XAUUSD.F trade ideas

Hellena | GOLD (4H): LONG to resistance lvl 3100 (wave B).Colleagues, at this point I have redrawn the waves a bit and realized that the upward movement is not over yet, but a rather large correction is possible within waves “ABC” and if wave ‘A’ is finished or almost finished, I expect wave “B”. I believe that the price will reach the level of 3100. After that a reversal and continuation of a small downward movement is possible.

But for now I would look at long positions.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold’s Wild Ride: Is the Correction Over?Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off.

Now, the big question is: Has Gold finished correcting, or is more downside coming?

________________________________________

Why I Expect Another Wave of Selling

📉 Gold Still Looks Vulnerable – Despite the rebound, I don’t believe the correction is over.

📉 Key Resistance Established – The 3,135–3,140 zone has now formed a strong ceiling, limiting upside potential.

📉 Selling Rallies Remains the Plan – Even with yesterday’s bounce back above 3,100, my outlook remains unchanged.

________________________________________

Trading Plan: Selling Spikes During NFP

🔻 Looking for price spikes during the NFP report as opportunities to sell into strength.

🔻 Targeting a new leg down toward the 3,030 support zone.

The correction is likely not done yet—let’s see if the market confirms it. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Rally Pauses – Correction Incoming!!!Gold ( OANDA:XAUUSD ) started to correct at the Potential Reversal Zone(PRZ) and near the upper line of the Ascending Channel . The question is, will we have a minor correction or a major correction(main)?

Gold is moving near Resistance lines and Fibonacci levels and was able to breaks the Uptrend lines . I view the upward movement of the last few hours as an upward correction , which will likely cause gold to fall again.

In terms of Elliott waves , it looks like Gold has completed a major wave 5 and I expect Gold to start a major corrective wave . In Gold's history , major impulse waves have completed precisely near the upper lines of ascending channels .

I expect Gold to decline at least to the Support zone($3,100-$3,085) , if gold can break the lower line of the ascending channel, we can be more confident that we are in the main corrective waves .

Do you think Gold can create a new All-Time High(ATH) again?

Note: If Gold goes above $3,130, we can expect more pumps and a new All-Time High(ATH).

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

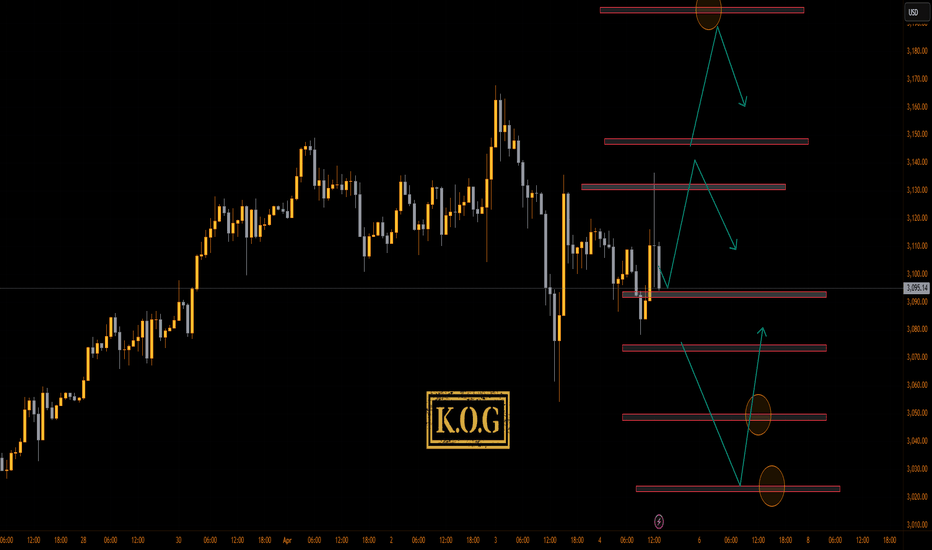

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

It’s been a decent week on the markets even with extreme movement we’ve managed to navigate the charts and end yesterday with a what looks like a full house of targets completed. For that reason, we have made the decision to not come back to the markets until next week. We’re sharing the levels, they are extreme, but it’s moving like there’s no tomorrow. Take it with a pinch of salt, less experienced traders, don’t even think about it. NFP and FOMC are the days most traders lose money and blow accounts, can you imagine what can happen during these market conditions.

Key level here 3135 to 3140, price needs to break above and support to target 3155-65, which in this scenario can be broken so above that the extreme level 3190-95.

Below, the break of 3110, this time could give us the breaker swing attempting to break and hold below 3000, this is what we ideally want to see, with price attempting to target that 3050 level again.

If it plays it plays, we’ll watch and the better trade set ups will come next week.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Gold - Heading Higher For Another +30%!Gold ( TVC:GOLD ) won't stop any time soon:

Click chart above to see the detailed analysis👆🏻

Back in 2015 we witnessed a significant rounding bottom formation on Gold, starting the next major bullrun. With the all time high breakout back in the end of 2023, this rally was just confirmed and after the recent trendline breakout, Gold can still head much much higher.

Levels to watch: $4.000

Keep your long term vision,

Philip (BasicTrading)

THE KOG REPORT - NFP UpdateEnd of day update from us here at KOG:

An absolutely crazy day on the markets with Gold continuing the move it started and completing hopefully now at the extreme level we wanted on the KOG Report. Our indicators were screaming short, we obliged and then waited for the lower level to give us a 90pip bounce initially with the support still holding us up.

We now have support below at 3020-18 which if broken can take us down into 3010 for another potential RIP, otherwise, resistance here stands at the 3050-55 level which if targeted will need to break to go higher!

We're done for another successful week on the markets and will be back on Sunday for the KOG Report and our view for the week ahead.

Wishing you all a great weekend and as always, trade safe.

KOG's bias of the week:

Bullish above 3040 with targets above 3091✅, 3097✅, 3101✅ and above that 3110✅

Bearish on the break of 3040 with targets below 3035✅, 3027✅, 3020✅ and below that 3010

RED BOXES:

Break above 3095 for 3101✅, 3106✅, 3110✅ and 3120✅ in extension of the move

Break below 3077 for 3070✅, 3066✅ and 3055✅ in extension of the move

KOG

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

A decent day on gold again. We didn't get the push down for the long, however, the long came from the red box level completing most of the bias level targets as well as two mega Excalibur targets for the day. We then got the RIP from above giving the short to those who wanted more!

We're now at support 2980 which needs to break to go lower, otherwise, we'll look for price to push up again into that 3006-10 region and look for a RIP there. If we get it, we're on for our lower target which is active.

From Camelot this morning:

Price: 3007

KOG’s Bias of the day:

Bullish above 2990 with target above 3010✅ and above that 3019✅

Bearish on break of 2990 with target below 2075

RED BOXES:

Break above 3010 for 3017✅, 3020✅, 3024 and 3030 in extension of the move

Break below 2998 for 2990✅, 2985✅, 2977✅ and 2970 in extension of the move

As always, trade safe.

KOG

There's a Time to Trade and a Time to Watch Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to trade and a time to watch.

Conservation of Capital is Essential 💰

The best traders understand that their capital is their lifeline. It’s not about making trades; it’s about making the right trades.

The market doesn’t reward effort; it rewards patience and precision.

Instead of jumping into mediocre setups, learn to appreciate the value of patience .

Every time you enter a trade that doesn’t meet your criteria, you risk your capital unnecessarily. And every loss chips away at your ability to capitalize on the real opportunities when they come. Capital preservation should be your priority.

Focus Only on A+ Signals 📌

Not every setup is worth your time and money. The goal should be to only enter positions that offer a clear edge – signals that you’ve identified as high-probability opportunities through your experience and strategy.

A + setups are those that offer:

• A clear technical pattern or setup you've mastered.

• A favorable risk-to-reward ratio, ideally 3:1 or better.

• Alignment with your overall strategy and market context.

If these criteria aren't met, it’s often better to do nothing. Waiting for the right setup and market conditions is part of the game.

The Power of Doing Nothing 🤫

Inaction is a skill. It requires discipline to avoid the urge to "force" trades. But the market will always be there tomorrow , and so will the opportunities.

By learning to watch rather than trade during uncertain or suboptimal conditions, you avoid unnecessary losses and conserve your capital for when the market truly presents an edge.

Conclusion 🚀

Trading is about quality, not quantity. Respect your capital and recognize that sometimes, the smartest move is to wait. Let the market be clear.

Remember, there’s a time to trade and a time to watch. Master this balance, and you’ll be miles ahead of most traders.

Gold Hits Key Support – Reversal Ahead or More Fall?Gold ( OANDA:XAUUSD ) has entered a Correction phase after losing its ascending channel . Now, if you are in a Short position , this post will help you know where to take profit on your position or if you are looking for a Long position for gold , what area is suitable .

Gold is approaching an important Support zone($2,956-$2,917) that I don't think can be broken within a first attack . What do you think?

In terms of Elliott waves , Gold appears to be completing a bearish wave 5 , which appears to be able to complete at the Support zone($2,956-$2,917) .

I expect Gold to start rising again from the Support zone($2,956-$2,917) and to at least rise to $3,000 again and get close to the Resistance zone($3,058-$3,021) . It is likely to fall again after this move .

In your opinion, has Gold started a major correction, and to what price can this correction continue?

Note: If Gold can touch $2,890, we can expect further declines.

Note: Because the downward momentum is currently high, it is likely that wave 5 will also complete near $2,913, and we will see a fake break of the Support zone($2,956-$2,917).

Gold Analyze ( XAUUSD ), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

HelenP. I Gold may continue to fall and break support levelHi folks today I'm prepared for you Gold analytics. After failing to hold above the resistance zone between 3140 and 3155 points, Gold made a sharp reversal. The strong bearish reaction from this area marked the end of the previous bullish momentum and triggered an aggressive sell-off. That move broke several minor support levels and pushed the price all the way down to the current support zone between 3010 and 2990 points. Previously, Gold had shown a stable uptrend, consistently bouncing from the trend line and using it as a dynamic support. Each pullback was met with buying pressure, allowing the price to climb higher. However, this time, after reaching the 3140 resistance level, buyers were overwhelmed by strong selling activity. Currently, Gold is trading just above the key support zone and close to the trend line. This area has acted as a pivot level multiple times, but the latest price action shows hesitation from buyers and growing control from sellers. Given the recent sharp decline, the break from the resistance zone, and the pressure near the current support, I expect Gold to continue falling toward 2960 points — my current goal. If you like my analytics you may support me with your like/comment ❤️

Gold new ATH at 3,168: A Final Push Before the Drop?Yesterday was a high-volatility day, and we all know why.

Gold surged to yet another all-time high at 3,168, and luckily, I had already closed my sell trade around break-even—otherwise, my stop loss would have been triggered.

________________________________________

Gold Still Set for a Hard Drop?

Despite the rally, my outlook remains unchanged—I still believe Gold is due for a significant correction.

📉 3,100 Held as Support – But buyers are struggling to hold onto gains around 3150

📉 Every New High is a Selling Opportunity – So far, Gold has failed to sustain its breakouts, reinforcing a potential distribution phase.

________________________________________

Trading Plan: Selling the Rallies

🔻 Target: At least 3,080

🔻 Preferred Strategy: Continue selling into rallies

For now, I remain bearish and will keep looking for opportunities to short the market. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Bearish Trend vs. Fundamentals –What’s Driving the MarketGold’s Bearish Trend vs. Fundamentals –What’s Driving the Market?

Gold has hit our first target, just as we predicted. Some doubted this move, but it happened. The current geopolitical situation is messy, making it hard to judge what’s good or bad right now. One thing is clear—gold seems heavily manipulated. Since Trump’s controversial decisions, other countries have grown wary, and gold’s price has been hesitant to rise.

There’s a lot of talk about a U.S. and global recession, partly due to Trump’s tariffs and unpredictable policies. Yet, despite this, gold prices are moving downward.

Interestingly, when inflation was at 10% in many countries, gold stayed around $2,000. But as inflation dropped to 5% or lower, gold prices climbed. This feels like manipulation at play.

Russia recently announced plans to sell gold between April 5 and May 12. This could flood the market with liquidity and push prices down. However, other Central Banks or Hedge Funds may be also involved in these transactions. Russia might not be acting alone.

From a technical perspective, the analysis remains unchanged.

After any significant correction, gold could continue to drop further, as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

GOLD (XAUUSD): Bullish Rally ContinuesGold is currently experiencing a bullish trend and has reached a new all-time high on a 4-hour time frame.

After quite an extended bullish wave, the pair was consolidating within

a horizontal range for some time.

The resistance of this range was recently broken, indicating strong buyer strength.

I believe that the growth will likely continue, with the market potentially reaching the 3180 level in the near future.

Gold prices cool after tariff announcement⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) surged to a new all-time high during the Asian session on Thursday as investors flocked to safe-haven assets amid heightened risk aversion. Market sentiment took a sharp downturn after US President Donald Trump unveiled sweeping reciprocal tariffs on Wednesday evening, igniting fears of a global economic slowdown and a potential US recession.

The announcement triggered a broad sell-off in equity markets, reinforcing the risk-off mood and further fueling demand for gold as a traditional store of value.

⭐️Personal comments NOVA:

Gold hits 3167 peak, buying pressure gradually decreases. Adjustment waiting for new moves from other countries on Trump's tariff policy

⭐️SET UP GOLD PRICE:

🔥 SELL 3165 - 3168 SL 3172

TP1: $3160

TP2: $3150

TP3: $3140

🔥BUY GOLD zone: $3108 - $3110 SL $3103

TP1: $3115

TP2: $3130

TP3: $3140

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD - Price can decline to support area and then start to growHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some time ago price traded inside a flat pattern, where it moved between support and resistance levels.

Then gold made fake breakout to the downside, but soon returned back and started to grow strongly.

It broke the upper line of the flat and entered a rising channel, forming a steady bullish movement.

Later price touched $3160 resistance and bounced down, making correction to $3070 support area.

Now gold trades inside rising channel and near $3070 level, showing signs of slowing the decline.

In my opinion, gold can bounce from support and reach $3160 resistance as the next upward target.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

XAU/USD: First Long,Then SHORT! (READ THE CAPTION)By examining the gold chart on the 15-minute timeframe, we can see that the price is currently trading around $3122, and I expect the price to soon reach higher levels such as $3128, $3133, $3135, and $3143, and after reaching each of these important levels, we will probably see an initial negative reaction!

Ultimately, I expect a strong rejection from the price once gold reaches $3144!

The level of this analysis is very high, so make sure to study it carefully!

Don’t forget to support this analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

#XAUUSD: Possible Easy 600+ Pips Buying OpportunityFollowing a substantial decline in gold prices, which dropped more than 1000 pips, there is a possibility that the price may experience a minor correction before resuming its downward trajectory. It is imperative to acknowledge that trading gold in the current market conditions carries significant risks, and there is a substantial likelihood of incurring substantial losses.

Good luck and trade safe!

Can Gold still break upward?- Gold prices just hit a record high, soaring past $3,085 per ounce in March 2025. That’s not just a number—it’s a warning sign. Investors aren’t piling into gold for no reason. They’re reacting to a world that feels more uncertain by the day.

- The U.S. has imposed heavy tariffs on Canada, Mexico, and China, triggering trade tensions that are shaking global markets. Inflation is still higher than expected, climbing to 2.8% in February, making traditional investments riskier. At the same time, the U.S. dollar is weakening, and Treasury yields are dropping, pushing investors toward gold as a safe bet. Add to that ongoing conflicts in the Middle East and rising tensions between Russia and Ukraine, and it’s no surprise that gold is surging. Every new crisis just makes it more attractive.

This isn’t just a temporary spike. Experts warn that the worst effects of these trade policies haven’t even hit yet, and if inflation keeps climbing, the global economy could be in for a rough ride. Gold isn’t just going up—it’s flashing a warning. It’s telling us that investors don’t trust what’s coming next. And if history is any guide, they might be right.

HelenP. I Gold will correct to trend line and continue to riseHi folks today I'm prepared for you Gold analytics. Earlier, the price was moving inside a consolidation range between 2955 and 2880 points. It tested the support zone multiple times, specifically the area between 2865 and 2880, before making a strong bullish reversal. After bouncing from Support 2 at the 2880 level, Gold began a confident upward movement. It broke through the resistance zone and exited the consolidation pattern, forming a clear uptrend and respecting the trend line throughout the rise. As the price climbed, it reached Support 1 at the 3055 level and paused briefly, consolidating near the support zone between 3055 and 3070. This zone held well, acting as a base for further growth. From there, the price made another upward impulse, reaching the 3125 area before pulling back slightly for a local correction. Currently, Gold is trading above the trend line and remains within a bullish structure. The recent reaction from the support zone confirms buyer strength and interest in higher levels. Given the previous impulse, the trend line support, and price action above key zones, I expect XAUUSD to continue rising toward the 3180 points, my current goal. If you like my analytics you may support me with your like/comment ❤️

WHY XAUUSD IS BULLISH ?? DETAILED TECHNICAL AND FUNDAMENTALSXAUUSD is currently showing strong signs of bullish continuation after completing a successful retest of the previous breakout zone near the $2,920–$2,950 region. Price action has respected this support beautifully and is now pushing back above $3,040, confirming the bullish structure. This retest and bounce pattern suggests that the market is preparing for a fresh leg higher, with my immediate target set at $3,100. The current structure is aligned with higher highs and higher lows, and momentum is shifting back in favor of buyers.

Technically, the move is clean. The bullish impulse from February to late March created a strong upside leg, followed by a healthy correction into a well-defined demand zone. This demand zone held firm, and the current reaction is supported by increasing volume and bullish candlestick formation on the 12H chart. The inverse head-and-shoulders structure around $2,930 gives this setup even more weight, with a clear breakout above the neckline indicating potential continuation toward higher time frame targets.

From a fundamental perspective, gold remains supported by ongoing geopolitical tensions, increased demand from central banks, and continued inflationary pressure globally. As the market anticipates this week's U.S. CPI data, investors are hedging against uncertainty, which is driving flows into safe-haven assets like gold. The recent pullback in the US dollar index and bond yields is also contributing to upside pressure on XAUUSD, further confirming the bullish outlook.

With both the technical setup and macro drivers favoring upside, I'm looking for continuation toward $3,100 and potentially beyond in the short to mid-term. This area also aligns with the next psychological resistance and projected extension level. As long as price holds above $3,000, any dips should be viewed as fresh buying opportunities. This setup offers an excellent risk-reward ratio for traders looking to capitalize on gold’s ongoing bullish momentum.

Hellena | GOLD (4H): SHORT to 38.2% Fibo lvl 3050.Dear colleagues, the price has been in an upward movement for quite a long time and I believe .that it is time for a correction in the “2” wave.

I think it is possible that there may be a small update of the maximum of the top of wave “1” to 3176.771, then I expect a correction to the area of 38.2% Fibonacci level 3050.

As usual there are 2 possible entry options:

1) Market entry

2) Entry by pending limit orders, if the price updates the maximum.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!