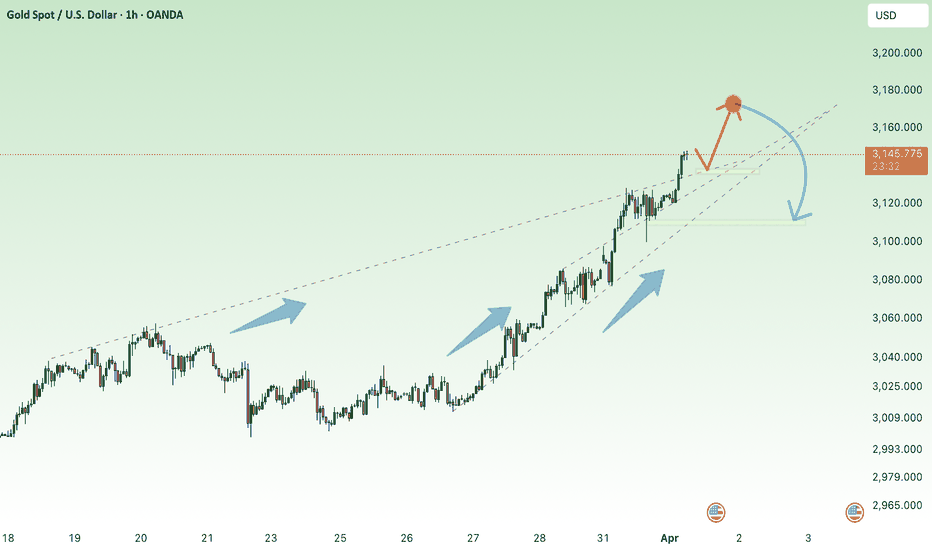

Lingrid | GOLD breaks Records REACHING New All-Time HighOANDA:XAUUSD market gapped up and continued to rise, reaching a new all-time high. It has already approached the resistance zone I highlighted in the weekly forecast and is above the 3100 level, which could serve as an entry zone due to the range and upward trendline below. As the monthly candle is set to print today, I believe the price may trade sideways around the current levels. However, if the price makes a correction toward support and rejects it, we should look for a buying signal in the market. My goal is resistance zone around 3150

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Gold trend in Eur and US sessions -Decline and increase again💢💢💢 Gold news:

➡️ Gold (XAU/USD) continues its upward trend during the first half of the European trading session on Monday, currently hovering near its all-time high just above $3,120. Uncertainty surrounding former U.S. President Donald Trump's so-called reciprocal tariffs, along with growing fears of a U.S. economic recession and geopolitical risks, continue to weigh on investor sentiment. The risk-off mood is evident in the generally weaker tone of the stock markets, driving the safe-haven precious metal higher for the third consecutive day.

➡️However, bullish traders may take a breather amid overbought conditions on the daily chart and ahead of key U.S. macroeconomic releases later this week.

Personal opinion:

➡️ In general, in the long term, the main trend of gold is still increasing and shows no signs of stopping. Therefore, waiting for the time when gold declines technically to buy at a good price is a reasonable measure

➡️ Currently, gold is having a technical adjustment after RSI entered the overbought zone and decreased again

➡️Analysis based on resistance - support levels and trend lines combined with EMA to come up with a suitable strategy

Plan:

🔆 Price Zone Setup:

👉 Buy XAU/USD 3100 - 3102

❌SL: 3095 | ✅TP: 3106 - 3112 - 3118

👉 Sell XAU/USD 3129 - 3132

❌SL: 3136 | ✅TP: 3125 - 3120 - 3115

FM wishes you a successful trading day 💰💰💰

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Although a choppy week to start with, we managed to get our move down which stopped short but gave a a fantastic pip capture, then based on the bias of the week managed to complete all our bullish targets plus the Excalibur targets that activated. Red boxes again played their part giving us precise entry and exit level activating and hitting their own targets, the best of which gave us over 300pips on the capture.

Now, end of week, we have support below 3075 and resistance on the fight for the close 3090. Too high to attempt the long, in the middle to attempt the short. So we'll wait and see how the market closes and come back on Sunday with the KOG Report and our view for the week ahead.

Wishing you all a great weekend.

As always, trade safe.

This weeks targets completed:

KOG’s bias for the week:

Bearish below 3040 with targets below 3010✅, 3006✅, 2997, 2985 and below that 2978

Bullish on break of 3040 with targets above 3050✅, 3055✅, 3063✅ and above that 3067✅

RED BOXES:

Break above 3037 for 3040✅, 3047✅, 3050✅, 3055✅, 3063✅ and 3066✅ in extension of the move

Break below 3010 for 3006, 3000, 2997, 2990 and 2985 in extension of the move

Bearish Projection - XAUUSD📉Bearish Projection - XAUUSD

📌On the 4-hour timeframe, the recent bullish trend appears to have completed its fifth wave, reaching the upper boundary of the structure. Additionally, Fibonacci extensions have surpassed the 2.618% level, indicating a potential retracement or corrective phase. Given the strong rally from $2832 to $3146, we anticipate a pullback toward the $2990 - $2945 zone, aligning with the 50%-61.8% Fibonacci retracement levels.

The recent surge in gold prices, driven by escalating trade tensions and geopolitical uncertainty, has led to significant resistance breakouts across multiple timeframes. With the US Jobs data release** scheduled this week, we could see increased momentum supporting a bearish correction for XAUUSD.

➡️Daily Support - 3010-3000

➡️Key Level - 3056-3044

➡️Expected Price Region - 2990-2945

➖➖➖➖➖➖➖➖➖

Gold has adjusted to the right level and continues to rise!From the closing point of view, the daily line finally closed with a big Yin line with an upper shadow slightly longer than the lower shadow. After such a pattern ended, today's market still has the need for adjustment, but as the market is oversold, the market has the need for rebound correction. Therefore, we treat it as a range shock during the day, maintain high-altitude and low-multiple, and focus on the intraday support of 2956-60. The short-term support is 2978-75. In theory, if you want to wash the market, wash it harder. 3000 can't stop it. Pay attention to the 3020-30 range, and even rush yesterday's high area and then fall. Today, it is mainly bullish and long. There is only more but no short below 2980. The bullish risk area above 3025-30, especially after a rapid rise, refer to the resistance to short! In general, the gold price is still in a long-term bullish trend, and the long-term operation still maintains the idea of buying on dips; the medium-term may maintain high-level shocks, and the medium-term operation needs to be treated with caution; although it is in a downward trend in the short term, beware of technical pullbacks due to oversold, and wait for opportunities to buy on dips in short-term operations.

Today's short-term operation strategy for gold is to focus on long positions on pullbacks and short positions on rebounds. The short-term focus on the upper side is the 3025-3030 line of resistance.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3030-3035, stop loss 6 points, target around 3010-3000, break to see 2990 line;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 2990-2993, stop loss 6 points, target around 3010-3020, break to see 3035 line;

GOLD → Growing economic risks increase interest ↑FX:XAUUSD rallied aggressively due to high interest driven by rapidly rising economic risks, mainly related to Trump's tariffs. For selling, the risk is very high, with the stock and cryptocurrency market declines only adding to the interest in the metal

Markets are taking refuge in defensive assets amid WSJ reports of Trump's possible tariff hike of up to 20% for most US trading partners. This could trigger inflationary pressures and stagflation, weakening the dollar and bond yields, which supports the gold price.

This week all eyes are on Trump's speech on Wednesday, PMI, NonFarm Payrolls and Powell's speech

Technically, it is not worth selling now as it is high risk, and for buying we should wait for a correction to key support levels

Resistance levels: 3127

Support levels: 3103, 3091, 3085

We are not talking about any trend reversal now. It is worth waiting for a local correction or consolidation, the market will mark important levels, liquidity zones or imbalances against which you can build a trading strategy. Gold will continue to grow because of the strongly increasing risks.

Regards R. Linda!

Gold (XAU/USD) Chart AnalysisGold (XAU/USD) Chart Analysis

**Current Price & Trend:**

- Gold is trading around **$3,132.70**, showing continued bullish momentum.

- The price is **above all key EMAs** (7, 21, and 50), confirming an **uptrend**.

**Key Levels:**

- **Resistance (~$3,140-$3,145)** → Price tested this level but struggled to break higher. A successful breakout could push Gold towards new highs.

- **Support (~$3,127-$3,130)** → The price is holding above this zone; if it remains stable, more upside is possible.

- **EMA 50 ($3,110.38)** → This acts as a dynamic support level. A break below it may signal weakness.

**Bullish Scenario:** 📈

- A **break above resistance** at **$3,140-$3,145** could trigger further upside.

- Volume increase would confirm strong buying momentum, with targets towards **$3,160-$3,170**.

**Bearish Scenario:** 📉

- If the price **fails to hold support** at **$3,127**, a pullback to the **EMA 50 ($3,110)** is likely.

- Breaking below **$3,110** could shift momentum bearish, targeting **$3,070-$3,080**.

**Conclusion:**

Gold remains **bullish** but is facing resistance. A breakout could push prices higher, while failure may lead to a correction. Traders should watch key levels for confirmation. 🚀

Gold suppresses the fall and shorts make big profitsYesterday, gold fell under pressure at 3150 and then tested the 3100 mark again in the evening, breaking the previous trend line that had been rising for several days. The market gradually slowed down from strong bullish trend, and the daily line turned negative.

Don’t expect the market to turn to bearish and fall sharply at this point. The long-short conversion needs time to brew, and now it is still a bullish trend, so the probability of forming a volatile trend here is relatively high, with a range of 3138-3100. Only when it breaks below 3100 can we see the market turning to bearish.

If the daily line is just a single negative correction, it will not change the overall upward trend. It depends on whether it can continue to close negative today.

If the European session suppresses the decline and weakens, then the third test of 3100 may break.

If the European session continues to strengthen and break through 3138, it will also hit the high point of 3148-3149

XAUUSD Time to start selling?Gold (XAUUSD) finally hit our 3 month $3000 target that we've been pursuing since the very first week of this year (January 06, see chart below) and in later stages upgraded to $3100:

Now the price has reached the top of the 1.5-year Channel Up, forming a similar 1D MACD peak formation while completing the +22.50% rise that the previous two major Bullish Legs had. As you can see, the pattern makes its Higher High on the 2nd MACD Bearish Cross and in 2 out of 3 Bearish Legs it retraced all the way to the 0.5 Fibonacci level, while on the remaining it the correction was contained to just above the 0.382 Fib.

On all cases the price came close to the 1D MA100 (green trend-line) before bottoming. As a result, even though some more Trump announcements may cause a momentary push upwards, we technically think that it is a solid level to turn bearish now with a fair 2900 Target on the 0.382 Fibonacci where by the end of April it should come close to the 1D MA100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is the golden large-scale "roller coaster" near miss?Gold took a large "V"-shaped reversal pattern on Thursday, with the highest hitting 3167 in the Asian session, and continued to fluctuate and fall in the European session. It successfully fell to the lowest 3054 before the US session and then rebounded. As of now, gold has deeply bottomed out and rebounded to 3135. It has now started the oscillation mode. Gold continues to fluctuate in the range of 3100-3135, waiting for the release of the initial jobless claims data in the US session. The data is bearish, and the shorts broke through the 3080 line. After all, the technical adjustment is almost done, and everyone can find opportunities to go long. Later, gold hit the 3054 line and rebounded quickly, and the long orders also recovered the losses. This process is full of thrills and excitement. After all, such a large bottoming rebound is relatively rare. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, pay attention to the short-term suppression of 3130-35 on the upper side, and pay attention to the short-term support around 3100-3106 on the lower side. Pay attention to the support of 3083-3087. After stabilizing above this position, continue to follow the low-long rhythm, and stick to the idea of going long after stepping back. I will remind you of the specific operation strategy during the trading session, so pay attention to it in time.

Gold operation strategy: Go long at 3105-3095

Gold Hits New Highs Amid Rising Uncertainty – 31 March 2025 MarkGold Market Overview – 31 March 2025

Gold ended last week at historic levels, closing near $3,085 per ounce, amid rising economic uncertainty and renewed tariff-related rhetoric from the U.S. President, particularly concerning the automotive sector.

During late trading hours yesterday, fresh developments regarding trade tensions—along with references to potential geopolitical escalation—were noted. These factors appeared to contribute to a gap-up opening for gold, which reached a new all-time high of $3,125 per ounce.

While future price movements remain uncertain, market participants may monitor the following levels:

* The $3,125 high could serve as a key reference point; any revisit to this level may draw attention to the $3,150 area.

* A moderation in momentum near $3,125 might result in a revisit to the $3,112 level.

* Should prices fall below $3,110 , the $3,100 area—commonly observed as a psychological benchmark—may become relevant.

* A continuation below $3,100 might bring the previous high of $3,085 back into focus.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GOLD Bullish Continuation - Will Buyers Push Toward 3,084$?OANDA:XAUUSD is currently trading within an ascending channel, maintaining a bullish structure. The price has broken above a key resistance zone which has now flipped to support, aligning with a potential bullish continuation.

With momentum favoring the upside, the price could move toward the 3,084$ level, which aligns with the midline of the channel. However, a failure to hold this level could indicate a potential shift in momentum.

Traders should monitor for bullish confirmation signals, such as bullish engulfing candles, strong wicks rejecting the support zone, or increased buying volume, before considering long positions.

Let me know your thoughts or any additional insights you might have! 🚀